Executive Summary

Real estate is not only the world’s largest asset class but also the oldest. With a track record that spans centuries, it continues to dominate modern portfolio allocations. It accounts for around two-thirds of total real assets which translates to around two-thirds of global net worth.1 Collectively, the real estate market comprises US$11.4Tn worth of assets held in public and private vehicles at the end of 2021. The U.S. remains the largest market with assets worth U.S.$4.1Tn – more than the size of the next 5 markets combined.2

The impact of the Global Financial Crisis was fully reflected in asset valuations by 2010. Since then, Real estate has continued to post strong year-on-year performance despite multiple business cycles and global events affecting the equity and fixed income markets. The low correlation to equities and fixed income asset classes makes it a natural diversifier for portfolios looking at hedging market risks while benefitting from a liquidity buffer through periodic rental income. The asset class also boasts a strong correlation with inflation, making it an important long-term hedge against inflation, particularly for real estate assets with high mark-to-market potential that are leased for relatively short tenures.

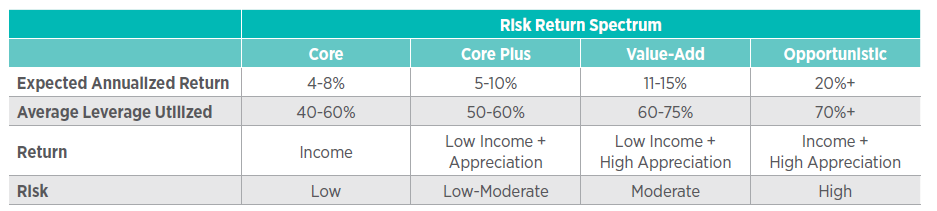

Broadly, real estate can be classified by sectors (Industrial, Multifamily/Residential, Retail, and Office) or by strategy (Core, Core Plus, Value-Add, and Opportunistic). Depending on the investment strategy and tenure, investors could diversify traditional portfolios with an allocation to real estate in order to generate higher risk- adjusted returns.

The multiple sectors and strategies within Real Estate also provide investors with a secondary layer of diversification which became much more evident during the COVID-19 pandemic. We saw growth in the industrial and multifamily sectors as online retail bolstered the demand for warehousing/fulfillment centers and homeowners upgraded their homes to accommodate space needs to work from home. Retail and Office, on the other hand, struggled as the pandemic compelled the industry to experiment with digital alternatives and working from home.

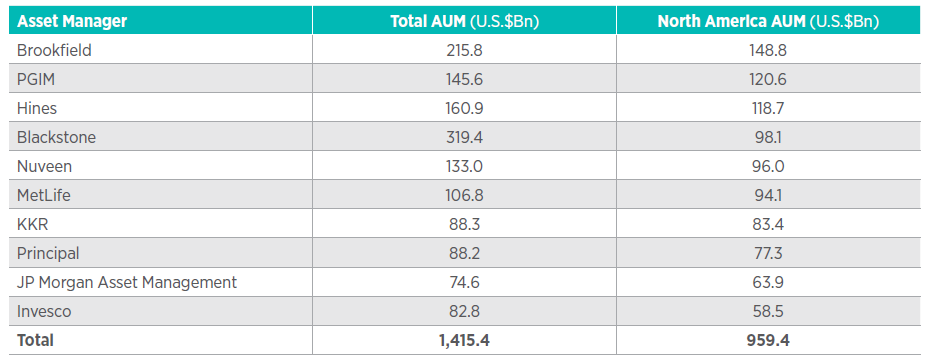

Investors have taken notice of the benefits of allocating to this asset class with participants including pension funds, sovereign wealth funds, endowments, insurance companies, banks, family offices, and corporates. The Top 10 asset managers in North America are already managing U.S.$1.4Tn of real estate across the world.3

Looking forward, we see industrial real estate on firm footing backed by strong demand for manufacturing, cold storage, automobiles, warehousing, construction, and medical services. With respect to multifamily, we see long- term demographics supporting high growth well into the next decade coupled with an emerging class of renters- by-choice that will ensure high rental yields.

High quality retail and office properties continue to attract high occupancy and rental yields. We see the retail sector emerging stronger out of the pandemic with less uncertainty. Some retail sectors like grocery, discount retailers, and restaurants have turned around quickly while other sectors like theatre and retail banking are continuing to take a longer path to recovery in the face of digital competition. Grade-A office developers have not seen huge space downsizing by corporations as they continue to have teams in the office a few days a week to effectively collaborate and build firm culture.

As we pass through an environment of higher interest rates and less liquidity there will be opportunities to buy into these sectors in the medium term. We see investors continuing to hold and build allocations to this asset class as opportunities emerge across strategies and sectors.

This publication aims to look at these aspects in greater detail with special emphasis on the current trends shaping the industry. This is not to be used as investment advice and is only intended for educational purposes.

Real Estate – The Oldest Asset Class Dominating Modern Wealth Allocations

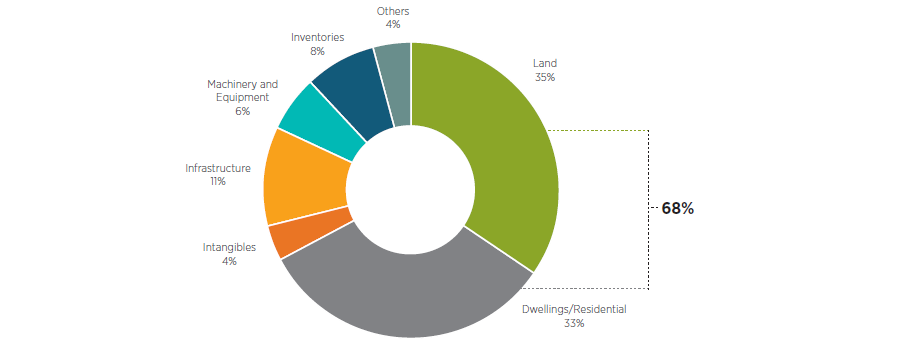

Real Estate is one of the oldest asset classes in the world with the first records of transactions in the U.S. dating back centuries. What is more interesting is that it continues to remain the largest portfolio allocation amongst real assets accounting for ~68%4 of the total global net worth.

Distribution of Real Asset, 2020 %

Source: McKinsey Global Institute.

Overview

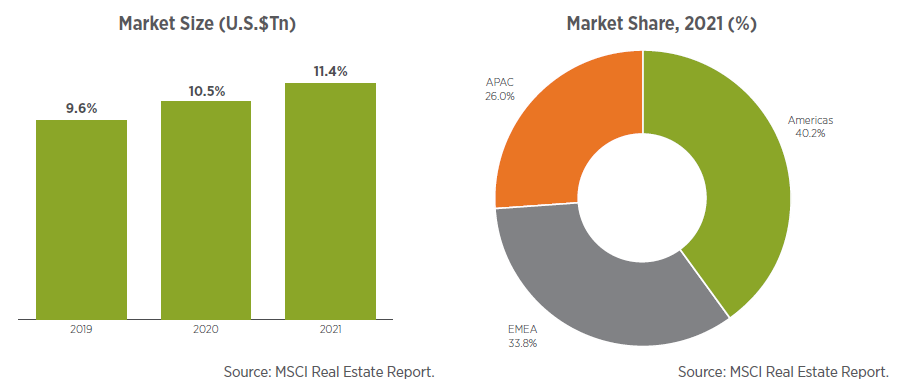

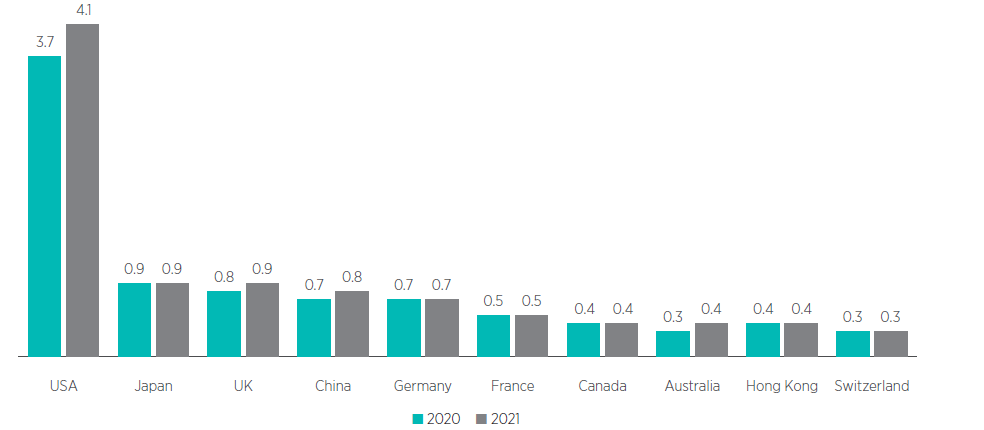

The global real estate market (public and private) has grown from U.S.$9.6Tn in 2019 to U.S.$11.4Tn in 2021. Geographically, the Americas lead the pack accounting for 40.2% of the market or U.S.$4.6Tn5. The U.S. alone contributes U.S.$4.1Tn to the U.S.$4.6Tn total Americas market. The Americas is also the fastest growing region with 12.9% growth in 2021. The U.S. market grew by 13.1% in the same period.

10 Largest Real Estate Markets in U.S.$Tn (2021 vs 2020)

Source: MSCI Real Estate Report.

The U.S. has long remained the most attractive market due to a variety of factors including economic size, (relative) housing affordability, growing population, and government regulation/stability. These factors make it the most ideal candidate to chart a V-shaped recovery once yields stabilize post the recent correction driven primarily by higher interest rates.

Sectors

Properties can be broadly categorized as commercial or residential. Commercial real estate includes industrial, retail, and office sectors. Residential real estate is comprised of residential lots or dwelling units such as condos, apartments, etc.

Industrial real estate is an umbrella term for manufacturing, production, storage, and distribution facilities. It’s comprised of warehouses, fulfillment centers, and storage lockers. The main driver of industrial real estate is consumption and trade. As a result, industrial real estate is often used for things such as just-in-time production, last-mile distribution, and have proximity to end consumption. Properties will be close to key transportation hubs and large population centers.

Multifamily real estate is comprised of residential properties with more than one dwelling. These are often found in the form of condos, apartments, and mixed-use properties. Demographics are the main driver of multifamily real estate and, over the past two decades, urban cores of cities have become increasingly popular places to live, work and play. This renaissance has attracted multifamily development, presenting new choices for families and attractive investment opportunities.

Retail real estate is comprised of shopping malls, strip malls, and plazas. The main driver of this sector is consumer demand and foot traffic. As the population increases in an area, so does the demand for consumer goods. However, e-commerce has significantly impacted this sector as last-mile distribution and technology advancements have driven consumption in a different manner.

Office real estate is comprised of workspaces. The main driver of office spaces is employment. As employment numbers increase so does the demand for workspaces, even after the COVID-19 pandemic.

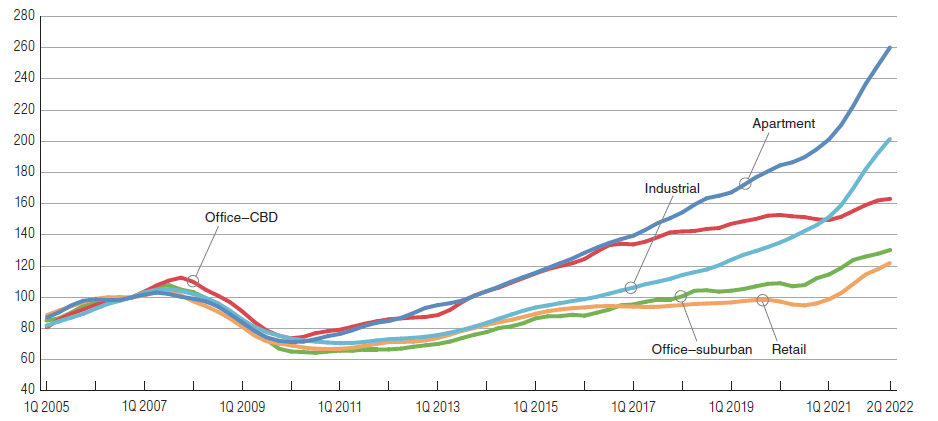

Source: RCA CPPI, MSCI Real Assets. Note: 100 = December 2006.

The chart above shows the movement of price indices for different types of real estate assets over the last 16 years across multiple business cycles and events.

- Consistent growth since 2010 once the full impact of the Global Financial Crisis was priced in

- Growth supported by strong demand for these assets in a largely ‘low interest rate’ environment over the past decade

- The growth in the Industrial sector has accelerated further in the last 2 years primarily on account of structural changes brought on by COVID-19 necessitating higher demand for warehousing and cold storage to support e-commerce

- The Apartment/Multifamily sector continues to benefit from a favorable demographic mix ensuring high demand from renters and buyers for the next 1-2 decades

- Retail has emerged from shadows of uncertainty with offline retail retaining a large portion of the overall retail pie despite the e-commerce-driven surge in online shopping

- Office is recovering steadily with high quality Grade-A assets maintaining high demand and new niche segments like medical offices and life sciences facilities propelling new growth

We have seen some niche sub-sectors grow at a faster pace through the pandemic including medical offices, life sciences facilities, data centers, self-storage, and cold storage warehouses. These sub-sectors are providing new growth avenues for the Office and Industrial sectors. They are also enhancing the overall diversification as some of these (especially medical offices and life sciences facilities) remain less cyclically correlated and act as a hedge during uncertain times like the recent pandemic. We explore more of these emerging sectors in the ‘Current Trends’ section of this report. Overall, the fundamentals remain strong, and quantitative tightening induced economic weakness is expected to create investment opportunities across these sectors in the near to medium term.

Real Estate Investment Strategies

Investors can achieve various investment goals by selecting the strategies most suited to their portfolio. Certain strategies have a lower risk profile with a focus on income generation with stable values, reliable tenants, and long-term leases. In other cases, strategies focus on asset appreciation via property development, upgrades, or repurposing. The four primary real estate investing strategies include Core, Core-Plus, Value-Add, and Opportunistic.

Core strategies focus on high quality properties that are fully or close-to-fully occupied on long-term leases in highly marketable locations. Core assets are perceived as the safest strategy due to their income stability and often mirror fixed income assets in terms of relative risk and return. Low-risk core investment opportunities have always been a focal point in real estate.6

Core-Plus strategies are similar to core strategies in terms of investing in high quality properties but with a greater risk profile on account of having upcoming maturity on leases and strong to mediocre tenant profiles or locations. Investors may be able to achieve a slightly higher return owing to higher risk vs. core assets. The primary driver of returns is income generation with the opportunity for some capital appreciation.

Value-add strategies include assets that generate medium to high cash flows while simultaneously generating value by repositioning properties through upgrades/renovations. The combination of current income and capital appreciation results in an attractive risk-adjusted return.7

Opportunistic strategies are identified by their high risk/reward potential. The focus is on capital appreciation rather than consistent income generation. Properties are typically in development or distressed stages and the strategy may involve repurposing or redeveloping them. Executing this strategy involves quite a few challenges including regulatory approvals, high upfront capital requirements, costly debt financing, high cost of construction material, and no initial income to offset costs.

Development is a subset of the opportunistic strategy and is comprised of both greenfield (ground-up) and brownfield projects (repurposing existing projects). The risk profile of this strategy is significantly greater than core and value-add strategies due to its ground-up approach.

Source: First National Realty Partners.

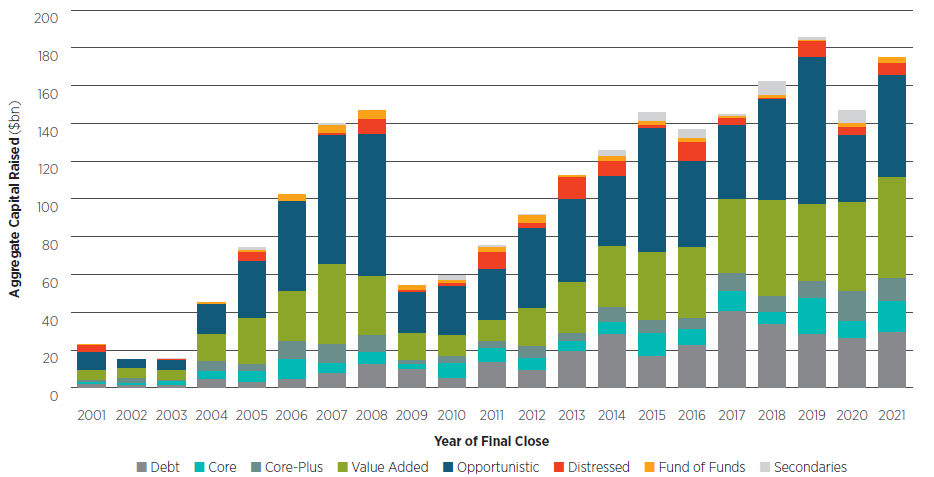

Capital Flows

While the public market is significantly larger, there are private market opportunities. Global private real estate AUM is estimated to total U.S.$1.5Tn as of year-end 2022. Capital inflows have continued to increase as sustained public market volatility has driven investor interest toward alternatives. Closed-end private real estate fundraising has bounced back from U.S.$150Bn raised across 468 funds in 2020 to U.S.$205Bn raised across 496 funds in 2021. While markets corrected in 2022 due to various factors such as inflation, higher interest rates, and quantitative tightening, the outlook for real estate remains positive. Over the long-term, 90% of investors intend to maintain or increase real estate allocations.8 Allocations to core and core-plus strategies have increased in the recent past due to their low-risk perception in otherwise volatile markets.

Fund Capital Raised by Strategy, 2001 to 2021

Source: Preqin Pro.

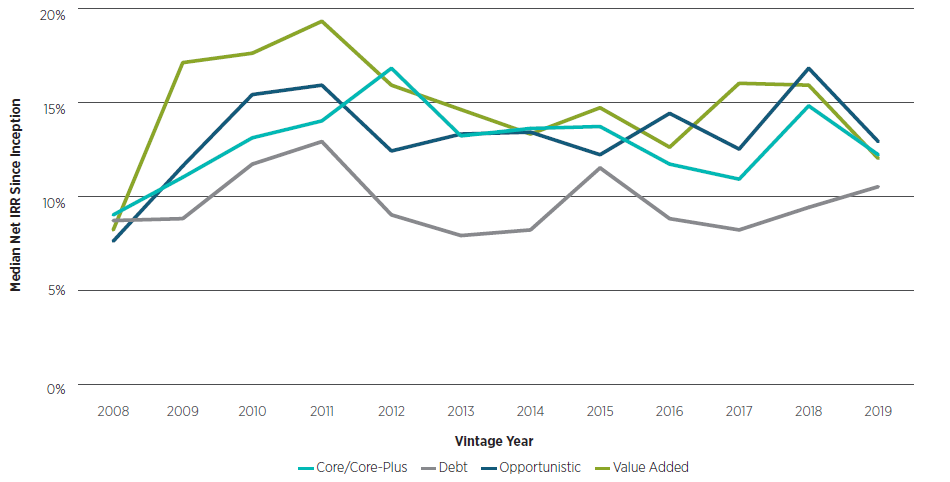

Strategies predicated on capital appreciation are typically more reactive to economic cycles than regular income- based strategies thus initial returns typically spike but then gradually normalize. As expected, value-add and opportunistic strategies have produced better returns over time compared to other strategies.

Closed-End Private Real Estate by Strategy and Vintage Year

Source: Preqin Pro.

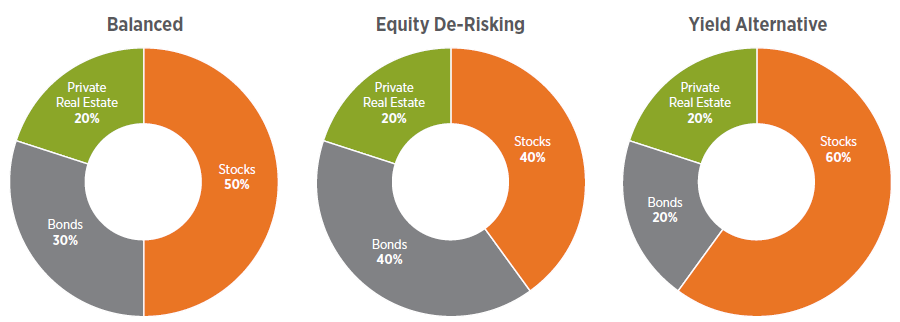

Why Investors Should Add Real Estate to Their Portfolio

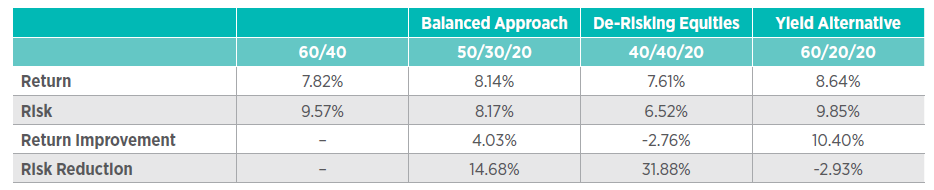

Historically, the model investment portfolio has consisted of a 60/40 allocation between public equities and fixed income. However, this can reduce portfolio effectiveness as it does not capitalize on a fully investable universe including asset classes like alternatives and commodities. Furthermore, in vanilla asset classes such as public equities, the rise of information symmetry has exponentially increased the use of passive indexing strategies. As a result, alternative asset classes can be used to generate alpha. Even a small allocation of 20% in real estate has been shown to bolster risk-adjusted returns.

Source: Cadre.

Source: Cadre. Model portfolio based on 1979 to 2021 during periods of high inflation (above 3.35%). Stocks, bonds and real estate represented by S&P500, Bloomberg Barclays US Aggregate Index, and NCREIF Property Index respectively.

For many investors, it is important to balance liquidity from public markets with private investments that generate additional yield and diversification. From a holistic view, there are several factors for determining real estate allocations in a portfolio:

- Income stability to drive diversification and performance

- Divergence in global markets can present opportunities

- Access to skilled asset managers can add value and customize risk exposure

- Real Estate’s ability to hedge against inflation

- Technology and management ability to unlock productivity

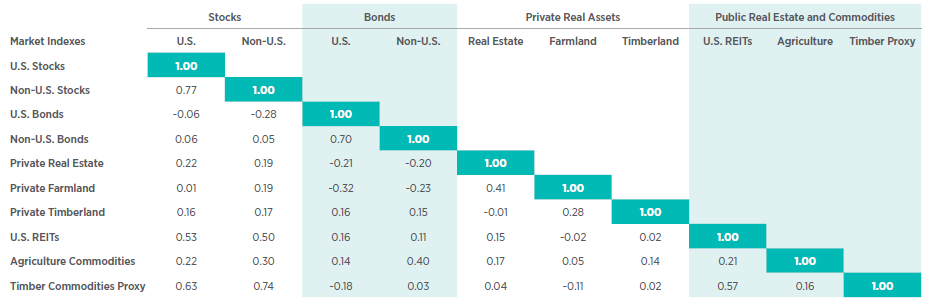

While the traditional portfolio is comprised of various asset classes including equities, fixed income, and commodities, it is prudent to evaluate opportunities for further diversification. This is particularly true when evaluating and incorporating alternatives in a portfolio. From 1992-2020, private real estate only had a 0.01 correlation coefficient with U.S. stocks, U.S. REITs (real estate investment trusts) had a 0.22 correlation coefficient with U.S. Stocks, and a 0.05 correlation coefficient with private real estate.9 This suggests that listed REITs correlate more with equities rather than private real estate, driving home the point that private real estate investments can provide greater diversification.

Correlations of Real Assets, Commodities, REITs (1992-2020)

Source: Nuveen.

One of the biggest risks of specific thresholds within traditional asset allocation is that it undermines overlapping risk exposures of alternatives. One way to mitigate the overlap is to assess the correlation of alternative asset classes – private equity, real estate, and infrastructure (timberland and farmland).

Real Estate also acts as a hedge against inflation. As interest rates rise to combat inflation, it is important to note, different real estate assets can either benefit from or be negatively impacted. Assets with short-term leases benefit from an increase in inflation due to their ability to recalibrate considering market conditions. This is how real estate thrives in high inflationary environments, by providing yield where capital appreciation is not prevalent. On the contrary, higher interest rates will negatively impact long-term assets financed with floating- rate debt.

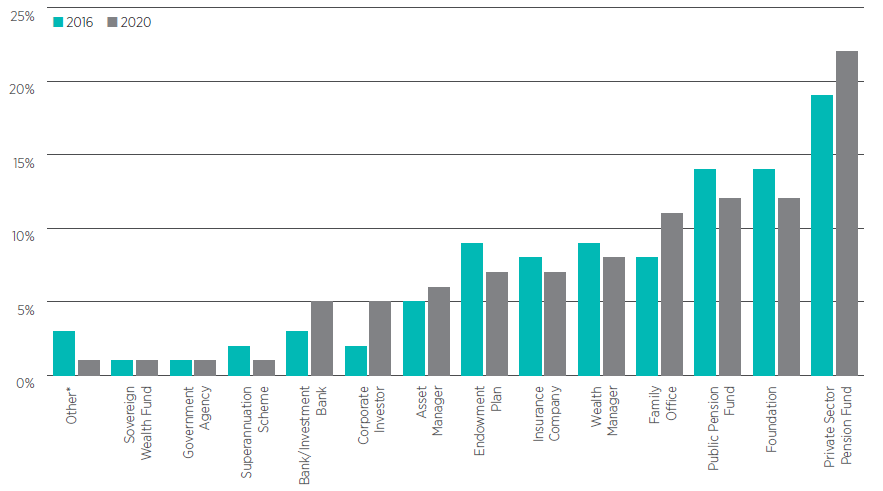

In terms of portfolio allocation, real estate is a common investment strategy in North America and Europe, with current average allocations of around 6%. According to a Knight Frank Wealth survey, 27% of Ultra-High Net- Worth individuals’ investable assets are directly allocated to real estate.10 In particular, the two investor classes with outsized allocations are family offices and private sector pension funds. Others, such as asset managers and endowment plans are under-allocated which suggests increased future participation.11

Investors in Real Estate by Type, 2016 vs. 2020

Source: Preqin.

Top Real Estate Asset Managers in North America

Through both public and private vehicles, the top 10 real estate asset managers in North America manage an aggregate AUM of ~U.S.$1.4Tn with ~67% invested in North American markets. Six of these managers are in the top 10 global real estate managers list with all of them ranking in the top 20 among global real estate managers

Source: Institutional Real Estate Inc.’s Global Investment Managers 2021 Report.

Structure Considerations in Real Estate

From publicly listed securities to housing properties, investors have a variety of means to gain exposure to the real estate market. There are three primary components when understanding the dynamics of real estate investment vehicles – open-ended/close-ended, public/private, and direct/indirect structure. Key factors to consider in all strategies include return profile, asset quality, diversification, liquidity, and area of investment focus. Structure is a critical component that affects strategy and the associated property types, liquidity, and risk/ return spectrum.

Open-Ended vs. Close-Ended Structure relates to the investment vehicle liquidity. Open-ended vehicles allow investors to commit and allocate capital in a free, open manner vs. a fixed fund life for the closed-ended structure. Capital pooling from investors can occur during pre-determined capital deployment schedules such as monthly, quarterly, and annually. Existing investors can also make subsequent investments and prospective investors can allocate new capital. In contrast, close-ended vehicles have a predetermined fixed capital commitment and the deployment takes place through capital calls during the investment period. After the set date, no additional commitments are accepted. Given open-ended structures offer liquidity and capital subscriptions/redemptions, invested assets will typically be comprised of lower risk, highly marketable core assets. This ensures the fund will be able to provide liquidity for its investors. Additionally, given that investors can invest and redeem at any point in time, liquidity of the assets and valuation of assets play a critical role. In a closed-ended fund, these factors are less significant, and managers will have less focus on providing liquidity throughout the term of the fund. As such, investors demand an illiquidity premium in closed-ended funds and the performance is expected to compensate for this illiquidity vs. open-ended structures.

Public vs. Private relates to the availability of the vehicles holding real estate. Both public and private forms have unique benefits and risks which should be considered in conjunction with investment goals and risk/ return tolerance. Public real estate structures can range from individual equities, public REITs, or a combination of the two via exchange-traded funds and mutual funds. REITs are publicly registered real estate vehicles that own, operate, and finance real estate and provide access to dividend-based income and capital appreciation. Depending on the jurisdiction there are requirements to distribute at least 90-95% of taxable income in the form of dividends. These pass-throughs receive flow-through treatment mirroring direct ownership and preventing double taxation.

Public REITs are more common as they trade on exchanges and in turn, provide increased liquidity. However, this causes REITs to be prone to public market volatility. Over the past several years, there has been a growing trend of the privatization of companies and vehicles, including REITs. This is primarily driven by the increased direct and indirect costs of remaining public due to reporting requirements. Additionally, public market volatility has further pushed managers to venture toward non-listed vehicles.

On the opposite spectrum of public real estate is private real estate. While there are fewer liquidity and reporting requirements, many structures have evolved to provide enhanced transparency and liquidity including Private REITs. Private real estate structures often enable underlying portfolio managers to execute longer-term strategies leading to superior risk-adjusted returns and diversification benefits.

Direct vs. Indirect relates to owning the property directly or owning it via securities/instruments such as REIT. Direct real estate investing entails buying a property or a stake in one to generate income and capital appreciation. Direct real estate provides investors control over decisions about the property including maintenance, renovations, and financing. Investors can select their ideal property with characteristics that match their preference and risk profile. Despite these benefits, there are also some considerations when investing directly. Typically, there are fewer participants in direct real estate transactions and in turn, each participant will be required to invest larger amounts of capital. Additionally, a property will be subject to the market’s liquidity. Marketable commercial properties in great locations typically require over 90 days for sale. With direct investing, time spent on value creation is crucial.

Conversely, indirect real estate investing typically entails the purchase of shares/units in a fund or company. Typically, income generated by the properties will flow-through to investors via distributions. Indirect real estate allows investors to access a pool of real estate assets through a single investment. Indirect vehicles on average have low investment minimums and help investors achieve a diversified portfolio with small amounts of capital. Also, the properties held in indirect vehicles are often managed by professionals who dedicate all their time to managing the properties. Through these vehicles, an investor can access professional managers with extensive experience in the asset class. However, investors should also review the assets in the vehicle - Given that investors have less control and visibility with this type of investment, the vehicle may include properties with undesirable characteristics that an investor cannot carve out of the portfolio.

Additional Factors to Consider

There are some key factors to consider when investing in Real Estate:

Term and Structure of Leases: During periods of high inflation, short lease terms allow rents to be marked- to-market more frequently. This allows investors to receive and offer market rates, which provides inflation protection in conjunction with higher economic growth. On the flip side, longer-term contracts offer a degree of foresight. Some assets with net leases enable expense pass-throughs, which are tax-preferred structures.

Asset Characteristics: Investors must also consider property characteristics such as location, size, amenities, and age of the unit. The location of the property is arguably the most critical factor in all real estate strategies. It is a major determinant in marketability and resale potential. The properties in marketable locations may be more valuable due to proximity to transportation, recreational areas, and business functions. Factors such as unit size and age also play a notable role for reasons such as foreseeable functionality and maintenance costs.

From a macroeconomic perspective, properties in low-supply markets with strong demand represent attractive opportunities. Since supply is often finite via the time to plan development, obtain permits, and execute physical construction, properties in metropolitan areas such as New York can provide consistent rental income while providing long-term capital appreciation.

Leverage: A core component of real estate is leverage. Leverage is particularly helpful during periods of high inflation as debt gets paid down with higher rentals from marked-up leases. That said, it is important to note that construction costs also increase during this phase leading to stress for leveraged properties under development. As central banks weigh the magnitude of interest rate hikes, rates continue to have an effect on cost of capital, maximum debt levels, repayment ability, and, in turn, profit and property value.

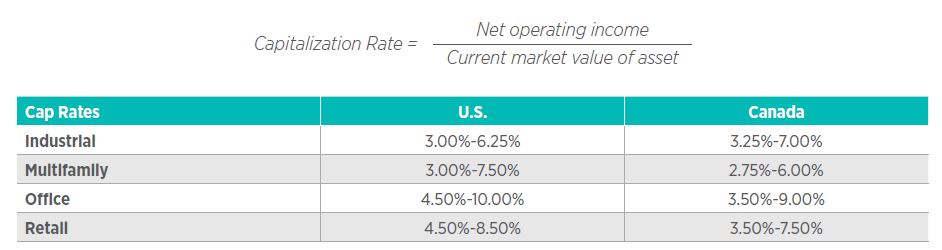

Asset Valuation: To calculate property values, one of the core factors used is capitalization rate (cap rate). The cap rate is a discount rate and is used as the expected rate of return from a property. It is calculated by taking a property’s net operating income and dividing it by the market value. Opportunistic and value-add properties have higher capitalization rates as they are used as a proxy for investment risk. They also vary by industry and geography. Below is a sample range of cap rates for different property types.12

Source: Colliers Canada – Cap Rate Report Q1 2022, CBRE – US Cap Rate Survey H1 2022.

Current Trends

Retreat to ‘Normal’ Business Cycles

The real estate industry was hit hard by COVID-19 and when the lockdown measures ensued, the effects were immediate. Deal volumes and values declined, though some sectors were more negatively impacted than others – most offices shut down with work from home becoming mainstream and retail avenues recorded low to no foot traffic. The industrial sector picked up some steam from the growth of e-commerce as a large part of commerce transactions shifted online. This period also saw many retailers (both online and brick & mortar) expand warehousing to meet the surge in demand. Residential housing also surged due to high demand from home buyers driven by the need to work from home, low unemployment, and stimulus support from the government. The retail sector, however, saw a lot of uncertainty and churn especially for small-sized businesses.

Governments across the Americas helped shield the impact felt by businesses during the pandemic by providing economic support. According to the U.S. Federal Reserve, the pandemic resulted in mass liquidity ready for deployment, with an accumulation of U.S.$2.7Tn in excess savings. And what the Federal Reserve initially suggested to be a transitory environment, has played out somewhat differently. Higher inflation (above the long- term target of 2%) is likely to remain in place for the foreseeable future. Since the initial spike of 4.2% in April 2021, inflation has risen to a high of 9.1% in June 2022 as the Ukraine-Russia crisis exacerbated supply chain issues and global commodity prices.

As per most relevant indicators, it seems that we have entered a post-pandemic world. The sticky nature of inflation continues to exist and correspondingly, the fight against inflationary concerns continues. To combat this, central banks have and will continue to increase interest rates, the core predictor of borrowing costs, affordability, and property valuations. The real estate industry, like most industries, is facing headwinds in a high inflation and high interest rate environment.

Property market fundamentals are “normalizing” as we see sectors coming back to pre-pandemic trajectories. Just as we saw different sectors react differently during the pandemic, we see them recover in a way that normalizes the overall long-term trajectory. We will see the housing and industrial sectors slow down in the short to medium term offering opportunities for investment. At the same time, we see retail and office continuing to gain momentum in 2023.

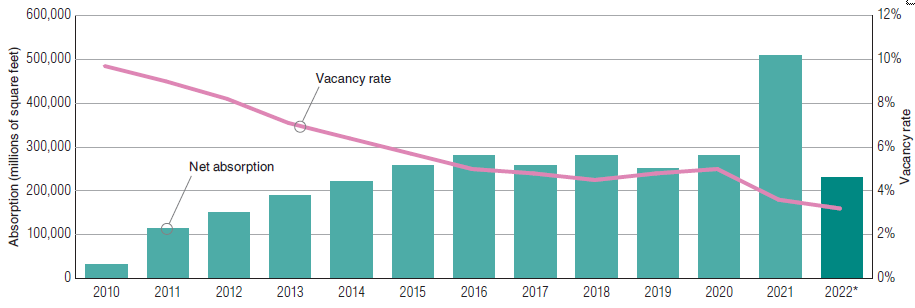

Industrial: Strong Fundamentals Attracting Investor Interest

The year 2021 saw the rapid expansion of light industrial facilities including warehousing, fulfillment centers, and cold storage. These segments grew in response to shifting customer behavior from offline to online. We have not seen a large portion of those sales return to offline retailers once they opened up in 2022. This structural shift in the way consumers shop has given a new impetus to the light industrial sector.

Despite economic headwinds, Industrial real estate absorption remains high in 2022 and is expected to cross pre-pandemic levels. This spread offers embedded net operating income growth for the foreseeable future. According to research from MSCI Real Assets of surveyed U.S. industrial managers, in-place rents were 22 percent below spot market rents.

The imbalance of supply and demand has not only pushed leasing rates on existing properties higher but new developments as well. Combined with all-time lows in vacancy, the industrial space is poised to benefit from numerous tailwinds.

Industrial Property Net Absorption and Vacancy Rate, 2010-2022

Source: PwC’s Emerging Trends in Real Estate 2023 Report. *As of second quarter.

Housing: Demographics, Affordability, and Customer Preferences Supporting Long-Term Demand

A four-generation surge of household formation and housing preferences will buoy fundamental apartment demand through and beyond 2030. With 1.3 million new U.S. households projected each year through 2035, apartment industry trade groups—the National Multifamily Housing Council (NMHC) and the National Apartment Association—calculate that the United States needs 4.3 million newly built apartments between now and then. That level of new development would work out to 331,000 new multifamily rental units annually. This would expand the existing apartment rental stock in the United States by more than 20 percent in just over a decade.

Another factor to consider is the increasing unaffordability trend in developed nations where property values are rapidly outpacing household income. In Canada, the Housing Affordability Index, which measures the share of income needed to cover housing-related expenses, has recently peaked at 0.48. This is even higher than housing affordability preceding the Great Financial Crisis. A similar situation is growing in the U.S., where there is a far larger market. The equivalent index, though with slightly different scaling (based on a scale of 100), also shows the growing unaffordability. Any score under 100 indicates the median household income does not even qualify for a mortgage for a median-priced home. The U.S. housing affordability index reached 104.4. While the median household can barely qualify for a mortgage at these levels, this pales in comparison to the prior year when the affordability index was valued at 146.8. As a result of growing unaffordability, there is growing acceptance to rent amongst the middle-income, middle-age demographic. For investors, this represents an attractive tailwind for residential opportunities.

The emergence of a rent-by-choice segment (discretionary rental households who can afford to buy a home) has increased the demand for multifamily housing. According to Harvard’s Joint Center for Housing Studies (JCHS), the number of renters making at least $75,000 jumped by 48 percent over the decade ending just before the pandemic, to 11.3 million. With this increase, the share of renter households in this income group rose from 20 percent to 26 percent.13 The supply side of the equation has not caught up to the high demand leading to higher rentals across markets.

Retail: Flight to High-Quality Grade-A Assets

Given the outsized challenges that retail has faced in recent years and with economic uncertainty on the horizon, the outlook for the retail sector in the immediate future differs significantly for different segments and property types.

Grocery in the U.S. remains white-hot, with growth bolstered by aggressive expansion plans from newer market entrants like Aldi and Lidl. Off-price apparel has returned to robust growth, with players like Kohl’s and Burlington experimenting with smaller-format stores to facilitate expansion into new markets. “Athleisure” and new digital- native apparel brands have ramped up brick-and-mortar growth even as department stores and many legacy players are still facing challenges. Perhaps most surprising of all is the massive surge in restaurant growth. Fueled by QSRs and new fast-casual concepts, major chains were poised to add as many as 7,000 units through midyear 2023. As for theaters, they remain deeply challenged and we anticipate consolidation ahead. Retail banking continues to deal with digital disruption, driving less need for overall branches and smaller footprints. Drugstore chains are reducing store counts, though online pharmacy has yet to emerge as a major disrupter. Department stores, particularly outside of the luxury sphere, still largely need to downsize and evolve their models to remain relevant.

Nowhere is the bifurcation in performance greater than in the mall world. Class A and trophy malls account for roughly one-third of the inventory, but 80 percent of the sales. Those properties have benefited from the flight to quality and have been the focus of nearly all the growth from new clicks-to-bricks (digital-native brands opening physical stores) and experiential concepts, as well as a substantial influx of food and beverage concepts.

Office: Medical Offices and Life Sciences Facilities Opening New Growth Avenues

The Traditional office sector is struggling with pandemic-induced behavioral changes with complete work from home and hybrid arrangements still being the norm across corporates. The high-quality properties within the traditional office space continue to retain high occupancy and command rentals as corporates continue to renew. The need to build an organizational culture and to ensure the entire workforce comes into the office on certain days has made decisions to give up real estate tough for grade-A tenants.

While the traditional office demand outlook remained uncertain due to lagging return-to-office momentum, the pandemic accelerated the growth of a few segments within the overall office sector including medical offices and life sciences laboratories. These sectors proved to be non-cyclically correlated as they grew at a higher pace during the pandemic and continue to exhibit high growth.

The U.S. healthcare system supports an insured population of more than 300 million people and represents over 18 percent of the U.S. gross domestic product.10 The medical real estate that supports this industry generally falls into two categories: inpatient, or hospitals, and outpatient, or medical office buildings (MOBs). Occupied by medical tenants, MOBs are facilities where services and procedures are performed on an outpatient basis. These buildings may be on a hospital campus or attached to the hospital building. Due to the increasing number of insured people who followed the introduction of the Affordable Care Act of 2010, as well as an aging population, the already significant demand for medical services has continued to grow.

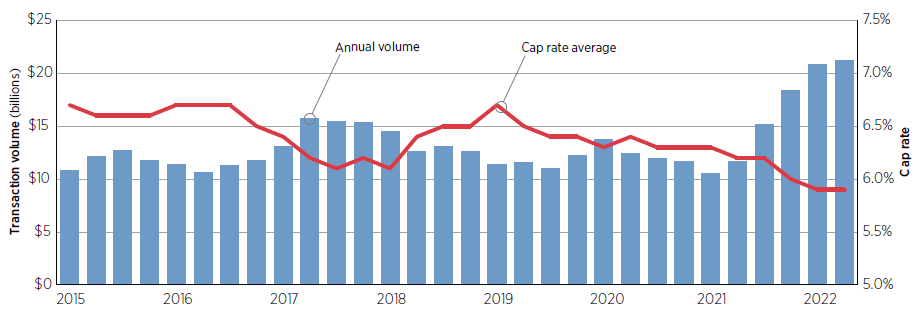

Source: PwC’s Emerging Trends in Real Estate 2023 Report. Note: Transaction volume is for trades valued at $2.5 million or more; figures are trailing 12 months, indicating annualized volume. Cap rate is average, trailing 12 months. Data believed to be accurate but not guaranteed and is subject to future revision.

Tenants of medical office buildings tend to sign much longer lease terms than tenants of other types of commercial real estate—sometimes up to 15 or 20 years—and are much more likely to renew since moving too far away would jeopardize their local patient market share. Transaction activity over the last year has grown to an average annual run rate exceeding $20 billion, with institutional private equity accounting for most of the activity. During this time, there has been significant compression in capitalization (cap) rates. Average MOB cap rates have compressed from above 6.5 percent in 2015 to below 6.0 percent in early 2022.14 Looking ahead, medical office transaction activity will face the same headwinds— rising interest rates, inflation, and a potential recession—as other real estate sectors. However, with so many entities interested in investing and solid sector fundamentals, future activity will likely remain strong.

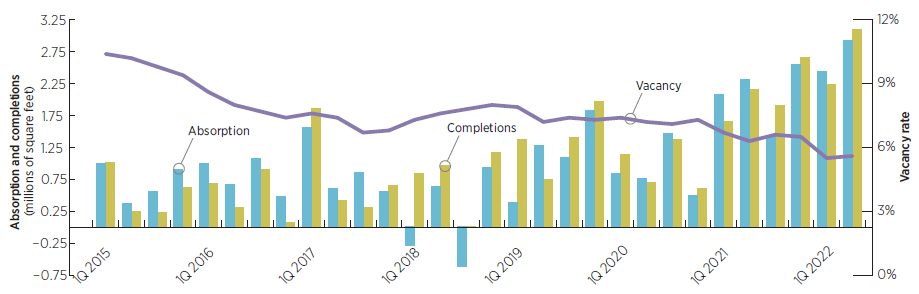

The life-sciences industry is flourishing amid record levels of venture capital funding, continued investments in research and development (R&D), and burgeoning investment in local ecosystems that will bolster long-term industry expansion in core clusters and emerging markets alike. Commercial laboratory real estate has been in high demand as life-sciences companies expanded and scaled operations over the last two years, driven by record venture capital funding and strong revenue gains among select public companies. Real estate investors followed in a similar fashion, targeting opportunities within the sector as the appetite for alternative real estate investment opportunities accelerated.

Life-Sciences Real Estate Supply and Demand, Top U.S. Markets, 1Q 2015-1Q 2022

Source: PwC’s Emerging Trends in Real Estate 2023 Report. Note: Top U.S. life-sciences markets include Boston; San Diego; San Francisco Bay area; Greater Washington, D.C.; Research Triangle Park, North Carolina; Seattle; and Philadelphia, which represent 80 percent of the total U.S. life-sciences market.

ESG

A growing aspect amongst all asset classes is Environmental, Social, and Governance (ESG) factors, which are used to measure sustainability and ethical impact. As the focus on climate change becomes more prominent, commercial and residential buildings will adopt more stringent energy/waste management. In addition, investors are increasingly paying attention to social aspects like employee diversity, working conditions, and community impact. A recent investor poll showed that nearly 50% invested in real estate have ESG policies in place, nearly 20% plan on introducing policies within the next year and the remaining 30% are not interested or hesitant in introducing ESG to their investment considerations or are unsure about its implementation.15

Outlook

We remain positive on the real estate sector overall and see most sectors reacting differently as we move through the high inflation-interest rate environment.

Housing and industrial sectors have started to cool down from their pandemic peak levels owing to high cap rates. Even as valuations are impacted negatively, we see the impact being offset by high income as housing unaffordability and consumer preferences drive up the rental market. The Industrial sector has also seen strong continuing occupancy despite the overall inflationary environment and is expected to grow at a normal pre- pandemic pace in the medium term. In the long run, we see both housing and industrial sectors perform well as higher liquidity spurs deal activity in the next 1-2 years.

Retail and Offices have emerged stronger post the pandemic and there has been a move toward ‘quality’ for tenants. This has resulted in valuations staying strong for high quality grade-A properties. We also believe lower grade retail and office properties will be increasingly re-purposed to new uses if regulatory hurdles were to ease and investors see return potential in such projects.

Real estate is a core contributor to a diversified portfolio and provides reliable income generation. Paired with its ability to function as an inflation hedging vehicle and low correlation to traditional securities, it is clear why real estate is a popular alternative asset among institutional investors. Geographically, we see the U.S. and some European nations as the best positioned to chart a V-shaped recovery as we move through this economic cycle. Overall, we see an opportunity in the near to medium term to invest in quality Grade-A real estate assets in developed economies. Low valuations in an increasingly tightening liquidity environment coupled with stable income yield can help generate significant upside once cap rates compress as the economic cycle turns around.

FOOTNOTES

1 McKinsey Global Institute: The rise and rise of the global balance sheet.

2 MSCI – Real Estate Market Size 2021-2022.

3 Institutional Real Estate, Inc.’s Global Investment Managers 2021 Report.

4 McKinsey Global Institute: The rise and rise of the global balance sheet.

5 MSCI – Real Estate Market Size 2021-22.

6 Preqin – US Real Estate Debt Finds Appeal with Steady Investors.

7 Preqin Investor Outlook – Alternative Assets H2 2022.

8 Preqin – 2022 Global Real Estate Report.

9 Nuveen – Portfolio Construction.

10 Knight Frank – The Wealth Report 2022.

11 Preqin – 2022 Global Real Estate Report.

12 Colliers Canada – Cap Rate Report Q1 2022, CBRE – US Cap Rate Survey H1 2022.

13 McKinsey Global Institute: The rise and rise of the global balance sheet.

14 McKinsey Global Institute: The rise and rise of the global balance sheet.

15 Preqin – 2022 Global Real Estate Report.