The Evolution of Portfolio Management

Portfolio Management Theory produced the 60/40 portfolio

An investment framework that can be used to create the best risk-adjusted returns for investors has long been the pursuit of portfolio managers.

Portfolio managers and academics have worked over the years to build an investment framework that can be used to create the best risk-adjusted portfolio for investors. The starting point for this approach has long been Modern Portfolio Theory, which was established in 1952 by Nobel Laureate Harry Markowitz. Modern Portfolio Theory (MPT) assumes that investors are risk averse – meaning they do not want to take risk without being compensated – and, as a result, the best possible portfolio is one that achieves the required amount of return while taking the least amount of risk: the optimal portfolio.

One of the great outputs of MPT was the 60/40 portfolio which, composed of 60% equities and 40% fixed income, has long helped investors achieve these goals. The 60/40 portfolio was in- tended to give investors a balanced mix of assets that are relatively uncorrelated and can be assembled with relative ease. This approach brought about the significant rise of balanced mutual funds and ETFs focusing on broad market indices.

Traditional Allocation:

60% Equity and 40% Fixed Income

Modern Portfolio Theory states that a risk-averse investor can construct portfolios to optimize expected return, given a level of market risk.

- The 60-40 Portfolio (Figure 1) was designed to be a balance of capital growth and income for the average investor.

- Modern Portfolio Theory developed a series of optimized portfolios given a universe of assets.

- The 60-40 Portfolio is a simplified approximation of a balanced efficient portfolio.

Figure 1 - The Traditional Portfolio Allocation

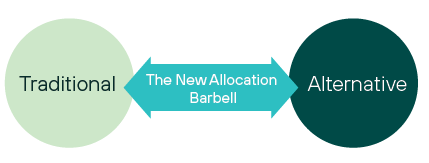

The Traditional Allocation Barbell

Investors must balance passive income versus capital growth from publicly traded assets:

Figure 2 - The Traditional Allocation Barbell

Portfolio Factoring:

Fama-French Model Investing

This investment framework introduces the idea of factoring the allocation beyond the 60-40 split in order to optimize the investor’s return, based on the level of risk they are comfortable with.

Portfolio factoring (Figure 3) is intended to enhance diversification, generate above-market returns, and manage risk. While portfolio diversification was the goal of traditional portfolio allocation, the gains of diversification are lost if the selected securities move in lockstep with the broader market. Portfolio Factoring can off set potential risks by targeting broad, persistent, and long recognized drivers of returns that provide less correlation between asset classes.

Figure 3 - An example of Portfolio Factoring Allocations

Alternative Market Opportunities:

Endowment Model

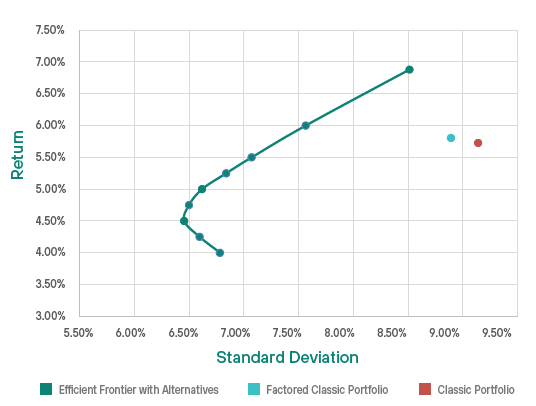

Institutional and sophisticated investors use Alternative Asset allocations to further enhance yield and diversify their portfolios beyond Portfolio Factoring (Figure 4). The Endowment Model accesses a much broader range of uncorrelated asset classes with the potential to better achieve the efficient frontier – the point where a portfolio offers the highest expected return for a defined level of risk or standard deviation (see Graph 1).

Figure 4 – An example of the Endowment Model

Private Market Opportunities within the Endowment Model

Alternative Assets also provide vehicles for exposure to private markets where active management thrives, presenting the potential for higher returns, diversification beyond public markets, and access to unique investment opportunities. Risks may include illiquidity of invested assets and higher costs to invest.

Graph 1 – The Efficient Frontier

Illustrated Endowment Model allocation using data from Mar 31/05 – Mar 31/23, where Alternative Portfolio is represented by: S&P 500; S&P TSX; MSCI Global; Russell 2000; Bloomberg US Agg; Bloomberg CAN Agg; Bloomberg Global Agg; Cliffwater Direct Lending Index (Private Debt proxy); Bloomberg Buyout Index (Private Equity proxy); MSCI World IMI Core Real Estate NR (CAD); Bloomberg Commodity Index; HFRI; MSCI World Infrastructure; 3-month Treasury. Factored Portfolio is represented by: S&P 500; S&P TSX; Bloomberg US Agg; Bloomberg CAN Agg; Bloomberg Global Agg; 3-month Treasury. Classic Portfolio is represented by: S&P TSX; Bloomberg CAN Agg; 3-month Treasury. Allocations change across the Efficient Frontier curve.

For illustration purposes only.

Alternative Asset Allocations for Individuals

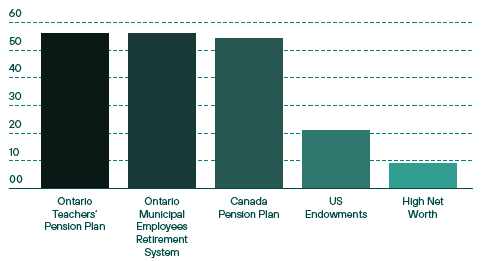

Institutional investors have been quick to adopt alternative asset investments, while retail investors have lagged in their alternative asset allocations versus institutions (Figure 5).

Figure 5 – Alternative Asset Allocation FY2022

Alternatives have the potential to better optimize a portfolio because they operate under different market conditions:

- Managers are less constrained

- Alts often operate in less efficient markets

- Alts often have low correlation to public markets

The New Investor Barbell

Accordingly, a new investor barbell is proposed which balances liquidity from public markets with private investments, giving a portfolio the potential to generate additional yield and diversification (Figure 6):

Figure 6

Retail Access to Alternative Investments

As Institutional allocations to Alternative Investments have grown, retail Investment Managers have taken note.

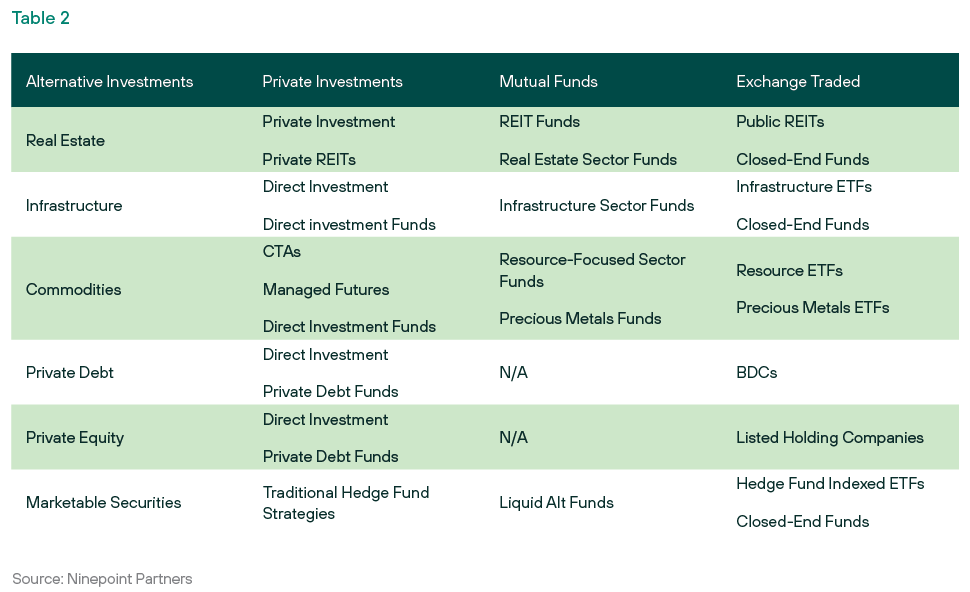

Today, there are several ways for a retail investor to access Alternative strategies and asset classes, many which feature liquidity more suited to the retail environment (see Table 2).

Alternative investments are only available to individual investors meeting the Accredited Investor definition. In all cases, investors should consult with their financial advisors to determine the suitability of any investment in meeting their financial goals. Alternative investments can often be less liquid, higher risk, and carry higher fees than other investment options.