The Fear of Running Out of Money

If you’ve spoken to an investor who retired immediately before the Great Financial Crisis of 2008, the first thing they might tell you is that the retirement lifestyle they had banked on through decades of saving and investing disappeared almost overnight.

Portfolio losses hurt when you are contributing funds in the accumulation phase, but they are downright deadly when you’re in the withdrawal phase.

Sequence of Return Risk

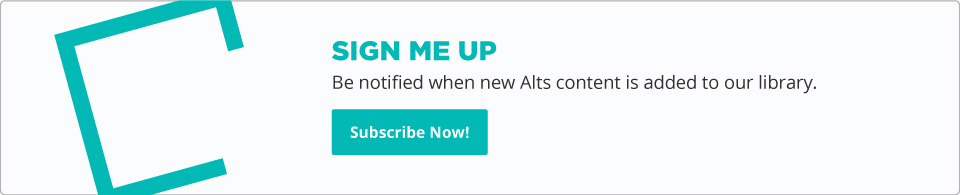

If you started with a $100,000 portfolio and made no new contributions or withdrawals, the sequence of returns of that portfolio are irrelevant to your ending value. For example, let’s say you experience five consecutive years of +10% annual returns followed by five consecutive years of -10% returns. You would end up with $95,099 (figure 1).

Figure 1: Investment 1

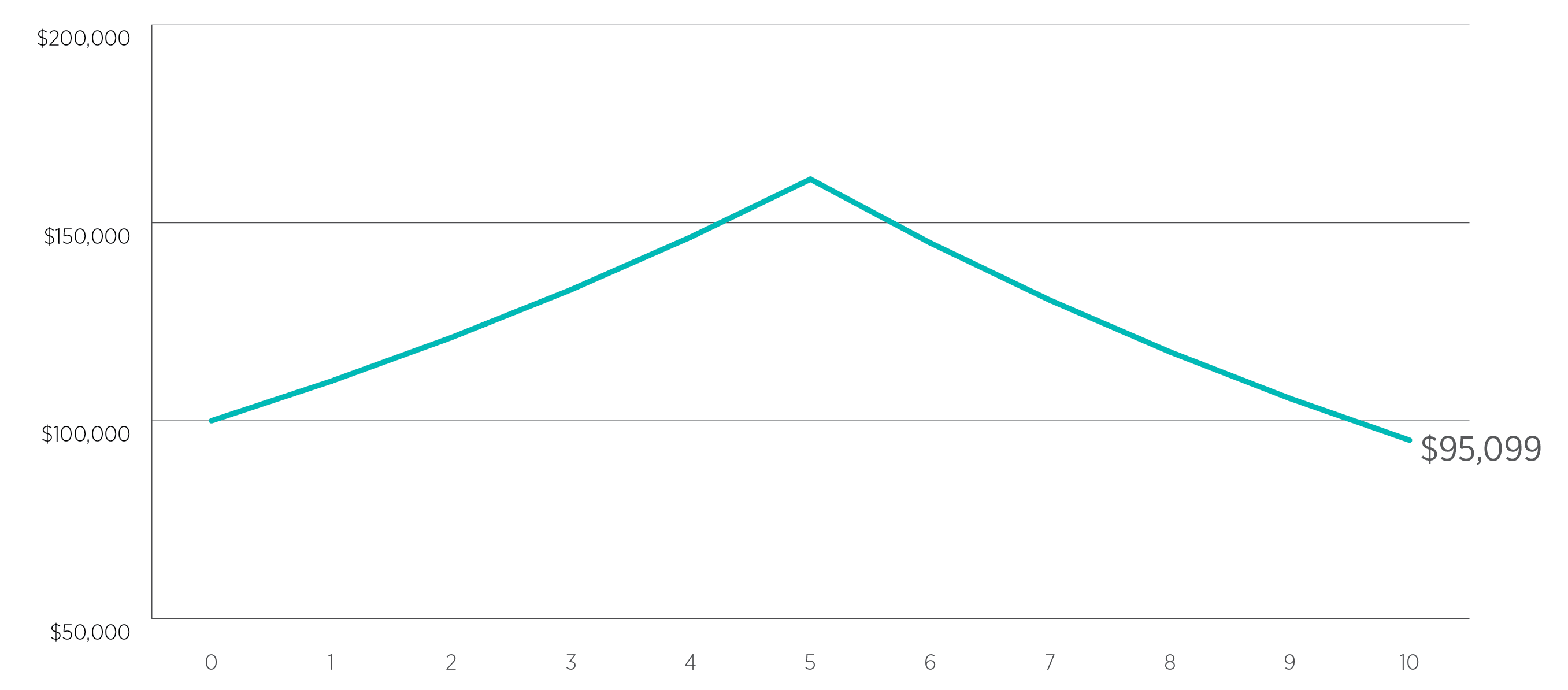

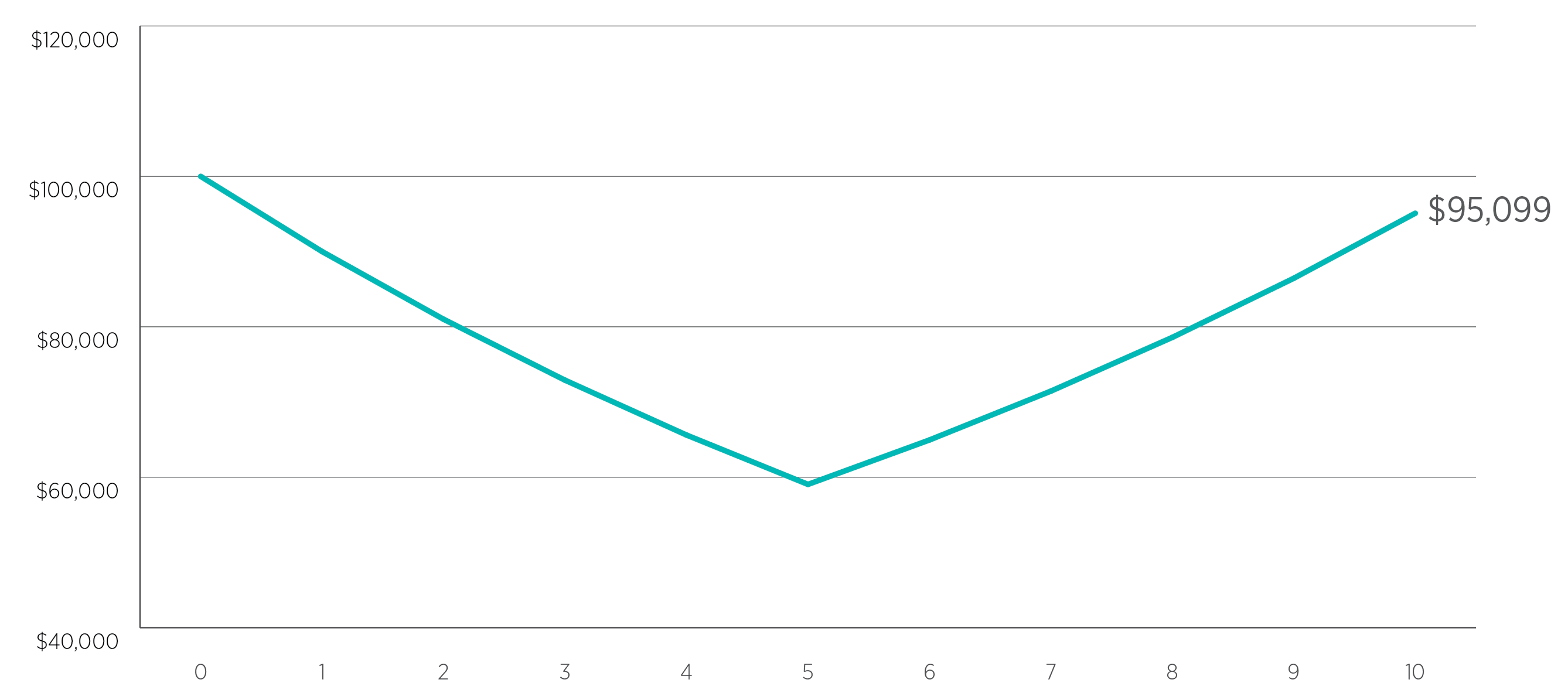

All Figures for illustrative purposes only

If the order of those returns were exactly reversed, with five consecutive years of -10% returns followed by five consecutive years of positive 10% returns, you would have the exact same $95,099 outcome (figure 2).

Figure 2: Investment 2

But if you add cash flows, either through contributions into the portfolio or withdrawals out of the portfolio, the sequence of returns can have a big impact on the ability of your portfolio to fund your goals.

Using the same two return scenarios, let’s now withdraw $10,000 annually at the end of each year. In the scenario where the strong returns occur first, we end up with $18,098 after 10 years, even after taking out $10,000 every year (figure 3).

Figure 3: Investment 1 with Withdrawals

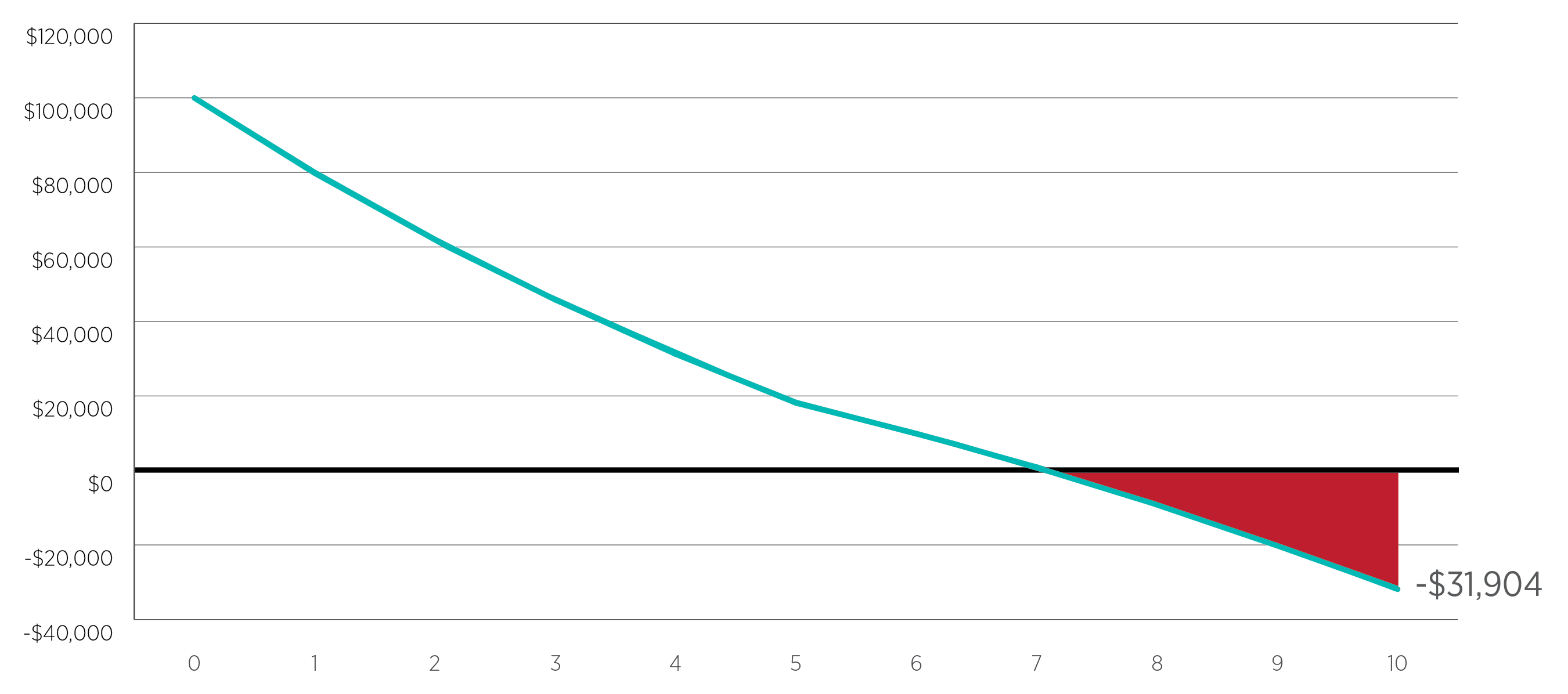

But in the second scenario where the returns were initially weak, we would run out of money just after the end of year seven (see figure 4).

Figure 4: Investment 2 with Withdrawals

Extrapolate this example out for a retirement scenario and the sequence of returns could make for the difference between a comfortable retirement with a residual legacy, versus running out of money. The different timing of drawdowns and subsequent compounding accounts for the different outcomes of the two paths. The timing of drawdowns matter, and they matter a lot.

How Often Do Drawdowns Occur?

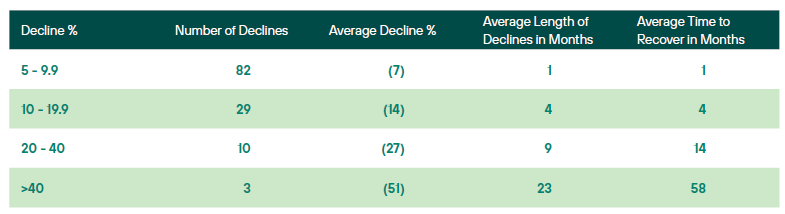

In the 78-year period starting from December 1945, the S&P500 experienced 82 pullbacks (defined as a decline between -5% and -9.9%), 29 corrections (-10% to -19.9%), and 13 bear markets (more than a 20% decline). During this timeframe, the single biggest decline for this index was a 57% drop in 2008. That’s an average of 1.6 drawdowns per year over the 78-year period (see Table 1).

Of course, relatively few long-term investors have 100% equity exposure when they are approaching retirement or are already retired. One of the more basic portfolio management rules of thumb for investors has been to increase their bond exposure as they get older. This would have worked quite well for the majority of the last 77 years, but much changed in 2022 when interest rates rose, inflation hit, and stocks and bonds displayed greater correlation than expected: the broader S&P/TSX Composite Index was down -8.7% while the Bloomberg Barclays Canada Aggregate (Bond) Index was down -11.3% for the same period.1

Table 1 - Declines in the S&P500 from Dec 1945 - Aug 2023

Source: Market Briefing: S&P 500 Bull & Bear Markets & Corrections, Yardeni Research, August 2023, https://www.aaii.com/journal/article/stock-market-retreats-and-recoveries, Ninepoint Partners Research

To many, 2022 was a wake-up call for the traditional 60/40 portfolio. As noted above, portfolio drawdowns of this nature can derail an investor’s long-term goals.

Is it possible that new thinking is required to optimally diversify one’s portfolio?

Why The Old Playbook May Not Work

John Wilson, Co-CEO, Managing Partner, and Senior Portfolio Manager at Ninepoint Partners, is quick to point out that investors today are facing a paradigm shift that hasn't likely been priced into the market yet. Asset values over the last 40 years have benefited from price stability generated by globalisation, demographics, technology, and policy discipline. That period is over.

Today, geo-political tensions (onshoring, friendshoring), the energy transition (investing in/complying with a net-zero future), and demographic headwinds (pension funding, labour shortages, union growth) all suggest a lengthy period of persistently higher costs and, as a result, higher levels of inflation than we've been accustomed to. Alternatively, if there is a chance of wrestling inflation to the mat, it would require much more economic weakness than we've seen so far, or significantly more quantitative tightening.

What's my protection if inflation is stickier or growth is weaker than anyone expected?

Any of the above scenarios will likely lead to market uncertainty and unwanted drawdowns. "The question investors have to ask," Wilson commented, "is what's my protection if inflation is stickier or growth is weaker than anyone expected? Has the playbook changed?"

Diversification in a New Economic Order

It continues to be true that one of the best ways an investor can chart a smoother journey for their portfolios is by ensuring that their portfolio is well-diversified – spreading investments across a range of uncorrelated asset classes to reduce overall portfolio risk.

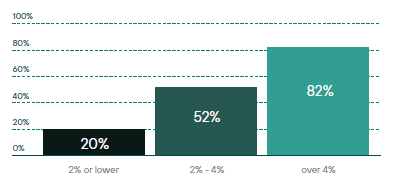

Investors have long accepted the idea that uncorrelated asset classes were good for portfolios – that’s always been the logic behind the traditional 60% stock/40% bond portfolio. Of course, as we’ve seen, the efficacy of a 60/40 portfolio can become strained in an inflationary period, with correlations between stocks and bonds typically becoming

more undesirably positive (Figure 5).

Figure 5 – Correlation Between Stocks and Bonds at Different Inflation Rates (% of time positively correlated)

Source: Investing.com. Data from 1984 to Feb 2022. Inflation is defined as the US CPI. Stocks are represented by the S&P500. Bonds are represented by US 10-Year Treasury Yields.

In today’s economic environment, the question becomes what combination of investments will

produce that smoother investor journey, helping to buffer a portfolio from damaging drawdowns? Enter the world of alternative investments.

“There’s a wide range of assets and strategies that fit into the ‘alternative asset class’, because really, alternative just means something other than owning stocks and bonds,” says Wilson. “Many people are already heavily invested in alternative asset classes because they own their own house. Real estate has attractive long-term rates of return and, importantly, the way real estate goes up and down is not heavily correlated with what happens in stocks and bonds.”

Other alternative assets that become interesting in today’s environment include those that diversify bond exposure: private debt can offer meaningful portfolio income, strong returns, and exhibits low correlation to traditional asset classes like stocks and bonds.2 Actively-managed, alternative fixed income funds are also worth considering in this regard as they have a broader range of strategies to draw from to manage interest rate risk. Assets that are tied to inflation rates become a consideration: infrastructure, real estate, and private debt often meet that criteria and most often exhibit low correlation to equities. The energy transition business is compelling, exploring funds at both ends of the transition story: oil, which will still be in use for decades, and carbon credits, that offer a substantive path to net-zero.

Of course, there are many considerations when exploring investing in alternatives. Like a house, an alternative investment may not have the same level of liquidity as publicly traded securities. But homeowners generally understand the role that real estate plays in meeting their long-term financial objectives and, like a house, investors would generally expect a return premium for those less-liquid investments. The first step, in all cases, is to engage a financial advisor to determine the suitability of alternative investments to meeting the investor’s financial goals.

Adding Alternative Asset Class Exposure to Reduce The Risk of Running Out of Money

A portfolio would never be 100% alternative investments. But the idea of adding alternative investments as an asset class to complement the more traditional asset classes is a time-tested one. In the world of large pension plans and sovereign wealth funds, alternative asset classes have been used for decades to produce income, return, and improved portfolio diversification. Today, as retail investors gain more access to professionally managed alternative investments and strategies, they stand to benefit from more effective portfolio diversification. In doing so, they can also better manage their risk of running out of money.

1 Bloomberg, August 2023

2 Preqin Global Report 2023: Private Debt, September 2022