Wisniewski's puzzle: Solving the income problem in a low yield world

Three dimensional wooden puzzles are beautiful to look at but are often very difficult to solve – unless you know how. Once you know how, solving the puzzle is simple. The same can be said of managing Fixed Income funds today.

Ten years ago, when interest rates were much higher and government bonds actually produced yield, index bond funds were solid products because they delivered income with much less sensitivity to the movement of interest rates. In today’s ultra-low-rate environment, that just isn’t the case anymore.

Most mutual funds and ETF’s are passive and constrained, meaning they must mirror a benchmark like the ICE Canada Broad Market Index. Typically, 74% of the securities contained in these bond funds are low yielding government or quasi-government bonds. As a result, these indexed bond funds yield less than a GIC, but with significant duration risk of around 8 years. If interest rates move up by only 0.25% an investor starts to lose money because these funds generate less income and are very sensitive to interest rate moves.

“Sure, government bonds are safe, but they aren’t risk-free,” Mark Wisniewski, Senior Portfolio Manager and Partner with Ninepoint Partners explains. “Locking in an interest rate for 10 years or more, that you wouldn’t normally accept for a year, isn’t a productive way to invest in bonds. Taking that much interest rate risk to earn a GIC-equivalent yield shouldn’t be acceptable to investors who are concerned about risk and capital preservation.”

Traditional mutual funds and ETF’s have very limited flexibility to alter their portfolios: they can’t materially alter security selection, sectors, or government and company exposure to enhance yield. Consequently, these passive managers cannot change the dynamics of their portfolio to be opportunistic or defensive and they have no ability to generate liquidity or harvest gains.

Wisniewski, who has been trading bonds at institutions like BMO, Goldman Sachs, and TD for over 24 years before joining Ninepoint, views the solution to today’s fixed income puzzle as a combination of active management and a flexible mandate that enables a manager to use all the tactical tools at their disposal.

Why liquid alternatives can provide a unique fixed income solution

Today’s fixed income investing environment has become even more challenging due to the persistence of ultra-low interest rates. Government bond yields are so low, a traditional fixed income fund now yields less than 2.0% and that’s before fees. If interest rates don’t continue to go down, it’s conceivable that these index bond funds will never produce a positive return. This is the conundrum globally: low bond yields are rendering traditional bond funds ill-suited to do their job – to generate income and preserve capital with less volatility.

“Unconstrained bond strategies, essentially liquid alternatives bond strategies, are a game-changer for fixed income,” Mark Wisniewski summed up. “Investors will now have access to a differentiated bond fund that can potentially deliver higher returns with much less correlation to the bond market, resulting in less volatility. For bond managers this provides more tools to do a better job. A bigger opportunity set of assets and strategies to generate returns, with improved diversification, less correlation to the index and a higher level of risk management. A true win-win!”

Ninepoint’s approach: a true liquid alternative

Our new liquid alternative, the Ninepoint Alternative Credit Opportunities Fund, will function very much like a credit multi-strategy, where we will be investing in different types of credit, employing various investment strategies. To accomplish this, we essentially run two portfolios that separate the different assets and strategies employed, the core and overlay.

Ninepoint Alternative Credit Opportunities Fund

Fund Construction

In the core portfolio we have an allocation to various types of credit, shorter-to-intermediate dated corporate bonds, high yield, structured notes, asset-backed securities, un-rated private placements, and hybrid securities, such as preferred shares. By blending different types of credit we can generate more yield without using a lot of duration or a concentration of lower quality credit. The securities in this portfolio will generate more income than a traditional portfolio of fixed income – no leverage is used here.

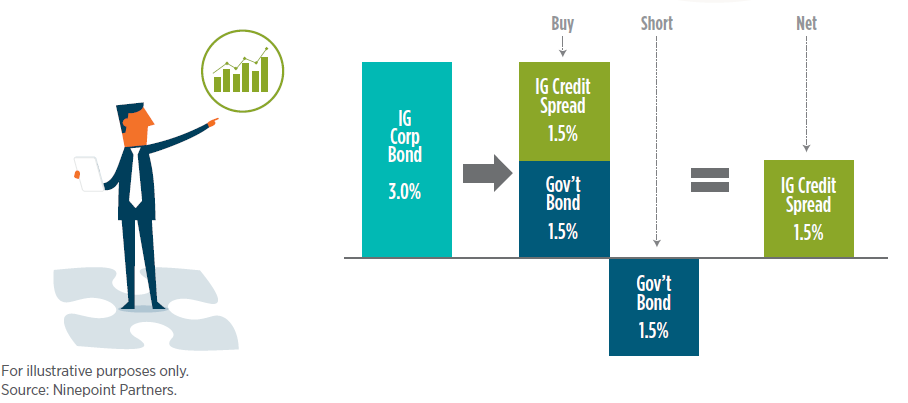

In the overlay portfolio we employ different strategies that include interest carry, active trading, and short selling. It’s also where we employ some leverage, but only on high quality investment grade credit. The overlay generates income with very little interest rate sensitivity as government bonds are short sold against all the corporate bond positions, isolating the credit spread.

Short Selling to Neutralize Interest Rate Risk

Leverage will be utilized to enhance returns, but given our higher yielding security mix, it will be much less than other managers would typically use. We don’t view leverage as being the end-all solution, it’s just one of many tools to utilize when risk-reward is sensible.

To mitigate downside in the portfolio due to volatility, like March 2020, there will we be an overlay of portfolio insurance hedges. A combination of credit derivatives positions and options strategies designed to dampen draw-downs.

“We will be launching a differentiated fixed income alternative that fully utilizes the strategies and assets available to us within the parameters of the liquid alternative class. Our fund won’t be just about using leverage on investment grade credit,” Wisniewski noted.

Are liquid alternatives the right fixed income product for you?

It really comes down to what you’re trying to achieve for your clients and what your current asset mix isn’t providing. If your objectives include more income, reduced risk, less correlation to passive bond funds, better diversification, or lower volatility, you may want to explore fixed income liquid alts.

That said, liquid alternative products can be complicated strategies and they can employ a lot of different investment tactics which include short-selling, different degrees of leverage, the use of derivatives and concentrations in different sectors or securities. When a fund has more latitude and additional tools at their disposal there is always going to be the concern of risk taking. It’s important for an investor to understand the game plan and whether the fund’s strategy and tools are being used to control risk, protect the downside, and manage volatility – or just simply juice returns.

Like all new strategy launches there will be lots of providers masquerading as alternative managers. In the fixed income space, there is a big difference between a passive index portfolio manager and an active unconstrained manager – they take a very different approach to risk, process and portfolio management. When selecting a new liquid alternative fund ensure that the manager has experience in alternatives, a well thought-out strategy, and a track record of managing a similar mandate.