Monthly Update

Year-to-date to January 31, the Ninepoint Global Real Estate Fund generated a total return of -1.30% compared to the MSCI World IMI Core Real Estate Index, which generated a total return of -2.60%.

Ninepoint Global Real Estate Fund - Compounded Returns¹ As of January 31, 2024 (Series F NPP132) | Inception Date: August 5, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

-1.3% |

-1.3% |

12.0% |

0.4% |

-6.1% |

2.6% |

3.8% |

5.9% |

MSCI World IMI Core Real Estate NR (CAD) |

-2.6% |

-2.6% |

12.3% |

2.7% |

-2.3% |

1.8% |

0.8% |

2.7% |

The year 2024 has started off much like 2023 ended, with stocks in the Communication and Information Technology sectors continuing to rally. However, after peaking last October and falling through the end of the year, the US 10-year Treasury bond yield retraced some of its recent move lower this past month. As rates ticked slightly higher in January, rate-sensitive securities in the Real Estate and Utilities sectors underperformed. Longer term, we are not overly concerned about this backup in rates, since we believe that those looking for immediate rate cuts simply got ahead of themselves towards the end of last year. Instead of focusing on the near term, investors should take a step back and focus on the bigger picture: inflation is easing, growth remains resilient, the jobs market remains strong, the earnings recession is over and rate cuts will begin sometime in 2024.

At the January FOMC meeting, the Fed unsurprisingly held rates steady at a range of 5.25% to 5.50%. As we’ve discussed previously, we’ve been reasonably confident that the final interest rate hike for the cycle occurred at the July meeting, but we recognized that Fed officials would continue to talk tough to prevent resurgent inflation. During Powell’s press conference on January 31, the Chairman stuck to this script, saying “So if you take that to the current context, we’re going to be data dependent. We’re going to be looking at this meeting by meeting. Based on the meeting today, I would tell you that I don’t think it’s likely that the Committee will reach a level of confidence [to cut rates] by the time of the March meeting, to identify March as the time to do that. But that’s to be seen”. We don’t see anything in that statement that changes our view that the Fed is taking a more balanced view in pursuit of their dual mandate of full employment and price stability.

Admittedly, the odds of a March cut are lower today (but not zero) and the most likely scenarios suggest an initial rate cut in May or June of 2024. After almost two years since the first interest rate hike, we accept the need to wait patiently for another two or three months before an easier monetary policy. But because the precise timing is unknown and the future economic environment remains uncertain, it would be reasonable to expect some volatility in the first half of 2024. Further, with the S&P 500 currently above 4,900 (or almost 20x 2024 forward earnings according to FactSet), it feels like investors have optimistically pulled forward some future returns. Therefore, after a flat year of earnings growth in 2023, a return to earnings growth in 2024 (currently forecasted at just under 10%, again according to FactSet) will be required for the market to continue to move significantly higher over the balance of the year.

Nevertheless, if growth does meet expectations and mega-cap tech moves sideways or even underperforms in 2024 from here (quite possible given the high expectations and high multiples already applied to these equities), our dividend focused mandates should do well on both an absolute and relative basis. As always, we are continually searching for companies that are expected to post solid revenue, earnings and dividend growth but still trade at acceptable valuations today.

For the Ninepoint Global Real Estate Fund, we are concentrating our research efforts on high quality, dividend growth companies given our positive assessment of the risk/reward outlook over the next few years. After many years of outperformance from the high growth and high valuation Information Technology sector, if interest rates fall and earnings and cash flow growth become more widespread, we would expect a rotation out of the big winners of 2023 and into undervalued equities and REITs more aligned with our dividend-focused mandates in 2024.

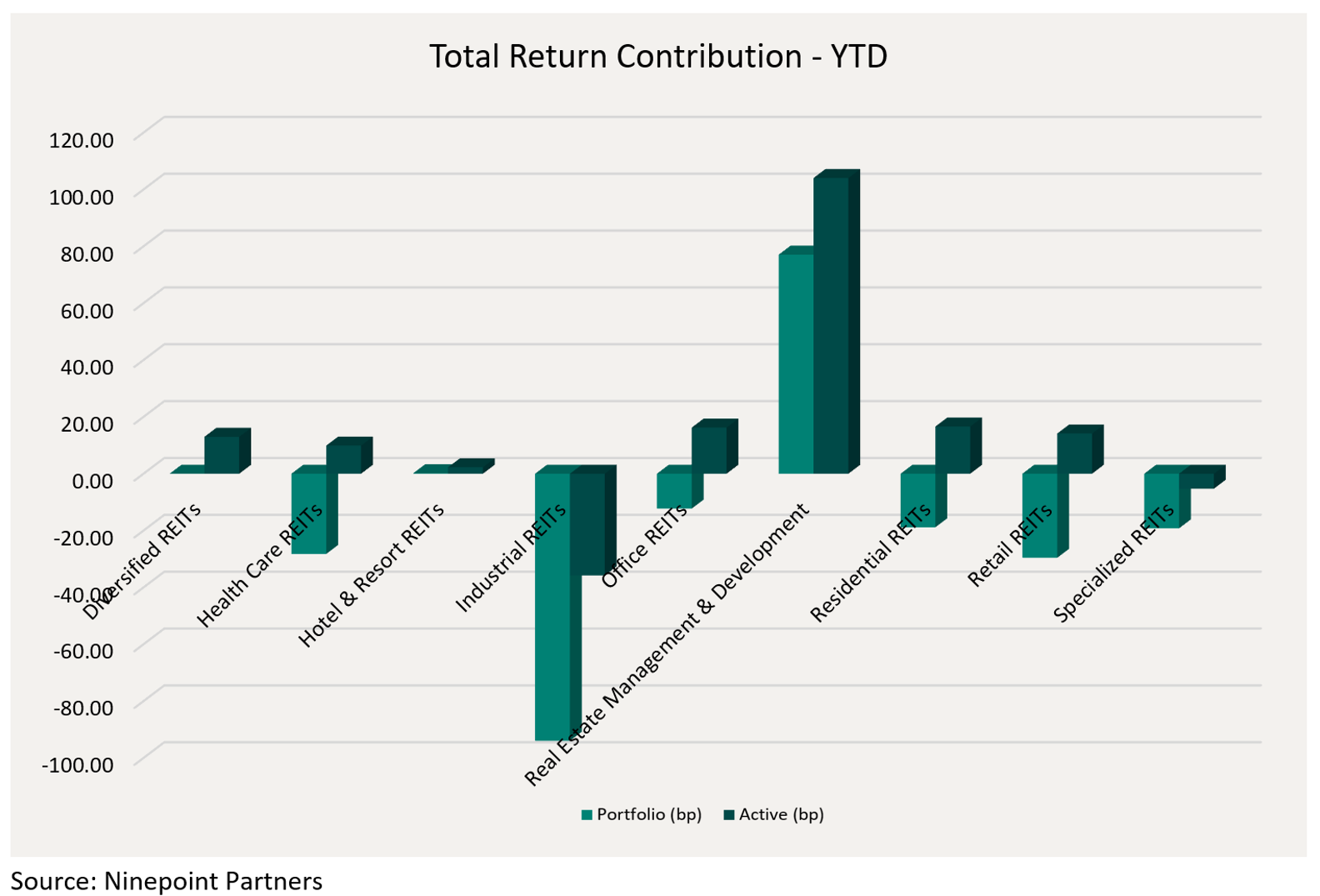

Top contributors to the year-to-date performance of the Ninepoint Global Real Estate Fund by Industry included Real |Estate Management & Development (+77 bps) and Hotel & Resort REITs (+1 bps), while top detractors by sub-industry included Industrial REITs (-94 bps), Retail REITs (-30 bps) and Health Care REITs (-28 bps) on an absolute basis.

On a relative basis, positive return contributions from the Real Estate Management & Development (+104 bps), Residential REITs (+16 bps) and Office REITs (+16 bps) industries were offset by negative contributions from the Industrial REITs (-36 bps) and Specialized REITs (-5 bps) industries.

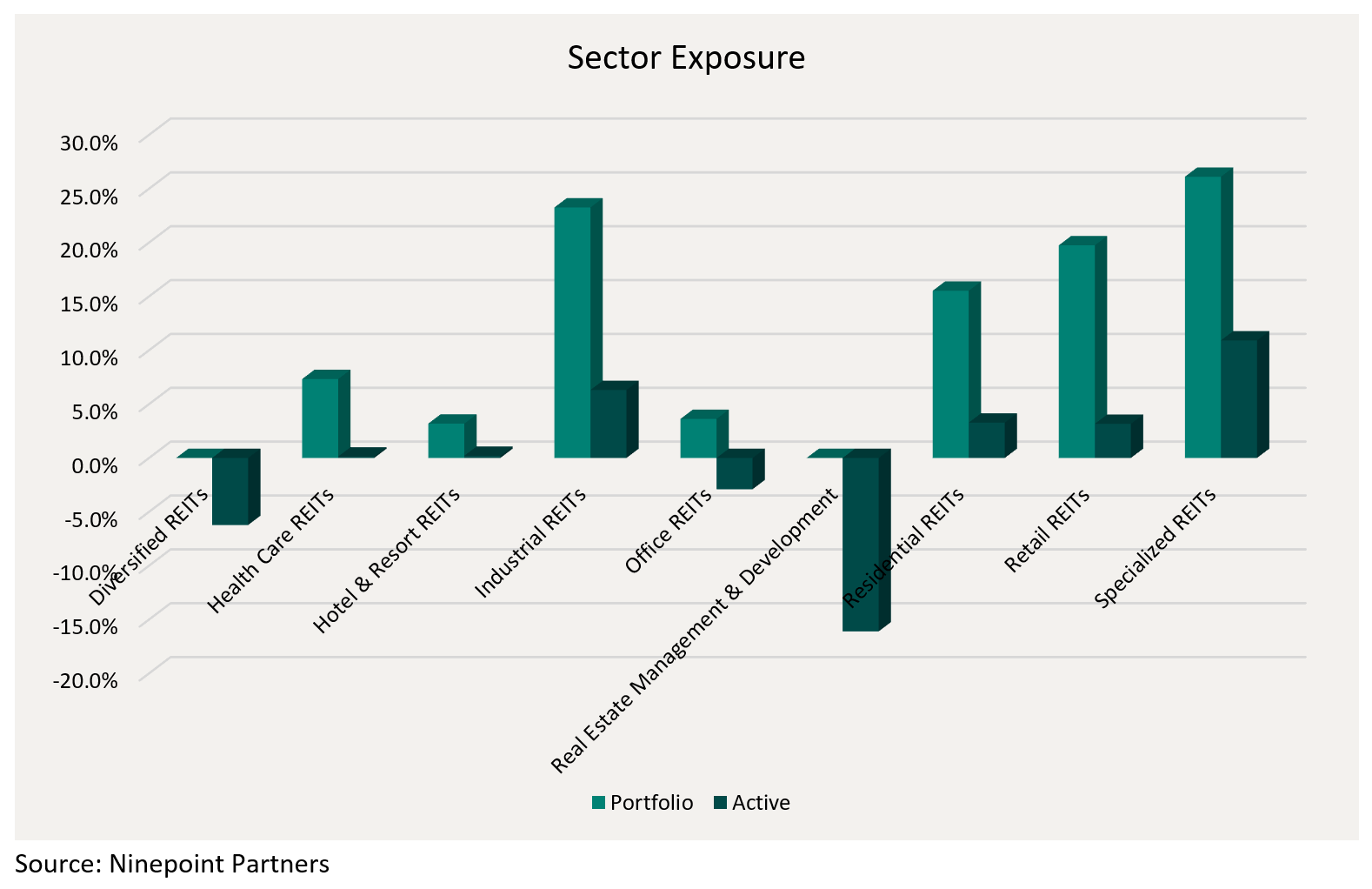

We are currently overweight Specialized REITs, Industrial REITs, and Residential REITs while underweight Real Estate Management & Development, Diversified REITs, and Office REITs. With the debate shifting toward the timing of the first interest rate cut of the cycle, we are looking forward to better relative performance from dividend paying real estate assets in 2024. In the meantime, we remain focused on high quality, dividend payers that have demonstrated the ability to consistently generate revenue and cash flow growth through the business cycle.

The Ninepoint Global Real Estate Fund was concentrated in 28 positions as at January 31, 2024 with the top 10 holdings accounting for approximately 43.3% of the fund. Over the prior fiscal year, 18 out of our 28 holdings have announced a dividend increase, with an average hike of 14.7% (median hike of 3.3%). Using a total real estate approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

January 31, 2024

January 31, 2024