Summary

In this month's commentary, we review recent Q4-23 financial results for many of the top holdings in the Fund. We also highlight continued enthusiasm for US cannabis as investors await a decision from the DEA to re-schedule cannabis on the Controlled Substances Act (CSA). Names such as TRUL +11% in Feb after a strong January and YTD + 94% reflect the multiple catalysts that are on the horizon for the sector in 2024. We also saw solid contributions from our pharmaceutical names such as LLY +30% YTD which continues to gain investor confidence based on its GLP-1 franchise it is building with Monjauro and Zepbound, breakthroughs in the treatment of obesity and type II diabetes. Another area where we have seen continued support is in our consumer healthcare focus where names like COST +14% YTD stand out.

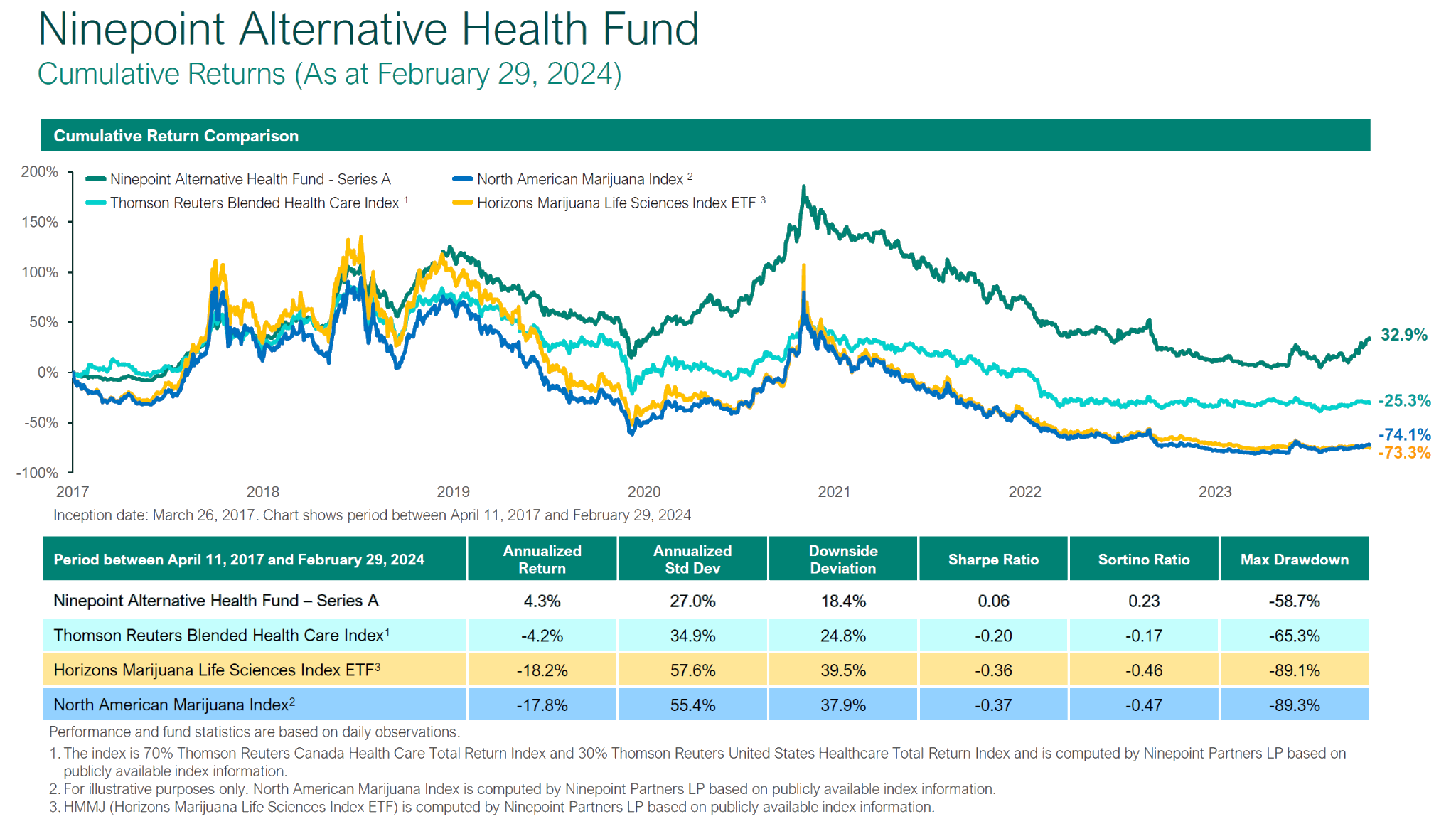

For the month, the Fund outperformed its benchmarks as the combination of US cannabis combined with select pharma and consumer health names held up better than the underlying benchmarks. We continue to illustrate our conviction in our diversified approach that continues to provide better risk adjusted returns than the individual benchmarks underlying our portfolio allocation.

Continued Enthusiasm for US Cannabis

Investor sentiment continues to be positive for US cannabis as the first of several catalysts in 2024 are drawing investors to the sector. We believe that two significant catalysts are lining up, and have the potential to happen within the next 45 days.

1. DEA Re-Scheduling Announcement

Firstly, at the Federal level is the DEA announcement re-scheduling cannabis to Schedule III from Schedule I on the Controlled Substances Act. The key read-through is that cannabis businesses will no longer be hampered by excessive US Federal taxation, unleashing significant cash flow growth for operators. The implications of the DEA announcement must not be understated as the ripple effect of a Schedule III move can result in the following positive outcomes:

i) reduced stigma could signal acceptance for US Custodians to hold US cannabis names thereby allowing institutional accounts to invest.

ii) reduced regulatory burden can open Banks to deal with marijuana based businesses (MRBs).

iii) Bank openness can lead to credit cards being used in dispensaries, reducing violent robbery risks in many cities.

iv) FDA backed research results and oversight can lead to enhanced potential capital raising and up-listing to senior US exchanges.

There are significant upside opportunities that can develop as a result of the DEA decision and it is due to this upcoming announcement that the US cannabis names have been rising in markets YTD.

2. Trulieve Tax Refund: A Sign of Things to Come?

As enthusiasm grows for the DEA announcement and resulting change to tax policy for US multi state operators, one of the Fund's top holdings, TRUL had significant success claiming tax refunds ahead of this announcement. TRUL previously announced it had claimed refunds for three years 2019, 2020 and 2021. The company announced in its Q4 call that it filed claims against previously filed tax returns for a total of $174 million ($143 million in federal, $31 million state), and has received $113 million in refunds to date, with only one rejection notice for just over $1 million. This is noteworthy for a number of reasons. First, the speed with which TRUL received the claim could mean that federal authorities are already planning for the DEA announcement and a change to federal tax policy for cannabis companies. This tax refund is not without risk as CEO Kim Rivers suggested there could be litigation involved in the discussion with the IRS, so, we will wait and see. But the fact remains that the IRS chose to refund very significant amounts of tax for a politically sensitive industry. It seems unlikely that such decisions were made without the knowledge and approval of the highest levels of the IRS.

A brief history lesson on how we got here and why this is positive for rescheduling. In 2014, the famous Cole Memo was drafted and every Congress since has enacted laws in support of the Cole Memo that specifically removes funding from the DOJ preventing the Justice Department from interfering with legal state run cannabis businesses. Essentially the federal government cannot prosecute medical cannabis businesses within state boundaries. This is consistent with a case that went to the Supreme Court back in 2005 where a person was charged under federal law for growing marijuana for medical personal purposes in California, and initially, the Federal Government stated that it had the right to arrest, using the Commerce Clause of the Constitution to intervene. However, the person ultimately won at the Supreme Court because federal authorities, interpreted by the Supreme Court, could only regulate interstate commerce (state to state) not intrastate (within one state) commerce. Legal businesses within state boundaries are off-limits from federal prosecution. Following this logic, it could be interpreted that any federal law, such as IRS Tax Code 280E or the Controlled Substances Act can be overlooked within state boundaries. This interpretation we believe is what drove TRUL to file its claim. To date, no other cannabis companies have taken this aggressive route.

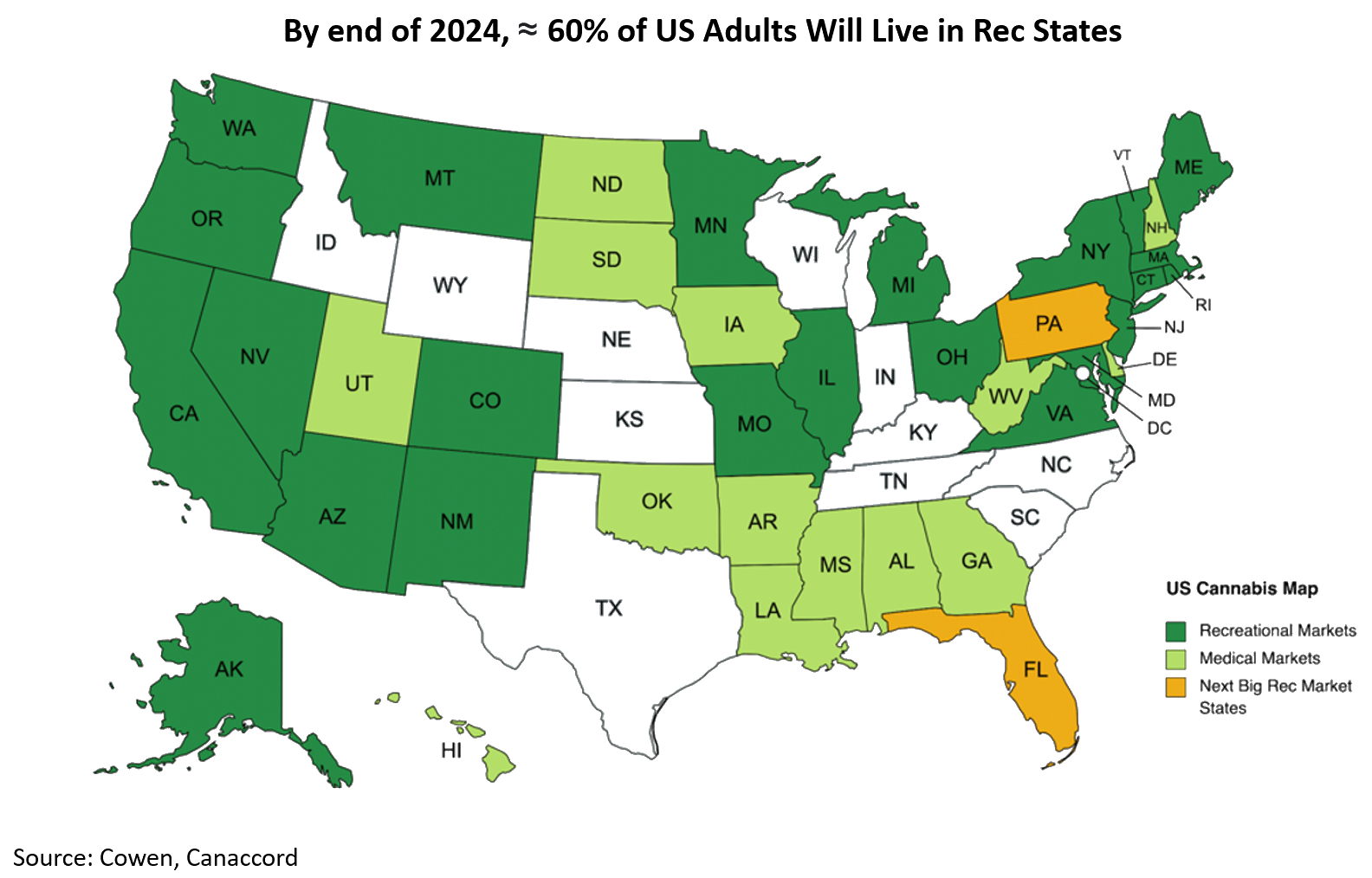

State-Level Adult Use Transitions

Another set of catalysts that can support further valuation growth for US cannabis names in the Fund deal with state-level adult use transitions. As the map of the US shows, the growth in state-by-state medical market transitions to adult use markets continues to grow and many of those transitions provide 2-4x growth or upside sales opportunities. In April of 2022, New Jersey used a limited license regime to launch adult sales that have benefitted MSOs that have wholesale cultivation to meet the growing market of dispensaries in the state. Over the last 12 months, NJ has grown from 19 dispensaries to 100 dispensaries offering wholesale growth to the leading cultivation licensees. In Q4 alone, data shows that NJ sales growth was +20%, making the state a prime sales and margin leader for those with exposure to that market. In 2023, Maryland, Missouri and Connecticut launched adult use sales again utilizing limited licensing strategies that has been beneficial for MSO’s and incumbent operators. The key message is that state run markets provide opportunities for significant cash flow growth. We compare the success of these limited license states with New York and California which have allowed a combination of either open licensing or significant tax hurdles that to date have reduced the upside for operators to want to compete in these otherwise larger markets.

Catalysts for April

The significant state adult-use catalysts for 2024 rest with Pennsylvania and Florida. In Florida, there is significant voter support for the potential Ballot Initiative on election night in November. Currently, over 67% of adult Floridians are estimated to be in favour. However, before November, the Florida Supreme Court is to decide on the validity of the language posed in the Ballot, to ensure language is not misleading. Under Florida law, the Supreme Court will need to decide by April 1st. If it is silent, then the initiative will stay on the ballot. There is a strong belief that this third attempt to bring adult-use cannabis to Florida will be successful. Florida is one of the largest states by population and is already one of the largest markets in the US generating sales estimated to be over $2 billion. Given annual tourism to the state, FL could be a $4-5 billion state market. Fund holdings are represented well in FL with Trulieve being the market leader with over 130 dispensaries, followed by Verano with 73 storefronts, AYR with and Green Thumb at 13.

Post April Catalyst

Pennsylvania is a medical market, with sales above $1.5 billion. It is another top ten US-populated state reviewing the transition to adult-use sales. Unlike Florida, where a cannabis unfriendly legislature has made it necessary to put it to a vote, PA laws allow for legislation to bring in adult-use sales. Governor Shapiro has unveiled his proposed budget for the F2024-25 year that starts July 1st. A review of the line items in the budget reveals that adult-use sales taxes as a new revenue stream. He is on the record discussing that PA needs to ensure the state does not lose out to neighbour Ohio which has just voted to bring in adult-use sales. Essentially PA is now encircled by NJ, VA, NY and OH that have all enacted adult-use legislation. With its large population, the operators in PA have significant upside opportunities. The Fund's top cannabis holdings are all represented with Trulieve at 20 stores, Curaleaf at 18, Verano at 17, Green Thumb at 16, while TerrAscend sits at 6 retail locations.

Eli Lilly Continues to Gain through GLP-1 Market

During Q4, LLY had another GLP-1 regulatory success as Zepbound was approved by the FDA. Zepbound is an injectable prescription that helps adults with excessive weight who also have weight-related medical problems, lose weight and keep it off. Zepbound is slightly different from Monjauro, both use the same medical compound, tirepatide, however Mounjaro went through clinical trials and was approved for treatment for type 2 diabetes while Zepbound has been cleared by the FDA as a treatment for weight loss. Early market response seems strong as the drug was only on the market for just weeks in the quarter ended Dec 31 with sales climbing to $175.8 million, more than double the $75 million estimate from analysts.

Clinical trials continue to be done on the GLP-1 drugs with results illustrating secondary and tertiary success aside from just dealing with weight loss or type II diabetes. It is the additional health benefits that is propelling LLY higher as its most recent announcement was a positive trial result focussed on a liver disease called metabolic dysfunction-associated steatohepatitis, or MASH. After 1 year of Monjauro use, 74% of patients showed no signs of MASH while liver fibrosis didn't worsen.

One of the upside surprises for LLY and its GLP-1 solutions is the strength of its distribution platform. A way to ensure efficient delivery of health services in the US is to team up with telehealth providers that can dispense through online portals. Lilly has been successful in launching LillyDirect that connects patients with a telehealth provider, Form Health, whose doctors work with patients to determine if patients could be candidates for GLP-1 medications. Providing ease of access and assured supply will be key to continued sales growth.

Q4-23 Financial Results

US Cannabis Company Results

Green Thumb Industries (GTI) was out first for the US Cannabis companies with its Q4-23 results with a big beat over analyst expectations generating quarterly revenue of $278 million, increasing 7% YoY vs analyst estimates of $270 million. Expansion of gross margins to 51% from 48% in Q3 was due to increased revenue from new cultivation coming online, offsetting prior quarter start-up costs. Keeping SGA expenses under control helped the company to have stronger margins generating adjusted EBITDA of $91 million or 33% of revenue in the quarter also beating estimates of $80 million that would have been a 29% margin. Driving growth for GTI is its focus in new markets where it is gaining traction with wholesale revenues up 13% YoY (its “CPG” consumer packaged goods division) from growth in Maryland, Nevada, New Jersey where the company holds the $3 position in overall sales. On the retail side sales were up 5.5% YoY in Q4 and 2% QoQ. GTI operates 91 retail locations in 14 different US markets

For the year, revenue reached $1.1 billion, increasing 4% YoY while adjusted EBITDA was $326 million or 31% an increase of 5% over the prior year. Cash flow generated from operations was $225 million, an increase 42% YoY. As investors might recall GTI announced a share buy back program in the summer of 2023 and to date have purchased $40 million at below market prices. Management has board approval to continue the program bringing the potential total to $100 million over 2024. In addition to its stated share buy-back program, management suggested the build out of 10 - 15 new dispensaries to be opened in FL, NV, MN, VA, and OH, after 7 dispensaries were built in 2023. Growth in 2024 is seen in adult-use conversions in state markets such as OH, VA and potentially FL and PA which are all attractive opportunities with current GTI cultivation and retail exposure.

Trulieve (TRUL) beat analyst expectations with earnings and EBITDA above estimates with revenues of $287 million ahead of consensus at $268 million. Revenue growth in the quarter was 4% QoQ which was above prior management comments, driven by better-than-expected consumer spending, higher traffic in dispensaries, as well as higher average basket sizes and units sold in PA AZ and MD state markets in addition to stronger pricing in FL. Wholesale distribution increased 19.1% QoQ while branded products sold through the TRUL retail network increased ~4% QoQ. A new store concept that is working well is a new Express Store concept that has smaller square footage, only 2-3 staff with an assumption that most consumers are repeat buyers. This smaller floor plate along with the use of sales data of consumers in the immediate area allows TRUL to hold inventory that is most in demand in that area. TRUL continues to generate efficiencies from “JeffCo”, its Jefferson County facility, a 3 million sq ft cultivation/processing facility launched last year. The result of higher efficiency operations saw a gross margin increase of 200 bps QoQ, and 100 bps YoY, while maintaining operating costs as a percentage of sales all leading to adjusted EBITDA margin of 31% for the quarter, a 300 bps increase QoQ and YoY. For Q4, adjusted EBITDA was $88 million, also a beat over consensus at $72 million.

For the year, TRUL generated revenues of $1.13 billion, with overall gross margin of 52%, or $589 million. The company achieved adjusted EBITDA of $322 million, or 29% of revenue. During 2023, the company had growth from adult-use sales in Connecticut and Maryland and opened new markets with medical dispensaries in Georgia and Ohio. Capital was deployed adding 17 new dispensaries in 2023, increasing its retail footprint to 192 retail locations with over 30% of retail locations outside its home state of Florida.

Verano Holdings (VRNO) announced top line growth of 5% YoY resulting in Q4 revenue of $237 million. Contributing to the company’s growth trajectory includes continued outperformance in Florida with VRNO revenues up ~11% vs Q3 while its wholesale business in IL also gaining traction reaching the #3 position in overall sales in the state. The company continues to maintain the 2nd largest market share in New Jersey, however contribution in this market saw a ~10% decline in the quarter as competition on the retail side has grown considerably this year with 90 stores in operation vs 19 one year ago. With third party store openings, onus is on wholesale distribution to maintain that leading market position. Gross margins were negatively impacted in the quarter as increased retail competition led to pricing pressure that resulted in a gross margin reduction to ~49.6%, lower than Q3 levels. Adjusted EBITDA for the quarter 2023 was $73 million or 31% of revenue, a strong overall result.

For the full year, revenue was $938 million, an increase of 7% vs 2022 with gross profit of $475 million or 51% of revenue. Adjusted EBITDA reached $305 million or 32% of revenue, these annual results driven by wholesale adult use sales in New Jersey, in addition to growth in Maryland and Florida retail. . For the year, VRNO added 16 dispensaries in 2023 bringing the total to 138 across 13 states. Continued growth is anticipated as the company continues to expand its FL business where revenue was up 11% in Q4 adding 3 new dispensaries to end ’23. VRNO is the #3 operator in the state and with adult use transition will be a meaningful growth element going forward. VRNO is also ready for the new Ohio adult use market with the state maximum 5 dispensaries and cultivation that is capable of scaling to meet OH market demand estimated to be a 2.5X market lift from the current medical market level. PA operations include 18 dispensaries that are well represented if PA Governor Shapiro is able to bring in adult use to the Keystone State.

Pharma Leader Q4 Results

Also noteworthy for Q4 financial results came from the Fund’s leading pharma position, Eli Lilly & Co (LLY) that reported a quarterly revenue beat of $9.35 billion vs estimates of $8.95 billion. The primary driver of the revenue beat came from its GLP-1 drug portfolio, aimed at helping those with excessive weight (obesity) and type II diabetes. Mounjaro the first launch GLP-1 drug from LLY in 2022 saw quarterly revenue growth of 24% to $2.2 billion vs estimates of $1.8 billion. Newly approved Zepbound also generated significant sales growth beating expectations by 36% to $175 million vs expected around $130 million. We see LLY as being well positioned to drive top-tier revenue growth and margin expansion over time as the GLP-1 market continues to evolve. Recent FDA approval of Zepbound in the Fall of 23 for adults with obesity or overweight with weight related comorbidities illustrates the continued demand and new market opportunities as further clinical trials bring out positive results related to weight related comorbidities. The company has also been investing in building drug supply both in the US with additional capacity in North Carolina in addition to a new $2.5 billion plant in Germany. LLY reported quarterly eps of $2.49 beating estimates of $2.30 while the company provided strong guidance for 2024 with revenues of $40.4 billion to $41.6 billion in sales, above estimates of $39.27 billion with adjusted eps of $12.20 to $12.70.

Option Strategy

Since inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately $4.93 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio in favor of names we prefer while generating approximately $30,000 in options income. We continue to write short dated covered calls on names we feel are range bound near term and from which we could receive above average premiums which included Abbott Laboratories (ABT). We also continue to write short dated cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including UnitedHealth Group Inc. (UNH), Johnson & Johnson (JNJ), Merck & Co. Inc. (MRK), and Universal Health Services Inc. (UHS).

The Ninepoint Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

Statistical Analysis

Fund |

TR CAN/US HEALTH CARE BLENDED INDEX |

|

|---|---|---|

Cumulative Returns |

49.4% |

-28.3% |

Standard Deviation |

27.3% |

28.5% |

Sharpe Ratio |

0.13 |

-0.27 |

February 29, 2024

February 29, 2024