Monthly Update

Year-to-date to February 29, the Ninepoint Global Infrastructure Fund generated a total return of 2.57% compared to the MSCI World Core Infrastructure Index, which generated a total return of -0.22. For the month, the Fund generated a total return of 4.08% while the Index generated a total return of 1.66%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of February 29, 2024 (Series F NPP356) | Inception Date: September 1, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

4.1% |

2.6% |

2.5% |

5.1% |

7.9% |

7.2% |

8.1% |

6.1% |

7.2% |

MSCI World Core Infrastructure NR (CAD) |

1.7% |

-0.2% |

0.5% |

4.6% |

2.2% |

6.0% |

4.7% |

8.0% |

10.2% |

The AI-fueled rally continued through February, as investors piled into the names tied to this investment theme and considered most likely to beat revenue and earnings expectations. Year-to-date to March 10th, the S&P 500 Information Technology sector has gained 11.1% and the S&P 500 Communication Services sector has gained 10.6%, while the S&P 500 Utilities and the S&P 500 Real Estate sectors have lagged. However, we are starting to see some signs that the rally could be broadening in 2024, with the S&P 500 Financials, Health Care and Industrials sectors essentially keeping pace with the overall market. Encouragingly, optimism has spread around the world, with Europe’s broad STOXX 600 and Japan’s blue-chip Nikkei stock indexes also hitting all-time highs in February.

The hype surrounding all things AI-related is triggering some to characterize the investment environment as a “bubble”, like the late 1990’s stock market. Others have suggested that overly dovish Fed watchers, who at one point were calling for up to six interest rate cuts in 2024, have powered earnings multiple expansion. However, we believe that the main driver of the recent equity performance is more fundamental in nature. The reality is that we are currently in the third quarter of recovery since the earnings recession ended in Q3 2023, which has been supportive of most of the price appreciation since the equity market lows last October.

Looking at the data, after earnings growth of approximately 4.8% in Q3 2023 and 4.1% in Q4 2023, the estimated year-over-year earnings growth rate for the S&P 500 in Q1 2024 is 3.4%, according to FactSet. But with 73% of reporting companies reporting a positive EPS surprise in Q4 2023, we expect the actual Q1 2024 EPS growth rate to exceed expectations once again. Importantly, analysts are projecting revenue growth of 5.0% and earnings growth of 11.0% for calendar 2024, led by the Information Technology sector (+17.9%) and the Communication Services sector (+17.4%), which should be unsurprising given the year-to-date sector performance noted above. The next two sectors in terms of forecasted earnings growth in 2024 are Health Care (+15.2%) and Financials (+12.2%), again lining up nicely with the year-to-date performance stats. So, with earnings growth expectations supporting stock price gains, it is difficult to see the rationale for calling the rally a “bubble”.

In terms of interest rate cut expectations, after becoming too dovish (and expecting up to six rate cuts in 2024), investors have reset their expectations to be more consistent with the Fed’s current guidance of three rate cuts. Admittedly, the most likely scenarios have pushed the first rate cut to June or July of 2024 and we accept the need to wait patiently for another few months before easier monetary policy. Further, with the S&P 500 currently above 5,100 (or slightly above 20x 2024 forward earnings according to FactSet), it feels like upside earnings surprises will be required for the market to move significantly higher over the remainder of the year. Nevertheless, if broader growth does beat expectations and mega-cap tech moves sideways or even underperforms in 2024 from here (quite possible given the high expectations and high multiples already applied to these equities), our dividend focused mandates should do well on both an absolute and relative basis. As always, we are continually searching for companies that are expected to post solid revenue, earnings and dividend growth but still trade at acceptable valuations today.

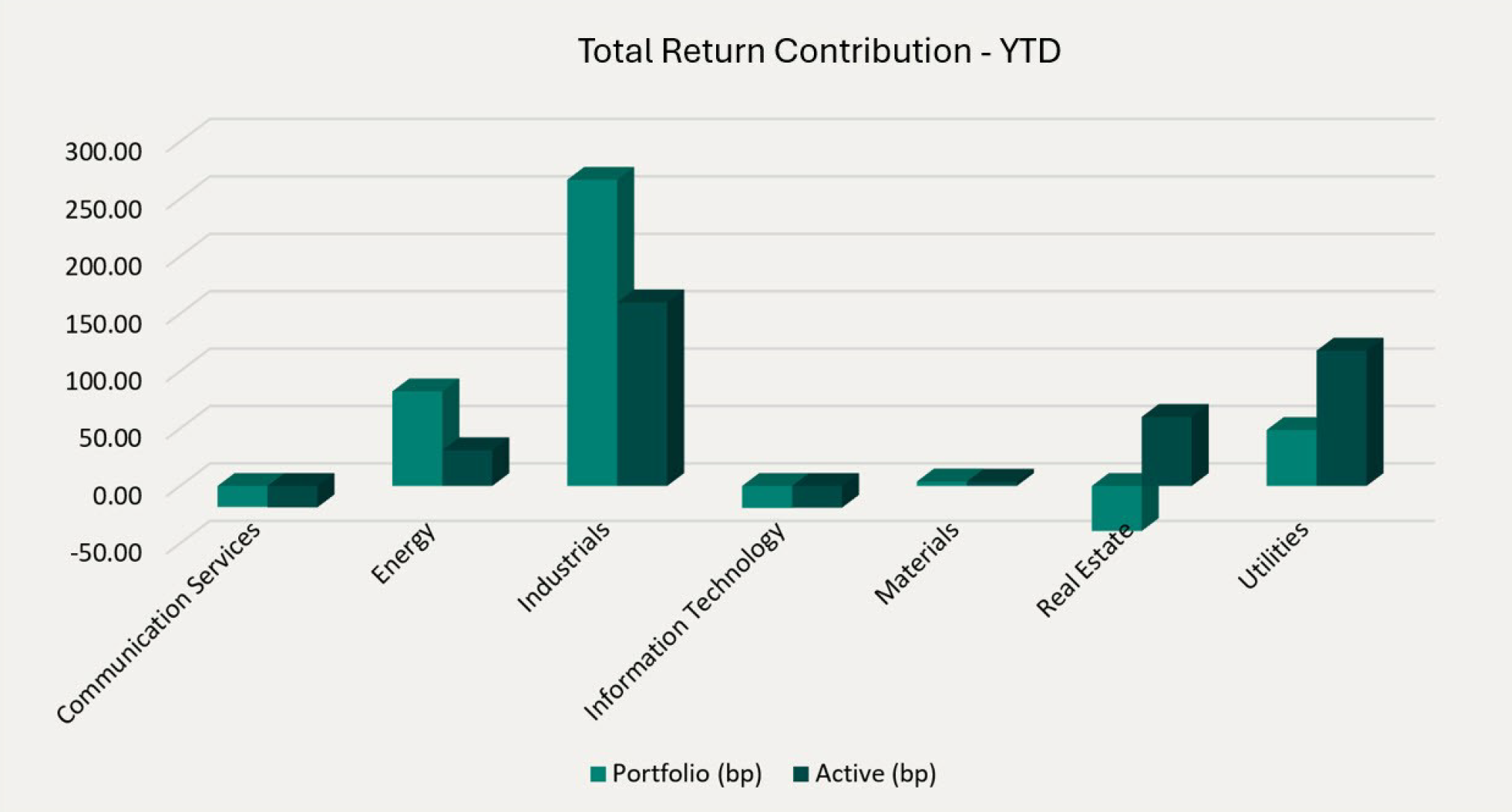

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Industrials (+267 bps), Energy (+82 bps) and Utilities (+49 bps), while top detractors by sector included Real Estate (-39 bps), Information Technology (-19 bps) and Communication Services (-18 bps) on an absolute basis.

On a relative basis, positive return contributions from the Industrials (+159 bps), Utilities (+118 bps) and Real Estate (+60 bps) sectors were offset by negative contributions from the Information Technology (-19 bps) and Communication Services (-19 bps) sectors.

We are currently overweight the Industrials and Communication Services sectors, market weight the Real Estate sector, while underweight the Utilities and Energy sectors. After many years of outperformance from the high growth and high valuation Information Technology sector, once interest rates begin to fall and earnings growth becomes more widespread, we would expect a rotation out of the big winners of 2023 and into undervalued equities more aligned with our dividend-focused mandates in 2024. In the meantime, we remain focused on high quality, dividend paying infrastructure assets that have demonstrated the ability to consistently generate revenue and earnings growth through the business cycle.

Despite some projects dealing with funding concerns in a higher interest rate environment, we continue to believe that the clean energy transition will be one of the biggest investment themes for many years ahead. Therefore, we are comfortable having exposure to both traditional energy investments and renewable energy investments in the Ninepoint Global Infrastructure Fund given the importance of energy sustainability and security of supply around the world.

The Ninepoint Global Infrastructure Fund was concentrated in 27 positions as at February 29, 2024 with the top 10 holdings accounting for approximately 44.0% of the fund. Over the prior fiscal year, 15 out of our 27 holdings have announced a dividend increase, with an average hike of 9.8% (median hike of 2.1%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

February 29, 2024

February 29, 2024