Monthly Update

Year-to-date to April 30, the Ninepoint Focused Global Dividend Fund generated a total return of 8.26% compared to the S&P Global 1200 Index, which generated a total return of 9.62%. For the month, the Fund generated a total return of -1.28% while the Index generated a total return of -2.07%.

Ninepoint Focused Global Dividend Fund - Compounded Returns¹ As of April 30, 2024 (Series F NPP964) | Inception Date: November 25, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

-1.3% |

8.3% |

5.2% |

16.4% |

16.2% |

7.6% |

8.6% |

8.2% |

S&P Global 1200 TR (CAD) |

-2.1% |

9.6% |

7.2% |

19.1% |

20.0% |

10.0% |

11.3% |

11.1% |

After the best start of the year for the equity markets since 2019, the markets corrected in April. The S&P 500 fell 4.2%, the Dow Jones Industrial Average fell 5.0% and the small cap Russell 2000 fell 7.1%. Intraday, the S&P 500’s peak to trough 5.9% decline falls within the typical 4% to 6% correction that should be expected by equity investors at any time during a normal year and does not suggest that anything more significant is looming.

The correction was triggered by fears that disinflation was beginning to stall out above 3%, with US CPI increasing 0.4% in March and 3.5% over the last twelve months (core CPI also came in higher than hoped for at 3.8% over the last twelve months). When the advance GDP data came in at 1.6% for the first quarter of the year, compared to 2.4% expected by analysts, fears of stagflation began to creep into the investment narrative. The market (at one point having priced in almost seven rate cuts), quickly discounted the number of expected interest rate cuts to less than two for 2024. We believe this represents peak hawkishness for the year, with recent core PPI data (up only 0.2% month over month and up only 2.8% over the last twelve months) and core PCE (the Fed’s favourite measure of inflation, up only 0.3% month over month and up only 2.8% over the last twelve months) less scary and trending in the right direction.

Importantly, tighter financial conditions haven’t done serious damage to the health of the jobs market yet, and the most recent non-farm payrolls reported indicated the creation of 175,000 jobs in April and an unemployment rate of 3.9%, which has remained within a range of 3.7% to 3.9% since August 2023. With the average US consumer still confident in their employment situation, growth estimates remain robust and investment analysts are currently forecasting 2024 revenue growth of 4.9% and earnings growth 11.0% and 2025 revenue growth of 5.8% and earnings growth of 9.5%, according to FactSet. Further, valuations are slightly more reasonable after the April correction, with the S&P 500 forward P/E multiple currently at 19.9x (admittedly above the 10-year average of 17.8x and the 5-year average of 19.1x), led by the Information Technology sector at 26.5x and the Consumer Discretionary sector at 24.2x. But we find that other sectors are much more attractively valued based on forward earnings estimates, such as Energy at 12.3x, Financials at 15.0x, Real Estate at 16.3x and Utilities at 16.6x.

As investors contend with a steady stream of economic and company-specific data, the biggest debate in the market today remains the timing and pace of interest rate cuts in the United States. We believe that the market was overly dovish when expecting up to seven interest cuts in 2024 and is now overly bearish when expecting less than two interest rate cuts in 2024. Any little bit of good news on the inflation front will likely push rate cut expectations back to two or three for the year, with US 10-year bond yields falling commensurately. Thankfully, Chairman Powell still seems comfortable with allowing inflation to trend lower over an extended but reasonable time horizon and doesn’t seem to feel the need to risk damaging the economy in the short run to reach his target. In the past, Powell has clearly stated that rate cuts must happen before the 2.0% target is reached, otherwise real interest rates would become too restrictive as inflation falls.

Our outlook for the equity markets is positive over the balance of the year but the path still depends on two different scenarios. If we get fewer rate cuts than currently expected because growth, inflation and employment remain robust, mega cap growth should regain leadership and outperform but if we get more than two or three rate cuts, the rally should broaden as growth reaccelerates across most of the other sectors. In either case, the recent equity market correction has likely offered investors a nice opportunity to upgrade their holdings at better prices. As always, we are continually searching for companies that are expected to post solid revenue, earnings and dividend growth but still trade at acceptable valuations today.

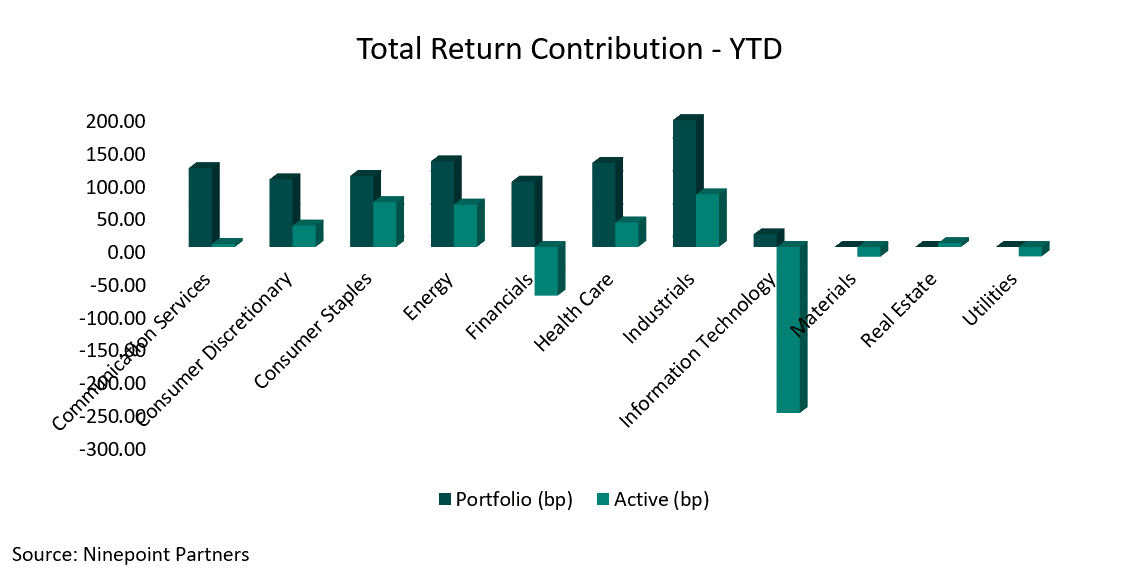

Top contributors to the year-to-date performance of the Ninepoint Focused Global Dividend Fund by sector included Industrials (+193 bps), Energy (+130 bps) and Health Care (+128 bps), while no sector detracted from performance on an absolute basis.

On a relative basis, positive return contributions from the Industrials (+80 bps), Consumer Staples (+68 bps) and Energy (+65 bps) sectors were offset by negative contributions from the Information Technology (-253 bps), Financials (-74 bps) and Materials (-15 bps) sectors.

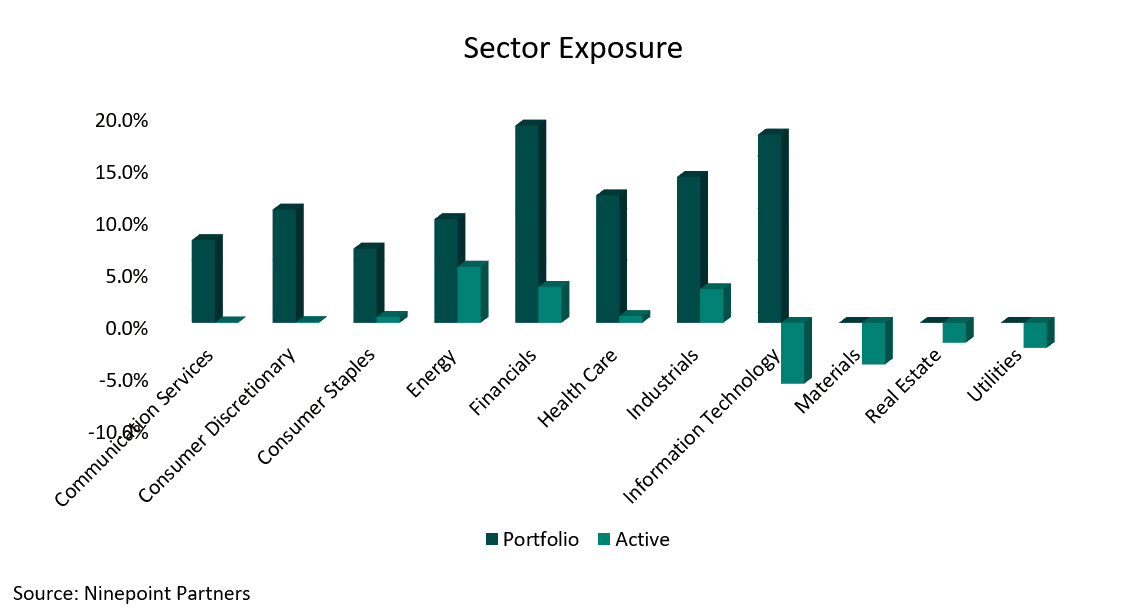

We are currently overweight the Energy, Financials and Industrials sectors, while underweight the Information Technology, Materials and Utilities sectors. As we get closer to the first interest rate cut of the cycle, we expect the market to recover from the recent correction and performance to broaden across sectors. As the growth rate differential between the Information Technology sector and everyone else narrows through the year, we expect a rotation into undervalued equities more aligned with our dividend-focused mandates in 2024. In the meantime, we remain focused on high quality, dividend payers that have demonstrated the ability to consistently generate revenue and earnings growth through the business cycle.

The Ninepoint Focused Global Dividend Fund was concentrated in 28 positions as at April 30, 2024 with the top 10 holdings accounting for approximately 44.3% of the fund. Over the prior fiscal year, 17 out of our 28 holdings have announced a dividend increase, with an average hike of 2.2% (median hike of 5.8%). We will continue to apply a disciplined investment process, balancing various quality and valuation metrics, in an effort to generate solid risk-adjusted returns.

Jeffery Sayer, CFA

Ninepoint Partners

April 30, 2024

April 30, 2024