The Canadian Large Cap Leaders Split Corp has now been active for three months. We have been through a quarterly dividend cycle and cash flow from each of our holdings has flowed into the Corp. Importantly, we’ve had several of our companies boost dividend payments, including Bank of Montreal, Canadian Natural Resources, Manulife and TELUS, supported by generally solid results. Further, the Bank of Canada has just become the first of the G7 economies to cut interest rates, reducing its key overnight rate by 25 bps from 5.00% to 4.75%, which should provide a nice tailwind for our dividend paying stocks and allow price to earnings multiples to expand.

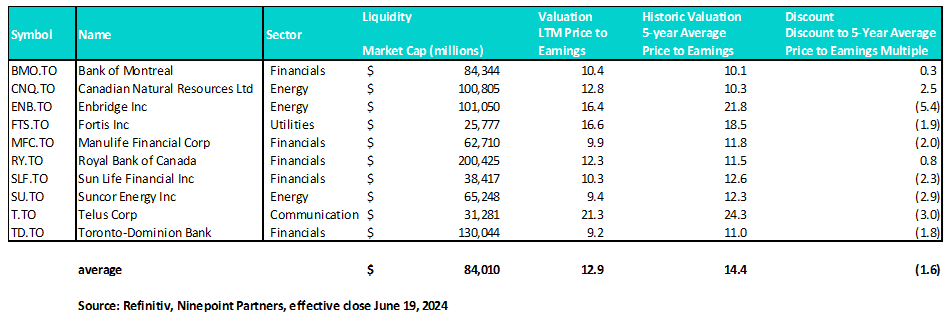

Despite the good results from our individual holdings, the Class A Shares (NPS on the TSX) continue to trade at a discount to the reported NAV. We don’t believe that this has anything to do with the valuation or financial performance of our holdings as demonstrated by the chart below:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return no yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

From the chart, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 12.9x, compared to the 5-year average price to earnings multiple of 14.4x, a 1.6x multiple point discount (rounding has slightly impacted these calculations). But with the Class A Share trading approximately 12%* below the reported NAV, we can adjust this table to visualize the implied valuation:

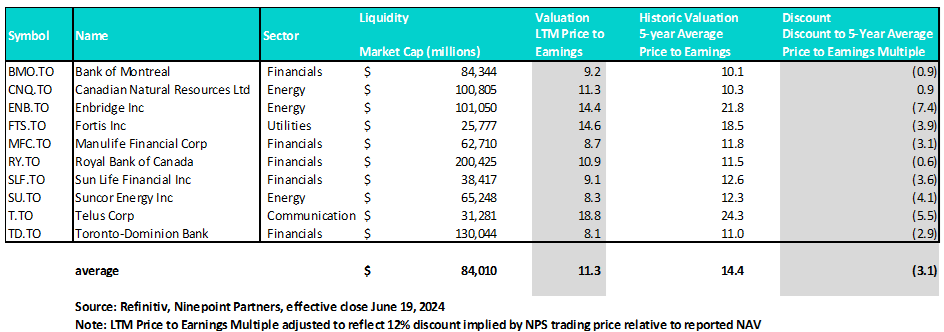

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return no yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

It is almost shocking to see that the implied discount has expanded to 3.1x worth of multiple points, which highlights a unique opportunity to buy a portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuation levels (and approximately 12%* below the prior night’s close) through the purchase of shares of NPS on the open market.

In fact, because we believe that the Class A Shares are so undervalued, on May 24, 2024, Ninepoint Partners published the following press release:

TORONTO – Ninepoint Partners LP (“Ninepoint”), on behalf of Canadian Large Cap Leaders Split Corp. (the “Company”) (TSX: NPS/NPS.PR.A), announced today that the Toronto Stock Exchange (the “TSX”) has accepted its notice of intention to make a normal course issuer bid (the “NCIB”) to purchase its class A shares (“Class A Shares”) and preferred shares (“Preferred Shares”) through the facilities of the TSX and/or alternative Canadian trading systems. The NCIB will commence on May 28, 2024 and terminate on May 27, 2025.

Pursuant to the NCIB, the Company proposes to purchase, from time to time, up to 182,563 Class A Shares and 182,563 Preferred Shares of the Company, representing 10% of the public float of 1,825,633 Class A Shares and 1,825,633 Preferred Shares. As of May 16, 2024, there were 1,835,633 Class A Shares and 1,825,633 Preferred Shares issued and outstanding. The Company will not purchase, in any given 30-day period, in the aggregate, more than 36,712 Class A Shares or more than 36,512 Preferred Shares, being 2% of the issued and outstanding Class A Shares and Preferred Shares as of May 16, 2024.

Ninepoint, the manager of the Company, believes that such purchases are in the best interests of the Company. All purchases will be made through the facilities noted above and in accordance with the rules and policies of the TSX. All Class A Shares or Preferred Shares purchased by the Company pursuant to the NCIB will be cancelled.

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its third distribution, payable on June 14, 2024, to the Class A Shareholders of record at the close of business on May 31, 2024. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend.

Again, with the NAV rising steadily since the IPO but with the Class A Shares currently trading at an unwarranted discount, we believe that buying stock today represents an attractive long-term investment opportunity for both new and existing shareholders.

We appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

*As of close on June 19, 2024. Subject to change daily.

May 31, 2024

May 31, 2024