Monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Economics

Last month, we discussed that the market had become too bearish on bonds, assuming that the string of strong data would continue and therefore expecting monetary policy to remain very restrictive (or perhaps even more restrictive). Since then, we have seen U.S. economic data surprise to the downside (the strong U.S. May jobs report being the exception, but the details were mixed) and with that, bonds have rallied off the lows.

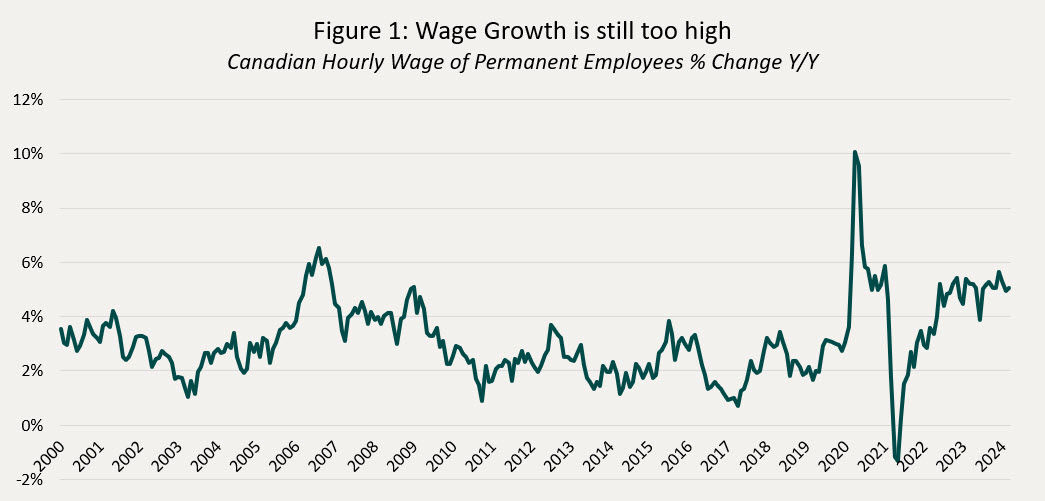

Here in Canada, so far year to date, economic data has been weak enough to spur the Bank of Canada (BoC) to become the first G7 central bank to cut rates this cycle. The tone of the statement and press conference were clearly dovish, signaling more rate cuts to come. While the cut itself wasn’t a surprise to anyone, the dovishness of the messaging was very surprising, if not shocking to us. Why on earth would the BoC give anything resembling forward guidance on the path forward for monetary policy, when headline and core inflation are still in the high 2% range. Yes, the economy is operating under potential (i.e. aggregate supply is ahead of aggregate demand) and inflation has surprised to the downside, but it seems a bit early to be declaring victory. And particularly when the whole country is watching, waiting patiently to reengage with the housing market once it knows peak rates are now behind. The last thing the BoC needs/wants is for the housing market to reaccelerate, for prices to jump again and for this to feed back into core inflation. Yes, the unemployment rate is now at 6.2%, well above the 5% trough we reached in 2022, but wage growth is still very elevated (Figure 1 above) and shows no sign of decelerating. This is clearly incompatible with their 2% inflation target, and unless we see a much weaker labour market in the months to come, we do not expect the BoC to cut rates more than twice this year and maybe once.

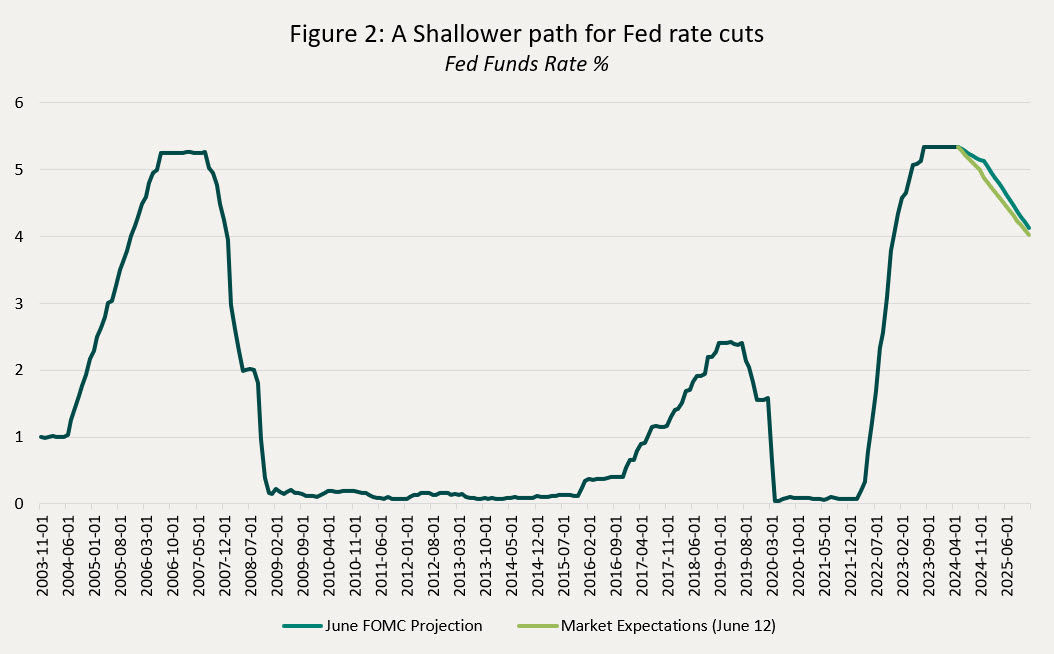

For the U.S. Fed, the calculus is a little easier to make sense of; services inflation has clearly been sticky, and the economy, while it slowed down from last year’s torrid pace, is still performing well. Therefore, why would they be in a hurry to loosen monetary policy? And that is exactly what the FOMC is messaging: higher for longer interest rates, with their famous Dot Plot at the June meeting signaling no more than 1 cut in 2024 (although it was a close call for 2 cuts), and, assuming the economy behaves as expected, another 4 more in 2025 for a very shallow rate cut cycle (Figure 2), pretty much in line with current market expectations.

Central banks are a bit like oil tankers, they change directions very slowly, but once a new trajectory has been taken, they are very unlikely to pivot again rapidly. The Fed, ECB, BoE and BoC have all been on hold for the last several months, and we are now starting to see the first signs of that pivot towards the next stage of the cycle. Given the recent overshoot of inflation and its stickiness due to wages, they ought to take their time, moving only gradually, to avoid a policy mistake. The worst outcome for all would be for them to cut too soon, leading the economy to bounce and heralding a return of inflation. Unless the economy falls off a cliff, one should fade excessive rate cut enthusiasm (like this past January). But, monetary policy is restrictive, and certain parts of the economy are weakening, showing up in increased default and delinquency rates for businesses and households, so we should equally fade excessive monetary policy hawkishness, as we had done in April.

Credit

As per Bloomberg, Canadian investment grade spreads widened 2bps in May (lagging the 4bps move tighter in the US) but are still 15bps tighter YTD. The small move wider in Canada can be broadly attributable to investors gearing up for a busy month of corporate bond supply (as some like to coin it, “supply indigestion”). May saw $13bln of corporate bond deals bringing the YTD amount to ~$60bln, up a whopping 44% vs same time last year. The elephant in the room for the last couple months has been the Coastal Gas Link jumbo bond deal which priced early June. They raised $7.15bln across 11 tranches, which marks the largest corporate deal ever in Canada. As the deal came cheap to accommodate such a large size, we participated in numerous tranches, which has served us extremely well thus far, as the deal has performed exceptionally well, especially given its size.

Worth mentioning, Canadian banks reported Q2 earnings in May, and while bank by bank results were mixed, some of the commonalities were: tepid loan growth and rising Provision for Credit Losses. Low loan growth coupled with advantageous funding outside the Canadian market should prove to be supportive for Canadian dollar bank credit spreads going forward (we have had an overweight position).

Individual fund commentary

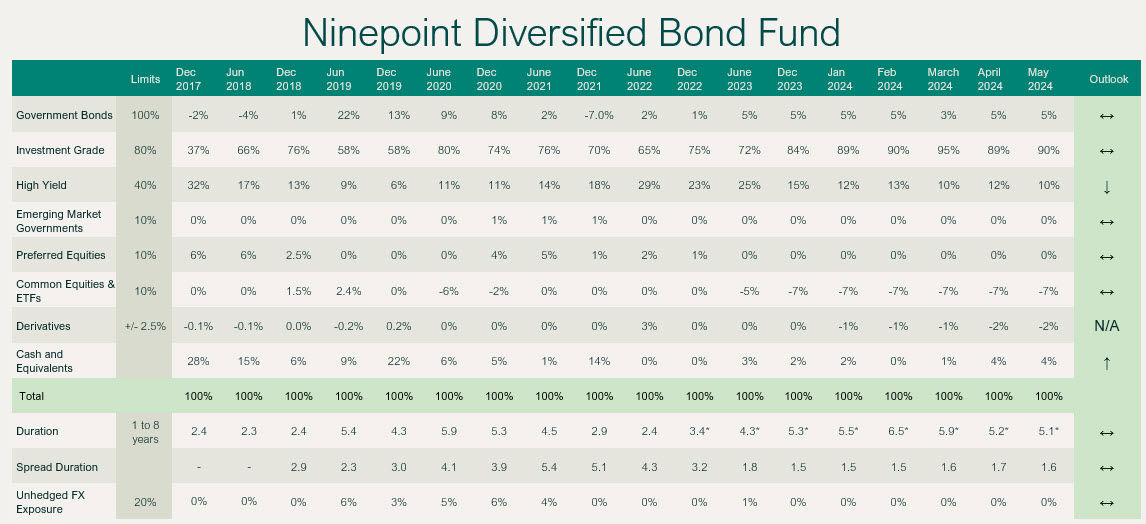

Ninepoint Diversified Bond Fund

May was a solid month for the fund, up 1.21%. While the broader Canadian investment grade spreads widened, our defensive posture showed its merit, helping drive performance. We continue to barbell the fund between high-quality short-term corporate bonds for income and long-term government bonds for ballast (which have worked extremely well thus far in June). We maintain our bearish stance on broader High Yield and express it through a short position in the HY U.S. Index ETF. As of month end, the fund has a yield-to-maturity of 7.3% and cash yield of 4.5%.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF MAY 31, 2024 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

1.2% |

0.7% |

0.5% |

4.4% |

4.9% |

-1.1% |

0.7% |

2.1% |

3.2% |

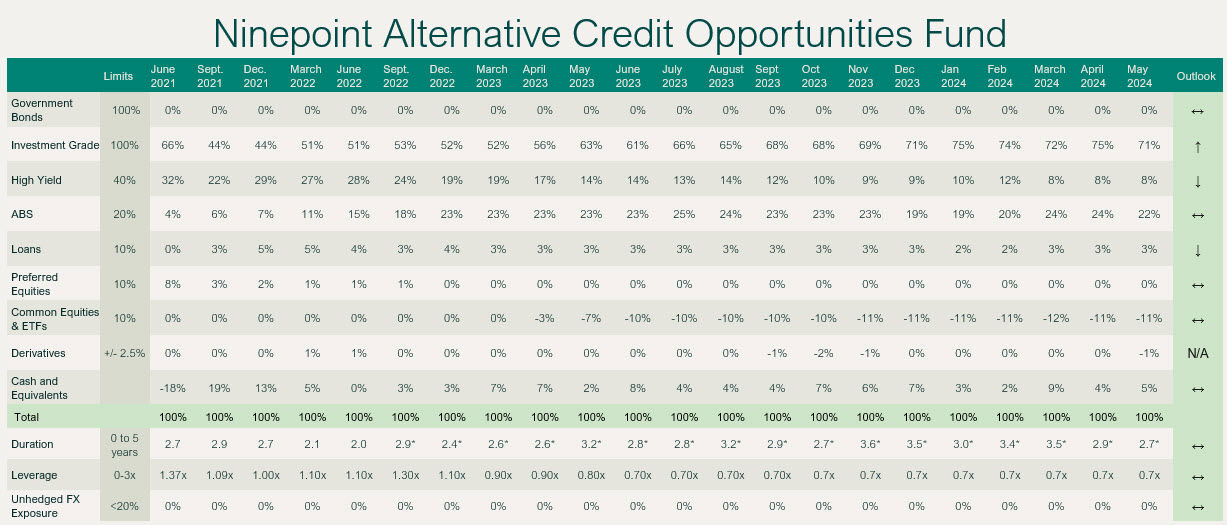

Ninepoint Alternative Credit Opportunities

The fund posted a 1.22% gain in the month, aided by our defensive credit stance in the face of a slight widening in Canadian IG credit. We remained judicious in the primary market as many deals came with flat or negative new issue concessions. Leverage stood at 0.7x (same as prior month), yield-to-maturity of 8.2% (down slightly from prior month) with a cash yield of 6.2% (also down slightly from prior month). As articulated in our April commentary, we executed many cost-effective relative value hedges in May, which is prudent given the richness in many longer-dated high-quality corporate bonds.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF MAY 31, 2024 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

Fund |

1.2% |

3.5% |

1.9% |

6.4% |

8.8% |

0.7% |

0.9% |

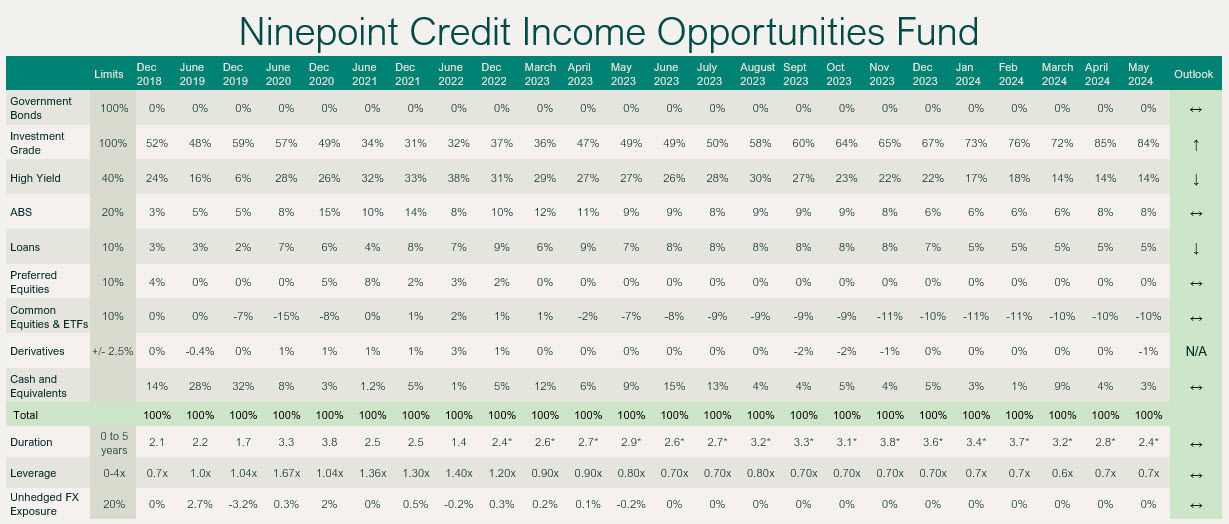

Ninepoint Credit Income Opportunities

The fund posted a 1.04% gain in May even in the face of slightly wider credit spreads. Short-term high-quality credit remains a core position as the Canadian yield curve remains inverted. We have lots of liquidity in the fund with many maturities occurring over the next several months which we will deploy into areas of the market where we get adequately compensated. As articulated in our April commentary, we executed on many cost-effective relative value hedges in May which is prudent given the richness in many longer-dated high-quality corporate bonds. Leverage was unchanged on the month at 0.7x while the yield-to-maturity and cash yield were 8.8% and 6.2% respectively, both down slightly month over month.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF MAY 31, 2024 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

Fund |

1.0% |

3.8% |

1.9% |

6.8% |

8.8% |

2.1% |

5.1% |

4.6% |

With credit spreads quite narrow on a historical basis, and some cracks starting to appear in credit markets (e.g. consumer and small business delinquencies) we remain defensively positioned, waiting for wider spreads to deploy capital. Why take more risk when everything is expensive? We prefer to wait for deals.

But with central banks finally pivoting, interest rates offer some value here, hence our slightly higher than usual duration across the funds. And, given the higher level of interest rates, our funds offer very attractive yields.

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

May 31, 2024

May 31, 2024