Summary

In this month’s commentary, we discuss positive catalysts on the near term horizon that market participants may not be factoring into their investment decisions. We will update investors on US Cannabis Re-Scheduling as the July 22nd date for public consultation winds down and the next phase; potential administrative hearings begins. To that point, we also discuss the recent Presidential Debate on June 27th and any implications it may have on the Re-Scheduling process. On the state market front, we examine the opening of the Ohio adult-use market; the negotiations around Pennsylvania adult-use legislation as well as the Florida Ballot Initiative, all looking quite favourable in terms of opening new markets and adding scale in the near term. We will also discuss select company announcements that are driving investor interest. Finally, in early July, we updated our investment strategy to include short selling and we discussed our focus here.

Ninepoint Cannabis & Alternative Health Fund - Compounded Returns¹ as of June 30, 2024 (Series F NPP5421) | Inception Date - August 4, 2017

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

-2.2% |

5.6% |

-14.6% |

5.6% |

13.5% |

-19.2% |

-7.7% |

4.8% |

During the month, the Fund’s leading performers include the following positions, provided along with their YTD performance:

MTD Performance |

YTD 2024 Performance |

|

|---|---|---|

COST |

4.9% |

29.1% |

LLY |

10.3% |

55.9% |

GTI |

4.8% |

8.9% |

TRUL |

-5.6% |

83.8% |

On the Re-Scheduling Front

Sentiment surrounding rescheduling took a double hit during the month as investors dealt with the fallout from a concerning debate performance by President Biden as well as a Supreme Court decision that is expected to have a significant impact on US government agencies and their ability to enforce laws through regulations where there is ambiguity in the language of the legislation as passed by the House & Senate. While investor response was immediately negative, below we analyze the expected effect of each of these items on rescheduling.

June 27th Presidential Debate: Implications on Cannabis Reforms

Viewers who tuned in on June 27th saw a very frail and often confused President Biden. Whether it was travel fatigue, lack of preparedness or in fact an age issue doesn’t matter. What does matter is that the image the American public was left with led to concern about whether he could continue to run the country let alone lead the US for an additional four more years.

On the day after the debate, cannabis stocks abruptly weakened on the prospects of a President Biden loss at the polls and an inability to Re-Schedule cannabis before election night. We believe that is short-sighted and doesn’t consider the existing legal process. The Department of Health & Human Services (HHS) has already submitted its 250-page report detailing cannabis’ low abuse potential, various medical uses as well as safety relative to other Schedule I and Schedule II drugs. The current and next steps are to weigh whether any groups that oppose the Re-Scheduling have legal standing to slow down or de-rail the process. Given that Re-Scheduling is a matter of scientific and medical data as well as a change in tax policy and not of market access or competition, few if any groups would be able to successfully be granted legal standing requiring a hearing. As a result, a Final Rule published in the Federal Register before the November election is still the most likely outcome. Further, if we think about recent comments from former President Trump on the issue of cannabis, this is not an issue he cares very much about. His focus is on the economy, tax cuts, immigration policy and America’s security. Cannabis is not in his top ten.

At the time of publishing this report, we are a little over a week away from the end of the public consultation period, when interested parties are able to log on to claim their support or opposition to Re-Scheduling. However, what is important is that not all opinions matter in this consultation. The ones that do matter are those that the Attorney General and DOJ determine to have legal standing. In a note to investors in late June, Beacon Securities Cannabis Analyst Russel Stanley wrote;

It is our view that despite the negative sentiment, US cannabis stocks have a number of positive catalysts that provide tailwinds however given the election and related media coverage, there is a lack of conviction on the part of other investors at the current time.

One of the biggest issues to come out of Re-Scheduling is the tax change that will lower taxes owing and enhance cash retained in US cannabis companies. Many companies have unilaterally decided to stop paying 280E related taxes on the understanding that once Re-Scheduling takes place, it will be retroactive to January 1st. However, the IRS has come out to warn those companies that are making unilateral decisions that taxes are to June 30th still owing and must be paid.

The IRS issued a statement saying that 280E still applies to cannabis companies.

This should not be a surprise to anyone. What is important in reviewing the leading cannabis companies is that one company, Trulieve (TRUL) has been transparent and disclosed that it was successful early in 2024 after refiling previous tax returns, it had received over $100 million and yet is holding that cash on its balance sheet in reserve pending the potential for future litigation. This is a conservative strategy given Re-Scheduling has not passed yet. For some other players to just stop paying, there are greater risks.

Supreme Court officially overturns Chevron Deference Doctrine

A headline that is causing uncertainty for many industries whose companies compose a significant amount of the S&P 500 is the Supreme Court decision reversing what is known as the Chevron deference. The current case is called Loper Bright Enterprises v. Raimondo and the decision by the Supreme Court of the US overruled the Chevron deference doctrine which is from a 1984 decision that outlines how courts defer to federal agencies’ reasonable interpretations of ambiguous statutes where agencies administer.

The decision may serve to weaken the power of federal agencies and regulators as it applies to issues in federal court challenges to administrative agency decisions, especially those where a federal agency uses the interpretation of ambiguous statutory language to set policy. This has wide implications for most industries regulated by the federal government. Everything from energy to farming to cannabis to wind farms to electric vehicles to name just a few. Agency interpretation though is important especially when Congress delegates authority to an agency to give meaning to a particular agency’s interpretation. In these types of situations, Agency interpretation is followed.

Will The Chevron Deference Decision Impact Cannabis

As this decision came out late last week, some investors thought that it was in part responsible for weakness on the last day of the quarter. We have received communications from US legal experts that have reviewed the Chevron case. A thorough review of the process for Re-Scheduling brings us to the view that the Chevron decision will not have a negative impact. Legal challenges are a prospect but that did not change with this decision. The overturning of Chevron has actually helped Re-Scheduling because HHS has the power to review cannabis Re-Scheduling provided by Congress in the Controlled Substances Act. In 2023 HHS used a test adopting scientific and medical standards that are according to its delegated authority in the CSA making it less likely that a court could overturn the process. As a result, the media is making a lot out of this Supreme Court decision, but we are of the opinion that given the work of HHS, this change should not be an obstacle to Re-Scheduling.

Shorting Strategy

The Fund Manager has added shorting to our arsenal of strategies to enhance returns and reduce volatility. A primary focus of shorting for the Ninepoint Cannabis & Alternative Health Fund will be Canadian cannabis companies that are listed on NASDAQ and NYSE. We believe that at times there is a misunderstanding on the part of investors who buy Canadian cannabis names when positive US catalysts are announced. At present Canadian cannabis companies are limited in terms of their exposure to the US market. What we have is a mis-match between highly liquid high multiple Canadian names that generate very little if any cash flow from operations relative to US cannabis companies that tend to have stronger cash flow, better upside with new state markets coming online yet all trade at low single-digit multiples. Periodically we aim to take advantage of this mismatch by shorting certain positions as they tend to trade well ahead of their revenues or implied growth rates.

In addition, we are implementing pair trades that will also enhance returns. Pairs trades occur within one industry group where one company is undervalued relative to another that is trading with higher multiples. In that case, we could go “long” the undervalued name and “Short” the over-valued name.

Overall, our goal is not to set up significant short positions that we will hold for months at a time. Our intention is that these trades will be in response to short-term dynamics in the market and will be of a limited duration.

The Ninepoint Cannabis & Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

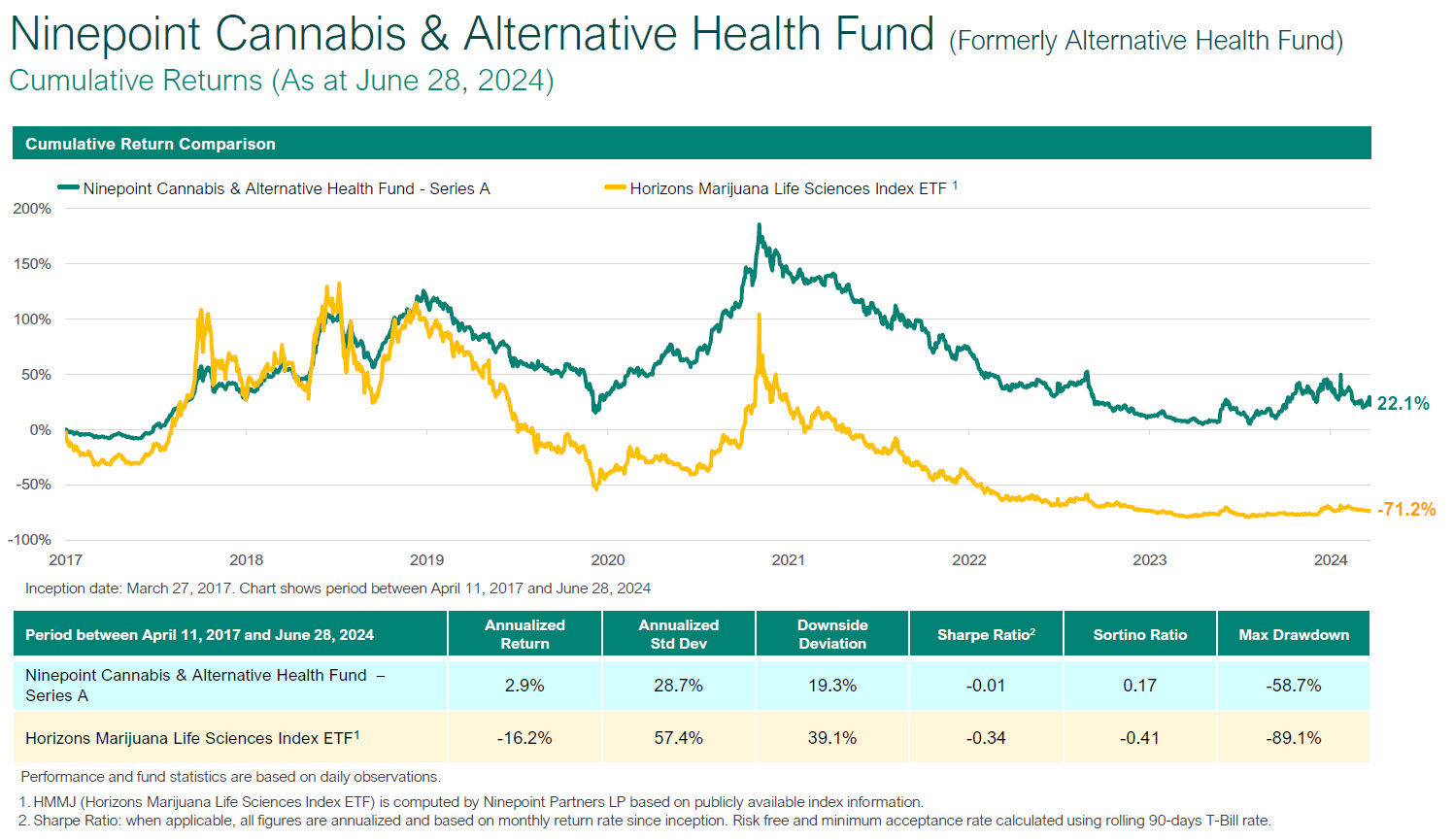

Statistical Analysis

Fund |

|

|---|---|

Cumulative Returns |

37.9% |

Standard Deviation |

27.7% |

Sharpe Ratio |

0.06 |

June 30, 2024

June 30, 2024