As we get ready for the start of the Q2 2024 earnings season, the fundamentals of our investments continue to look solid. The Bank of Canada has just become the first of the G7 economies to cut interest rates, reducing its key overnight rate by 25 bps from 5.00% to 4.75%, thus making our portfolio of high quality, dividend payers look even more attractive from a yield perspective.

Despite the solid outlook and steady dividend payments, the Class A Shares (NPS on the TSX) continue to trade at a discount to the reported NAV. We believe this discount was exacerbated during the month of June as Canadian investors experienced quite poor equity performance. In our view this was directly related to changes in the capital gains inclusion rate put forth by the Federal Liberal government. The bump in the inclusion rate from 50% to 66.67% triggered investors to lock in capital gains and losses before the change came into effect on June 25. Essentially, investors dumped equities for tax planning purposes irrespective of price or valuation. The Financials, Energy and Real Estate sectors seemed to be particularly hard hit by the selling, but we expect that investors will rebuild their positions shortly now that the deadline for tax planning purposes has passed.

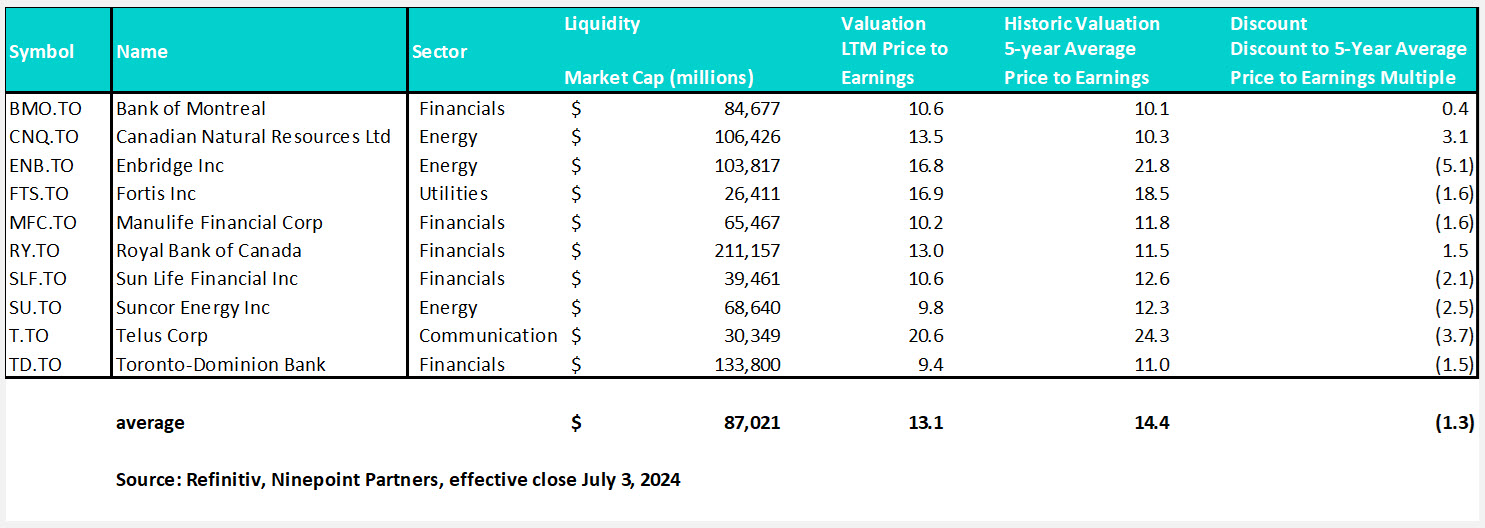

If anything, we think that the temporary selloff has offered an interesting entry point for high-quality Canadian listed companies as demonstrated by the chart below:

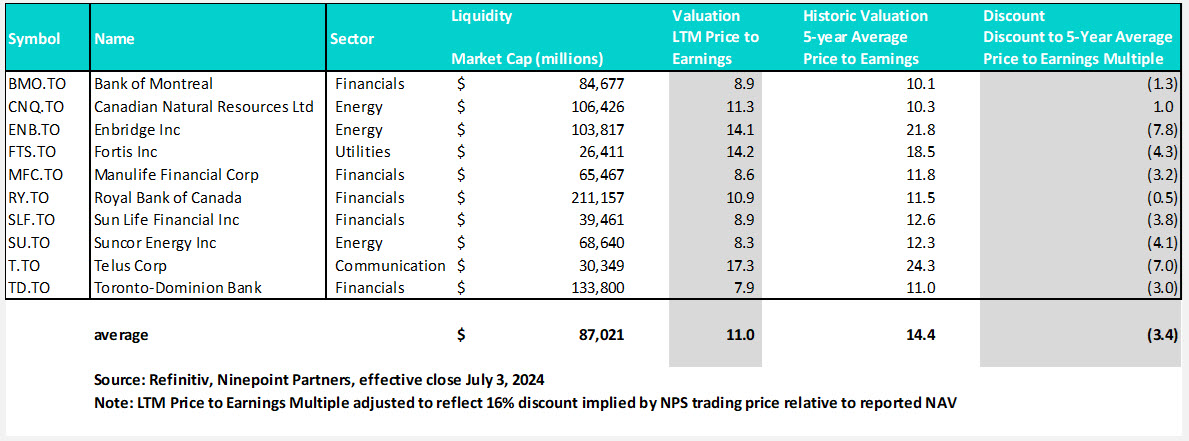

From the chart, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 13.1x, compared to the 5-year average price to earnings multiple of 14.4x, a 1.3x multiple point discount. But with the Class A Share trading approximately 16% below the reported NAV at the close on June 28, we can adjust this table to visualize the implied valuation:

It is almost ridiculous to see that the implied discount has expanded to 3.4x worth of multiple points, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuation levels (and well below the prior night’s close) through the purchase of shares of NPS on the open market. Obviously, given the discount, we were active with our Normal Course Issuer Bid during the month, which is accretive to all shareholders.

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next set of distributions, payable on July 12, 2024, to Preferred and Class A Shareholders of record at the close of business on June 28, 2024. As planned, holders of the Preferred Shares will receive the $0.1875 per share regular quarterly dividend and holders of the Class A Shares will receive the $0.1250 per share regular monthly dividend.

Again, with the Class A Shares currently trading at an unwarranted (and we believe temporary due to the tax change as described above) discount, we believe that buying stock today represents an attractive long-term investment opportunity for both new and existing shareholders.

We appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

June 30, 2024

June 30, 2024