Monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Economics

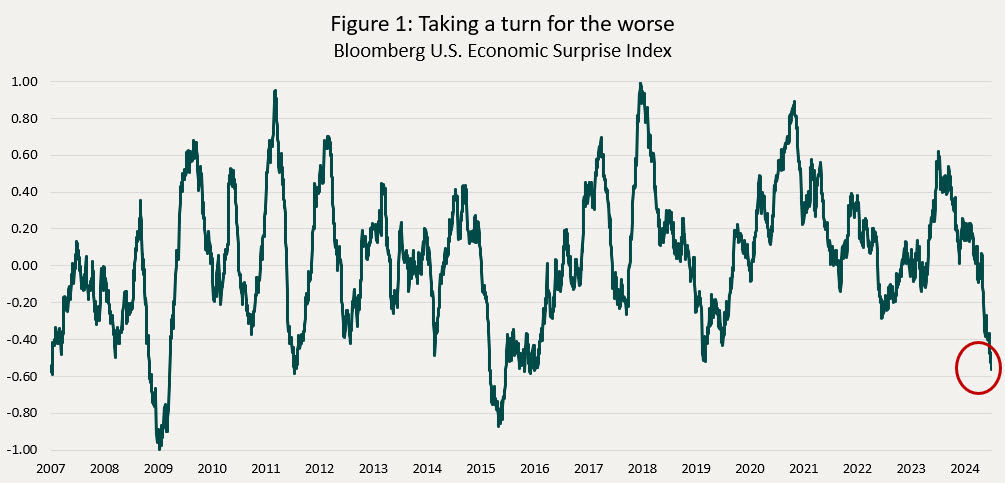

Over the past month, economic momentum in the U.S. has taken a turn for the worse, with housing, retail sales, PMIs and even employment measures all coming in very weak. To put it all in perspective, we have shown in Figure 1 below, the U.S. economic surprise index, as calculated by Bloomberg. Rarely has it been this weak, and the weakness is quite broad across most sectors. With fiscal stimulus waning, U.S. households running out of pandemic-era savings and monetary policy biting, it was to be expected that economic activity would eventually wane.

Indeed, we have been expecting this for a while. As regular readers of this commentary would know, we have never subscribed to this idea of “immaculate disinflation”, whereas inflation moves back down after the harshest rate hike cycle in decades without paying some sort of economic price. Monetary policy simply takes time to work its way through the economy.

If this downward momentum persists, we expect market participants to start envisaging more than the 1-2 rate cuts that are priced-in for this year (i.e. a real cut cycle). This backdrop would be very positive for our strategies, which are positioned defensively (more interest rate exposure, less credit risk, more liquidity). In that scenario, interest rates will go sharply lower, and credit spreads should widen, benefiting our long-term government positions, as well as our credit hedges.

In the event that this period of economic weakness proves to be short lived, we expect both the Fed and BoC to proceed carefully with a very shallow rate cut cycle, since only a true economic downturn (i.e. higher unemployment) can rapidly bring wages down, and with that services inflation, which has remained incredibly sticky. In this case, higher for longer remains valid, and we will maintain our position stance.

The one wild card to our outlook is likely to be politics. While the elections in the UK and France are of less significance to the North American backdrop, the U.S. election in November carries a lot more weight. Following the Presidential debate, odds have clearly shifted in favour of a Trump re-election. While the devil will ultimately be in the details of who also wins the house and senate, all else equal, a Trump presidency is likely to be more inflationary than the status quo, and thus negative for rates. The question then becomes: would those inflationary policies be met with punishingly harsh monetary policy (and likely leading to a worse economic fallout down the line)? It is too soon to tell, but it is certainly one scenario we need to contemplate as we move into the Fall.

Credit

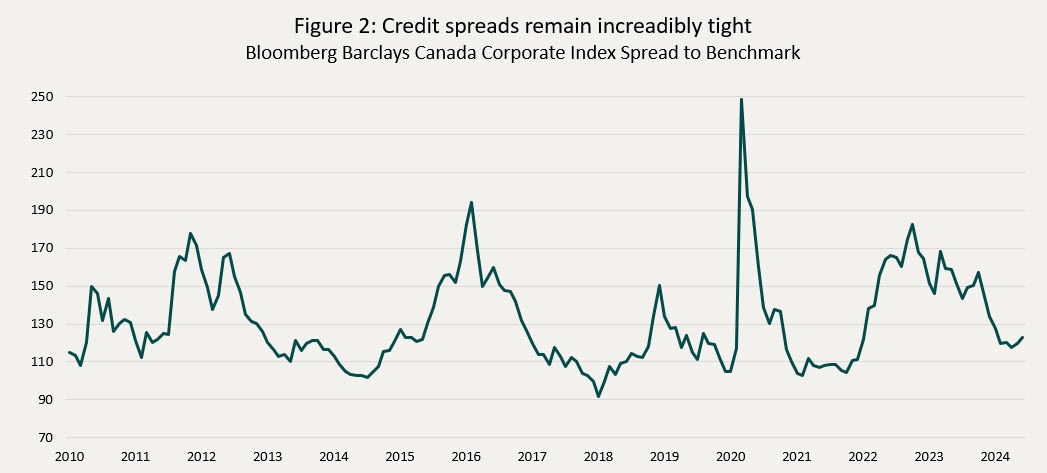

So far 2024 has been an incredibly busy year in credit with $80.8bn of new issues, on track for a record year.[i] Volumes are tracking well above last year (+46% y/y), but this supply has been incredibly well absorbed by the street. Why? The industry has seen net inflows into bond strategies, so funds have lots of cash to put to work, and the net amount of supply (net of maturities) isn’t as large as the headline figures suggest. There have been a lot of maturities this year (and in our funds too), and this cash needs to find a home. Finally, the backdrop for risk assets in general has been very good, despite the weakening economic momentum. Equity markets are making new highs and credit spreads are back to historically low levels (for example see Figure 2 below), even the riskier parts of the markets (e.g. leveraged loans and high yield bonds). All these conditions have made it easy for corporate issues to find takers for their bonds.

Clients often ask us, why, if the appetite for risk seems unbounded, are we so defensively positioned, particularly regarding credit risk. The answer is simple: we aren’t getting compensated to take risk right now. And that is particularly obvious when one looks at overall credit spreads, like in Figure 2 below.

We have now retraced most of the 2022 widening and sit close to post-GFC tights. Unlike equities, which are unbounded to the upside, credit spreads can only rally (i.e. decline) so far, since no one in their right mind would buy a corporate bond with no spread to a government bond. At current spread levels, there is limited upside in pure credit. The best one can hope for is to collect the extra income vs a government bond. And that’s why we are focused on shorter duration credit (high certainty of income, low risk from credit spreads widening) and have reduced leverage meaningfully across our funds. We even have some short positions in names we believe are more susceptible to a decompression in credit spreads (high yield and a few select issuers). We do not expect this positioning stance to change in the foreseeable future.

Fund Commentary

We are now halfway through the year, and the funds have performed well, returning 1.82% to 4.97% and with minimal drawdowns.

Ninepoint Diversified Bond Fund |

Ninepoint Alternative Credit Opportunities Fund |

Ninepoint Credit Income Opportunities Fund |

iShares Core Canadian Universe Bond ETF |

||

|---|---|---|---|---|---|

Year-to-date return |

1.82% |

4.95% |

4.97% |

-0.46% |

|

Max Drawdown YTD |

-1.57% |

-0.16% |

-0.02% |

-3.45% |

By comparison, an index fund like the iShares Core Canadian Universe Bond ETF (XBB) is down about 46bps and was down as much as 3.45% earlier this year. What drives this difference? Being active on positioning and doing what makes sense in the given environment: more sources of return, less interest rate risk.

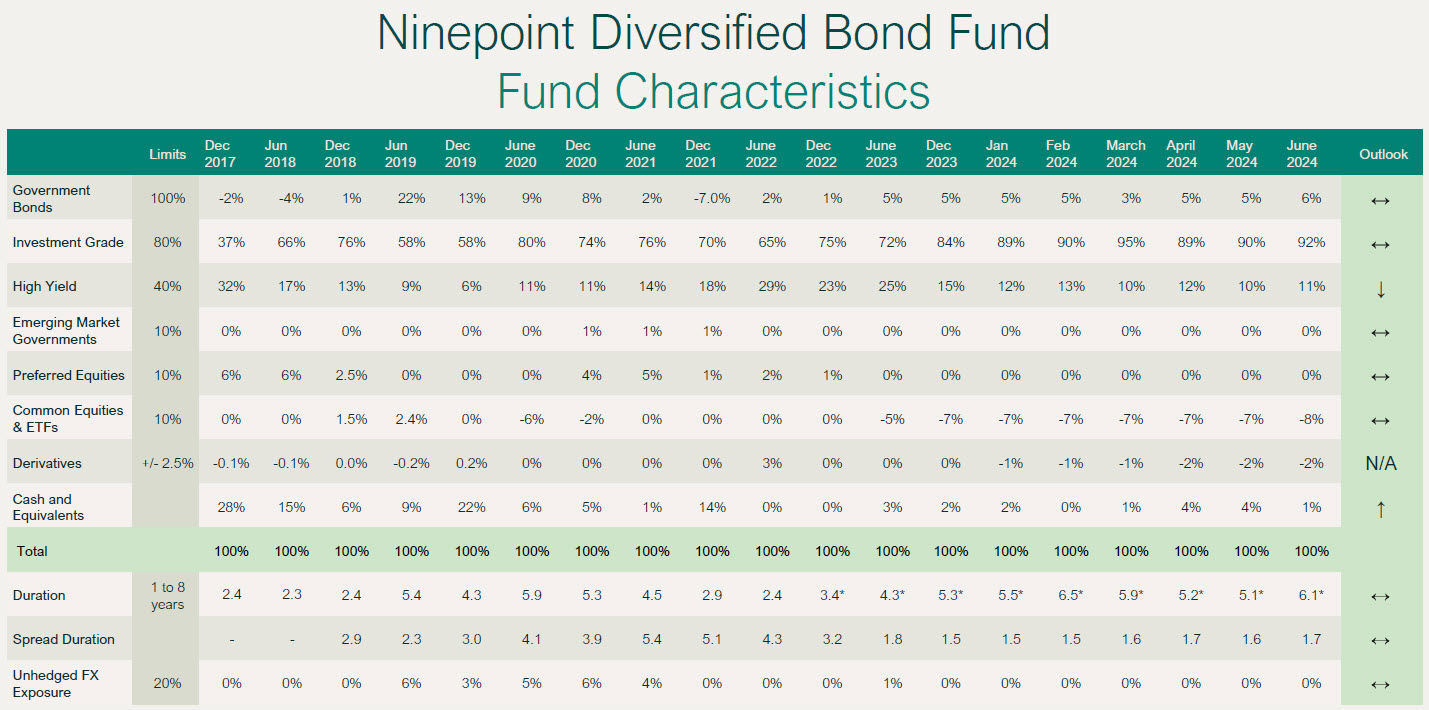

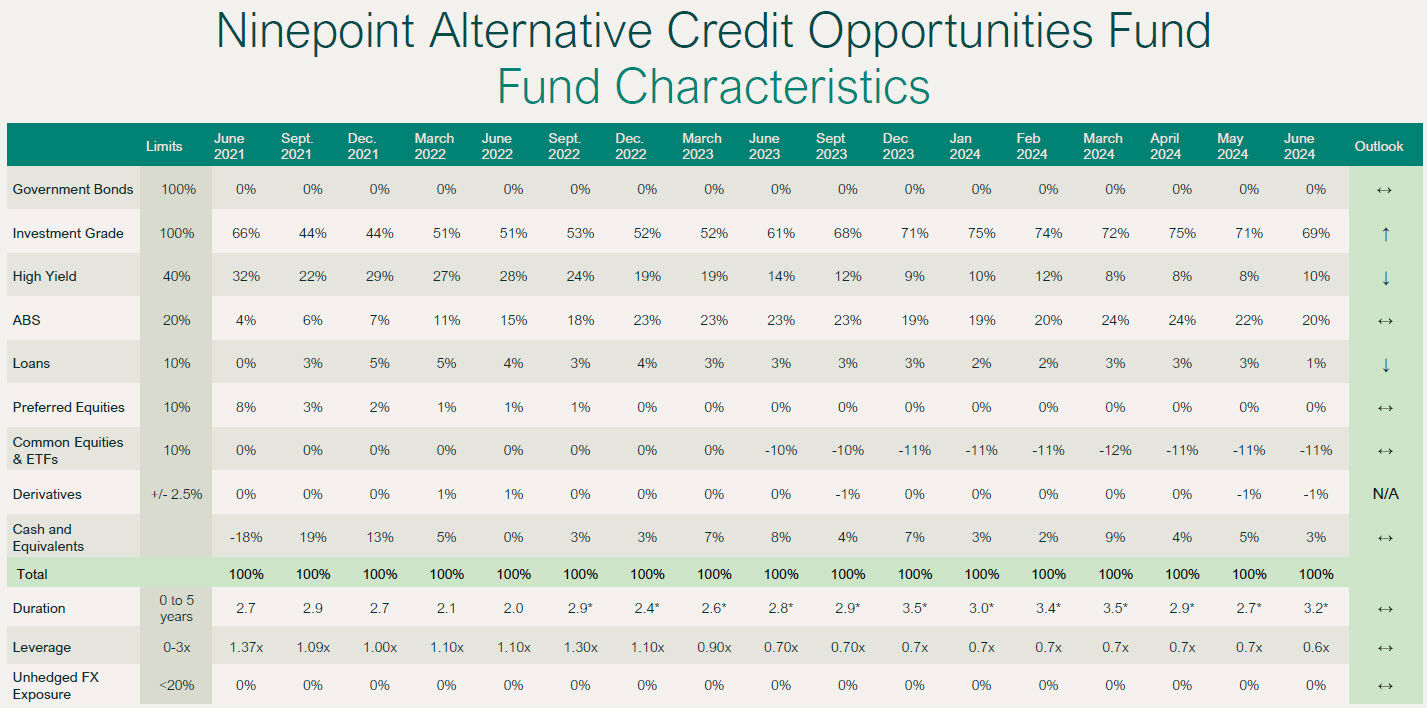

The bulk of the funds are invested in 0 to 3 year low coupon corporate bonds, which generate steady income with low volatility. A nice source of upside this year has been hybrid and limited recourse capital notes (LRCN), which were extremely cheap last year and have rallied strongly this year. These two components form the return/income stream of our barbell.

The other side of the barbell is the ballast, in preparation for an economic downturn. So far this year, this ballast has been a small detractor to performance. We have more duration in the form of long-term government bonds and options on them. Of course, the volatility in long term interest rates, which is the main reason XBB is down YTD, has also weighted on our performance. Finally, we also have credit hedges, which have been a small detractor to performance, as risk assets have rallied.

Would we have been up more without the defensive component of the barbell? Certainty. But we have a process; we follow the economy, central banks, politicians, and when our leading indicators start flashing orange and red, we take action. It is nearly impossible to get the timing perfect, but in investing, we find its better to be early than late.

Overall, we feel very good about our portfolios; we are generating high income, and have the right mix of bonds to make our funds highly liquid and tax efficient. If and when central banks break something, we will be ready to act from a position of strength.

Until next month,

Mark, Etienne & Nick

Ninepoint Diversified Bond Fund

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF JUNE 30, 2024 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

1.1% |

1.8% |

0.7% |

1.8% |

6.0% |

-0.8% |

0.9% |

2.2% |

3.2% |

Ninepoint Alternative Credit Opportunities

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF JUNE 30, 2024 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

1.4% |

5.0% |

2.5% |

4.9% |

9.8% |

1.1% |

1.3% |

Ninepoint Credit Income Opportunities

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF JUNE 30, 2024 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

1.2% |

5.0% |

2.2% |

5.0% |

9.5% |

2.4% |

5.2% |

4.7% |

June 30, 2024

June 30, 2024