In the stock market, things can happen slowly and then suddenly all at once. Historically, 5% drawdowns happen about three times a year while 10% drawdowns happen about once a year and we’ve just experienced the latter. The cause of this most recent drawdown was a confluence of factors finally adding up to shake investor confidence. It started with a rotation out of the mega cap growth leaders that has been underway since about the middle of July, as the US political situation and expectations for the upcoming election fluctuated wildly. There were also signs that the US economy and the US consumer were weakening even before some of the Mag7 stocks reported what could be considered mixed results. Further, the Fed declined to cut interest rates in July but, only two days later, a very weak nonfarm payroll report elicited fears that the Fed was behind the curve. Finally, after maintaining essentially zero interest rate policy for more than twenty years, the Bank of Japan raised interest rates by 25 basis points, a tiny but significant move, which triggered a rapid unwind of the Yen carry trade. The interconnectedness of this trade was apparent in the broad selloff across many asset classes and was most violently evident in the Nikkei 25, which plunged 12.4% in a single day.

Our portfolio of Canadian high-quality, dividend payers was not immune to the global selloff over the past few weeks, but as at July 31, the Class A shares of the Canadian Large Cap Leaders Split Corp had generated a positive return, recouping all the IPO fees through capital appreciation and dividends. Although we have given back some of our gains in early August, the outlook for the portfolio remains solid and, as interest rate cuts accelerate in Canada, our holdings look even more attractive from a yield perspective. Once again, we think that a temporary selloff has offered an excellent entry point for high-quality Canadian listed companies as demonstrated by the chart below:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

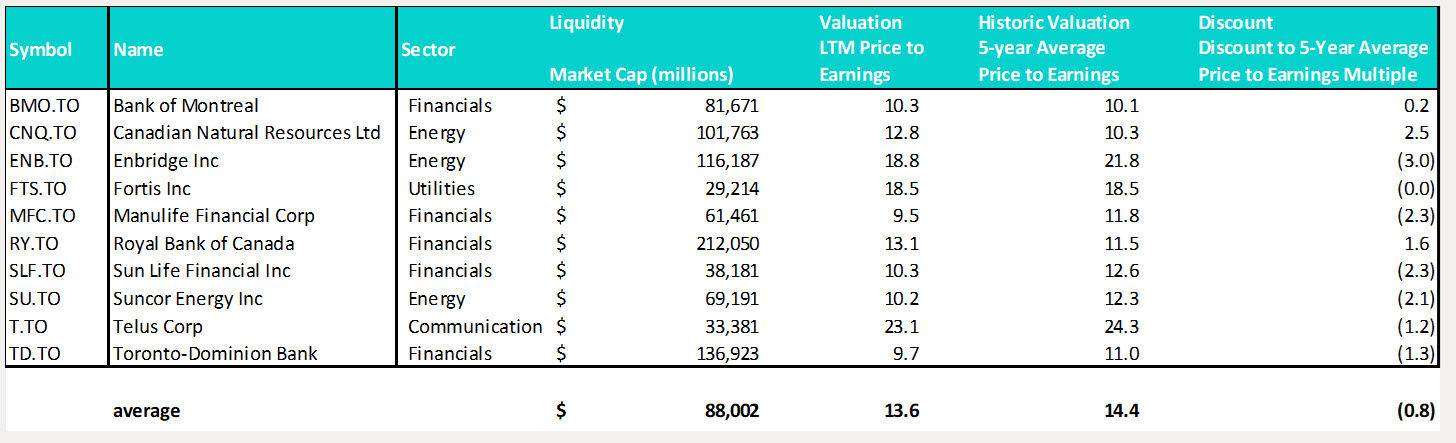

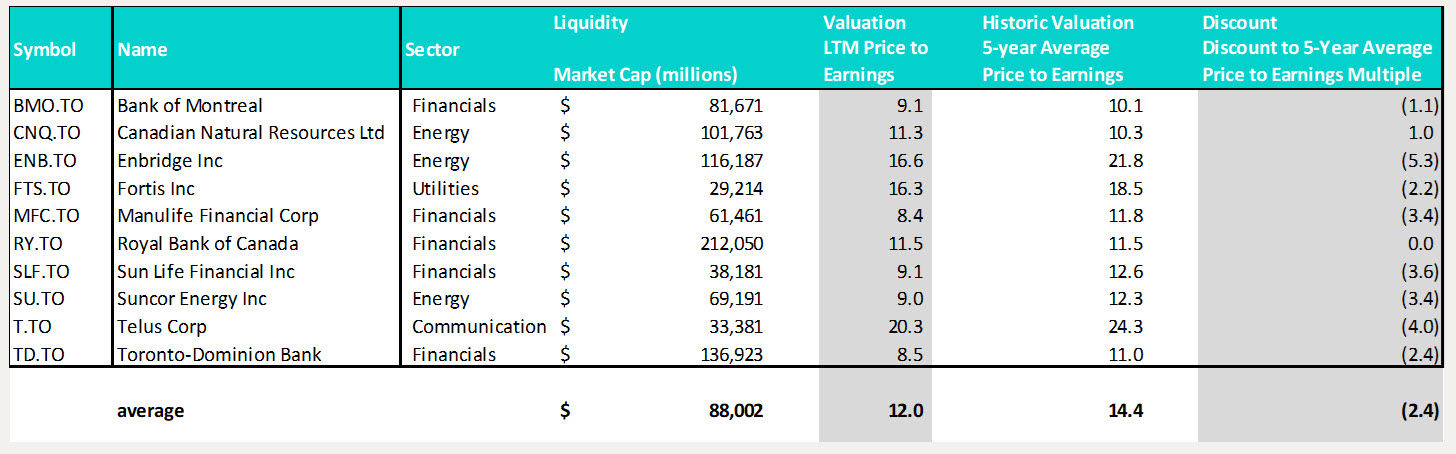

From the chart, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 13.6x, compared to the 5-year average price to earnings multiple of 14.4x, a 0.8x multiple point discount. But with the Class A Share trading approximately 12% below the reported NAV at the close on July 31, we can adjust this table to visualize the implied valuation:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 2.4x worth of multiple points at the close on July 31, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuation levels (and well below the prior night’s close) through the purchase of shares of NPS on the open market. Given the discount, we were active with our Normal Course Issuer Bid during the month, which is accretive to all shareholders. We remain confident that purchasing stock today offers a compelling long-term investment opportunity for both new and current shareholders.

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distribution, payable on August 14, 2024, to the Class A Shareholders of record at the close of business on July 31, 2024. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend.

We appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

July 31, 2024

July 31, 2024