Monthly Update

Year-to-date to July 31, the Ninepoint Global Real Estate Fund generated a total return of 8.32% compared to the MSCI World IMI Core Real Estate Index, which generated a total return of 7.36%. For the month, the Fund generated a total return of 8.00% while the Index generated a total return of 7.03%.

Ninepoint Global Real Estate Fund - Compounded Returns¹ As of July 31, 2024 (Series F NPP132) | Inception Date: August 5, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

8.0% |

8.3% |

12.5% |

9.7% |

10.2% |

-0.9% |

4.7% |

6.6% |

MSCI World IMI Core Real Estate Index |

7.0% |

7.8% |

10.5% |

10.6% |

13.6% |

-0.3% |

2.0% |

3.7% |

In the stock market, things can happen slowly then suddenly all at once. Historically, 5% drawdowns happen about three times a year while 10% drawdowns happen about once a year and we’ve just experienced the latter. The cause of this most recent drawdown was a confluence of factors finally adding up to shake investor confidence. It started with a rotation out of the mega cap growth leaders that has been underway since about the middle of July, as the US political situation and expectations for the upcoming election fluctuated wildly. There were also signs that the US economy and the US consumer were weakening even before some of the Mag7 stocks reported what could be considered mixed results. Further, the Fed declined to cut interest rates in July but, only two days later, a very weak nonfarm payroll report elicited fears that the Fed was behind the curve. Finally, after maintaining essentially zero interest rate policy for more than twenty years, the Bank of Japan raised interest rates by 25 bps, a tiny but significant move, which triggered a rapid unwind of the Yen carry trade. The interconnectedness of this trade was apparent in the broad selloff across many asset classes and was most violently evident in the Nikkei 25, which plunged 12.4% in a single day.

Thankfully, reassuring comments out of the BoJ and various US FOMC members seems to have stabilized the markets, at least temporarily. Recent earnings also have been generally supportive, outside some of the Mag7, and with 91% of the S&P 500 companies having reported, 78% have reported a positive EPS surprise and 59% have reported a positive revenue surprise (according to FactSet). For Q2, the blended (actual and forecasted) year-over-year earnings growth rate of the S&P 500 is 10.8%, which if it holds would be the highest earnings growth rate since Q4 2021, back when we were lapping the Covid lockdown quarters.

In this quarter, earnings growth has been led by the Utilities, Information Technology, Financials, Health Care and Consumer Discretionary sectors, while the Materials and Industrials sectors have been the only sectors to report a year-over-year decline. But the outlook remains good and for 2024 and 2025 analysts are expecting earnings growth of 10.2% and 15.2% respectively. Plus, valuations have improved and after the correction the forward P/E ratio is approximately 20.2x, which is above the 5-year average of 19.4x and above the 10-year average of 17.9x, but below the forward P/E ratio of 21.0x at the end of the second quarter of 2024. We expect that the earnings growth rates of the Mag7 and the rest of the market will narrow through the remainder of 2024, which should support broader participation as the rally eventually resumes its upward trend sometime in Q3 or Q4.1

Importantly, although the Fed did not cut interest rates in July, we fully expect that the first interest rate cut of the cycle will be confirmed at the August Jackson Hole Economic Symposium and will occur in September. After the last FOMC meeting, we think that Chairman Powell struggled to find convincing arguments to support a hawkish stance any longer and, because many FOMC members still expect at least two interest rate cuts in 2024, we believe that two 25 bps cuts are likely by the end of the year.

From there, the Fed will likely proceed with a series of 25 bps interest rate cuts through 2025 to orchestrate an economic soft-landing. However, this outcome is not assured, and we are mindful that some of the recent data suggests that the US economy may be slowing faster than anticipated by the Fed. We are also nervous that the US Presidential elections will create added uncertainty, which may cause volatility to pick up as we get closer to November, much like the 2016 and 2020 election years. Despite these concerns, we are continually searching for companies that are expected to post solid revenue, earnings and dividend growth but still trade at acceptable valuations today.

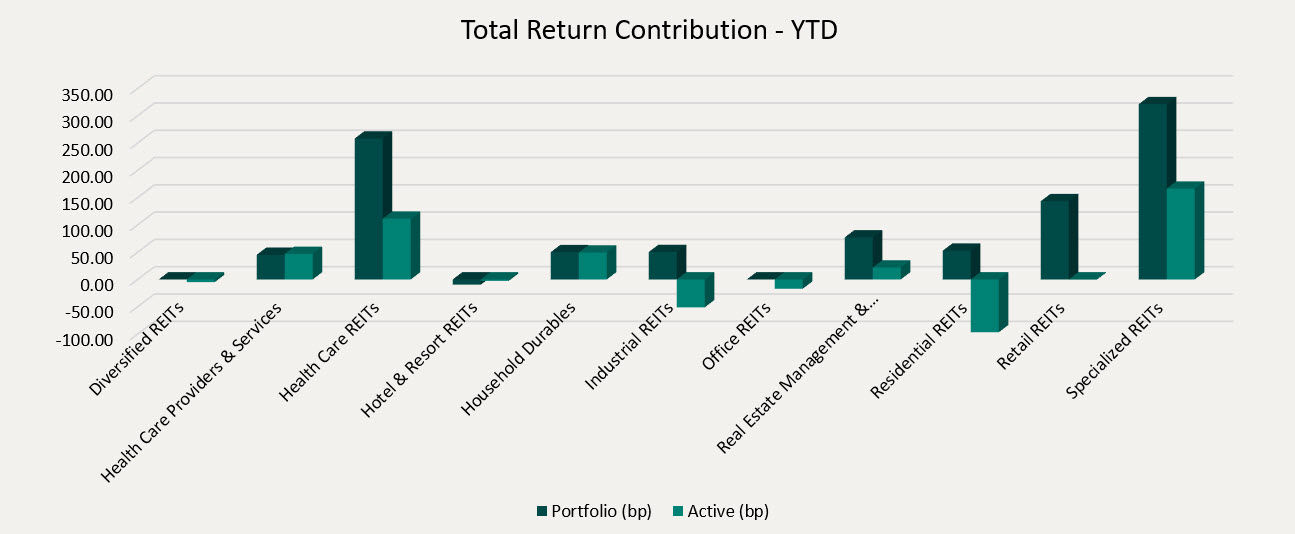

Top contributors to the year-to-date performance of the Ninepoint Global Real Estate Fund by sub-industry included Specialized REITs (+321 bps), Health Care REITs (+258 bps) and Retail REITs (+143 bps), while top detractors by sector included only Hotel & Resort REITs (-10 bps) on an absolute basis.

On a relative basis, positive return contributions from the Specialized REITs (+166 bps), Health Care REITs (+111 bps) and Household Durables (+49 bps) sub-industries were offset by negative contributions from the Residential REITs (-97 bps), Industrial REITs (-51 bps) and Office REITs (-17 bps) sub-industries.

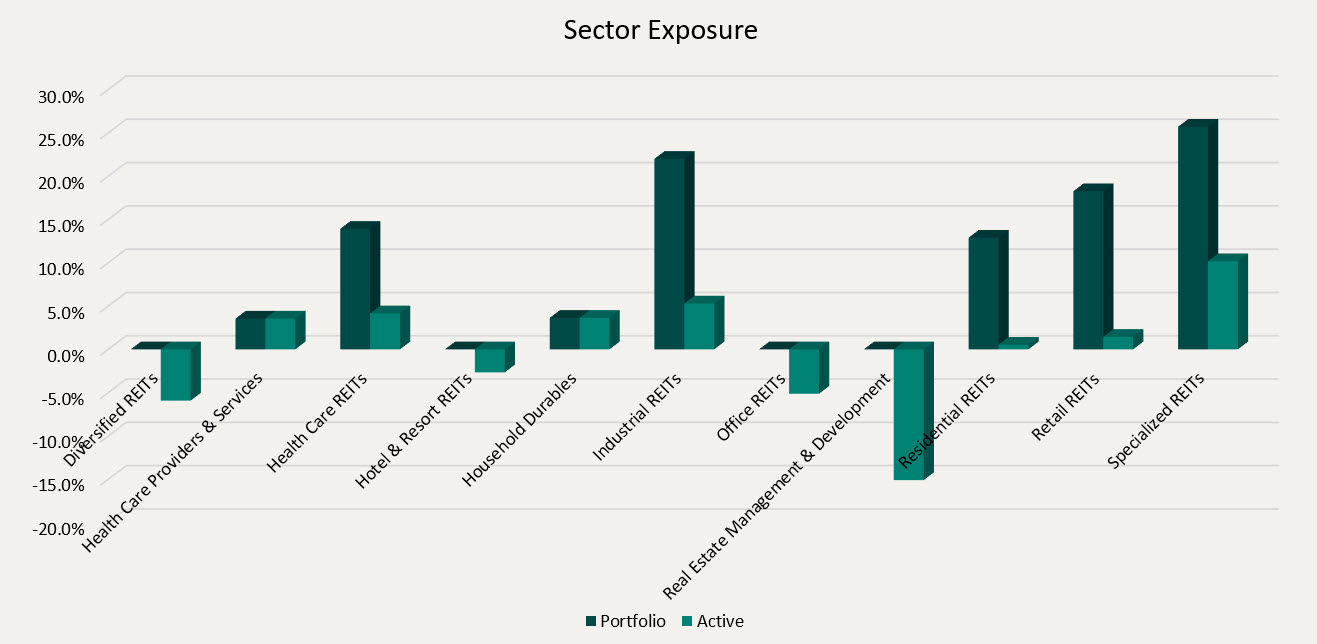

We are currently overweight Specialized REITs, Industrial REITs, and Health Care REITs while underweight Real Estate Management & Development, Diversified REITs, and Office REITs. As investors begin to assess the implications of the upcoming US Presidential election and the first interest rate cut of the cycle, are carefully watching the economic data to determine if the soft-landing scenario materializes. In the meantime, we remain focused on high quality, dividend paying real estate assets that have demonstrated the ability to consistently generate revenue and cash flow growth through the business cycle.

The Ninepoint Global Real Estate Fund was concentrated in 26 positions as at July 31, 2024 with the top 10 holdings accounting for approximately 45.3% of the fund. Over the prior fiscal year, 17 out of our 26 holdings have announced a dividend increase, with an average hike of 4.2% (median hike of 3.1%). Using a total real estate approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

1FactSet Earnings Insight

Fund Announcement

Ninepoint Partners LP announced on July 5, 2024, a proposal to merge (the Merger) Ninepoint Global Real Estate Fund (the Terminating Fund) into Ninepoint Global Infrastructure Fund (the Continuing Fund). The Terminating Fund will cease to be available for sale effective immediately. Following the Merger, pre-authorized purchase plans established for purchases of units of the Terminating Fund will be immediately transferred to the equivalent series of units of the Continuing Fund. Read the full press release here.

July 31, 2024

July 31, 2024