In August, the S&P 500 returned 2.3% and 2.4% on a total return basis while the TSX Composite returned 1.0% and 1.2% on a total return basis. But these figures don’t quite capture the volatility that rocked the markets in early August, before a recovery in the latter part of the month. We have discussed the drivers of the selloff previously, including the rotation out of the mega cap growth leaders, wildly fluctuating expectations regarding the upcoming US Presidential election, signs of a weakening US consumer, mixed results from some of the Mag7 stocks, a weak US nonfarm payroll report and a rapid unwind of the Yen carry trade. However, at the Jackson Hole Economic Symposium on August 23, Chairman Powell was quite clear, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risk”. It is therefore almost certain that rate cuts will begin in September, and we expect that the most likely scenario will entail three cuts of 25 bps each through the balance of the year.

The Bank of Canada is already in easing mode, and we have seen some good performance from our holdings in the Canadian Large Cap Leaders Split Corp as lower rates provided a tailwind to the Communication, Energy, Financials and Utilities sectors. However, we have made our first change to the portfolio since the IPO, swapping Bank of Montreal with the Canadian Imperial Bank of Commerce. The change was necessary due to BMO’s poor performance from its loan book, with provisions for credit losses rising over the past two consecutive quarters, at odds with the rest of the banking sector. Conversely, CIBC reported lower provisions for credit losses, allowing the bank to report 13% revenue growth and 27% adjusted diluted EPS growth in its most recent quarter, as Canadian domestic banking results remained resilient.

Our portfolio of Canadian high quality dividend payers has performed well over the past few months and the Class A shares of the Canadian Large Cap Leaders Split Corp have generated a positive return, recouping all the IPO fees through capital appreciation and dividends. The outlook for the portfolio remains solid and, as interest rate cuts accelerate in Canada, our holdings look even more attractive from a yield perspective, as demonstrated by the chart below:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

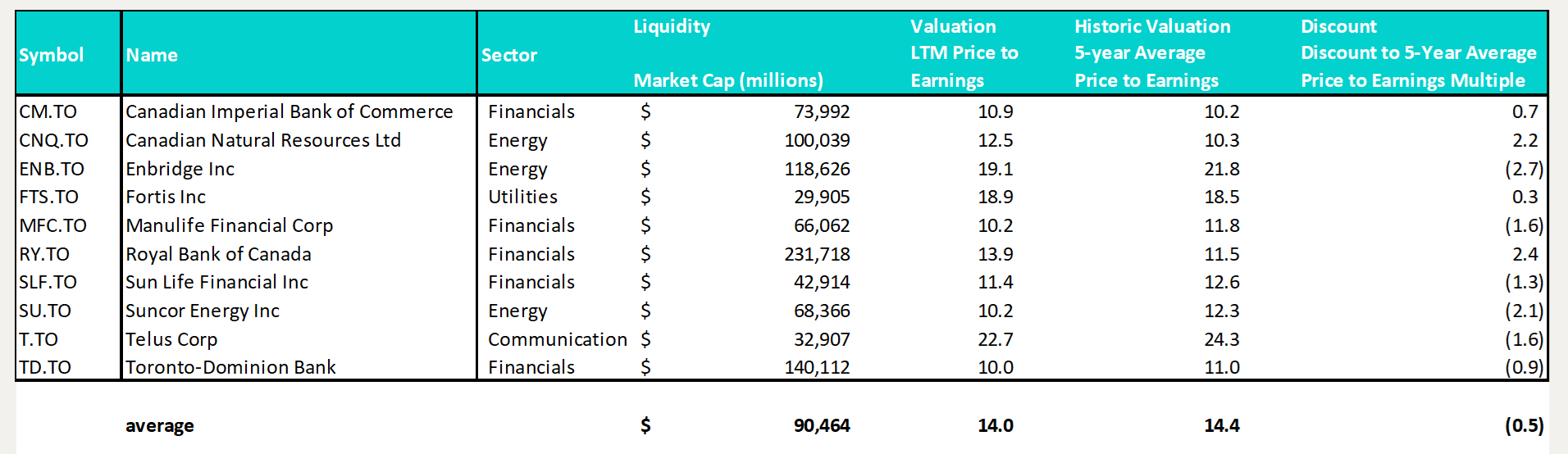

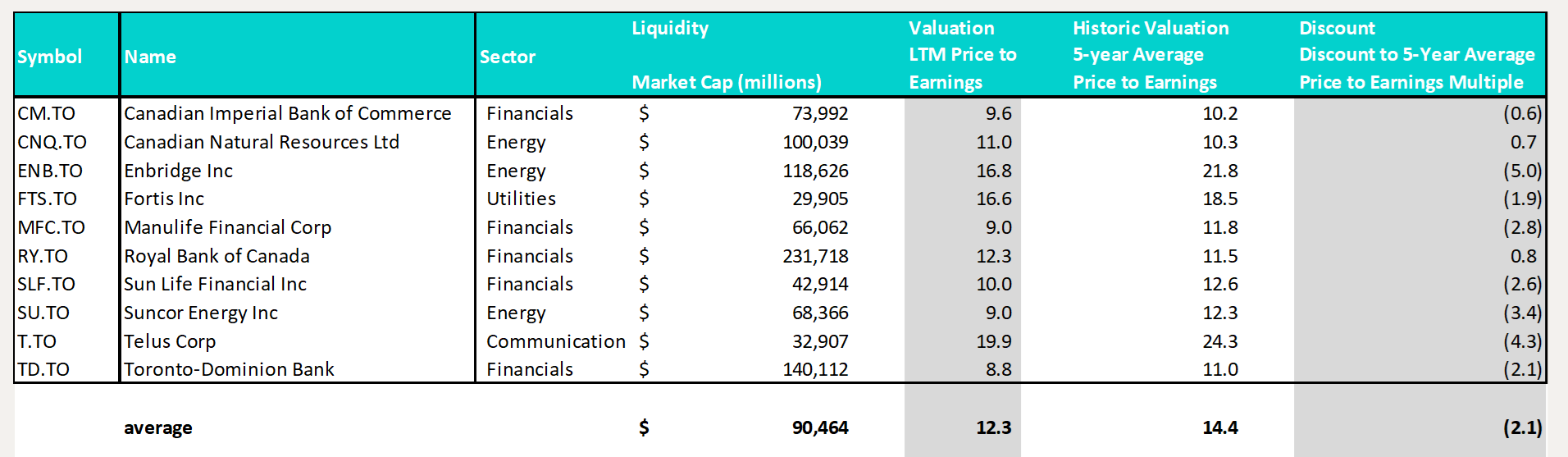

From the chart, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 14.0x, compared to the 5-year average price to earnings multiple of 14.4x, on average a 0.5x multiple point discount. But with the Class A Shares trading approximately 12% below the reported NAV at the close on August 31, we can adjust this table to visualize the implied valuation:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 2.1x worth of multiple points at the close on August 31, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuations through the purchase of shares of NPS on the open market. Given the discount, we continue to believe that buying stock today represents an attractive long-term investment opportunity for both new and existing shareholders and our Normal Course Issuer Bid remains in effect.

As monetary policy easing allows our dividend-paying securities to regain some ground against some of the growthier stocks that have led the market over the past few years, the torque from the synthetic leverage offered by the Class A Shares should become apparent in our relative performance going forward.

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distribution, payable on September 13, 2024, to the Class A Shareholders of record at the close of business on August 30, 2024. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend.

We appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

August 31, 2024

August 31, 2024