Monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Following the intense volatility of early August, all eyes were on central bankers at the annual Jackson Hole symposium. In his speech, Chair Powell did not disappoint, stating that “We do not seek or welcome further cooling in labor market conditions” and that “The time has come for policy to adjust”. The message couldn’t have been clearer: after two years of intense focus on inflation, they are now shifting their attention to the downside risks to the economy. We heard the same message from Governor Macklem at the last BoC meeting, their attention has now clearly shifted to downside risks to inflation and the economy.

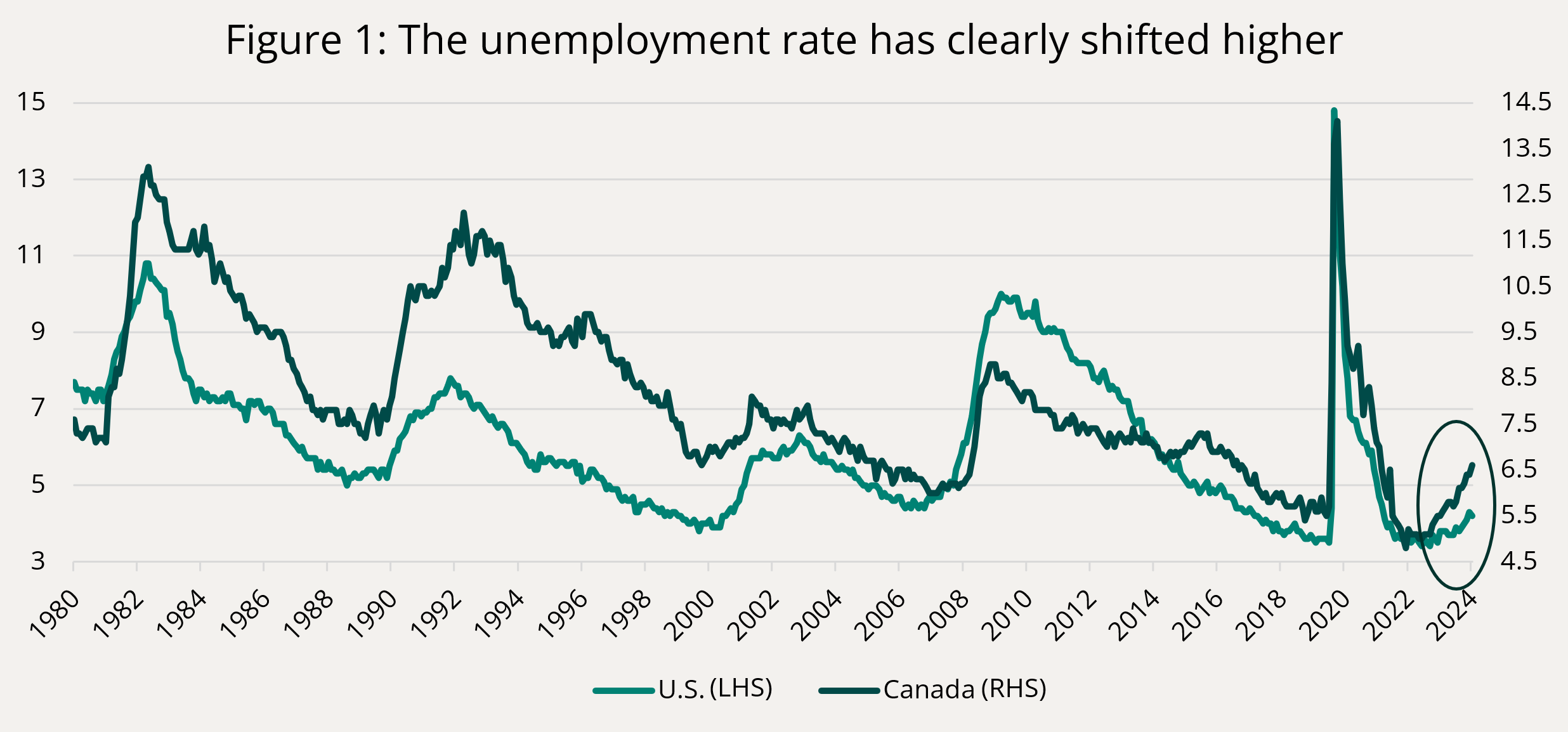

And for a good reason. After defying gravity for several quarters, the U.S. economy is finally losing steam as government spending and accumulated savings from the pandemic are no longer providing a boost. Here in Canada, the weakness in the economy has been more pronounced (lower government deficits and pandemic savings), which helps explain both the lower terminal rate achieved here (5% vs 5.5%), and the faster pace of cuts (0.75% already, vs 0% in the U.S.). Meanwhile, the labour market has lately shown marked signs of deterioration, with the unemployment rate accelerating to the upside (Figure 1 above).

Are central banks behind the curve, and is a recession a foregone conclusion? Both are complicated questions.

Because monetary policy acts with long and variable lags, it is difficult to know exactly when enough rate increases have been done to cool down the economy. And as we had stressed earlier this year, a softer labour market was a necessary condition to finally overcome elevated services inflation. With the labour market now softening, central bankers have greater confidence that inflation is now a problem of the past. If they had cut interest rates any sooner, they might have jeopardized all the recent progress on inflation. They therefore needed that softening in labour conditions that we are now observing these past few months.

Unfortunately, labour market dynamics tend to be self-reinforcing; firms lay people off, these people cannot spend as much as they did before, and demand goes down, prompting other firms to lay-off workers. That helps explain the behavior of the unemployment rate in Figure 1, with long periods of slow declines during economic expansions, followed by sharp moves higher during recessions. That is why the Fed and BoC have changed their focus so abruptly from inflation risk to recession risk.

But those long and variable lags in monetary policy work both on the way up and on the way down. It takes up to 12-18 months for a rate action today to have its full impact on the economy. Remember: we just had the steepest and largest rate hike cycle since the 1980s. If we are indeed entering a period of self-reinforcing labour market weakness and rapid increases in the unemployment rate, we should expect the pace of rate cuts to accelerate. The latest employment report in the U.S. wasn’t good enough nor bad enough to encourage the Fed to cut by 50 basis points in September, the final decision remains a coin toss between 25 basis points and 50 basis points. Here in Canada the unemployment rate is already at 6.6% and we believe that it is possible that the BoC will accelerate the pace of cuts at their October meeting. Based on the state of the Canadian economy over the next 12 months, the BoC might have to cut below the neutral rate.

Credit

Investment grade spreads in the U.S. ended the month 2 basis points tighter, albeit with some volatility intra-month. The weaker than expected Non-Farm Payrolls print initially sent spreads wider but the widening reversed by month end. In Canada, investment grade spreads widened 4 basis points on the month, lagging the US move as is often the case. On the year, Canadian spreads are still sitting 11 basis points tighter but have bounced wider off the tights experienced in May.

In Canada, August was a busy month in terms of issuance whereby $8.7 billion of supply found a home. This is the busiest August on record and puts 2024 YTD issuance within spitting distance of the total 2023 issuance. The market has broadly digested supply very well this year and we will be keen to see if this persists heading into the typically busy fall period. A noteworthy trend coming out of Canadian bank earnings has been their willingness to tap non-CAD markets due to superior pricing. This lack of bank supply has helped Canadian bank debt retain a bid in our market, which proved beneficial to our fund's current positioning.

We are increasingly judicious in our credit selection and prefer larger, higher rated companies. Our liquidity remains ample as we keep the powder dry for bargains should the economy continue to decelerate.

Individual Fund Discussion

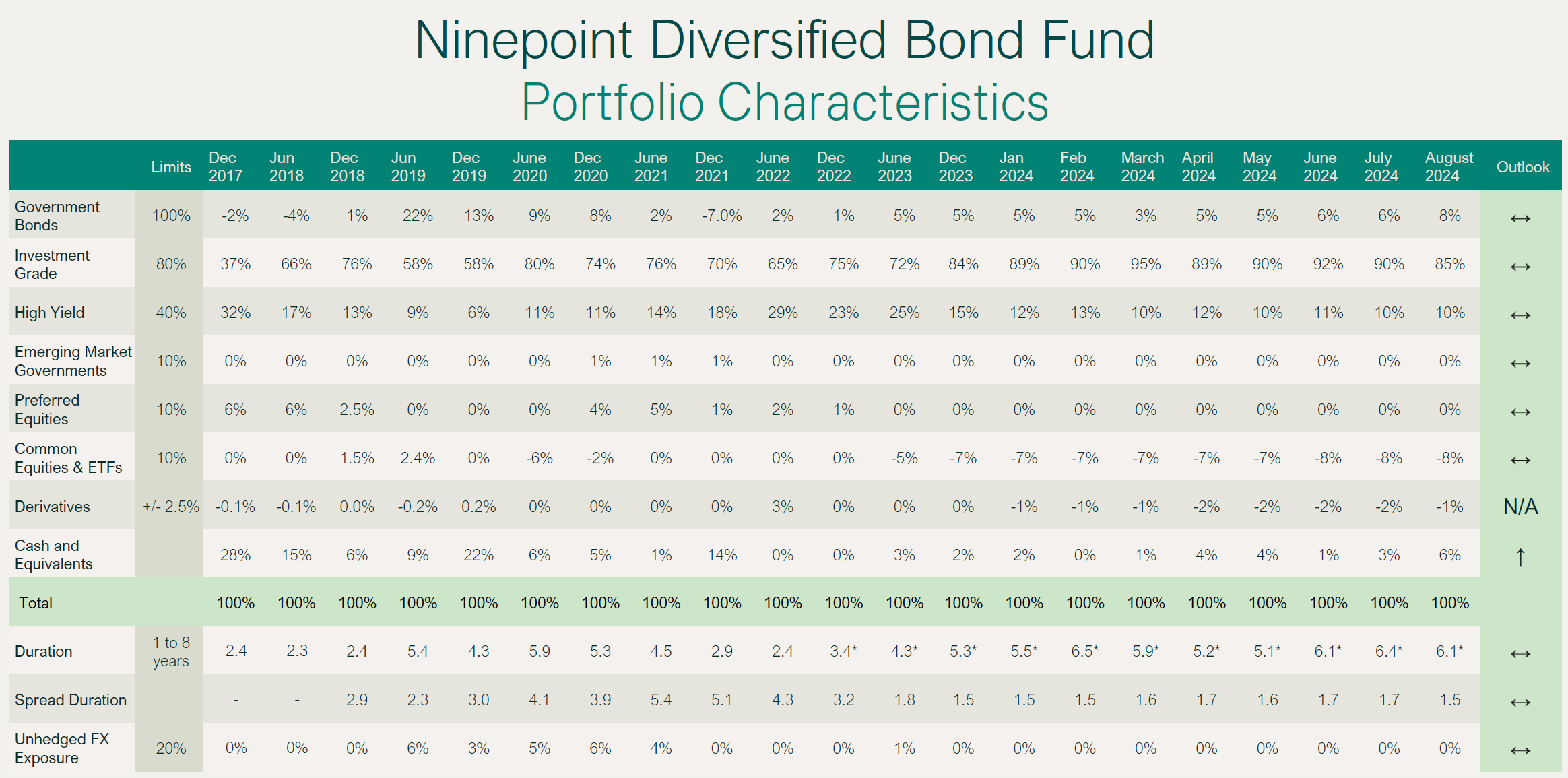

Ninepoint Diversified Bond Fund

Performance in August was +61 basis points, putting YTD returns at 4.52%. Positioning is little changed, and we continue to recycle maturities into the new issue market where we see some value. A prime example was CGI in the first week of September as they came in an attractive part of the curve at a relatively cheap price. The fund’s yield-to-maturity was down on the month, as we had been selling some high-yielding LRCN into strength. As of month end, yield to maturity was 6.3% while duration was 6.1 years.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF AUGUST 31, 2024 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

0.6% |

4.5% |

3.8% |

4.3% |

8.9% |

-0.3% |

1.0% |

2.5% |

3.4% |

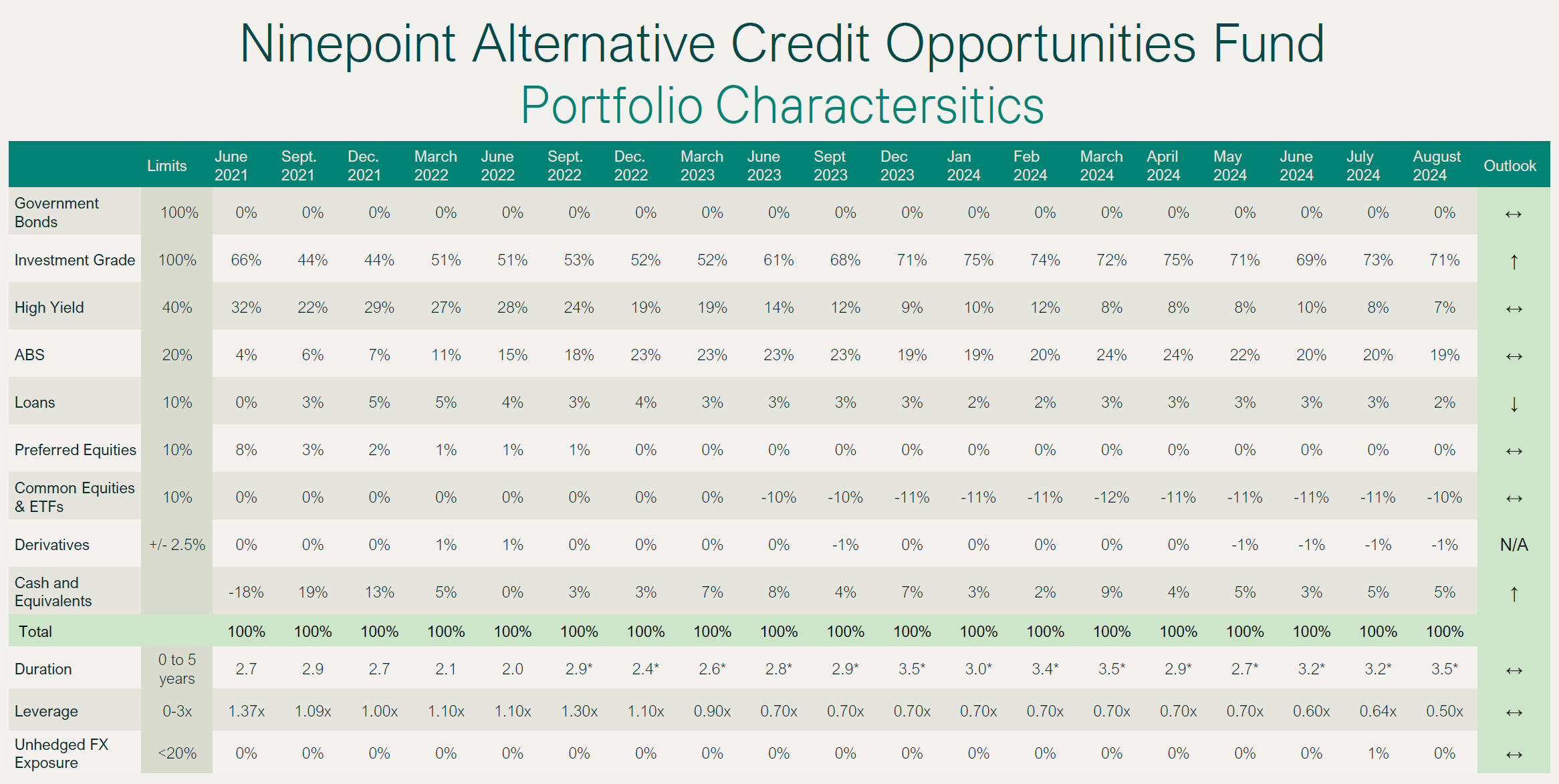

Ninepoint Alternative Credit Opportunities Fund

Performance in August was +58 basis points, putting YTD returns at 6.82%. Our defensive positioning remains intact and we continue to recycle maturities into the new issue market where we see value. Examples include CGI and George Weston in the first week of September as they came in an attractive part of the curve in addition to a cheaper valuations. Leverage ticked down modestly on the month as we gear the fund up for what is typically a busy fall new issue market. As of month end, yield-to-maturity stood at 6.7% while duration was 3.5 years.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF AUGUST 31, 2024 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.6% |

6.8% |

3.3% |

5.2% |

11.1% |

1.5% |

1.8% |

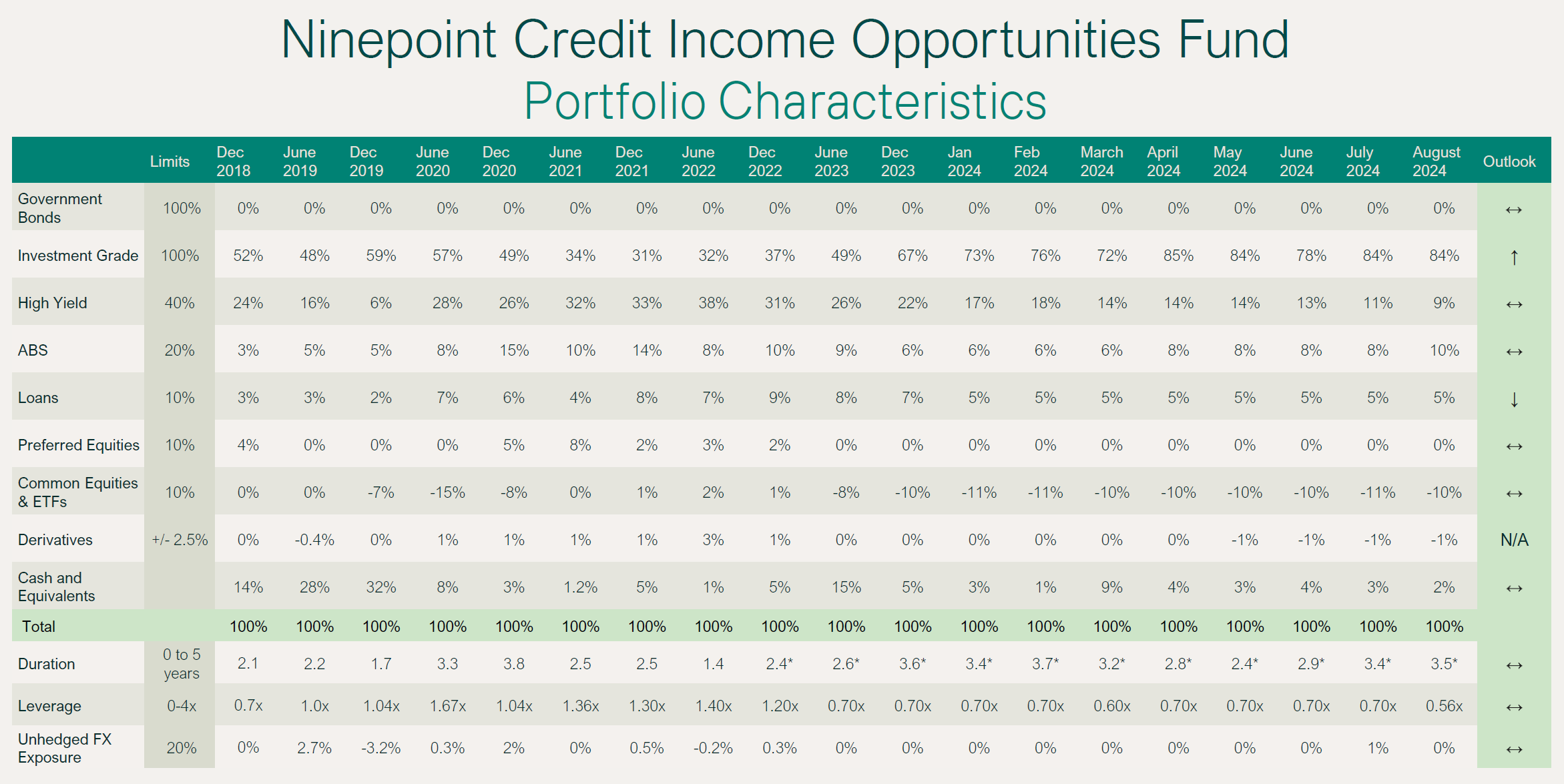

Ninepoint Credit Income Opportunities Fund

Performance in August was +66 basis points putting YTD returns at 6.88%. Our defensive positioning remains intact and we continue to recycle maturities into the new issue market where we see value. Leverage ticked down modestly on the month as we gear the fund up for what is typically a busy fall new issue market. As of month end, yield-to-maturity stood at 7.3% while duration was 3.5 years.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF AUGUST 31, 2024 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

0.7% |

6.9% |

3.0% |

5.0% |

10.5% |

2.7% |

5.5% |

4.9% |

Conclusion

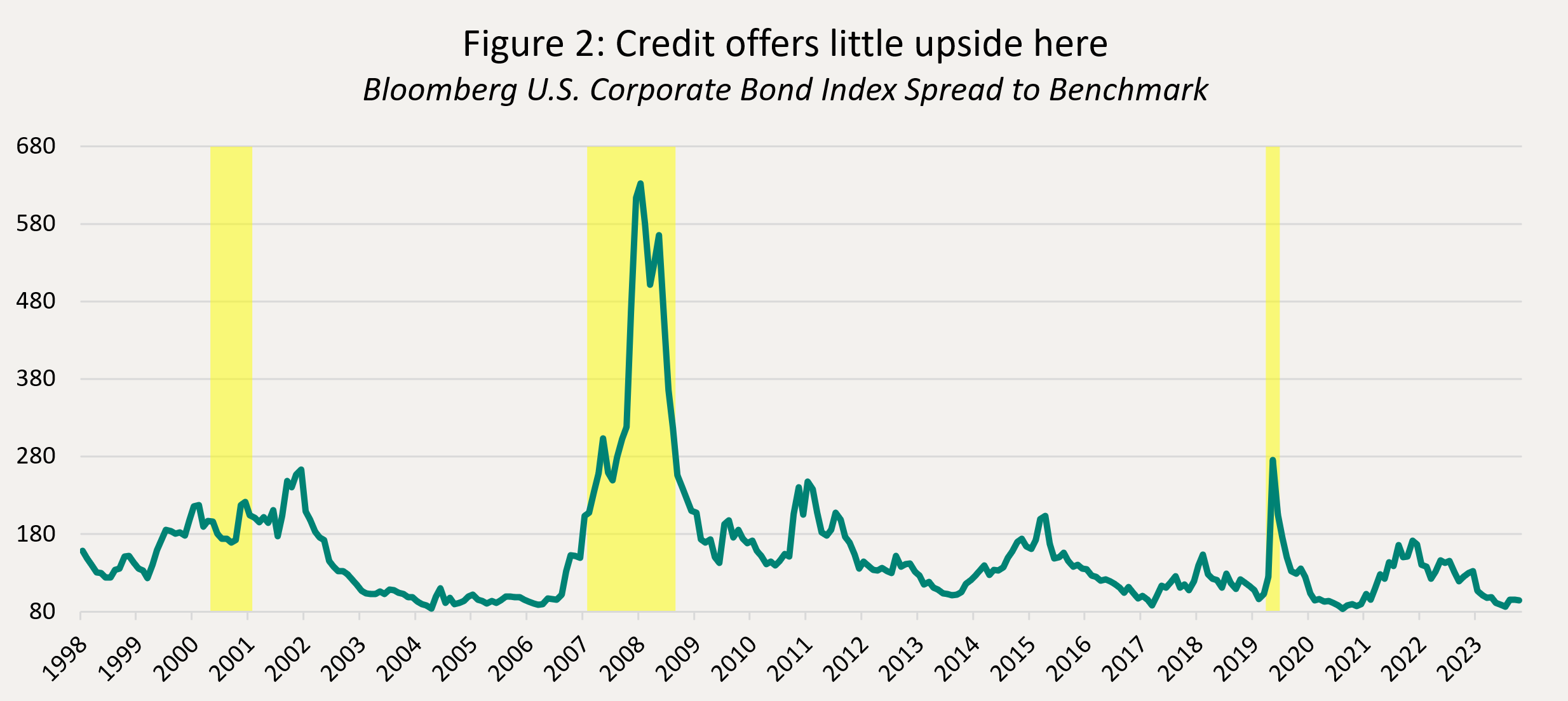

With the heavily anticipated rate cut cycle underway and credit spreads at cycle lows (Figure 2 below), we believe that our funds are defensively positioned to generate attractive income for our clients without excess volatility. We have government bond duration, credit hedges, low overall credit exposure and some options that should benefit from elevated volatility.

All this preparation is now paying off. Despite all the volatility in markets, our funds have performed well over these past few months and are now up between 4.52% and 6.88% year-to-date. We are adequately prepared for what comes next.

Until next month,

Mark, Etienne & Nick

August 31, 2024

August 31, 2024