Monthly Update

Year-to-date to August 31, the Ninepoint Global Infrastructure Fund generated a total return of 15.79% compared to the MSCI World Core Infrastructure Index, which generated a total return of 12.34%. For the month, the Fund generated a total return of 1.73% while the Index generated a total return of 1.61%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of August 31, 2024 (Series F NPP356) | Inception Date: September 1, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

1.7% |

15.8% |

4.1% |

12.9% |

18.7% |

7.9% |

8.1% |

6.3% |

7.9% |

MSCI World Core Infrastructure NR (CAD) |

1.6% |

12.3% |

7.9% |

12.6% |

17.8% |

5.4% |

5.4% |

8.2% |

10.8% |

In August, the S&P 500 returned 2.3% and 2.4% on a total return basis while the TSX Composite returned 1.0% and 1.2% on a total return basis. But these figures don’t quite capture the volatility that rocked the markets in early August, before a recovery occurred in the latter part of the month. We have discussed the drivers of the selloff previously, including the rotation out of the mega cap growth leaders, wildly fluctuating expectations regarding the upcoming US Presidential election, signs of a weakening US consumer, mixed results from some of the Mag7 stocks, a weak US nonfarm payroll report and a rapid unwind of the Yen carry trade. However, at the Jackson Hole Economic Symposium on August 23, Chairman Powell was quite clear, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risk”. It is therefore almost certain that rate cuts will begin in September, and we expect that the most likely scenario will entail three cuts of 25 bps each through the balance of the year.

What happens in the equity markets after the first interest rate cut depends on the magnitude of the economic slowdown and the pace of job losses (basically the path depends on whether we get a hard or soft landing). Currently, economic growth remains robust, but the unemployment picture is softening, with the August payrolls coming in at 142,000 (and the unemployment rate at 4.2%) while the June and July jobs numbers were revised lower by a total of 86,000 jobs. Thankfully, the Fed has acknowledged the importance of monitoring the downside risks to the labour market and the forward curve is currently indicating slightly over 100 bps of easing through the balance of the year. Given the potential for higher volatility in the near term, we are planning to stay open-minded and nimble over the next couple of months.

Although September has started with another market wobble, at least recent earnings have been generally supportive, and with more than 99% of the S&P 500 companies having reported, 79% have reported a positive EPS surprise and 60% have reported a positive revenue surprise (according to FactSet). For Q2, the blended (actual and forecasted) year-over-year earnings growth rate of the S&P 500 is 11.3%, which marks the highest earnings growth rate since Q4 2021. Importantly, the outlook remains good for 2024 and 2025, with analysts expecting earnings growth of 10.1% and 15.0% respectively. Further, valuations have improved slightly, and the forward P/E ratio is approximately 20.6x, which is above the 5-year average of 19.4x and above the 10-year average of 18.0x but below the forward P/E ratio of 21.0x at the end of the second quarter of 2024 (again all according to FactSet). Looking forward, we expect that the earnings growth rates of mega cap tech and the rest of the market will narrow through the remainder of 2024, which should support broader participation as the rally eventually resumes its upward trend sometime in Q3 or Q4.

Given where we are in the cycle, we believe that the Fed will proceed with a series of 25 bps interest rate cuts through 2025 to orchestrate an economic soft-landing. Nevertheless, we are mildly worried that some of the recent data suggests that the US labour market may be softening faster than anticipated by the Fed. We are also nervous that the US Presidential election will create added uncertainty, which historically has caused volatility to pick up closer to November, much like the 2016 and 2020 election years. Despite these concerns, we are continually searching for companies that are expected to post solid revenue, earnings and dividend growth but still trade at acceptable valuations today.

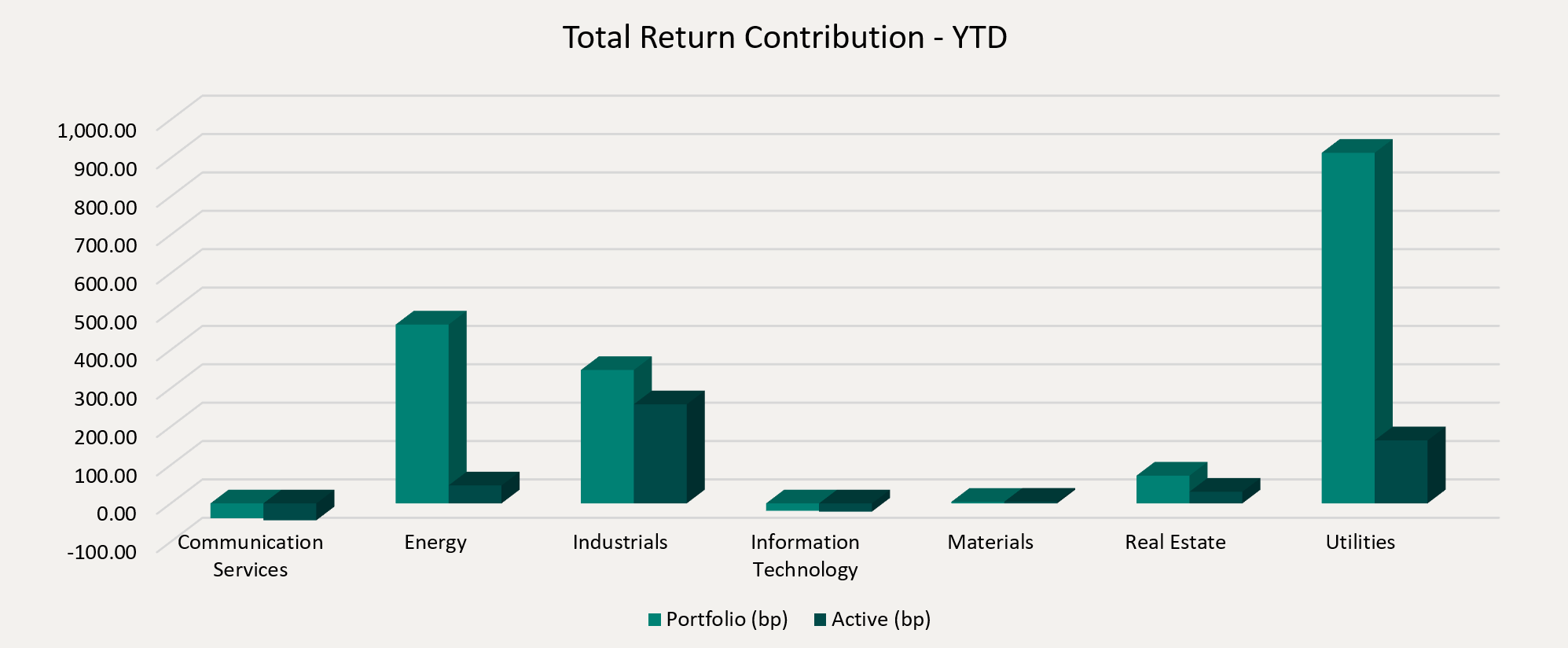

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Utilities (+914 bps), Energy (+466 bps) and Industrials (+348 bps), while top detractors by sector included Communication Services (-39 bps) and Information Technology (-19 bps) on an absolute basis.

On a relative basis, positive return contributions from the Industrials (+258 bps), Utilities (+164 bps) and Energy (+47 bps) sectors were offset by negative contributions from the Communication Services (-44 bps) and Information Technology (-21 bps) sectors.

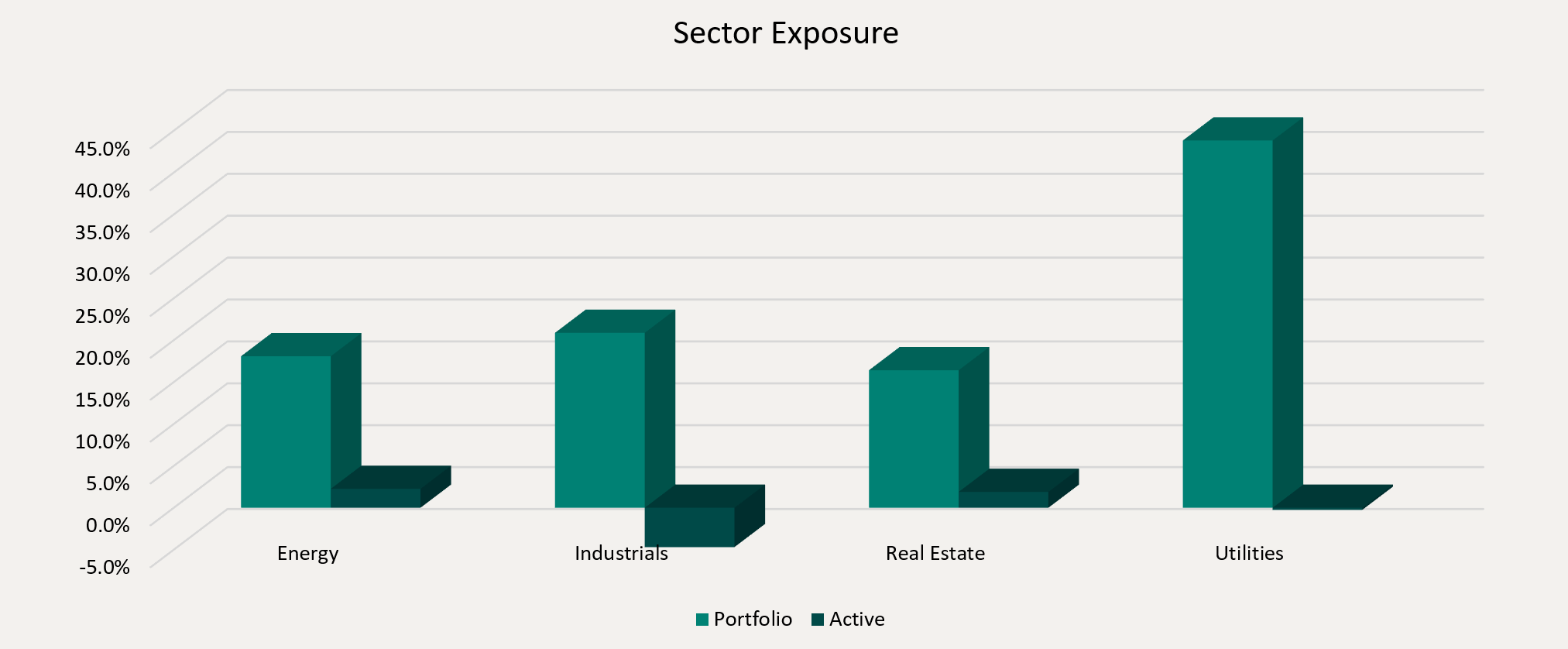

We are currently overweight the Energy and Real Estate sectors, while underweight the Utilities and Industrials sectors. As investors begin to assess the implications of the upcoming US Presidential election and the first interest rate cut of the cycle, are carefully watching the economic data to determine if the soft-landing scenario materializes. In the meantime, we remain focused on high quality, dividend paying infrastructure assets that have demonstrated the ability to consistently generate revenue and earnings growth through the business cycle.

We continue to believe that the clean energy transition will be one of the biggest investment themes for many years ahead. Therefore, we are comfortable having exposure to both traditional energy investments and renewable energy investments in the Ninepoint Global Infrastructure Fund given the importance of energy sustainability and security of supply around the world. Further, electricity demand is expected to accelerate dramatically, led data centers, manufacturing and transportation and we are looking to position the Fund to take advantage of this theme.

The Ninepoint Global Infrastructure Fund was concentrated in 30 positions as at August 31, 2024 with the top 10 holdings accounting for approximately 39.4% of the fund. Over the prior fiscal year, 25 out of our 30 holdings have announced a dividend increase, with an average hike of 14.1% (median hike of 6.0%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

1FactSet Earnings Insight

August 31, 2024

August 31, 2024