Introduction

Without immediate catalysts or news flow, investor interest in US Cannabis remains subdued among retail investors as everyone awaits election night results on November 5th. Significant catalysts are around the corner with the Florida Ballot initiative; Schedule 3 Final Ruling and potential congressional action on US Banking legislation possible in the next year. Each of these three elements possesses significant upside potential for equities described below. While markets continue to discount the upside opportunities in US cannabis, we see the leaders in the sector improving their balance sheets becoming stronger as they reach the next stage of this large market. During September we saw Green Thumb Industries (GTI) refinance $150 million of its senior debt at terms that are the most advantageous of any operator in the space. Outside cannabis we continue to see an upside in our consumer healthcare focus with COSTCO (COST) coming out with strong Q4-24 results, illustrating the strength of its distribution in addressing consumer needs.

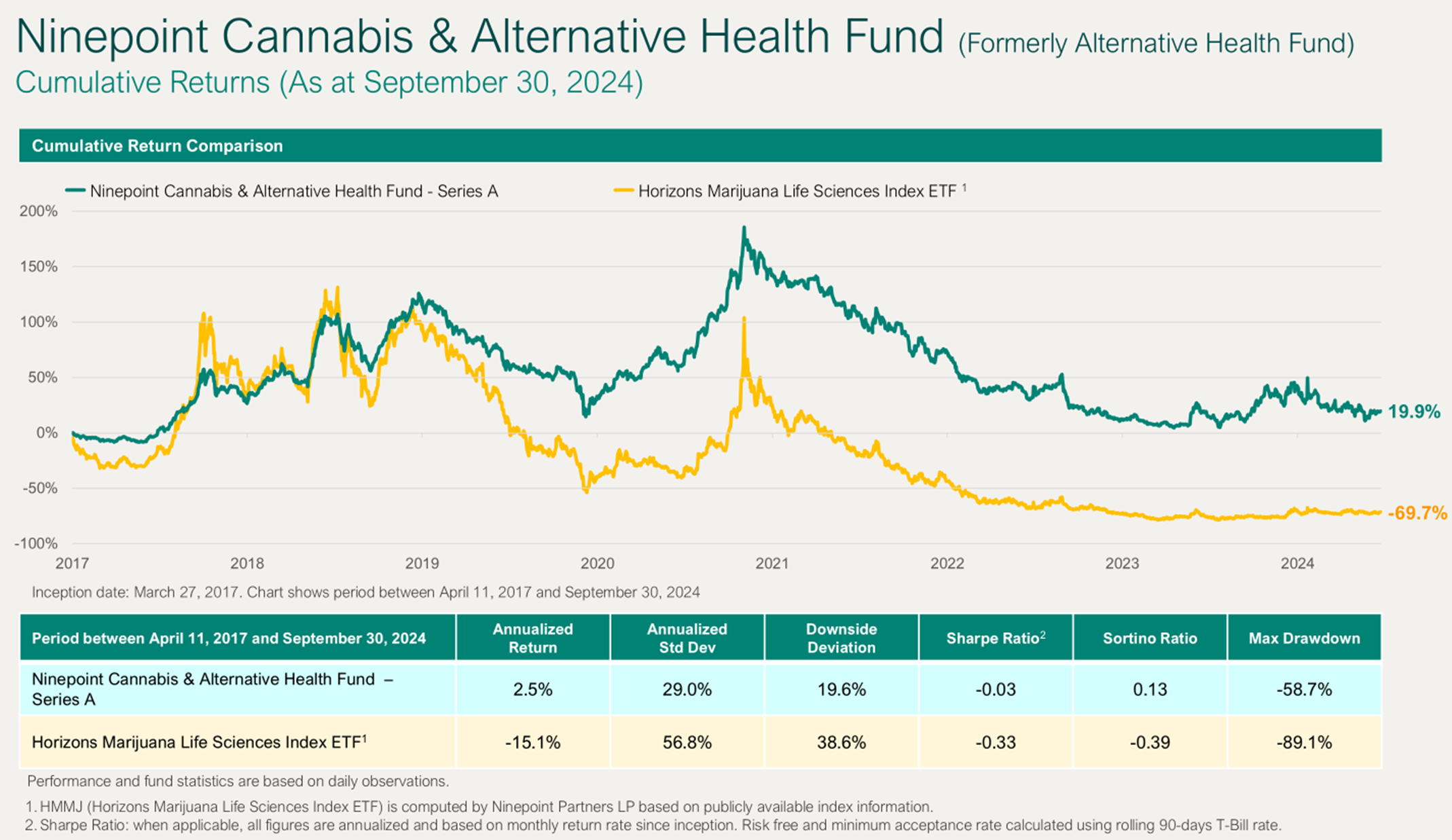

Ninepoint Cannabis & Alternative Health Fund - Compounded Returns¹ as of September 30, 2024 (Series F NPP5421) | Inception Date - August 4, 2017

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

6.4% |

4.0% |

-1.5% |

-15.9% |

2.2% |

-16.1% |

-4.5% |

4.4% |

US Cannabis Updates

On election night November 5th, the state of Florida is voting on Ballot #3, a measure to legalize cannabis for recreational use. With a population of over 20 million people and over 100 million tourists annually, this vote will be significant for the leading cannabis holdings in the Fund. FL is the second largest state market generating approximately $2 billion in revenue annually and could become a $4-5 billion market in the next few years. However, the equities with the greatest exposure to Florida do not reflect the upside to be unlocked. Under Florida law, a successful vote, of over 60% is required, the market should open in the spring of 2025, however, analysts are not adjusting cash flow forecasts. One of the largest positions in our Fund is Trulieve Cannabis, with approx. 160 retail stores operating in Florida, selling close to 40% of all legal cannabis currently consumed in the state. Other names in the fund with significant FL exposure that should see considerable upside include Verano Holdings (VRNO) with close to 80 retail stores; Curaleaf (CURA) with 65 Florida-based stores and Cresco Labs (CL) with 33 FL stores.1

US Cannabis Re-Scheduling

On re-scheduling, this has been a longer than anticipated saga that began two years ago when President Biden requested expedited review of cannabis scheduling. Important in considering this decision is that the majority of Americans now live in states where cannabis is legal yet the businesses that operate them deal with a significant amount of operational and tax burden due to cannabis being a schedule I controlled narcotic, equal in severity to heroin.

Over the last two years, US Department of Health and Human Services (HHS) reviewed and assessed research that describes the efficacy of cannabis in treating various illnesses including chronic pain, epilepsy, anxiety, PTSD, and suggesting a lower risk of abuse than previously assumed. As a result of these findings released early this year, the Drug Enforcement Agency (DEA) is holding an administrative hearing in early December to determine if the findings from HHS are medically and scientifically sound enough to be relied upon to move forward with rescheduling.

While the rescheduling proposal is being reviewed, there is more and more research continuing to bolster the case for rescheduling. There has also been an increase in bipartisan support for rescheduling cannabis, reflecting broader societal support. Washington is currently willing to delay what will become the inevitable.

Another factor that can have a significant impact on re-scheduling cannabis, reducing the tax burden related to IRS Code 280E and further leading to better listing opportunities for US cannabis is the national election decided on November 5th. The US national elections have control of the White House, Senate and House all up for grabs in the general election. There are significant regulatory changes that can enhance the standing of cannabis with respect to banking and listing on US exchanges. With re-scheduling achieved, changes to rules on banking access can be adjusted allowing cannabis operators to take credit card payments for transactions, reducing the risk of violent theft from dispensaries. Congressional action on SAFE Banking seems to have bi-partisan support and with one party potentially controlling all three houses of government, there is potential for resolution in favour of the industry. With a change in banking rules, US listing requirements can also change providing access to US cannabis companies to list on NASDAQ

It is important to understand why listing in the US is an advantage. If we compare US cannabis stock volumes relative to Canadian cannabis company volumes, we see a dramatic difference. At a time when many US cannabis companies are generating significant operating cash flow and approx. 30% EBITDA margins, Canadian companies, burdened by unlimited licensing causing increased competition in addition to generally poor operating performance. As a result, Canadian companies are barely breaking even at best. However, from a trading perspective, the trailing 3-month average volume on US cannabis stocks is down 39% since the last peak in early June. The Canadian operators, which trade on the Nasdaq, traded 138% of their market caps in the last 90 days. Even removing Tilray (TLRY) which traded 200%, the other 7 companies still traded 105% of the market cap. A key difference is access to trading interests in the US. SAFE Banking after Re-scheduling unlocks that trading volume, enhancing the value of the underlying equities. The above noted catalysts should not be ignored when doing a top-down analysis. The optionality that exists is similar to what we had post-2001 tech.2

Green Thumb (GTII) Debt Refinancing

One of the Fund's largest holdings, GTII recently made two significant announcements: a debt refinancing and the extension of its share repurchase program. In mid-September, GTII closed a $150 million financing, a 5-year syndicated credit facility led by Valley National Bank. This was a non-brokered, bank-only financing without any equity kickers or sweeteners (i.e.: no warrants, etc.). This is an important aspect of the financing since most US cannabis companies must offer some equity upside to get regional banks and nonbank lenders to participate. The interest rate was established at Secured Overnight Financing Rate (SOFR) + 5.00%. This refinancing allowed the company to retire its senior secured debt due April 30, 2025. The new facility matures in 2029.3

The company’s Board of Directors also re-authorized a $50 million share repurchase program allowing for the repurchase of up to 10.5 million Subordinate Voting Shares over the next 12 months. This is the second year GTII has had a Share Buyback program. In its first year, the company bought back 6.5 million shares at a cost of $73.3 million. Benefits to the company and investors include creating a floor price for the stock resulting in improved share price performance in addition to enhancing per-share earnings and cash flow results. Bottoms are a process and management's acknowledgment to support its shares might be a warning to the market of what is to come. Other holdings in the portfolio are also considering share buybacks.3

COSTCO Q4-24 Earnings

Costco has long been known for its stability and strong customer base, even in the face of broader economic headwinds. In Q4 as recessionary fears plague many retailers, COST stands out as the company reported net sales of $249.6 billion, an increase of 5% YoY. Net income for the fiscal year was $7.37 billion, $16.56 per diluted share, compared to $6.292 billion or $14.16 per diluted share, in the prior year. Costco comparable sales increased 6.9% YOY, accelerating from 6.5% in Q3-24 with the acceleration coming from increased traffic, rather than price increases. U.S. same store sales (SSS) grew 6.3% (ex. Gas) while e-commerce increased 19.5%. There was a slight dip in U.S. and Canada membership renewal rates to 92.9% in the fourth quarter from 93% in the preceding quarter. Costco has 76.2 million paid household members, up 7.3% from the prior year while executive memberships grew 9.6% year over year to reach 35.4 million, now accounting for 46.5% of all paid members and driving 73.5% of worldwide sales. Costco opened 14 new warehouses during Q4, including 10 in the U.S. Overall, Costco operates 891 warehouses, including 614 in the United States and Puerto Rico, 108 in Canada, 40 in Mexico, 35 in Japan, 29 in the United Kingdom, 19 in Korea, 15 in Australia, 14 in Taiwan, 7 in China.

https://www.nasdaq.com/articles/should-you-buy-hold-or-sell-costco-stock-after-q4-earnings

The Technology Opportunity in Healthcare

The Fund has maintained a weighting in sectors related to healthcare including pharmaceuticals, medical devices, medical insurance providers, and vendors of health and wellness products and services. More recently, we have seen an emerging opportunity to increase the Fund’s exposure to healthcare-related technologies. Technology companies are investing billions of dollars to drive healthcare innovations with a wide range of solutions that include patient care to drug discovery all with the use of AI being a particular focus. A particular focus from tech has been on the AI can improve patient outcomes. Whether it is precise diagnosis to modelling patient populations for emerging needs, advanced technology will be increasingly called upon to improve outcomes. We see management companies analyzing efficiencies in the delivery of healthcare services, while we also see analytics enhancing the review of digital images for early detection of cancer and other diseases. Increasingly technology and healthcare companies are using AI to enhance the delivery of information, data modelling for disease management as well as early diagnosis of various ailments.

Telemedicine and telehealth company Teladoc Health, Inc.(TDOC) signed a partnership in 2023 with Microsoft (MSFT) using Azure OpenAI Service, Azure Cognitive Services, and conversational solutions via Nuance (see below) that will automate the creation of clinical documentation during virtual exams improving the quality of shared medical information and the care TDOC provides.

The technology opportunity in healthcare has not gone unnoticed by the large tech companies, reflecting the size and potential of the addressable market. MSFT recognized healthcare as a growing opportunity as far back as March of 2022 when it purchased a speech recognition company, Nuance for $16 billion. MSFT has since integrated a range of its products within this service including Teams, Azure, and Healthcare Bot. Using Nuance, MSFT has built a communication platform capable of dealing with complex medical jargon.

Apple Inc (AAPL) has focussed on consumer applications. Apple Watch’s health functions along with Apple’s Health App are two of the most visible forays into healthcare. Apple Watch’s ECG function demonstrates the company’s continued innovation. In addition to these higher-profile offerings, AAPL has also developed a number of applications based on its core on collecting and integrating healthcare data for patients and healthcare providers. Integrating and accessing data across devices is a core competency of APPL’s.

Option Strategy

Since the inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately CAD$5.11 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio in favor of names we prefer while generating approximately CAD$23,000 in options income. We continue to write short dated covered calls on names we feel are range bound near term and from which we could receive above average premiums which included Pfizer (PFE) and Merck & Co. (MRK). We also continue to write short dated cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including UnitedHealth Group (UNH) and Universal Health Services (UHS).

The Ninepoint Cannabis & Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

1. https://www.headset.io/blog/floridas-cannabis-market-set-to-explode-with-adult-use-legalization

2. Excelsior Equities October 7, 2024

Statistical Analysis

Fund |

|

|---|---|

Cumulative Returns |

35.8% |

Standard Deviation |

27.5% |

Sharpe Ratio |

0.03 |

September 30, 2024

September 30, 2024