The US Federal Reserve has now begun easing monetary policy. After 525 basis points of tightening from March 2022 to July 2023, the FOMC finally lowered interest rates by 50 basis points to 5.00% on September 18. The beginning of the easing cycle was well telegraphed, most notably during Chairman Powell’s speech at the Jackson Hole Economic Symposium on August 23, when he stated, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risk”. However, we were somewhat surprised, along with most market watchers, when the FOMC started with a cut of 50 basis points instead of 25 basis points. However, we like the bold move since, theoretically, it would be safer to cut by 50 basis points and downplay the dovishness if the economic data comes in stronger than expected rather than cut by 25 basis points and appear well behind the curve if the economic data weakens suddenly. Perhaps there was a little game theory in play, but Powell’s comments in the press conference summed it up nicely, “This recalibration of our policy stance will help maintain the strength of the economy and the labour market and will continue to enable further progress on inflation as we begin the process of moving forward to a more neutral stance”.

The Bank of Canada is already in easing mode and, now that the Fed has cut by 50 basis points, we expect interest rates in Canada to be cut by a similar amount on October 23. Falling interest rates are generally supportive to dividend paying equities, and we have seen some solid performance from our holdings in the Canadian Large Cap Leaders Split Corp. In terms of company specific news, TD Bank announced that CEO Bharat Masrani would be replaced by Raymond Chun, the current head of Canadian personal banking, which was reasonably well received by the market. During the month, Fortis also announced a new $26 billion five-year capital outlook (implying 6.5% average annual rate base growth through 2029)1 and a 4.2% dividend bump (to $0.615 per share, to be paid on a quarterly basis), which boosts the dividend pool available to our Shareholders.

Overall, our portfolio of Canadian high quality dividend payers has performed well over the past few months and the net asset value of the Class A shares of the Canadian Large Cap Leaders Split Corp is now comfortably above the IPO price. The outlook for the portfolio remains solid and, as interest rate cuts accelerate in Canada, our holdings look even more attractive from a yield perspective, as demonstrated by the chart below:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

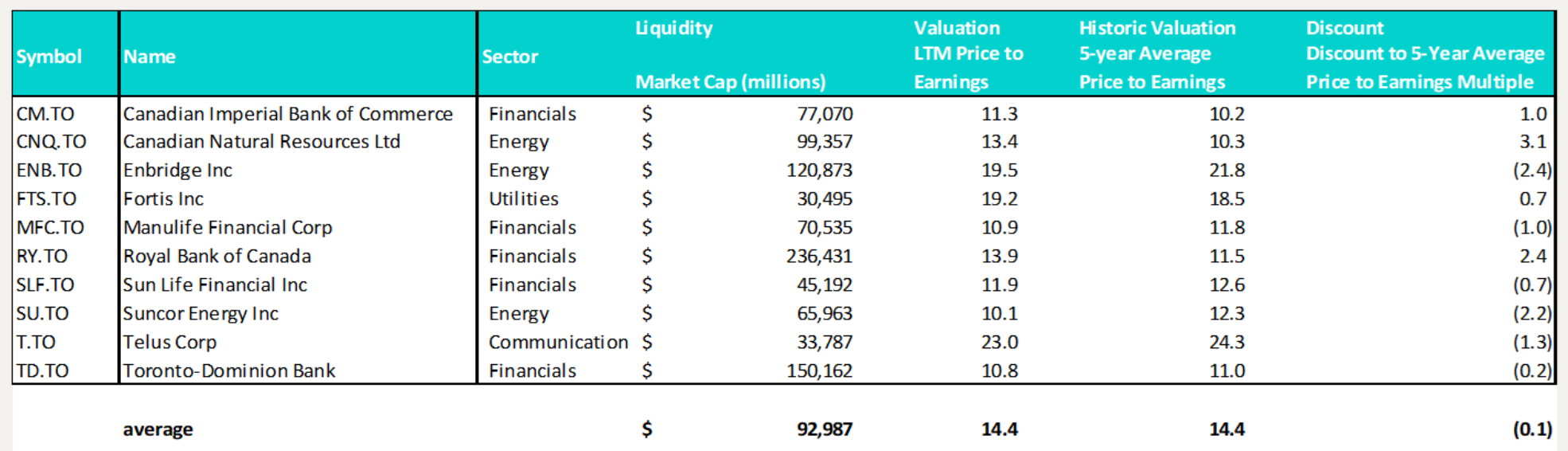

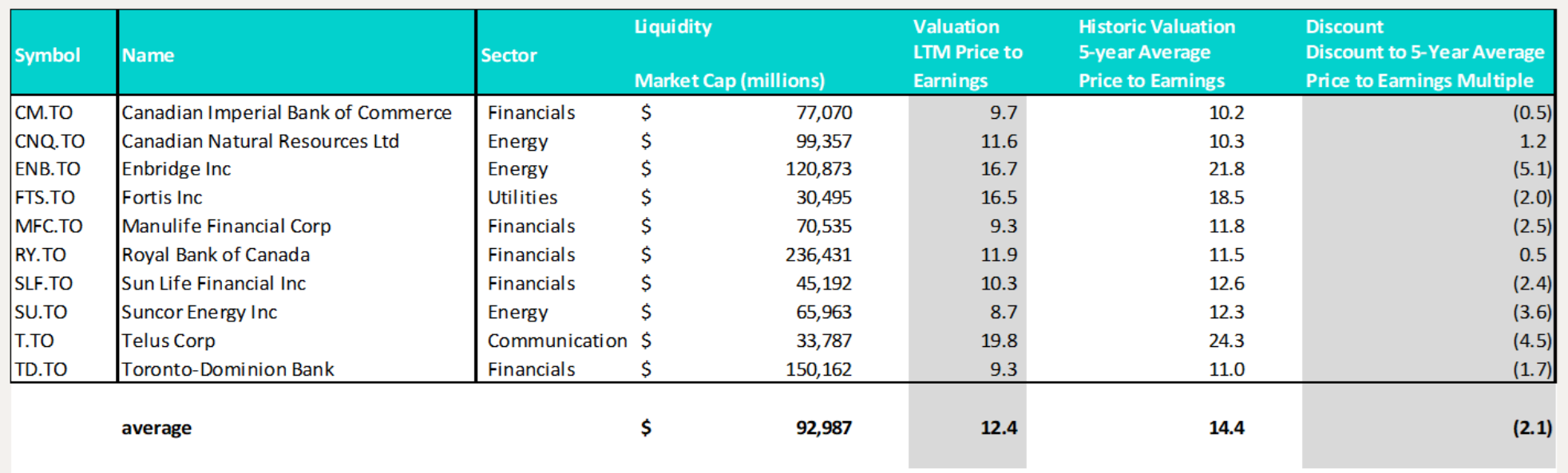

From the chart, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 14.4x, compared to the 5-year average price to earnings multiple of 14.4x, on average a slight 0.1x multiple point discount. Given our outlook for lower interest rates (and supported by a significant discount to the S&P 500, which currently trades at about 21.5x forward earnings)2, multiples still have plenty of room to expand in Canada. But with the Class A Shares trading approximately 14% below the reported NAV at the close on October 2, 2024, we can adjust this table to visualize the implied valuation today:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 2.1x worth of multiple points at the close on October 2, 2024, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuations through the purchase of shares of NPS on the open market. Given the discount, we continue to believe that buying stock today represents an attractive long-term investment opportunity for both new and existing shareholders and our Normal Course Issuer Bid remains in effect.

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distributions, payable on October 11, 2024, to both Class A and Preferred Shareholders of record at the close of business on September 27, 2024. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend and holders of the Preferred Shares will receive the $0.18750 regular quarterly dividend.

As always, we appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

1. https://www.fortisinc.com/news/news-releases/detail?id=9466

2. FactSet Earnings Insight

September 30, 2024

September 30, 2024