Monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

All eyes were on the U.S. Federal Reserve meeting in September, and Chair Powell did not disappoint, kicking off the rate cut cycle with an oversized 50 basis points cut. For reference, the last time the Fed cut rates by 50 basis points was during the pandemic, and prior to that 2008. Suffice to say, they are a rare occurrence typically associated with extreme events.

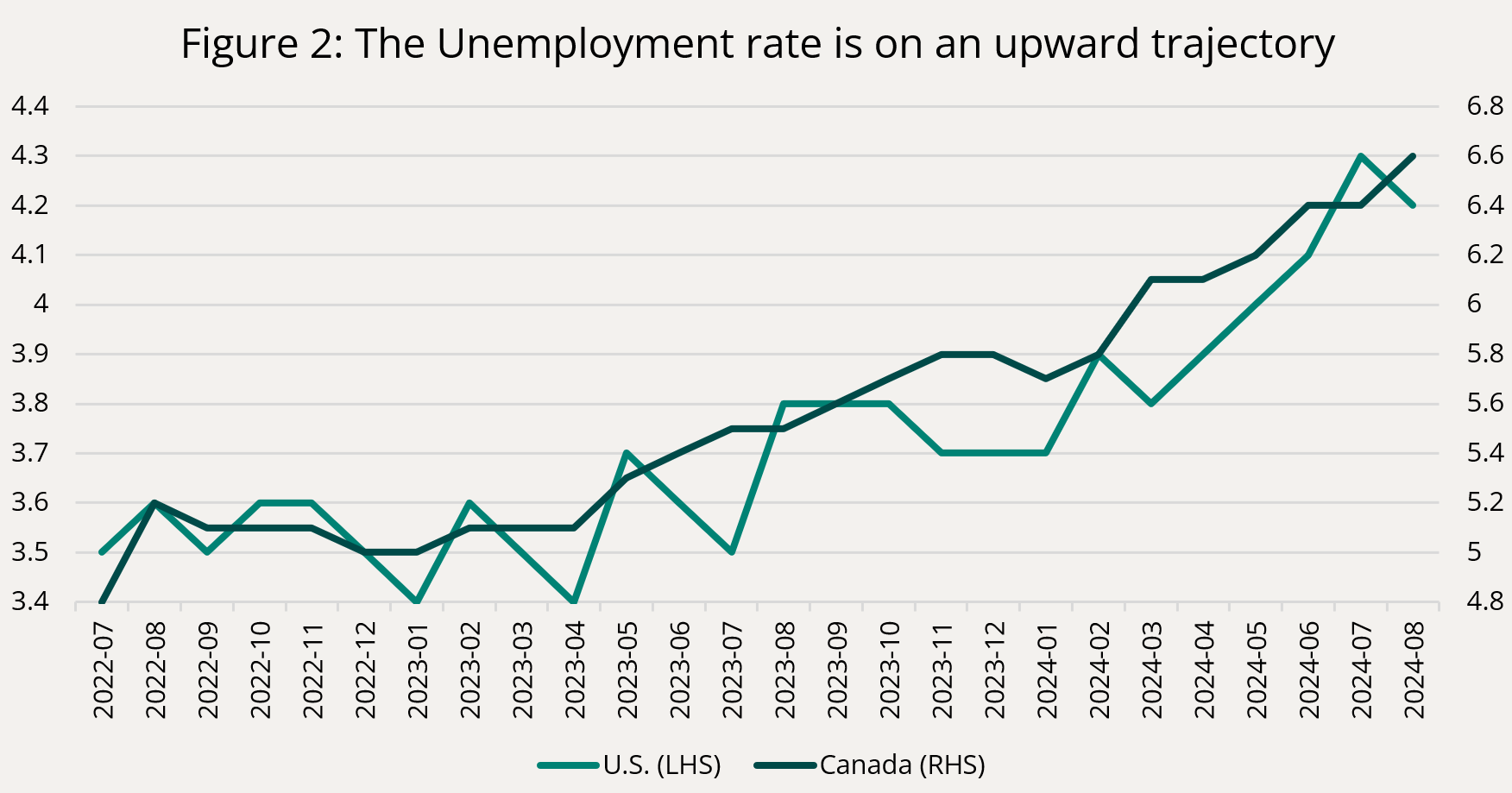

Nonetheless, Powell did his best to reassure the public that he still sees the U.S. economy as strong, and that with upside risks to inflation diminishing, it was now time to make monetary policy less restrictive and try to steer the economy towards a soft landing. Indeed, the Fed now forecasts economic growth of 2% for the next 3 years, along with an unemployment rate that mildly increases to 4.4% (from 4.2% currently) and then slowly tapers off. Such an outcome would be truly remarkable, given we have just gone through the fastest, steepest rate hike cycle since the 1980s.

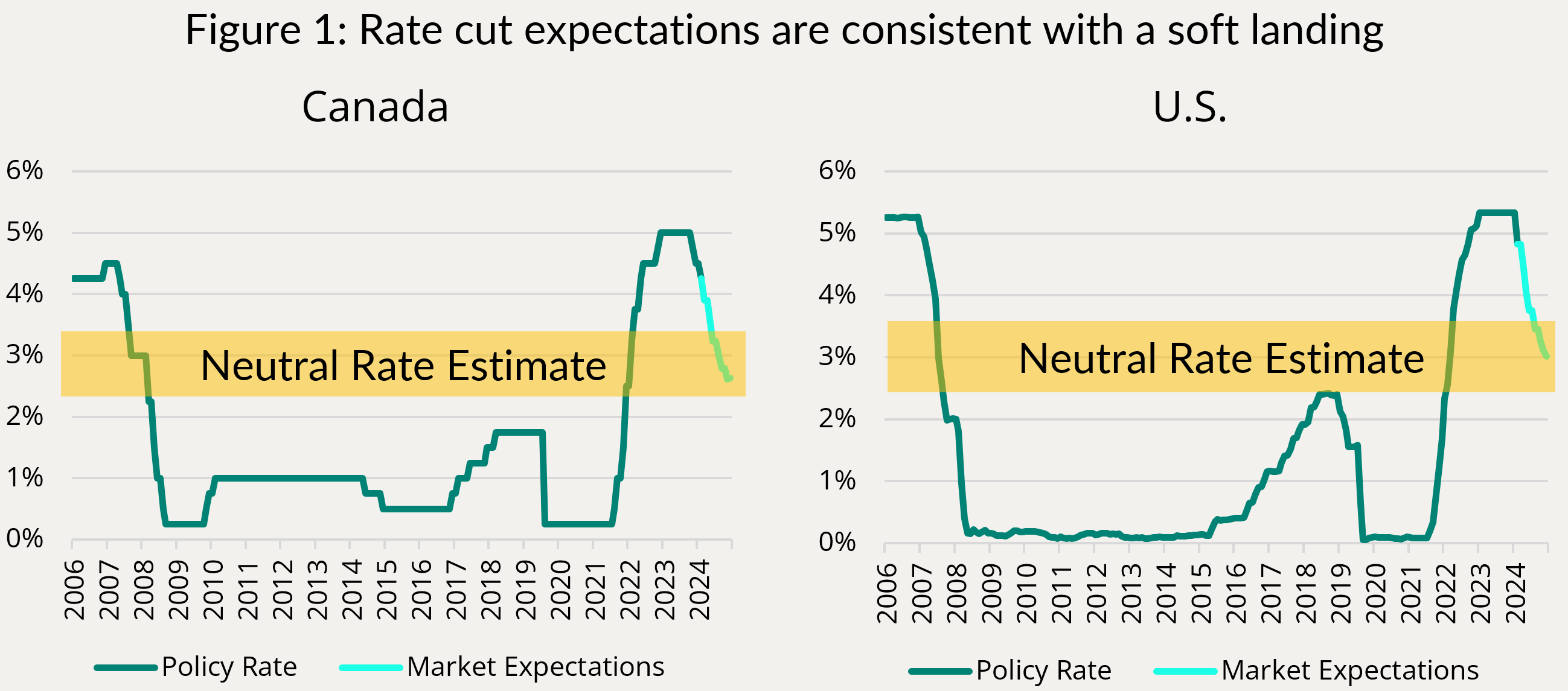

Equity and credit markets reacted strongly to this dovishness, with the S&P 500 and TSX reaching new all-time highs, while credit spreads rallied within spitting distance of their recent tights. Looking at expectations for further rate cuts (Figure 1 below), the bond market also seems to be buying into this idea of a soft landing, seeing both the Fed Funds Rate and the Bank of Canada overnight rate heading back towards neutral over the next 12 months and stabilizing there. Overall, consensus in asset markets seems to be for a high probability of a soft landing.

Only time will tell if this extremely benign forecast will come to pass. In the meantime, it feels to us like Chair Powell has marked a very clear line in the sand: if the unemployment rate increases further above that 4.4% level they have penciled-in for this year and next, they will take more forceful measures to loosen policy and stimulate the economy. So that leaves everyone, us included, waiting for the month end employment reports. Momentum on that front isn’t encouraging, with the unemployment rate increasing steadily over the past 12 months (Figure 2).

We think that the odds of the labour market stabilizing here, after deteriorating steadily, are quite low. After all, monetary policy acts with a lag, and the economy today is still reflecting the monetary policy stance that has been in place for the past year or so (i.e. rates at their peak). The recent rate cuts will take months to make their way through to the real economy.

If and when the labour market crosses Powell’s red line, we expect risk assets to switch from pricing-in a soft landing to increasing odds of recession (i.e. stocks down, credit spreads wider). In this situation, we should start seeing rate cut expectations below neutral (around the 1.5-2% range), reflecting the need for central banks to stimulate the economy.

With this in mind, we continue to maintain our defensive stance, while being mindful of investor positioning and shifting consensus views.

As credit markets have rallied, we have taken profits on various low-coupon LRCN positions. Some of those bonds have moved up over 10% this year. We have replaced them with either first-generation LRCN bonds, which are callable next fall (and highly likely to get called, reducing their potential volatility), or with new issues of high-grade corporate bonds in the 3-5 year space.

Astute clients will also notice that our duration has dropped meaningfully this month. As long-term U.S. treasuries rallied going into the FOMC meeting, we thought the move was overdone, and reduced our positions, locking-in profits there as well. Since then, long-term bond yields have moved up ~20 basis points. We will look to add duration back at more attractive levels, and retain upside optionality via out-of-the-money calls on the TLT ETF.

Individual Fund Discussion

Ninepoint Diversified Bond Fund

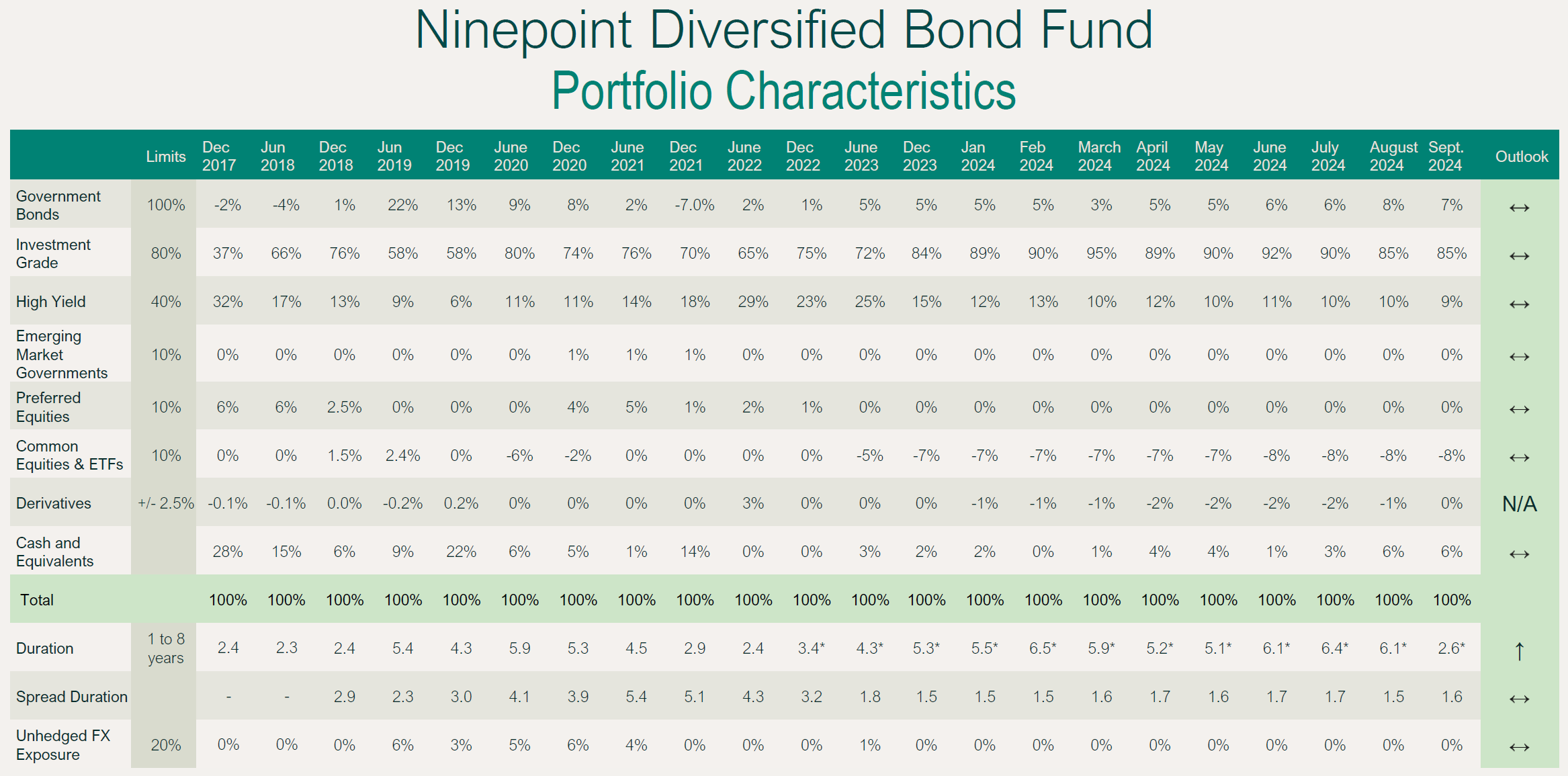

September was a solid month for the Ninepoint Diversified Bond Fund, returning 1.9%, bringing our year-to-date performance to 6.5%. As of month end, duration was down to 2.6 years, from 6.1 years the month before, reflecting the changes to our long-term government bond position discussed above. The fund’s yield to maturity has also declined to 5.4%, reflecting lower rates along the curve, and the sale of those LRCN. Other than the position squaring already discussed, there was very little new to report.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF SEPTEMBER 30, 2024 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

1.9% |

6.5% |

4.6% |

5.4% |

12.9% |

0.5% |

1.5% |

2.8% |

3.5% |

Ninepoint Alternative Credit Opportunities Fund

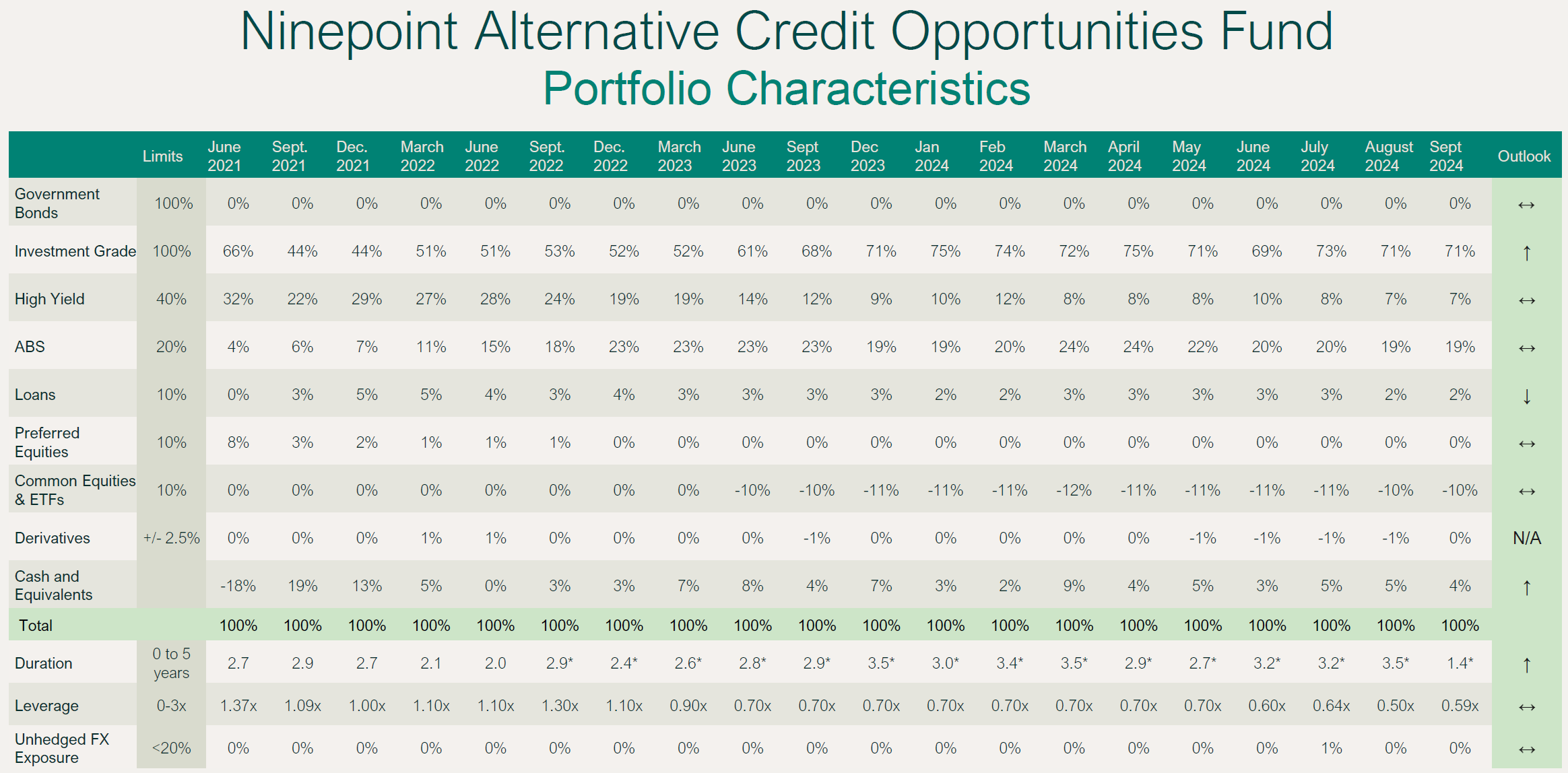

Strong performance in credit coupled with lower long-term rates drove a return of 1.3% in September, taking the return so far this year to 8.2%. Leverage went up a little bit (0.6x vs 0.5x last month) as we deployed some capital in the new issue market, which was literally on fire following the FOMC meeting. Expect leverage to come back down in the near future. The fund’s duration declined to 1.4 years, for the same reasons cited above, while the yield-to-maturity went down marginally (6.4%), reflecting lower rates and credit spreads.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF SEPTEMBER 30, 2024 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

1.3% |

8.2% |

3.1% |

5.7% |

13.5% |

1.8% |

2.1% |

Ninepoint Credit Income Opportunities Fund

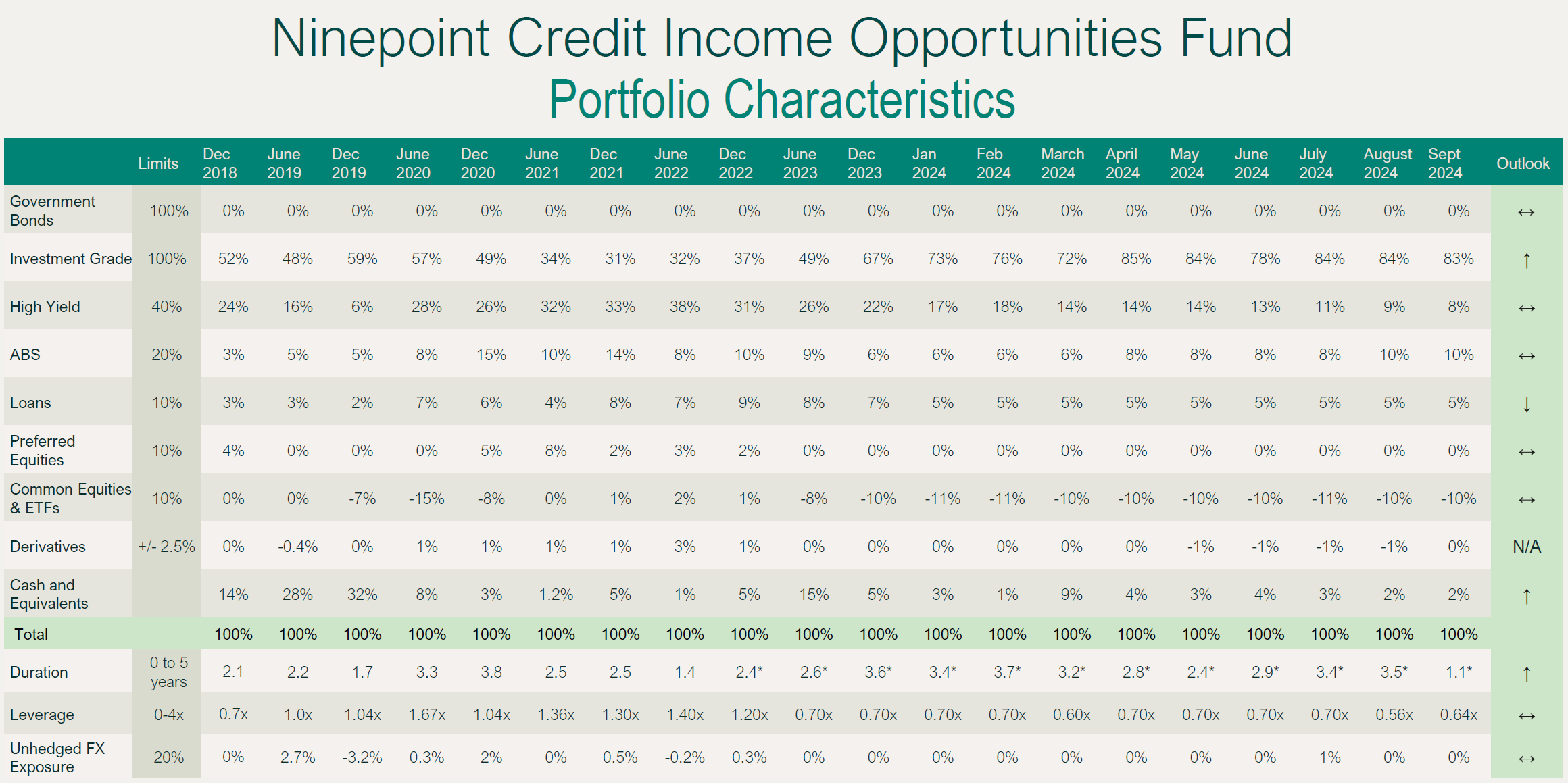

Driven by lower rates and credit spreads, the fund saw a return of 1.2% in September, resulting in a year-to-date performance of 8.2%. Leverage went up small (0.6x vs 0.5x last month) as we bought some hot new issues. Leverage should drift back lower in the coming weeks. Duration declined to 1.1 years as we took profits on long-term treasuries. The yield-to-maturity went down marginally (6.8%), reflecting lower rates and credit spreads.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF SEPTEMBER 30, 2024 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

1.2% |

8.2% |

3.1% |

5.3% |

12.6% |

3.0% |

5.7% |

4.9% |

Conclusion

All eyes will be on the September jobs report on October 4th, this should be a pivotal moment in this cycle.

Until next month,

Mark, Etienne & Nick

September 30, 2024

September 30, 2024