Monthly Update

Year-to-date to September 30, the Ninepoint Global Infrastructure Fund generated a total return of 21.54% compared to the MSCI World Core Infrastructure Index, which generated a total return of 15.60%. For the month, the Fund generated a total return of 4.97% while the Index generated a total return of 2.90%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of September 30, 2024 (Series F NPP356) | Inception Date: September 1, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

5.0% |

21.5% |

12.5% |

13.8% |

29.4% |

10.9% |

9.0% |

6.8% |

8.3% |

MSCI World Core Infrastructure NR (CAD) |

2.9% |

15.6% |

12.7% |

12.8% |

28.0% |

7.9% |

5.8% |

8.5% |

11.0% |

The US Federal Reserve has now begun easing monetary policy. After 525 basis points of tightening from March 2022 to July 2023, the FOMC finally lowered interest rates by 50 basis points to 5.00% on September 18. The beginning of the easing cycle was well telegraphed, most notably during Chairman Powell’s speech at the Jackson Hole Economic Symposium on August 23, when he stated, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risk”. However, we were somewhat surprised, along with most market watchers, when the FOMC started with a cut of 50 basis points instead of 25 basis points. We like the bold move since, theoretically, it would be safer to cut by 50 basis points and downplay the dovishness if the economic data comes in stronger than expected rather than cut by 25 basis points and appear well behind the curve if the economic data weakens suddenly. Perhaps there was a little game theory in play, but Powell’s comments in the press conference summed it up nicely, “This recalibration of our policy stance will help maintain the strength of the economy and the labour market and will continue to enable further progress on inflation as we begin the process of moving forward to a more neutral stance”.

In the immediate aftermath of the outsized rate cut, the markets were unsure how to react. Stocks spiked higher but then sold off aggressively throughout the remainder of the day as investors digested the news, waffling between fear of what the Fed might see coming and euphoria based on the prospect of much lower rates going forward. But what happens in the equity markets over the next twelve months following the first interest rate cut really depends on the magnitude of the economic slowdown and the pace of job losses (basically future equity returns after the first rate cut depends on whether we get a hard or soft landing). Currently, economic growth remains robust with Q3 GDP estimates at 2.5%, and the unemployment picture remains resilient with the September payrolls coming in at 254,000 (and the unemployment rate at 4.1%). Importantly, the forward curve is currently indicating just over 50 basis points of additional easing over the next two FOMC meetings and we believe that, based on Chairman Powell’s recent comments, two cuts of 25 basis points each is most likely scenario before year end.

Finally, with the US Presidential Election only a month away and geopolitical tensions rising, we believe that there is the potential for higher volatility in the near term, so we are planning to stick with our large cap, high quality investments. Beyond the short-term noise, the outlook remains good for 2024 and 2025, with analysts expecting earnings growth of 10.0% and 15.1% respectively, according to FactSet. Below the surface, the earnings growth rates of mega cap tech and the rest of the market should narrow through the remainder of 2024 and into 2025, which should support broader participation as the rally eventually resumes its uptrend sometime in Q4. We plan to take advantage of any volatility, and we are continually searching for companies that are expected to post solid revenue, earnings and dividend growth but still trade at acceptable valuations today.

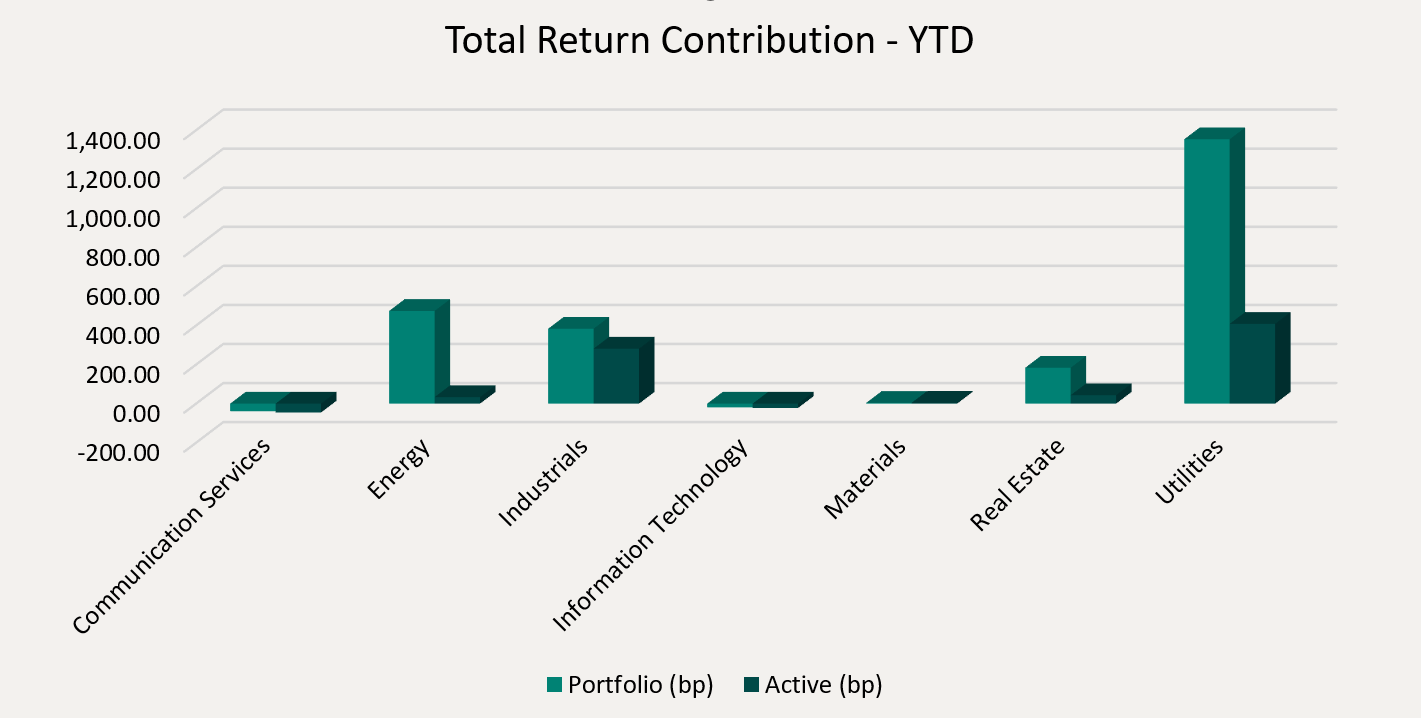

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Utilities (+1,354 basis points), Energy (+474 basis points) and Industrials (+384 basis points), while top detractors by sector included Communication Services (-39 basis points) and Information Technology (-19 basis points) on an absolute basis.

On a relative basis, positive return contributions from the Utilities (+409 basis points), Industrials (+282 basis points) and Real Estate (+43 basis points) sectors were offset by negative contributions from the Communication Services (-45 basis points) and Information Technology (-22 basis points) sectors.

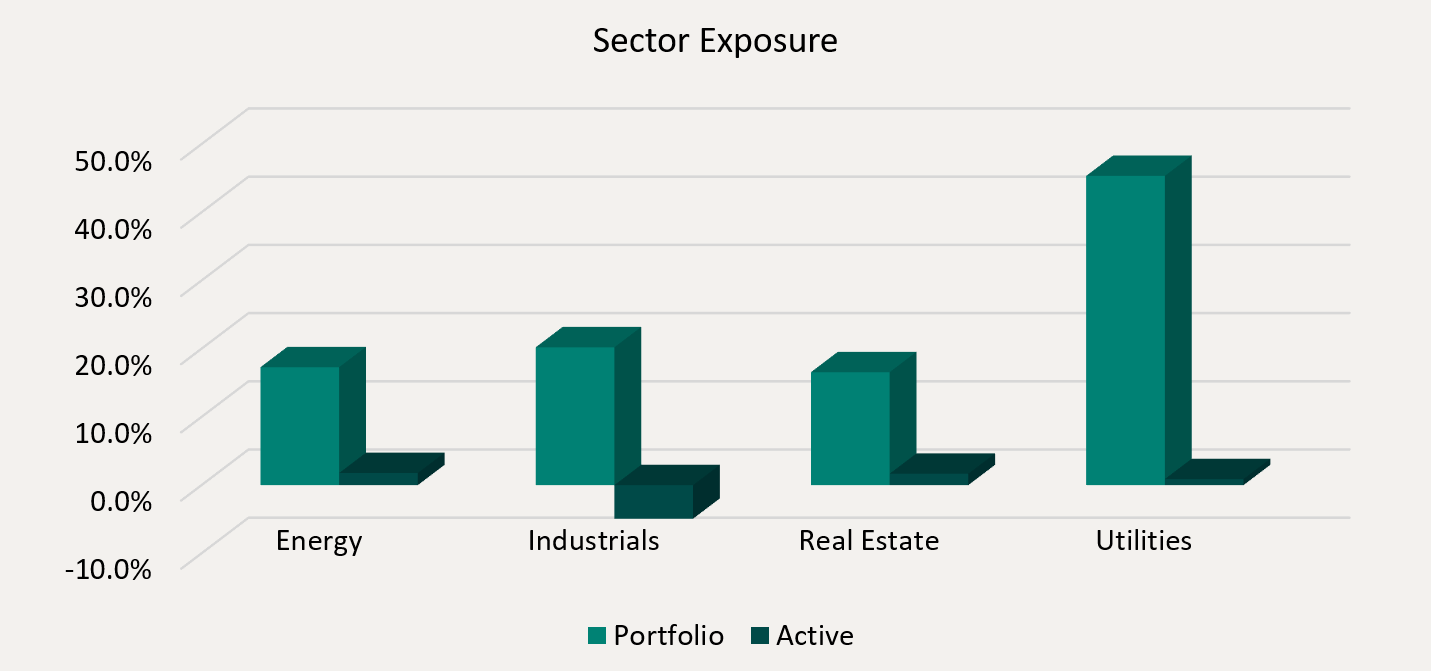

We are currently overweight the Energy and Real Estate sectors, market weight the Utilities sector and underweight the Industrials sector. Now that monetary policy easing has begun, we are carefully watching the economic data to determine if the soft-landing scenario materializes. Further, we remain wary that the US Presidential election may create some market volatility in the very near term. However, we remain focused on high quality, dividend paying infrastructure assets that have demonstrated the ability to consistently generate revenue and earnings growth through the business cycle.

We continue to believe that the clean energy transition will be one of the biggest investment themes for many years ahead. Therefore, we are comfortable having exposure to both traditional energy investments and renewable energy investments in the Ninepoint Global Infrastructure Fund given the importance of energy sustainability and security of supply around the world. Further, electricity demand is expected to accelerate dramatically, led data centers, manufacturing and transportation and we are looking to position the Fund to take advantage of this theme.

The Ninepoint Global Infrastructure Fund was concentrated in 30 positions as at September 30, 2024 with the top 10 holdings accounting for approximately 40.8% of the fund. Over the prior fiscal year, 25 out of our 30 holdings have announced a dividend increase, with an average hike of 14.1% (median hike of 6.0%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

1FactSet Earnings Insight

September 30, 2024

September 30, 2024