Effective May 3, 2024, Ninepoint FX Strategy Fund was renamed Ninepoint Global Macro Fund. There are no changes to the investment objectives or strategies of this fund.

Q3 2024 Commentary

Dear Investor,

The investment objective of Ninepoint Global Macro Fund is to generate long-term total returns by investing globally in FX futures on a long/short basis. To achieve the investment objective, the Sub-Advisor will utilize several investment trading methodologies collectively known as the “FX Strategy”, at the standard level of risk to invest in foreign currency futures utilizing a Bayesian statistical model to identify current drivers of currency returns.

The Fund is sub-advised by P/E Global LLC (“P/E” or the “Sub-Advisor”), a private asset management firm providing absolute return strategies, with special emphasis on the global currency markets. Founded in 1995, P/E serves investors worldwide with offices in Boston, MA, Jackson, WY, Singapore, Melbourne, Tokyo and London. As of October 1, 2024, P/E employed 60+ Individuals, with assets under management of approximately USD $18.9 Billion.

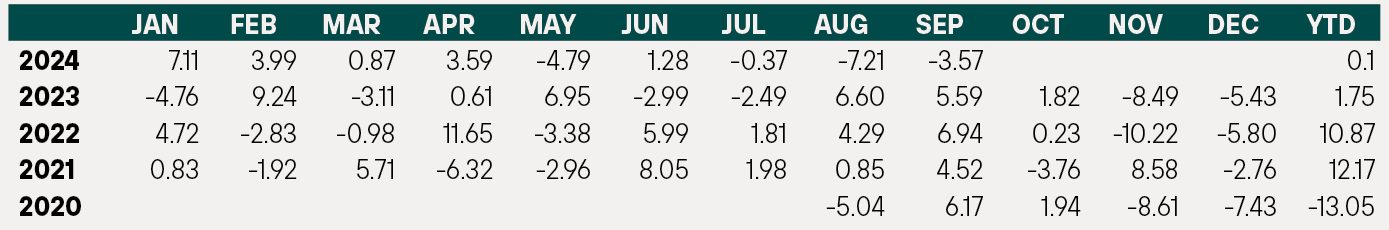

Ninepoint Global Macro Fund (formerly FX Strategy Fund) Monthly Returns (%) Performance as at September 30, 2024- Series F1 (NPP759) | Inception Date: August 6, 2020

The F1 Class units of the Fund returned net -10.85% (Class F1) for the quarter, bringing year-to-date net returns of 0.06% (Class F1).

Compounded Returns (%) as of September 30, 2024

1M |

YTD |

3M |

6M |

1YR |

3YR |

INCEPTION |

|

|---|---|---|---|---|---|---|---|

Fund |

-3.6 |

0.1 |

-10.9 |

-10.9 |

-11.8 |

4.7 |

2.3 |

During the quarter, U.S. Dollar performance was choppy. Beginning in July, the USD weakened early in the month, and then recovered versus most major currencies by month end. USD weakness resumed in August as U.S. employment showed signs of slowing growth, market participants sold dollars in anticipation of Federal Reserve interest rate cuts.

In September U.S. Dollar weakness continued as the Federal Reserve reduced the U.S. Federal Funds rate by 50 basis points, and signaled that an easing cycle had begun. As of end September, the fixed income markets projected extreme easing over the next twelve months, expectation levels not seen for twenty-five years. This amount of expected easing exceeded both the 2000-2001 period, when the technology stock bubble burst, and the 2007-2008 global financial crisis. While recession in the U.S. may loom, economic data indicates solid U.S. growth on both an absolute basis, and as compared to other global economies. In fact, global growth is slowing elsewhere, especially in Europe.

From a factor perspective, yield curve inversion and slowing global growth indicators increase the probability of risk aversion, which benefits currencies such as the U.S. Dollar, the Japanese Yen and the Swiss Franc. Inflation, while important, has moderated. Looking forward, we continue to hold bearish positions in European and Asia-Pacific currencies, versus those of North America.

Portfolio

As of end of September, the largest positions of the Fund were net negative notional exposures to the Australian Dollar, Euro and British Pound.

September 30, 2024

September 30, 2024