Introduction

In this month’s commentary, we review the US election results and implications on the regulatory changes that could have an effect on cannabis, pharma and healthcare. A key participant in the Trump victory was Robert F Kennedy Jr, an outspoken advocate for reduced vaccination, improved access to non-patented health modalities as well as proactive strategies to improve healthy lifestyles. The HHS/FDA led hearing on the Re-Scheduling of cannabis begins in early December and given the positive commentary from key representatives of the new administration, could come out with significant positive change for the cannabis sector. While there could be some slippage in timing due to personnel changes at the DEA and other agencies, the new administration has given no indications of derailing the process. The long-anticipated Florida adult use Ballot Initiative failed, unable to surpass the 60% support required despite a solid majority of Floridians backing the Amendment. We look at the implications of valuation and growth for the sector. Finally, we provide a review of Q3 financial results for top holdings in the fund and discuss the rationale for reducing our weighting in Eli Lilly & Co (LLY) a previous top ten holding.

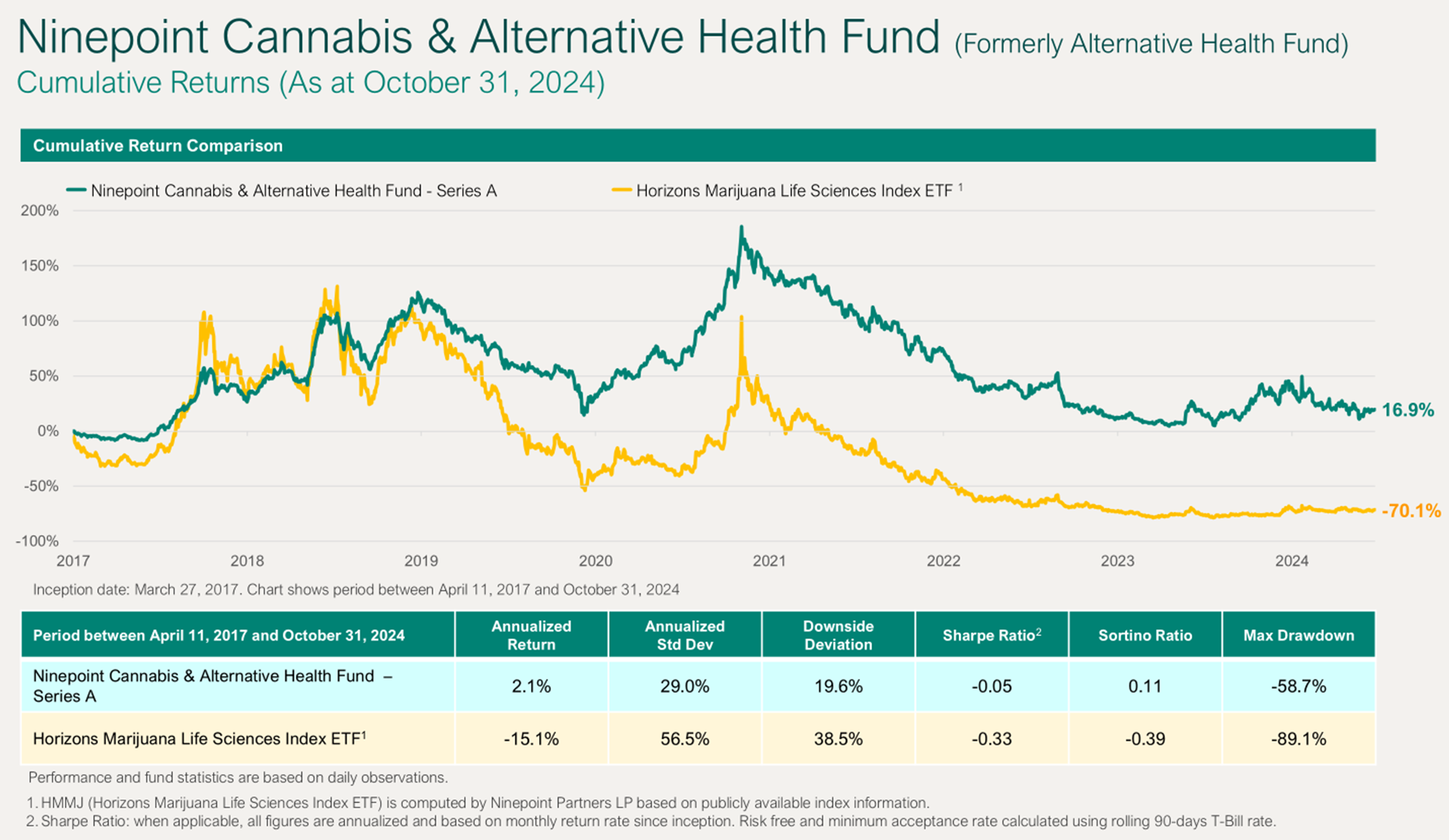

Ninepoint Cannabis & Alternative Health Fund - Compounded Returns¹ as of October 31, 2024 (Series F NPP5421) | Inception Date - August 4, 2017

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

-2.4% |

1.5% |

-5.2% |

-21.4% |

9.7% |

-14.5% |

-4.7% |

4.0% |

Presidential Election Result

On Tuesday, November 5th, Presidential elections were held with President Trump once again taking the White House. It appears that the Republican Party is poised to take control of Congress as well, already securing a majority in the Senate, and at the time of writing, on their way to holding their majority in the House of Representatives. We wanted to briefly discuss the implications of a second Trump Presidency on the portfolio. Recently, President-Elect Trump has spoken supportively about cannabis stating “I believe it is time to end needless arrests and incarcerations of adults for small amounts of marijuana for personal use". He has also been positive in his view of the current process of re-scheduling cannabis to a Schedule III drug.

"As president, we will continue to focus on research to unlock the medical uses of marijuana to a Schedule III drug, and work with Congress to pass common sense laws, including safe banking for state authorized companies, and supporting states rights to pass marijuana laws, that work so well for their citizens".

In addition, a key member of the Trump team is Robert F. Kennedy Jr who has been outspoken in his opposition to the FDA and its regulation or lack thereof over the pharmaceutical industry. Discussions on roles and responsibilities are ongoing, but we believe that RFK Jr. will be integral to setting health policy that is broader than simply targeting the pharmaceutical industry. He will seek change in many respects. We see his involvement as being positive not only for cannabis but also for other alternative health modalities. With respect to cannabis, he has stated marijuana should be decriminalized at the federal level using revenue to create “healing centers”. He has also discussed support for banking services for the cannabis industry as a way to normalize the industry.

The narrative in the market had been that the Democrats would be more supportive of cannabis legislation at the federal level. The past 4 years have proven otherwise. The Democrats were unsuccessful with internal debates on the best approaches to reform. The desire to add social justice provisions to cannabis reform made obtaining necessary Republican support challenging. In the end, the Biden White House was unable or unwilling to bring about desired change at the federal level. We now have a team that has expressed a desire for efficient government, for reduced regulation and for a healthier country. We see these factors as being favourable for US cannabis. We are optimistic given the people who surround the incoming President that supportive changes will be made.

Florida Ballot Initiative

Adult use of cannabis was on the ballot in Florida on November 5th. Smart & Safe raised a total of $150 million to fund outreach, advertising and advocacy to ensure a positive vote on election night. Gov DeSantis was not able to raise as much, with $12 million being donated by billionaire hedge fund founder Ken Griffin (Citadel LLC). In the latter part of the election schedule, it was determined that Gov. DeSantis had directed $50 million in funds from Florida’s state budget to fund an opposition campaign making the last weeks a very tight and hotly contested race. Florida’s medical-only cannabis market is generating close to $2 billion in medical revenues in 2024, according to industry research firm Brightfield Group. The opportunity for Florida focussed cannabis companies was upside of a 2X to 4X growth trajectory in cannabis sales that would significantly enhance earnings and valuation metrics.

To be successful in a ballot initiative and change the state’s constitution, Florida requires more than a simple majority, it requires a 60% positive vote to pass. We were fairly confident that the measure would pass as polls showed that a solid majority of Floridians supported the recreational cannabis initiative. If the vote passed, adult use sales would begin by May 2025. It was disappointing, considering what polling data showed heading into the vote that on election night, Ballot Initiative #3 did not pass, falling short of the 60% of the popular vote required, 55.9% in favour vs 44.1% against. We believe that weakness for the initiative came about as the Democratic National Committee abandoned the state of Florida while attempting to secure swing states such as Michigan, Pennsylvania and Georgia. As can be seen in the red wave that has captured all levels of Congress and the White House, last minute positioning from the Democrats failed to generate the necessary support at both the state and national levels.

The company’s with the largest presence in Florida that subsequent to the failed vote suffered the greatest are Trulieve Cannabis and Ayr Wellness. We provide a summary of TRUL’s Q3-24 operating and financial results below which illustrate its superior operating platform and financial stability independent of any potential adult use legislative changes. For the entire cannabis sector, Re-Scheduling of cannabis within the Controlled Substances Act is the next major catalyst to focus on to benefit the industry. The Re-Scheduling of cannabis to Schedule III would remove a significant level of taxation thereby changing the profitability of all players in the industry.

Re-Scheduling Cannabis at the Federal Level: Update

On November 1, Administrative Law Judge Mulrooney who is presiding over the US Federal Cannabis Re-Scheduling hearing, requested further details on the 25 Designated Participants that will be presenting evidence at the administrative hearing on December 2nd. As part of the information request, the Judge asked for clarification on whether each participant is “for” or “against” re-scheduling as well as providing credentials as to legal standing in front of the ALJ. In addition, information would be required as to how or why they are “sufficient” or “adversely affected or aggrieved” with the potential ruling, in addition to knowing if there are any “conflicts with either the DEA or DOJ, its leadership or personnel”. In an interesting development, DEA Administrator Anne Milgram has directed that the hearing be live-streamed along with providing a limited number of credentialed media to attend the hearings in person.

Among the list of 25 participants named for the hearing is Canadian cannabis company Village Farms International, represented by Shane Pennington, a well known cannabis advocate and partner at the US law firm of Porter Wright. We believe VFF is being included as a participant at the ALJ hearings as a group that can speak to the legal cannabis industry from many perspectives. VFF operates successfully in a Canadian legal market, distributing products across provincial borders for both medical patients and recreational customers as well as exporting across international borders. As a result of its medical business, VFF would be supportive of Re-scheduling as it would mean increased research into the medical benefits of cannabis. VFF also operates in the US with its vast Texas fruit and vegetable greenhouses and distributes produce to various state and international markets. Finally, VFF operates within the European cannabis market, so their unique perspectives will be valuable to support federal re-scheduling.

Q3-24 Financial Results

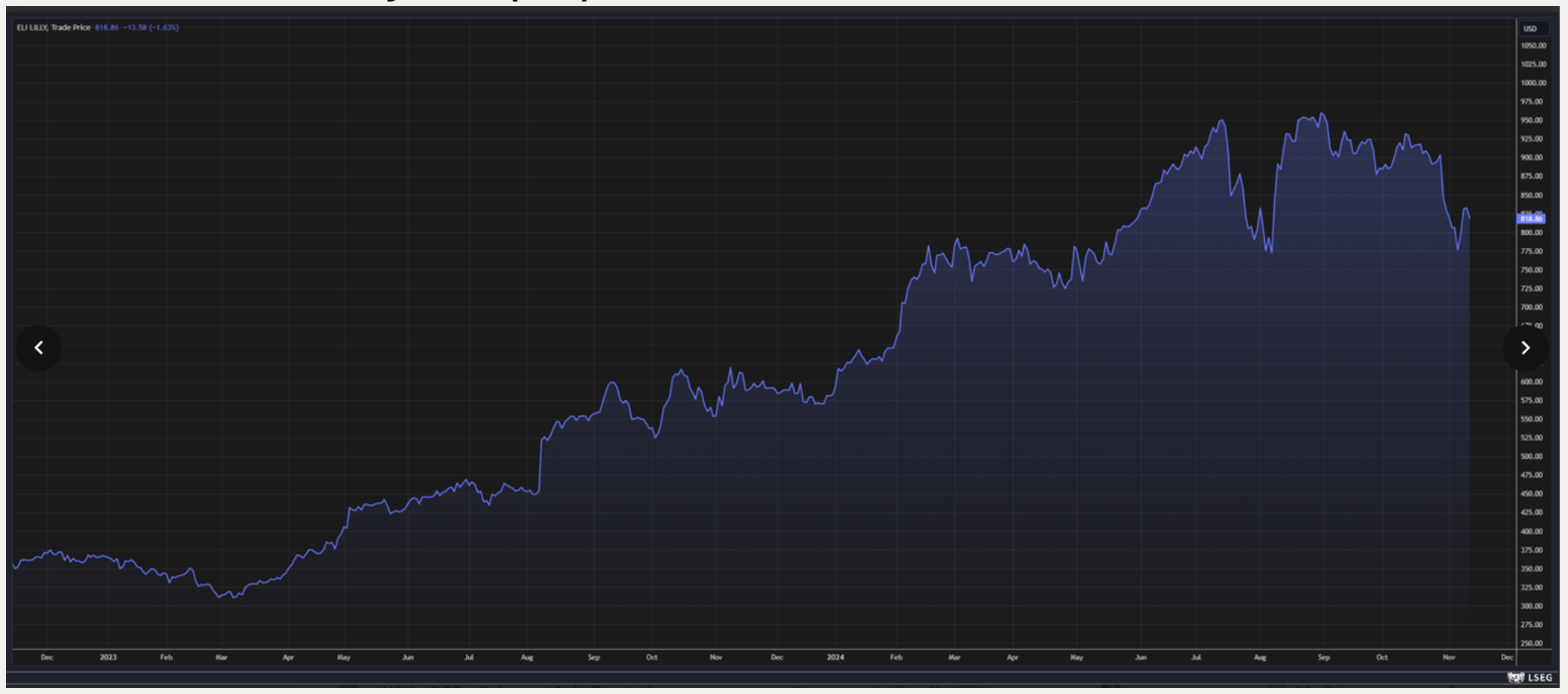

Reduced Eli Lilly & CO (LLY) to Minimum Weight

Core holding Eli Lilly & Co (LLY), which had been a top ten holding in the Fund for approx. 2 years, was first added to the portfolio nearly at $372USD/share and was reduced to a minimum weighting in the Fund prior to its Q3 earnings release. LLY recently reported weaker-than-expected Q3 results. We were proactive in our positioning, seeing increased competition in the US market, the Fund team progressively reduced our weight in the stock by 80% in the months running up to the earnings release. The time had come to take profits and recycle the capital to other opportunities given the high growth rate being priced in by the market. LLY had allocated several billion dollars to manufacturing and distribution however given the uncertainty with government approval for healthcare coverage, demand growth remains elusive given the price of treatment. After the company had previously raised forecasts Q2, they revised their Q4 and 1H25 guidance and partly blamed compounding pharmacies while also recognizing the lack of medical health coverage as a key impediment to growth. Members of Congress and select members within the health industry have stated that treating obesity like a chronic condition had good intent however came from a view that it was an important social issue rather than a pure health issue. As a result, the drugmaker slashed its full-year adjusted profit guidance.

Two Year Chart of Eli Lilly & Co (LLY)

Green Thumb Industries (GTI) the Fund’s core US cannabis position released results with 3Q revenues of $287 million, an increase of 4% YoY. GTI was able to generate top line gains after years of investment in dispensaries and wholesale distribution in limited license markets, growth in cultivation capacity and brand development. YTD the company has opened 13 dispensaries across NY, MD, OH and FL including 4 dispensaries in the quarter that helped partially offset price compression in certain markets. The addition of the 13 stores brings the number of stores for GTII to 99 retail locations across 14 different US markets. The wholesale (CPG) division stood out with 10% YoY revenue growth in Q3. Gross profit for Q3 was $147.6 million or 51.4% of revenue compared to $133.8 million or 48.6% from Q3-23. Adjusted EBITDA was $89.2 million or 31.1% of revenue as compared to $83.0 million or 30.1% of revenue in Q3-23.

Cash flow from operations remained strong with $48 million generated during the quarter after paying $35 million in taxes with Q3 net income of $9 million or $0.04 per basic and diluted share. The company stands out as a well-financed and efficient operator, GTI being the first cannabis company whose Board of Directors approved a Share Buyback in 2023, resulting in the repurchasing of 6.6 million shares for $73 million. In September, the Board once again announced another $50 million allocation to buy back shares to assist the company in maintaining a strong capital position.

Trulieve Cannabis (TRUL) announced solid gross margin results in Q3 that drove a significant beat in adjusted EBITDA. Revenues came in at $284 million in Q3, an increase of 3% YoY which was a slight miss vs consensus of $289 million and a 6% decrease QoQ. During the summer quarter, reduced store visits and general retail pressures added to top line headwinds. Traffic in TRUL dispensaries was up 10% YoY and 1% QoQ however sales volumes were impacted by inflationary pressures as basket sizes were down 3% in all state markets in which TRUL operates. However as mentioned, the company’s focus on operational efficiency led to more than offset the slight miss on top line by generating industry leading gross margins in Q3 which came in at 61% and gross profit of $173 million well above consensus. In addition, the company achieved adjusted EBITDA of $96 million, or 34% of revenue, up 24% YoY beating consensus EBITDA of $85 million. The company’s balance sheet is strong with cash and short-term investments at quarter end totaling $319 million. Despite the setback with respect to the ballot initiative TRUL has the operational scale to continue to be profitable while allocating capital to additional state markets either through licensing or via M&A. Currently, TRUL operates 30% of its dispensaries outside of Florida in state recreational markets AZ, MD and OH, and medical state markets such as WV, GA and PA. PA is a large medical state market that could transition to adult use via legislative action in the next 12 months.

Terrascend (TSND) had soft Q3 top-line results while margins improved from continued improvements in cultivation and production. The company continues to see growth on the horizon as the brand leader in NJ, a leading wholesaler in PA and has begun its entry into OH, the newest legalized state market. Revenues in Q3 were $74.2 million vs consensus $77 million, declining 4.3% q/q due to headwinds in Michigan retail and increased competition in New Jersey wholesale, partially offset by strong growth in Maryland wholesale which was up 26% q/q. Overall, strength in cultivation and production was evident in the generation of strong gross margins, expanding to 48.8% with a slight beat on consensus estimates of 48.7%. Exiting the quarter, the Company had $27.2mm of cash and a total debt of $190.3mm.

On the earnings call, TSND announced its first acquisition in Ohio, a single dispensary, Ratio Cannabis, in a location with no competitive dispensaries within 20 miles of the store. The transaction is closing over the next 8 weeks with a purchase price of $10 million, 50% cash. Similar to its foray into Maryland in 2022, management acquired individual dispensaries at lower single-digit EBITDA multiples while being able to leverage its management infrastructure in the neighbouring state of PA. In OH, TSND leadership in MI will lead the operation of the OH business. For transformational acquisitions as Chair Jason Wild describes them, they are considering acquisitions in Florida now that valuations could decline without an immediate transition to adult use. Illustrating sustained stability and growth is a strong balance sheet following the close of a $140 million senior secured term loan, which was used to refinance ~$115-120 million of debt maturities associated with PA and MI operations. Importantly, TSND has no major debt maturities until 2027.

Verano Holdings (VRNO) Q3-24 results reflected a similar pattern of sales as reported by other operators being impacted by inflationary headwinds. Revenues in Q3 were $217 million, a decrease of 2.6% versus the prior quarter. The decrease in revenue was driven primarily by declines in Florida retail due to a temporary shift in cultivation output, in addition to declines in Illinois and New Jersey retail as dispensaries continue to open across the state leading to increased retail competition and reduced vertical sales opportunities. Gross profit came in at $109 million or 50% of revenue down from $114 million or 51% QoQ. Given increases related to headcount and new dispensary openings SG&A expense rose to $92 million or 43% of revenue up from $87 million or 39% of revenue QoQ resulting in adjusted EBITDA of $64 million or 30% of revenue.

Option Strategy

Since the inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately CAD$5.14 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio. We continue to write short dated covered calls on names we feel are range bound near term and from which we could receive above average premiums including Pfizer (PFE) and Mckesson Corp. (MCK). We also continue to write short dated cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including UnitedHealth Group (UNH).

The Ninepoint Cannabis & Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

Statistical Analysis

Fund |

|

|---|---|

Cumulative Returns |

32.5% |

Standard Deviation |

27.3% |

Sharpe Ratio |

0.01 |

October 31, 2024

October 31, 2024