As we write this October commentary, it is amazing how much has happened during the month and into the first week of November. Earnings season has been in full swing, the Bank of Canada has cut interest rates by 50 basis points to 3.75%, the US Presidential Election has resulted in a Trump victory (and likely a Republican sweep) and the US FOMC has cut interest rates by 25 basis points to 4.75%. The impact of these significant catalysts has been clear, with most equity markets having one of the best weeks of the year and currently trading at all-time highs.

Since our last update, both of our insurance holdings have reported financial results, and the solid numbers were rewarded with significantly higher share prices. On November 4, Sun Life Financial reported strong insurance growth, with underlying net income of $1,016 million or earnings per share of $1.76 (up 9% and 11% respectively year-over-year with an underlying return on equity of 17.9%) and reported net income of $1,348 million or EPS of $2.33 (up 55% and 57% respectively year-over-year with a reported ROE of 23.8%). Importantly, SLF also announced a common share dividend increase, from $0.81 to $0.84 per share, an increase of 3.7%. Two days later, on November 6, Manulife Financial reported core earnings of $1,828 million or core earnings per share of $1.00 (up 4% and 7% respectively year-over-year with a core return of equity of 16.6%) and net income attributable to shareholders of $1,839 million or EPS of $1.00 (up 80% and 91% respectively year-over-year with an ROE of 16.6%)1. Impressive results and above consensus estimates, even after making various adjustments, including market-related impacts, actuarial assumption revisions and tax rate changes inherent to the insurance industry.

Overall, our portfolio of Canadian high-quality dividend payers has performed well and the net asset value of the Class A shares of the Canadian Large Cap Leaders Split Corp is comfortably above the IPO price. The outlook for the portfolio remains solid and, as interest rate cuts accelerate in Canada, our holdings look even more attractive from a yield perspective, as demonstrated by the chart below:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

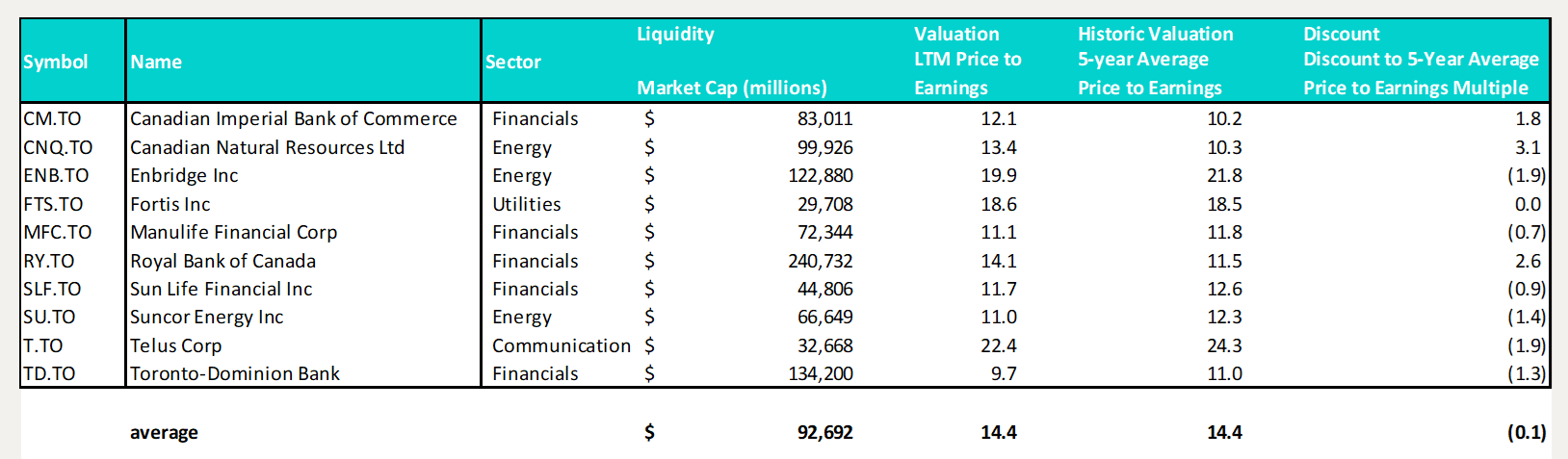

From the chart, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 14.4x, compared to the 5-year average price to earnings multiple of 14.4x, on average a slight 0.1x multiple point discount. Given our outlook for lower interest rates (and supported by a significant discount to the S&P 500, which currently trades at about 22x forward earnings, according to FactSet), multiples still have plenty of room to expand in Canada. But with the Class A Shares trading approximately 12% below the reported NAV at the close on November 1, 2024, we can adjust this table to visualize the implied valuation today:

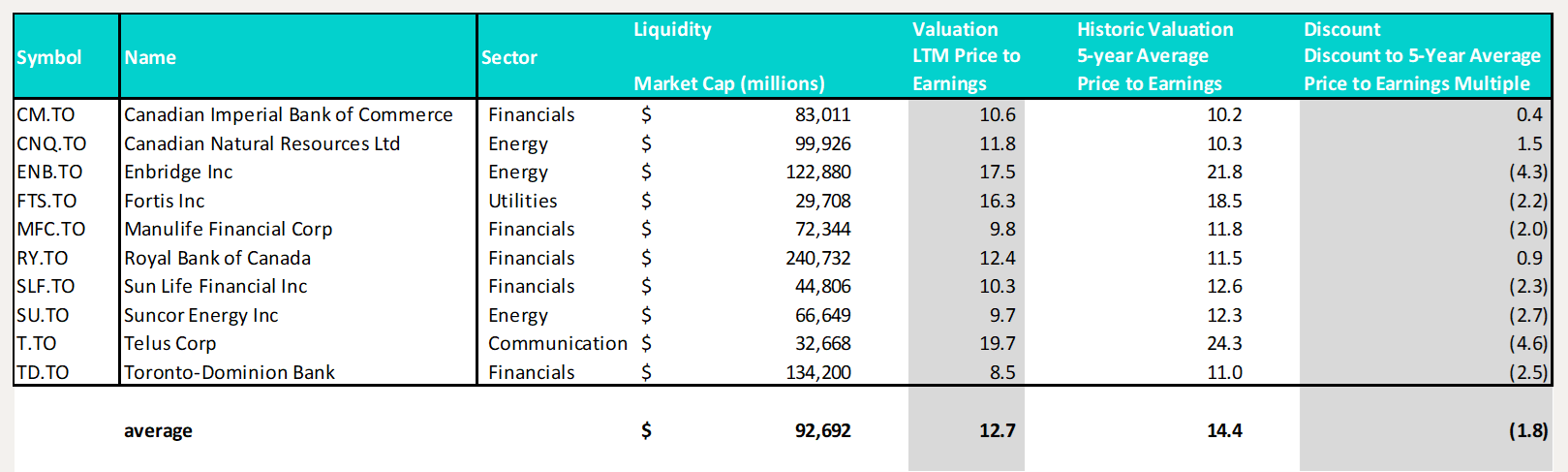

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 1.8x worth of multiple points at the close on November 1, 2024, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuations through the purchase of shares of NPS on the open market. Given the discount, we continue to believe that buying stock today represents an attractive long-term investment opportunity for both new and existing shareholders and our Normal Course Issuer Bid remains in effect.

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distribution, payable on November 14, 2024, to Class A Shareholders of record at the close of business on October 31, 2024. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend.

As always, we appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

1Company financial reports.

October 31, 2024

October 31, 2024