The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

A lot has happened since our last commentary. Global growth (excluding the U.S.) continues to slow, prompting central banks around the world to loosen monetary policy (China, UK, Sweden, ECB, Canada and the Fed all cut rates this past month). Most notable has been China, where they announced several rounds of both fiscal and monetary easing. The housing slump there continues to weigh on consumer confidence, and growth has disappointed. Additionally, China is probably bracing for another trade war when Mr. Trump takes office in January 2025.

The landslide victory of Trump and the Republicans in the U.S. election marks an important inflection point. Their two most important policy proposals are well known: tariffs and tax cuts. During the campaign, the President-Elect made several promises with regard to both of these. Tariffs are generally fully passed on to consumers, resulting in an increase in prices (i.e. inflation). With Robert Lighthizer widely expected to return to the U.S. Trade Representative office, we take the threat of widespread tariffs seriously. Analysis by Goldman Sachs Investment Research points to an increase in U.S. core inflation of about 1%, should most of the tariffs promised by Trump be enacted.

Trade uncertainty or trade wars more generally, increase uncertainty and therefore have an impact on growth. Using the experience from the 2016-2018 trade wars, Goldman Sachs estimates a hit to U.S. growth of 0.3%, and as much as 0.9% for Europe and 0.7% for China. With the USMCA (or NAFTA) open to renegotiations in 2026, we should also expect trade uncertainty to negatively impact investment in Canada. Overall, tariffs and trade wars should negatively impact global economic growth, disproportionally affecting America’s trading partners, with a minimal impact on U.S. growth.

On tax cuts, there is in theory very little fiscal room with deficits already at >6% of GDP. But Trump and Republicans in general seem to pay very little attention to deficits while in control of government, and we know that this is a priority for the incoming administration. With a Republican sweep, we expect additional fiscal easing in the form of tax cuts for households and perhaps companies as well, resulting in an even more unsustainable fiscal path for the U.S. As we had seen in the U.K. with the Liz Truss Budget debacle, bond vigilantes are on high alert, and the risks are non-trivial that the U.S. might face a similar situation if they compound their fiscal woes with even more reckless spending.

The net effect of all these policies is weaker global (ex. U.S.) growth and higher inflation for the U.S. In this context, we would expect monetary policy to diverge, with the Fed forced to keep rates higher for longer due to the inflation shock brought on by tariffs and the growth impulse from fiscal easing, while the rest of the world continues to ease monetary policy to offset the negative growth shock brought on by the trade wars. As the fiscal deficit widens in the U.S., we would expect long-term interest rates to remain elevated or even to grind higher, resulting in steeper yield curves there and abroad (long-term rates are often correlated across countries). The net result should be a stronger U.S. dollar, which historically is also associated with slowing growth in emerging markets (whose debt is often denominated in USD).

Canada

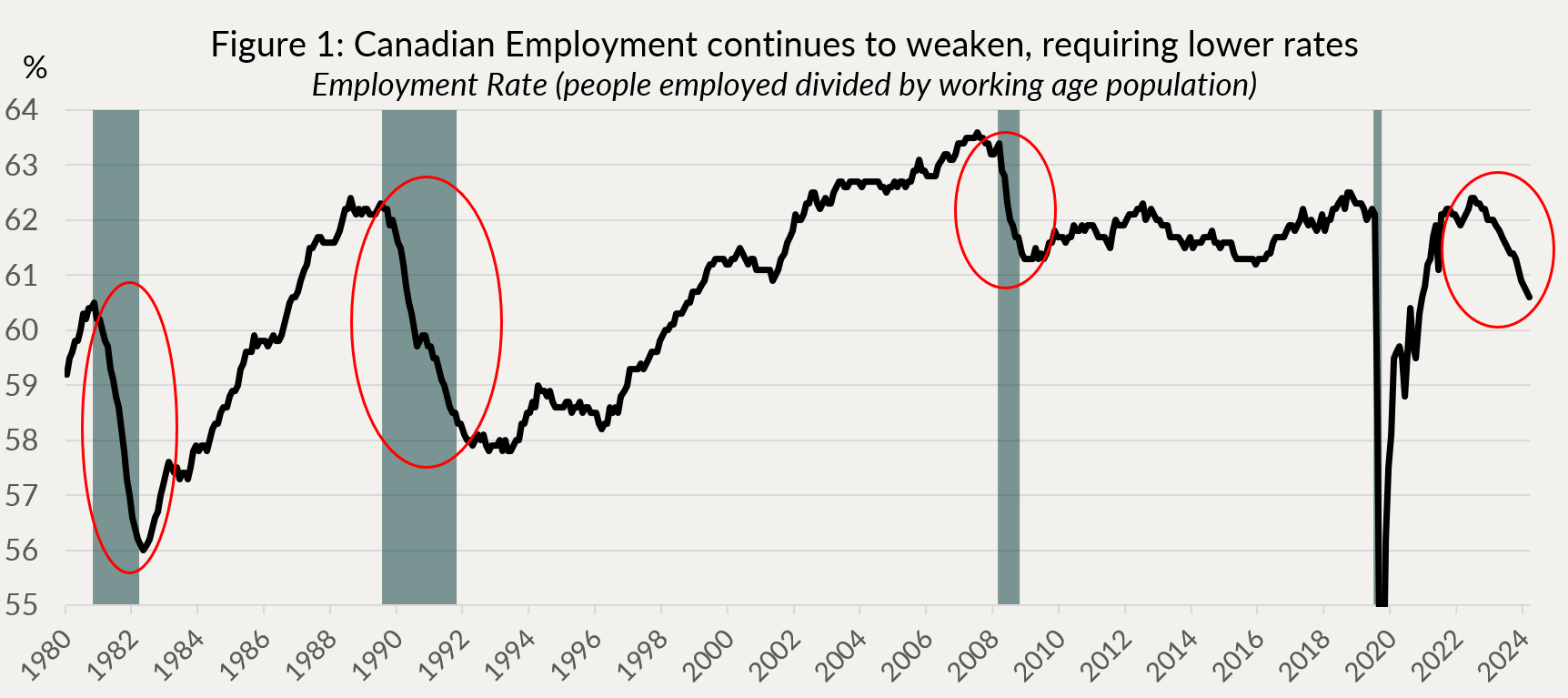

Closer to home, the Canadian economy remains weak, and with a trade war brewing on the horizon, it could weaken further. Figure 1 below shows the employment rate, the proportion of employed workers in the overall working-age population (aged 15 to 64). This ratio has now declined by a magnitude that is usually associated with recessions.

The BoC cut rates by 50 basis points in October, taking the overnight rate to 3.75%, still above their estimate of the neutral rate (2.25-3.25%). With the economy as weak as it currently is, restrictive monetary policy is no longer appropriate, and we need rates in a mildly stimulative stance (i.e. less than 2.25%). We therefore expect the BoC to keep cutting at a brisk pace, further widening the gap between Canadian and U.S. rates and putting downward pressure on the Loonie.

Credit

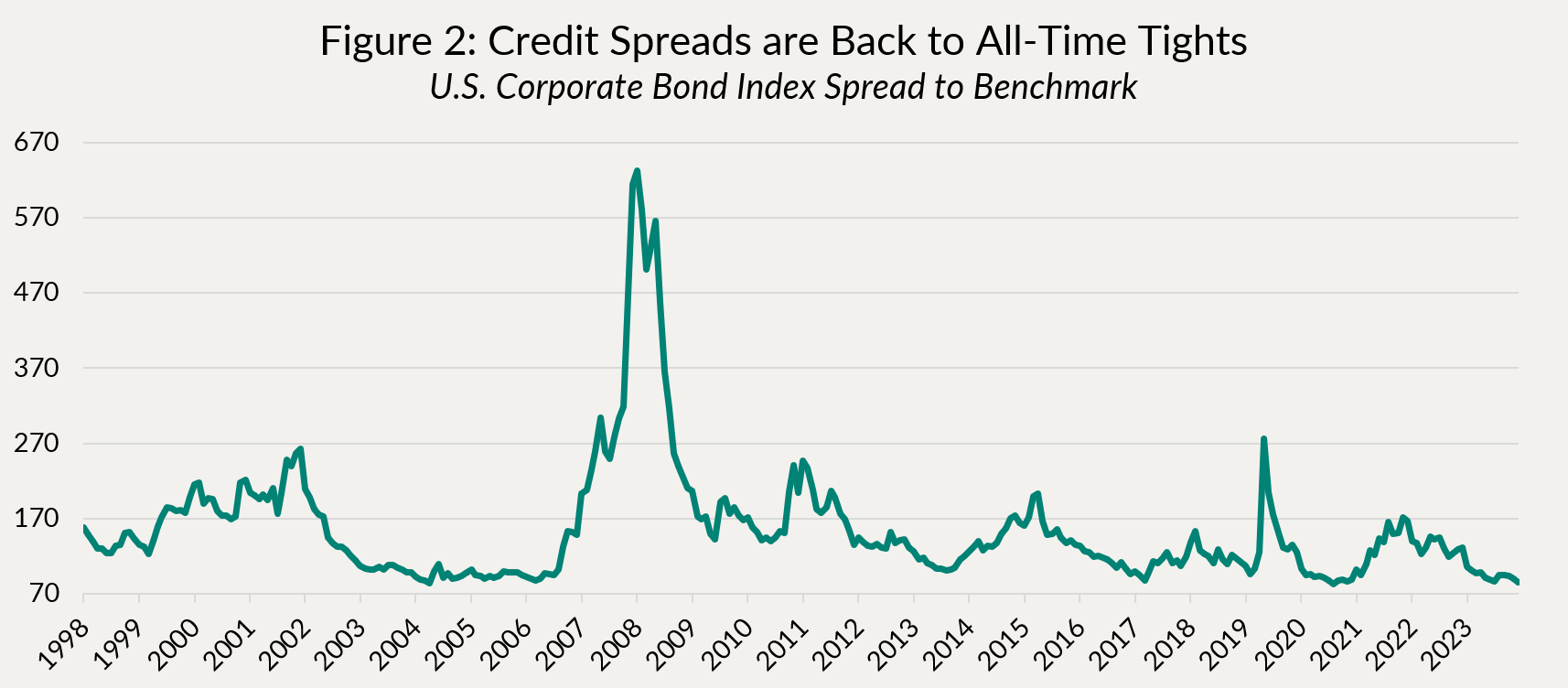

Credit performed well in October, tightening 6 basis points both in Canada and the US. Furthermore, the first week of November saw an additional gap tighter of ~7 basis points following confirmation of the US election outcome. US investment grade credit spreads are now at multi-decade tights (Figure 2) on the benchmark level and Canada isn’t too far off historic lows.

While all-in yields still make for a compelling case to own investment-grade credit, it is tough to imagine material spread tightening from here given the historical context and the numerous headwinds facing the global economy. We continue to find pockets of value in both primary and secondary markets. On the primary side, we participated in the Chartwell Retirement REIT 5-year new issue that came at a compelling spread versus other credits with similar tenors. We also participated in the Coast Capital Credit Union 3-year new issue given the scarcity of this name in secondary markets, attractive spread and short tenor. In secondary markets, we executed numerous switch trades across the funds. We trimmed numerous bank LRCN lines which have rallied ~100 basis points in two months to rotate into Enbridge hybrids which have lagged the rally. In the first week of November, following the U.S. election and the high risks of a trade war, we took profits in many non-U.S. autos to rotate into credits which will fare better under the new U.S. administration (i.e. less trade war exposed). The funds remain defensively positioned in credit given the rich valuations but still offer very attractive yields as outlined below.

Individual Fund Discussion

Ninepoint Diversified Bond Fund

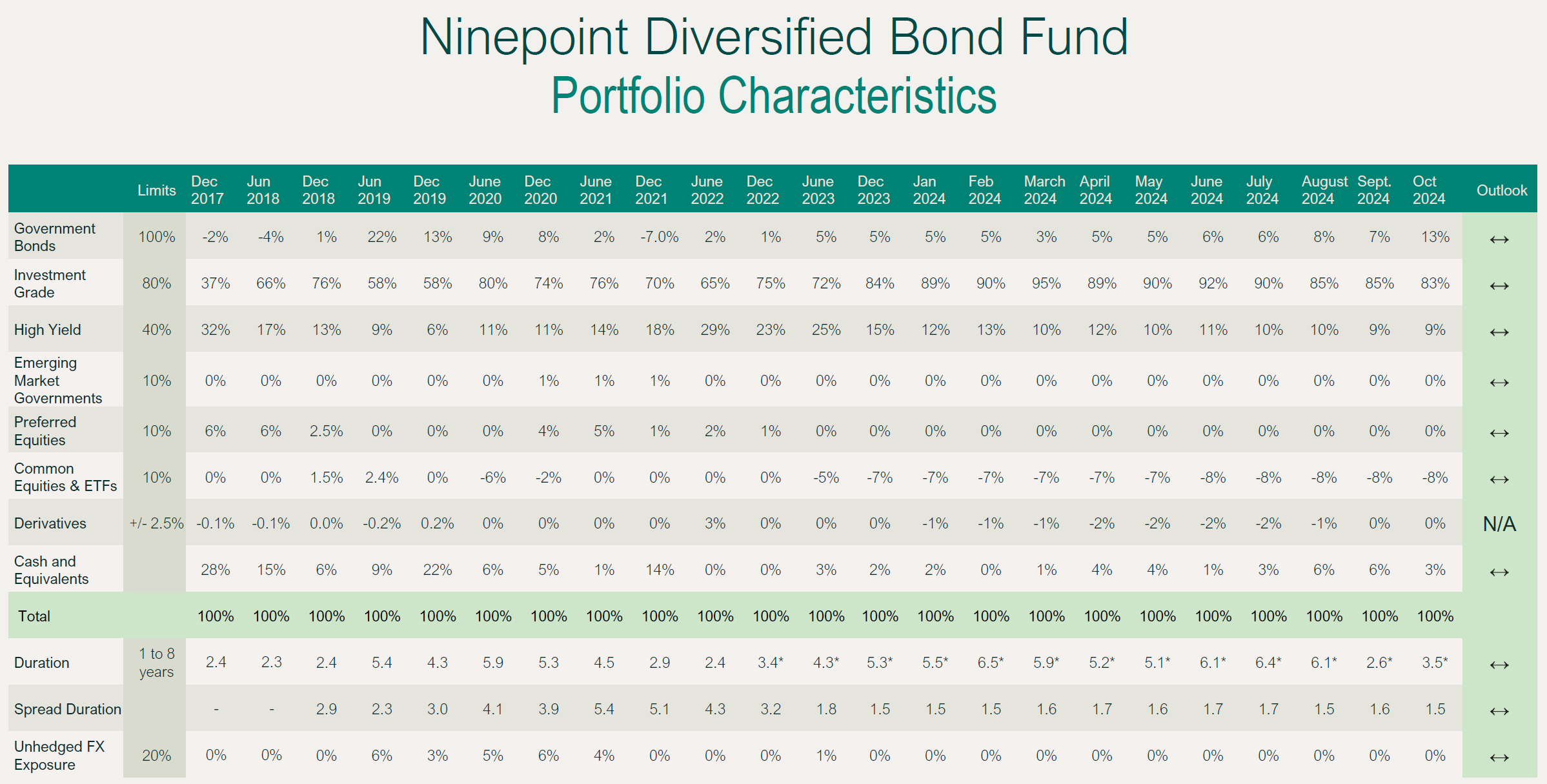

October was a good month for the fund, all things considered, returning 17 basis points (benchmark down 103 basis points) bringing year-to-date performance to 6.69%. During the month, we traded back into 10-year government bonds as rates sold off materially, bringing duration up to 3.5 years (vs 2.6 years at September month-end and 6.1 years at August month-end). Given the risks mentioned earlier, we do not expect to add much more to duration. The fund’s yield-to-maturity was 5.3% at the end of the month, virtually flat to September month-end.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF OCTOBER 31, 2024 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

0.2% |

6.7% |

2.7% |

7.2% |

13.6% |

0.9% |

1.6% |

2.8% |

3.5% |

Ninepoint Alternative Credit Opportunities Fund

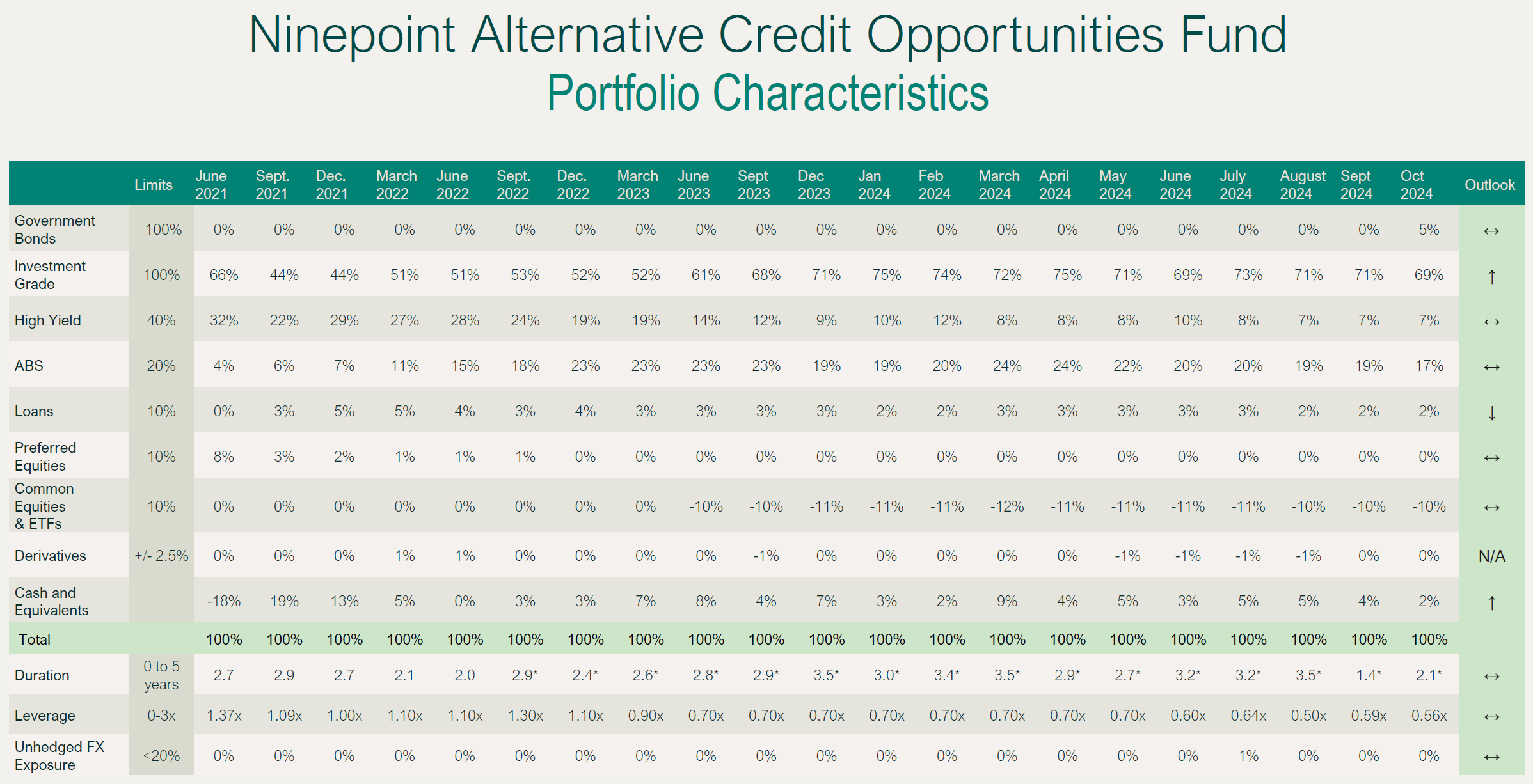

Given the solid spread compression in October, the fund returned 40 basis points on the month, bringing year-to-date performance up to 8.67%. The fund’s duration moved up slightly as we took advantage of the sell-off in government bonds. Duration now sits at 2.1 years vs 1.4 years the month prior. Leverage remained the same at 0.6x, which reflects our defensive posture in credit. The yield-to-maturity moved slightly down and now sits at 6.2%.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF OCTOBER 31, 2024 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.4% |

8.7% |

2.3% |

6.3% |

14.1% |

2.0% |

2.2% |

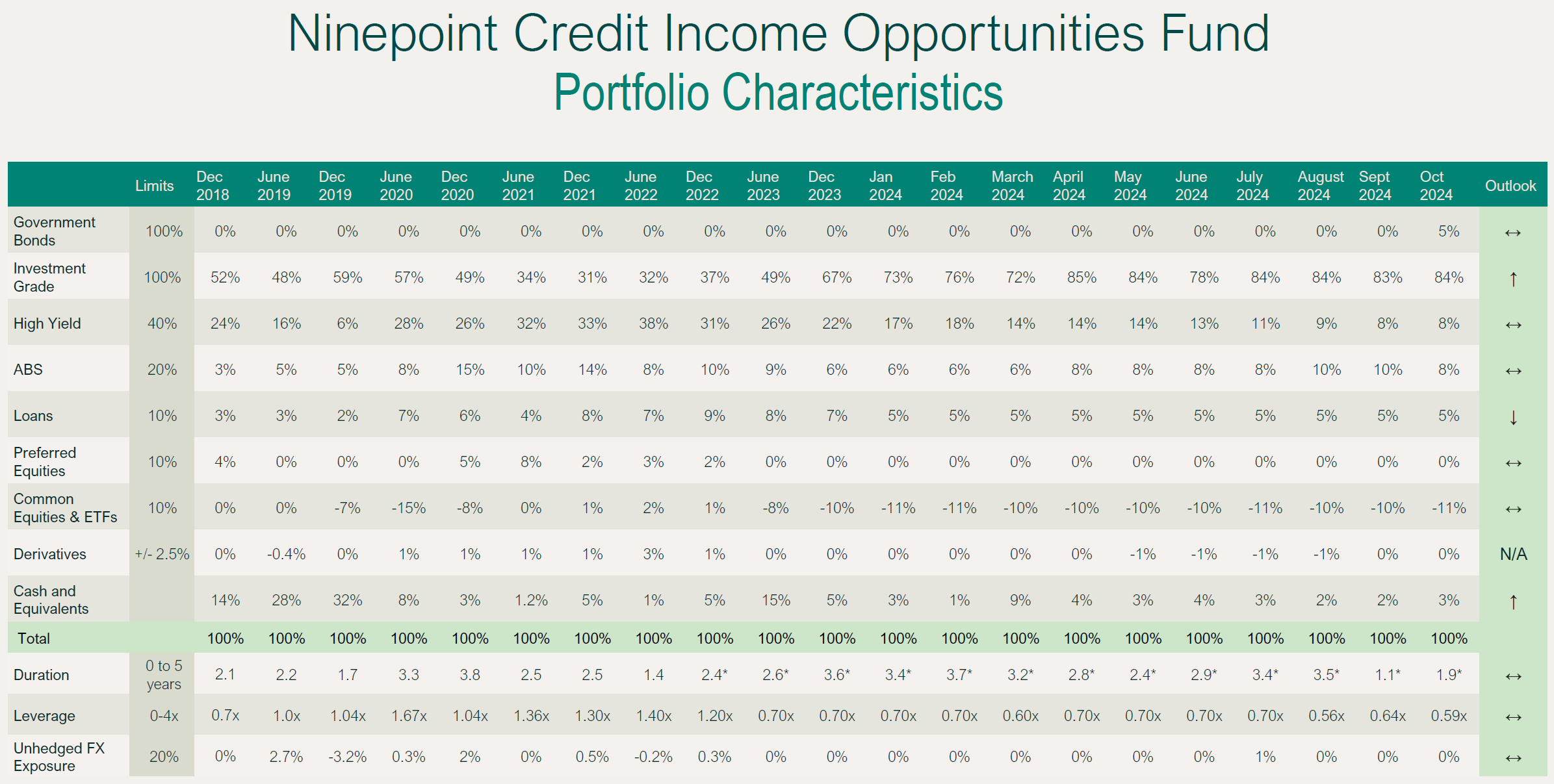

Ninepoint Credit Income Opportunities Fund

The fund returned 50 basis points on the month bringing year-to-date performance up to 8.71%. Leverage remained the same at 0.6x which reflects our defensive posture towards credit given the full valuations. The fund’s duration moved up slightly as we took advantage of the sell-off in government bonds to add exposure. Duration now sits at 1.9 years vs 1.1 years the month prior. The fund’s yield-to-maturity moved down slightly and is now 6.6%.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF OCTOBER 31, 2024 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

0.5% |

8.7% |

2.4% |

5.9% |

13.6% |

2.9% |

5.8% |

5.0% |

Conclusion

The world just got a whole lot more complicated. The sugar high in risk assets from the U.S. election might last for a little while longer, but eventually, the reality of the slowing global economy, trade wars and higher U.S. interest rates will be difficult to offset with expansionary fiscal policy. We see the medium-term risks to the U.S. economy as tilted to the downside once the trade wars are back in full swing. With that, the economic environment in Canada will become more challenging.

Until next month,

Mark, Etienne & Nick

October 31, 2024

October 31, 2024