Monthly Update

Year-to-date to October 31, the Ninepoint Global Infrastructure Fund generated a total return of 24.00% compared to the MSCI World Core Infrastructure Index, which generated a total return of 15.84%. For the month, the Fund generated a total return of 2.02% while the Index generated a total return of 0.21%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of October 31, 2024 (Series F NPP356) | Inception Date: September 1, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

2.0% |

24.0% |

8.9% |

18.3% |

31.0% |

9.8% |

9.5% |

7.3% |

8.4% |

MSCI World Core Infrastructure NR (CAD) |

0.2% |

15.8% |

4.8% |

15.7% |

25.2% |

6.8% |

5.9% |

8.2% |

10.9% |

As we write this October commentary, it is amazing how much has happened over the final week of the month and into November. Over a three-day span to end the month, Alphabet, Meta, Microsoft, Amazon and Apple all reported operating and financial results. Then the month of November kicked off with the US Presidential Election followed by the second-to-last FOMC meeting of the year, which was pushed back a day to avoid conflicting with the vote. The impact of these significant catalysts has been clear, with US markets having one of the best weeks of the year and currently trading at all-time highs.

In terms of mega cap tech, Alphabet began the parade with a big earnings beat and, perhaps more importantly, posted 12% revenue growth at its Google Search division (and 35% revenue growth at Google Cloud), which tempered some of the bearish views on the stock. The following day, both Meta and Microsoft reported earnings that beat expectations, but negative stock reactions were driven by softer than expected forward guidance and concerns regarding accelerating capex and slightly slowing revenue growth respectively. We believe that the negative stock reactions could be more attributable to investor positioning rather than weakening fundamentals at these tech behemoths. Next, Amazon reported impressive financial results, with 19% revenue growth at AWS and $17.4 billion of operating income, up 55% year-over-year and ahead of consensus expectations by approximately $3 billion. Finally, Apple reported inline results with revenue growth of 6% and adjusted EPS growth of 12% but because the rollout of Apple Intelligence, the Company’s AI enabled iOS, has yet to fuel accelerating iPhone sales, the stock reaction was muted. Overall, the generally solid, steady results demonstrate why the Information Technology sector remains a market leader and a top holding for many investors.

The main event during first full week of November was obviously the US Presidential Election and the Trump victory coupled with a strong showing across the board from the Republicans was extremely well received by the equity markets. In fact, it was the best one-day gain for the US markets in over two years, with the Dow Jones Industrial Average up 3.6%, the S&P 500 up 2.5% and the Nasdaq up almost 3.0%. With the uncertainty heading into the election removed, the investment themes that worked were the same as the ones that had worked after the 2016 election and were tied to deregulation, lower taxes and industrial onshoring. Conversely, stocks exposed to the threat of tariffs on foreign-produced goods and almost every stock related to renewable energy production dramatically underperformed. The US Dollar was strong, mostly due to the prospect of America-first policies, but bond yields spiked, mostly on fears related to unconstrained fiscal spending and rising deficits (a stronger growth outlook also partially helped both moves). We think that it is quite possible that the trends observed in the equity markets will persist through the balance of the year, as investors chase performance while feeling reluctant to sell winners to avoid realizing taxable capital gains.

Amazingly, the US FOMC meeting for November was almost an afterthought, but the Committee did announce its second rate cut of the cycle, lowering the overnight rate by 25 basis points to 4.75%. The odds of another 25-bps cut in December are currently priced at an 85% chance, but the number of interest rate cuts in 2025 have declined to roughly two from four since the election. The rationale suggests that President Trump’s policies (primarily aggressive fiscal spending and tariffs on foreign-produced goods) are considered broadly inflationary, but we would like to take a wait-and-see approach before making judgements as other policies may prove deflationary (further it remains to be seen what will ultimately be enacted). In the meantime, the prospect of lower interest rates remains supportive for the equity markets through the easing cycle as long as the economic data does not deteriorate.

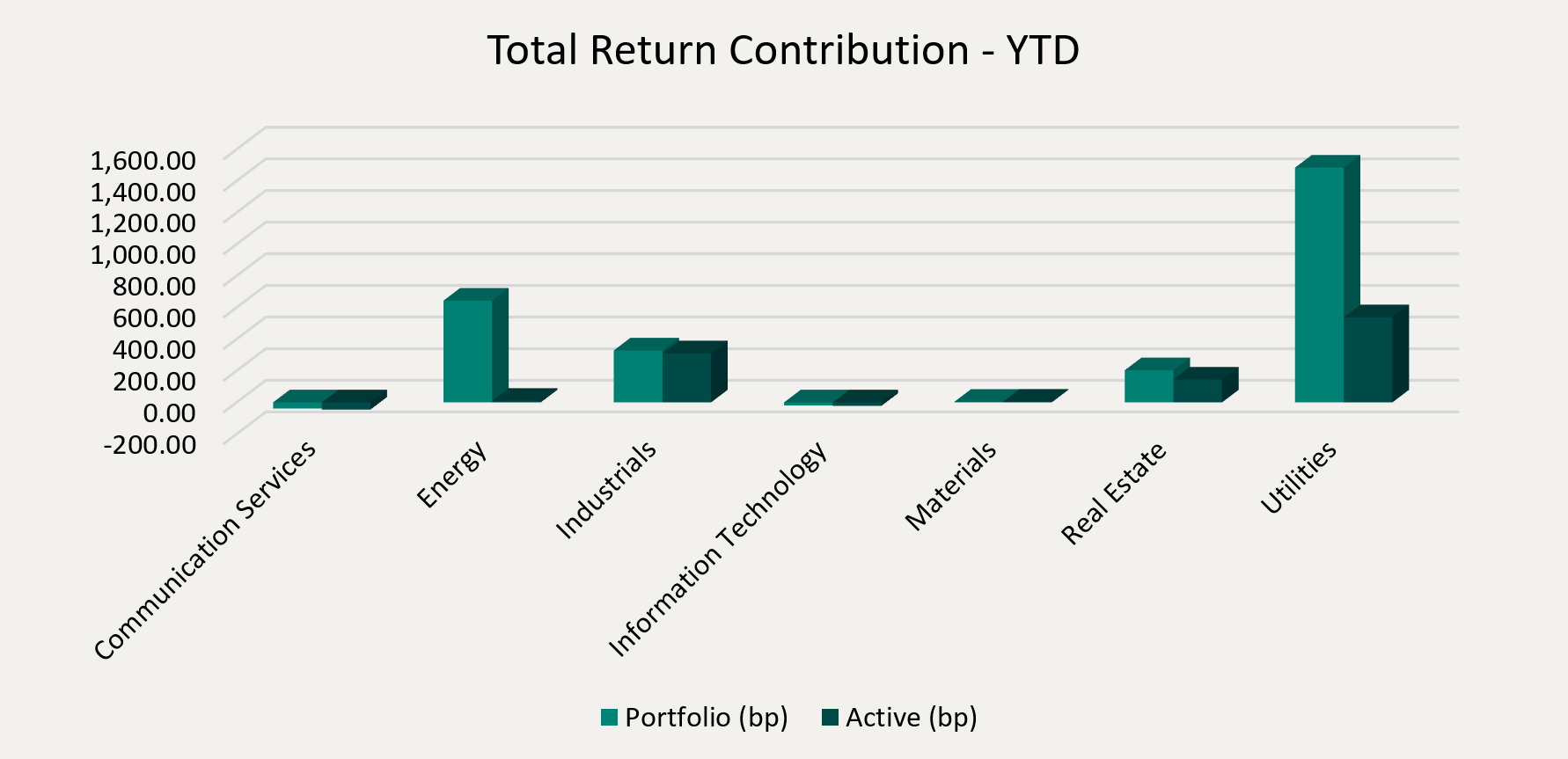

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Utilities (+1,484bps), Energy (+643 bps) and Industrials (+328 bps), while top detractors by sector included Communication Services (-39 bps) and Information Technology (-19 bps) on an absolute basis.

On a relative basis, positive return contributions from the Utilities (+538 bps), Industrials (+310 bps) and Real Estate (+144 bps) sectors were offset by negative contributions from the Communication Services (-46 bps) and Information Technology (-22 bps) sectors.

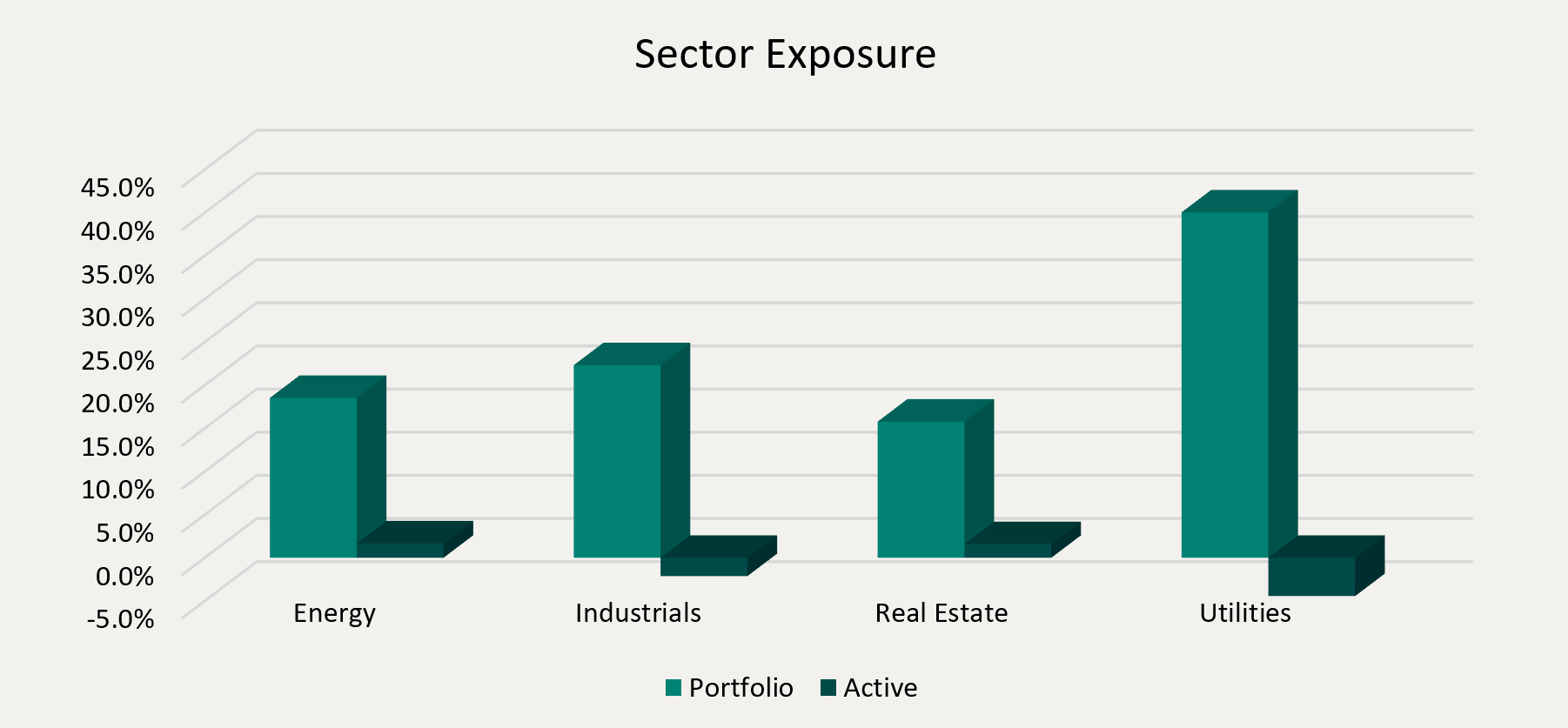

We are currently overweight the Energy and Real Estate sectors and underweight the Utilities and Industrials sectors. With uncertainty related to the US Presidential Election behind us and monetary policy easing underway, we are optimistic over the balance of the year. However, we will be carefully watching for policy announcements from the incoming President’s administration and the ensuing impact on growth and inflation. As always, we remain focused on high quality, dividend paying infrastructure assets that have demonstrated the ability to consistently generate revenue and earnings growth through the business cycle.

Despite the new administration in Washington, we continue to believe that the electrification of the US economy and the energy transition will be some of the biggest investment themes for many years ahead. Importantly, electricity demand is expected to accelerate dramatically, led data centers, manufacturing and transportation, industries that are largely supported by President Trump’s stated policies. Therefore, we are comfortable having exposure to both traditional energy investments, clean energy investments and electrical, natural gas, nuclear or multi-utilities in the Ninepoint Global Infrastructure Fund to take advantage of related investment opportunities.

The Ninepoint Global Infrastructure Fund was concentrated in 30 positions as at October 31, 2024 with the top 10 holdings accounting for approximately 37.1% of the fund. Over the prior fiscal year, 23 out of our 30 holdings have announced a dividend increase, with an average hike of 13.2% (median hike of 4.7%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

All financial figures are sourced from the respective Company's financial reports and LSEG Eikon.

October 31, 2024

October 31, 2024