Summary

In this month’s commentary, we review the regulatory landscape in the US as President elect Trump has announced the nominations for his Cabinet posts. With major health related positions such as HHS, FDA and NIH in addition to the nomination of a new Attorney General, we review the impacts that these individuals will have on the pharmaceuticals, healthcare and cannabis industries. There are ongoing regulatory reviews taking place such as cannabis re-scheduling that in our opinion have renewed support from incoming nominees. We will discuss the various nominees for NIH, HHS and FDA and the implications on regulation given the background of each nominee. In addition to the regulatory review below, we also discuss elements of the legal hemp derived product market in the US, the Farm Bill extension in addition to the recent acquisition that multi-state operator Green Thumb Industries (GTI) announced with NASDAQ listed Agrify (AGFY) this month.

Ninepoint Cannabis & Alternative Health Fund - Compounded Returns¹ as of November 30, 2024 (Series F NPP5421) | Inception Date - August 4, 2017

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

-12.3% |

-11.0% |

-8.9% |

-17.6% |

-10.5% |

-18.9% |

-7.4% |

2.1% |

Performance Chart

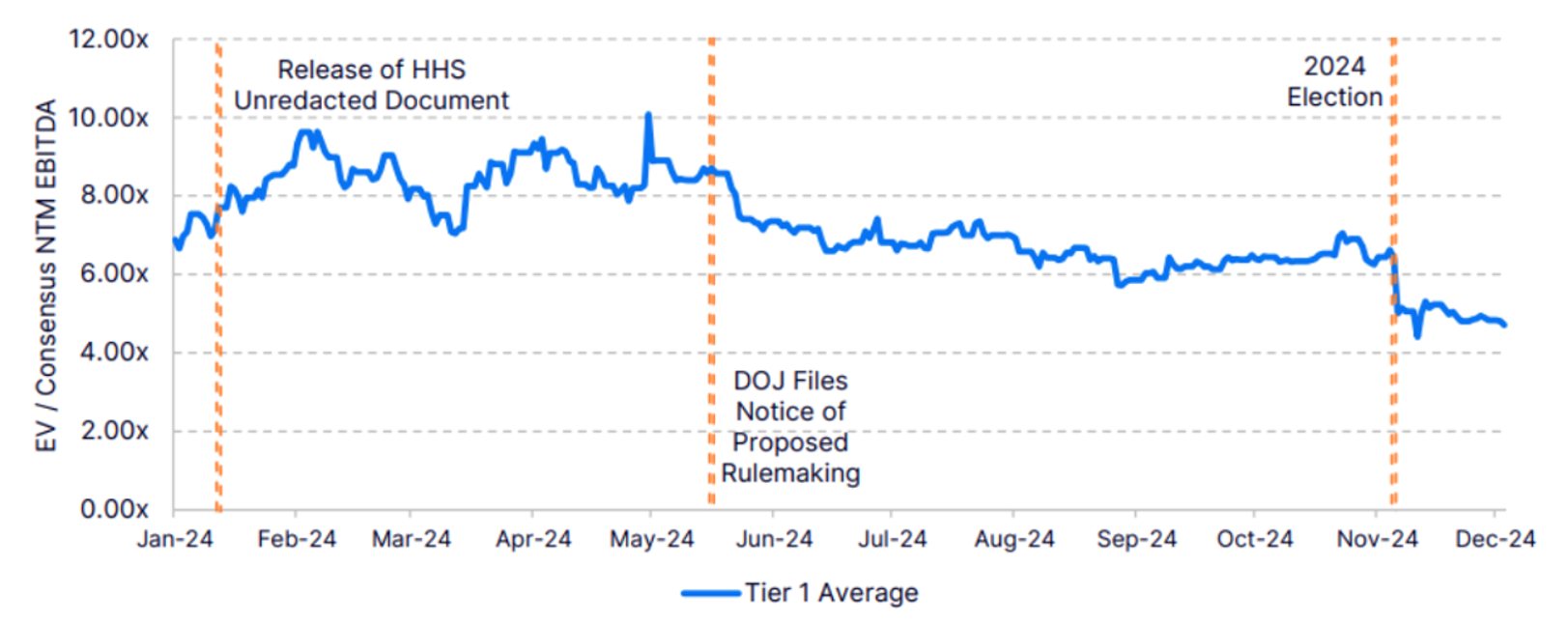

Rescheduling delays and negative results from the Florida Ballot have been the primary factors that have dragged down equity prices during the month of November. Many multi state operators (MSO’s) are trading at all-time valuation lows, close to 5x EBITDA. However, most companies are experiencing higher margins and have already gone through significant capital expenditure phases resulting in stronger cash flow generation going forward. As the chart below illustrates, we believe that the market isn’t appreciating the cash flow strength of these companies while also drastically underestimating the near term catalyst of the potential impact of regulatory change over the next 3 to 6 months. From a cash flow perspective, leading all MSO’s with cash flow from operations are companies such as Green Thumb Industries (GTI) with $283 million in adjusted cash flow from operations; Verano Holdings (VRNO) with $93 million; Cresco Labs (CL) with $98 million and, Trulieve Cannabis (TRUL) with $75 million. (source: LSEG) That strength is not reflected in the multiples below.

EV Multiples based on Consensus Next 12 Month EBITDA

Trump Nominees Suggests Changes in Federal Regulation:

Healthcare Pharma & Cannabis

Several senior health related appointments to the cabinet of President elect Trump have caused considerable consternation. We see the potential for change in the upcoming administration and have already adjusted the portfolio with respect to weightings for healthcare and pharmaceuticals. At month end November 30th, our weighting in pharma stocks is down to 12%. The most high-profile nomination is Robert. F Kennedy Jr., however additional names add support to our view of disrupting the healthcare complex in Washington. Trump has picked Jay Bhattacharya, M.D., Ph.D., to be the Director of the National Institutes of Health (NIH). Bhattacharya is a health economist and professor of medicine at Stanford University who rose to prominence as one of the three authors of the 2020 health strategy paper; The Great Barrington Declaration. The document supported using a herd immunity strategy for coping with COVID-19 rather than social distancing and mandated closures. He is known as an outsider to Washington circles and will, like RFK Jr. question the priorities of NIH which could result in clashes with longstanding industry practices.

For the Food & Drug Administration (FDA), Trump has nominated Johns Hopkins surgeon and author Martin Makary, M.D. He has stated views about the lack of transparency in medicine, and the rise in medical health errors in various treatments. In September, he joined Robert F. Kennedy Jr. at a round table in Congress on health and nutrition, where he criticized how food in the U.S. is grown and processed. He has also been outspoken in his criticism of the Orphan Drug Act pathway. Makary has stated “The industry has been gaming the system by slicing and dicing indications so that drugs qualify for lucrative orphan status benefits” with his view that pharma companies are exploiting the law by claiming orphan status for drugs that end up being marketed for more common conditions, generating millions while bypassing the formal multi-year drug approval process.

He was also a critic of the U.S. vaccine mandates during the COVID-19 pandemic, the most significant opposition being his views that children shouldn’t have to wear masks to reduce the spread of COVID-19 in playgrounds and schools.

Trump said Makary will "work under the leadership of Robert F. Kennedy Jr. to, among other things, properly evaluate harmful chemicals poisoning our nation's food supply and drugs and biologics being given to our nation's youth, so that we can finally address the childhood chronic disease epidemic."

BMO Capital Markets analyst Evan David Seigerman who covers Biotech and pharma wrote in a note to clients that he is positive on Makary for FDA Commissioner. "All in, we think the FDA pick should allow BioPharma investors a reprieve," Seigerman wrote, noting that Trump's choice "may reverse significant draw downs the week RFK Jr. was nominated head of HHS."

The most high profile nomination is RFK Jr. to lead Health and Human Services (HHS). This agency oversees 11 agencies including the FDA, the Centers or Disease Control (CDC), The National Institutes of Health (NIH), Administration for Children and Families (ACF) , and Centers for Medicare & Medicaid Services (CMS). The position has great importance in Cabinet for overseeing much of the US healthcare system. Most HHS Secretaries have been Governors or lawyers or members of Congress prior to taking over HHS while only few on the list since 2000 having been physicians. RFK Jr. has been involved as an outspoken advocate for what many call “alternative health strategies” being more proactive in approach with natural rather than medicinal approaches.

RFK Jr. was outspoken during the early days of the 2024 Presidential Primaries advocating for the legalization of cannabis, allowing cannabis retailers to be able to bank their profits while creating excise taxes at the federal level as a way to pay for healing centres that help treat addiction. He has also been outspoken about how the FDA has quashed psychedelics with his view being that there may be opportunities for treatment of PTSD. He has spoken out for close to 20 years about prescription drugs, children’s vaccines and the rate of illness of American children relative to other G-20 countries. Aside from the pharmaceutical industry, RFK Jr. has been highly critical of the processed food industry, questioning the preservatives and additives that are approved in the US relative to other countries. He has called for restrictions on ultra-processed foods as part of an initiative to address the high rates of chronic disease in the United States. "RFK Jr. has championed issues like healthy foods and the need for greater transparency in our public health infrastructure”, stated Bill Cassidy Republican Senator from Louisiana. It will be an interesting time as he takes over HHS, given the implications for new drug approvals, national health policy as well as changes to national standards for diet and the overall food industry.

A final Cabinet level position that should be addressed is President Trump’s nominee for Attorney General, former Florida Attorney General Pam Bondi. She was Florida AG from 2011 to 2019 under former Gov. Rick Scott. The former Florida AG was the second choice for Trump with Rep. Matt Gaetz withdrawing his nomination due to legal issues and an ongoing House of Representatives investigation. Gaetz received a strong endorsement from many in the cannabis industry as he has been supportive of federal legalization. Pam Bondi has a more challenging past with respect to cannabis. During Bondi’s term as Florida’s attorney general, state lawmakers approved a high-CBD, low-THC medical cannabis law in 2014 however also opposed a ballot amendment to more broadly legalize medical cannabis. At this point we will wait to judge her by her actions, however Trulieve Cannabis CEO stated on X that “To be fair, she was following the governor’s direction on that at the time, in that role,” Trulieve’s Rivers said this week on X. “I think she is a great pick!”. We see overall that the Cabinet nominations represent opportunities within healthcare and cannabis industries to bring new opportunities for investment during the next administration.

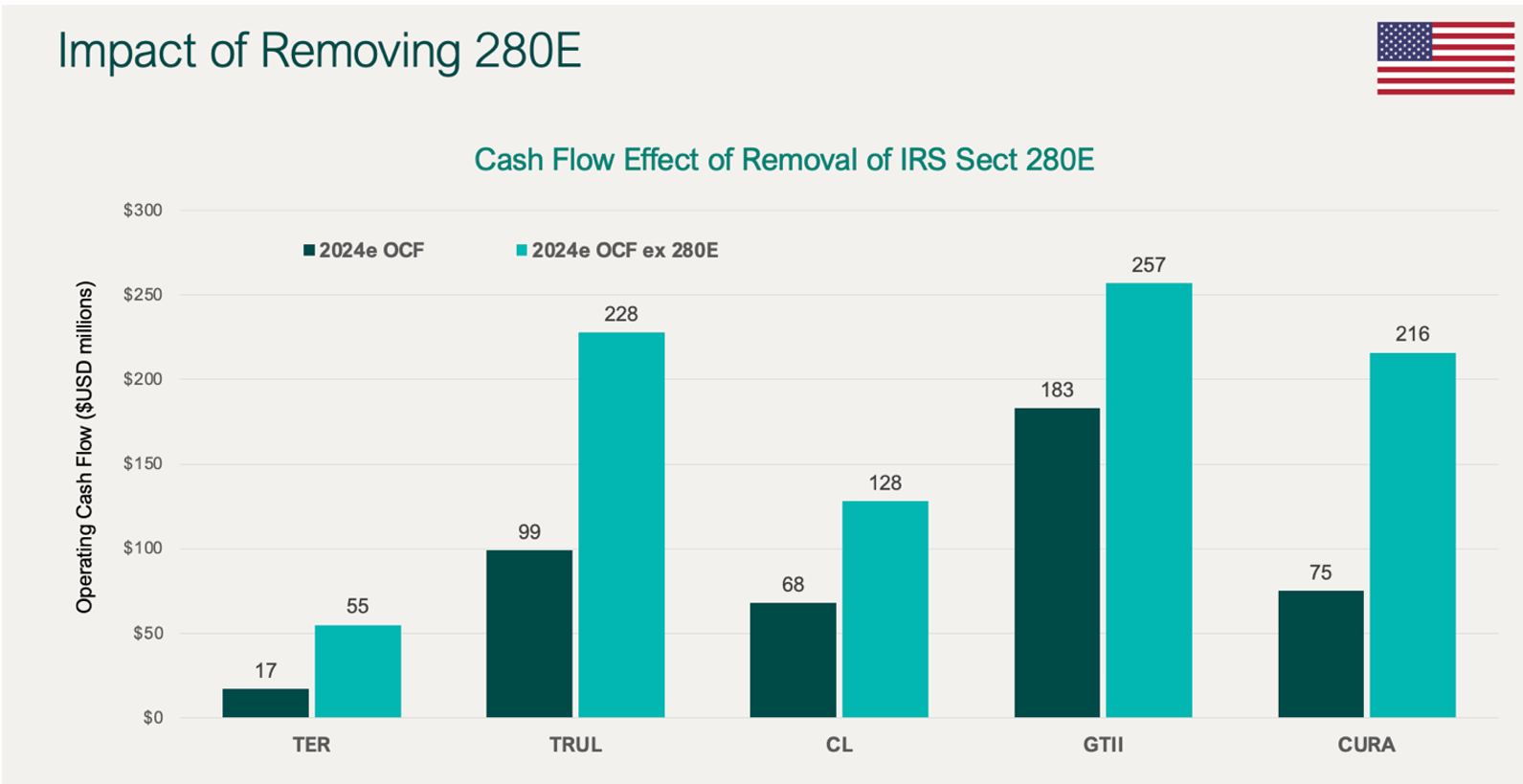

Rescheduling Hearings Began Dec 2nd

On December 2nd the hearing to review the re-scheduling of cannabis on the Controlled Substances Act (CSA) began under DEA Administrative Law Judge John Mulrooney. The first session revolved around procedural issues and logistics with respect to when various witnesses will be providing evidence. Hearings will begin January 21st with the ultimate decision focussed on the voracity of the medical and scientific research HHS has completed to determine that cannabis has a sufficiently low potential of addiction as well as enough medical evidence for treatment of ailments to warrant it moving from Schedule I to a Schedule III drug. As Judge Mulrooney stated Dec 2nd “this is not a trial about whether marijuana is good or marijuana is bad “My issues are much more narrow than that, and has to do with addiction potential…” It is important to note that rescheduling would remove various barriers to research as well as free up state-licensed cannabis business to take federal tax deductions unlike the restrictions imposed under the Internal Revenue Service (IRS) code known as 280E. We have re-posted a chart that illustrates the impact of the removal of Section280E for various MSO’s in the portfolio. However, its important to note, the Congressional Research Service (CRS) has stated that re-scheduling does not legalize marijuana at the federal level.

Hemp Industry Growth

As the cannabis industry in the US reacts to the changing dynamics around federal legislative changes, multi state operators (MSO’s) have taken note of the growing demand for hemp derived beverages. Cannabis plants and hemp plants are similar in shape and size and both contain CBD and THC. The main difference between the two plants (historically) is the amount of intoxicating THC that can be extracted from cannabis. As a result, cannabis is considered more intoxicating than hemp plants.

This determination has been called into question over the last 5 + years as the Farm Bill of 2018 legalized hemp at the federal level, allowing interstate commerce of hemp derived products, all while cannabis remains federally illegal. Some of the differences as a result of this legislation are that hemp companies can list on NASDAQ, can distribute products across state lines, and can be sold in non-regulated retail locations such as convenience stores. The extent of intoxication has been blurred by the Farm Bill designation as hemp derived beverages have not had the rigour or challenge related to the testing of THC levels as has been the case with beverages derived from cannabis plants. The result is that hemp derived THC has become an easier way to consume lower levels of THC in various products, whether its vape, gummies or beverages.

To initiate a wake up call for the cannabis market while market participants wait for further federal legislative and regulatory change, Green Thumb Industries (GTI) announced on November 4th that it had made an acquisition of agri-tech company Agrify (AGFY). The company went public on NASDAQ in January 2021. It offers GTI an opportunity to gain lower cost of capital as well as enhanced liquidity through structuring its overall business to meet NASDAQ listing requirements. AGFY provides cultivation and extraction technology and integration services for the general farm and cannabis industries. AGFY was in need of a cash infusion and GTI has the balance sheet strength to offer capital as well as opportunity for AGFY to expand its services to GTI’s multi state cultivation and multi brand business. We see this acquisition as positive for GTI allowing them to expand their reach with a relatively modest cash outlay.

One week later the second step in the plan was announced as AGFY, under GTI control signed a letter of intent to acquire certain assets from Double or Nothing LLC, (private) the owner and creator of the Señorita brand of hemp-derived legal THC drinks, in exchange for 530,000 shares of AGFY common stock.

Señorita was launched in the U.S. in early 2023. Señorita offers consumers HDLT (hemp derived legal THC) beverages that mirror well-known cocktails like a margaritas. Señorita’s HDLT products are currently offered in Canada and nine U.S. states. The product is also available direct to consumer where permissible under state law via the website senoritadrinks.com.

This acquisition will be interesting to watch as it provides multiple opportunities for upside. As stated previously, lower cost of capital for growth with a NASDAQ listing; access to technology to build GTI’s current hemp operations that consist of licensing it’s Incredibles and Beboe brands in 26 states (including GTI marijuana markets IL, FL NJ, MN OH). AGFY will also enhance GTI’s cultivation facilities in addition to the opportunity for cross boarder sales to regular retail stores for a variety of hemp derived brands.

Option Strategy

We were not materially active writing options during the month of November. President elect Trump’s nominee for Health & Human Services (HHS) RFK Jr. is a potential disruptor with traditional health care names. We chose to trade individually rather than pledge cash on puts and shares on calls. Overall we have lightened up on our overall pharma weights.

Since inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately CAD$5.14 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value to the portfolio.

We will continue to write short dated covered calls on names we feel are range bound near term and from which we could receive above average premiums. We will also continue to write, when markets allow, short dated cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, and introduce new names in the Fund.

The Ninepoint Cannabis & Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

Statistical Analysis

Fund |

|

|---|---|

Cumulative Returns |

16.2% |

Standard Deviation |

27.6% |

Sharpe Ratio |

-0.06 |

November 30, 2024

November 30, 2024