As we approach the holiday season and the end of 2024, investors should be pleased with their returns for the year. Further, although we are already part way through December, we are entering what has historically been a seasonally strong period for the equity markets, especially after excellent year-to-date performance. We think that the themes and trends that have been working are likely to persist through the balance of the year and into early 2025, as investors chase performance while refraining from selling winners to avoid realizing taxable capital gains.

Although we are optimistic for continued positive equity performance in 2025, we think that there is the potential for a brief period of weakness at the beginning of the year. Conceptually, portfolio rebalancing after year end may create some weakness at the index level, as investors rotate out of the largest mega cap growth companies into the more undervalued, cyclical parts of the market. Given our sector exposure and our individual holdings, specifically concentrated in Financials and Energy, we would theoretically stand to benefit from this trade.

Overall, our portfolio of Canadian high quality dividend payers has performed well and the net asset value of the Class A shares of the Canadian Large Cap Leaders Split Corp is significantly above the IPO price. The outlook for the portfolio remains solid and, as interest rate cuts accelerate in Canada, our holdings look even more attractive from a yield perspective, as demonstrated by the chart below:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

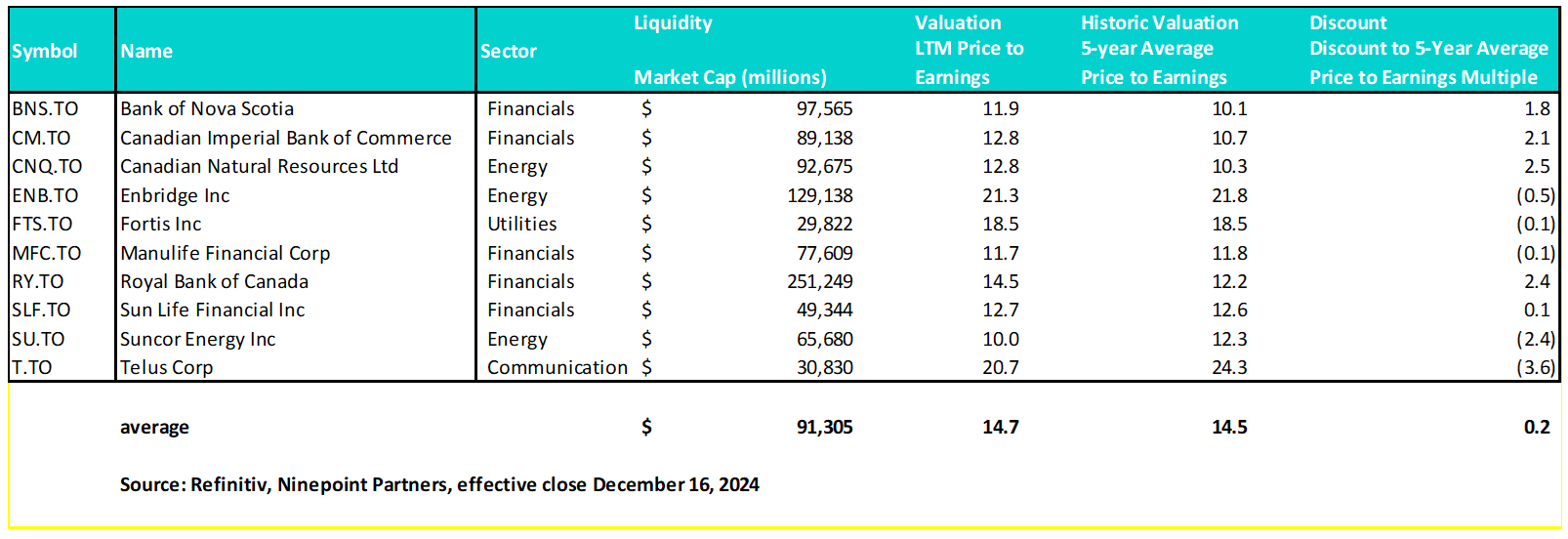

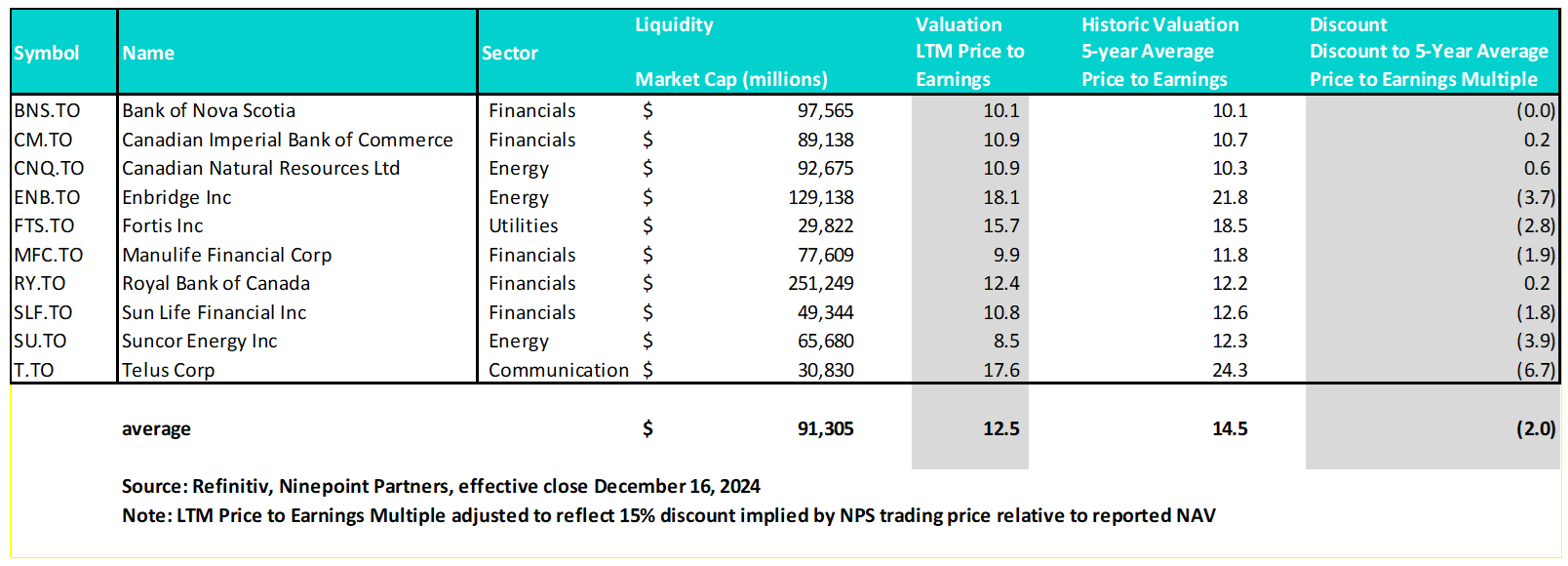

From the chart, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 14.7x, compared to the 5-year average price to earnings multiple of 14.5x, on average a slight 0.2x multiple point premium. Given our outlook for lower interest rates (and supported by a significant discount to the S&P 500, which currently trades at about 22x forward earnings, according to FactSet), multiples still have plenty of room to expand in Canada. But with the Class A Shares trading approximately 15% below the reported NAV at the close on November 29, 2024, we can adjust this table to visualize the implied valuation today:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 2.0x worth of multiple points at the close on November 29, 2024, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuations through the purchase of shares of NPS on the open market. Given the discount, we continue to believe that buying stock today represents an attractive long-term investment opportunity for both new and existing shareholders and our Normal Course Issuer Bid remains in effect.

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distribution, payable on December 13, 2024, to Class A Shareholders of record at the close of business on November 29, 2024. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend.

As always, we appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

November 30, 2024

November 30, 2024