The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

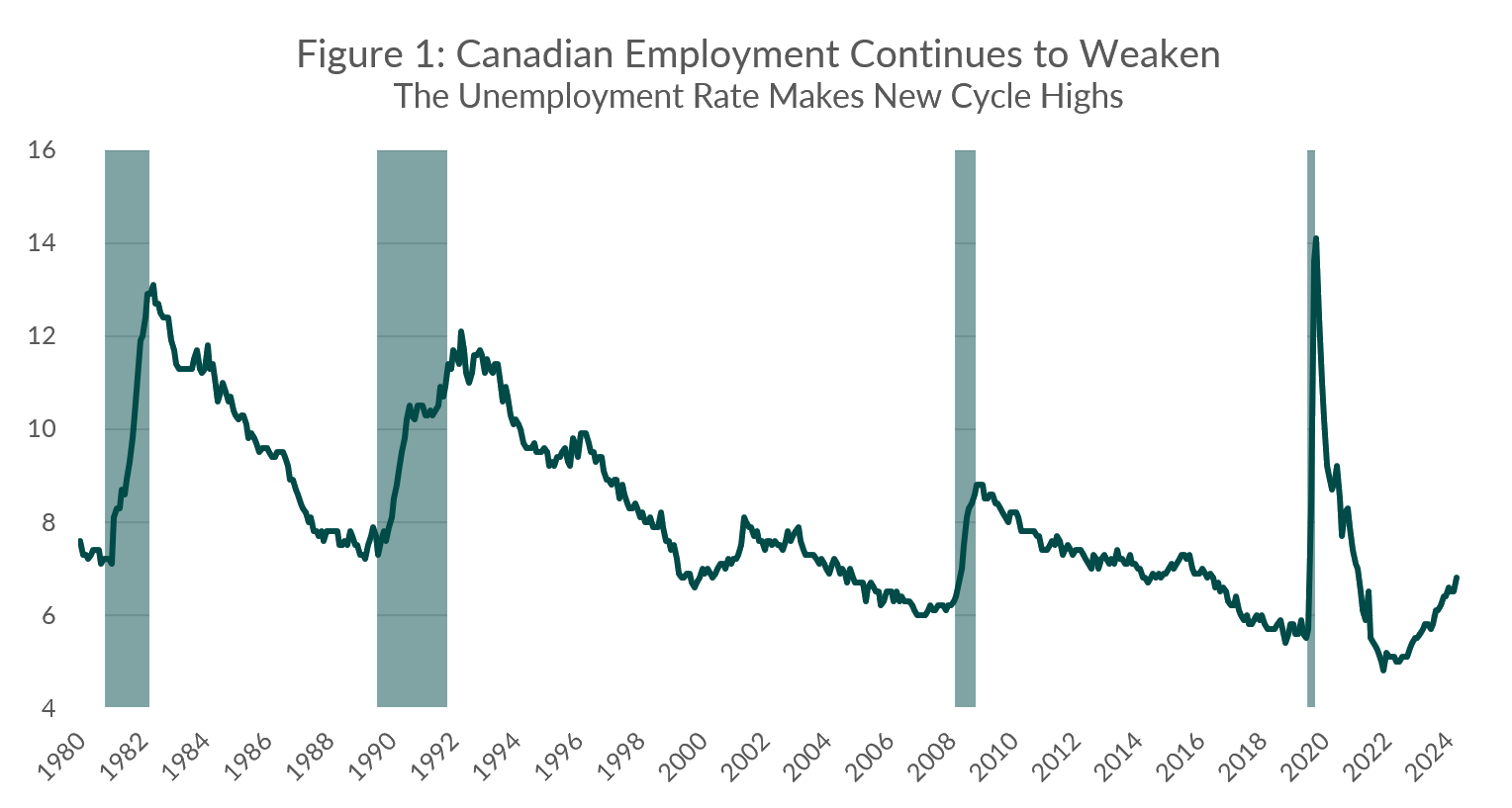

Now that the dust has settled following the U.S. presidential election, market participants are cautiously looking ahead to 2025. In Canada, we continue to see a deterioration in the labour market, with the unemployment rate now at 6.8% and rising (Figure 1 below). GDP growth is also disappointing, with only 1% growth in the third quarter. With this much slack in employment and the economy operating well below potential, we expect the Bank of Canada to continue cutting rates at a brisk pace.

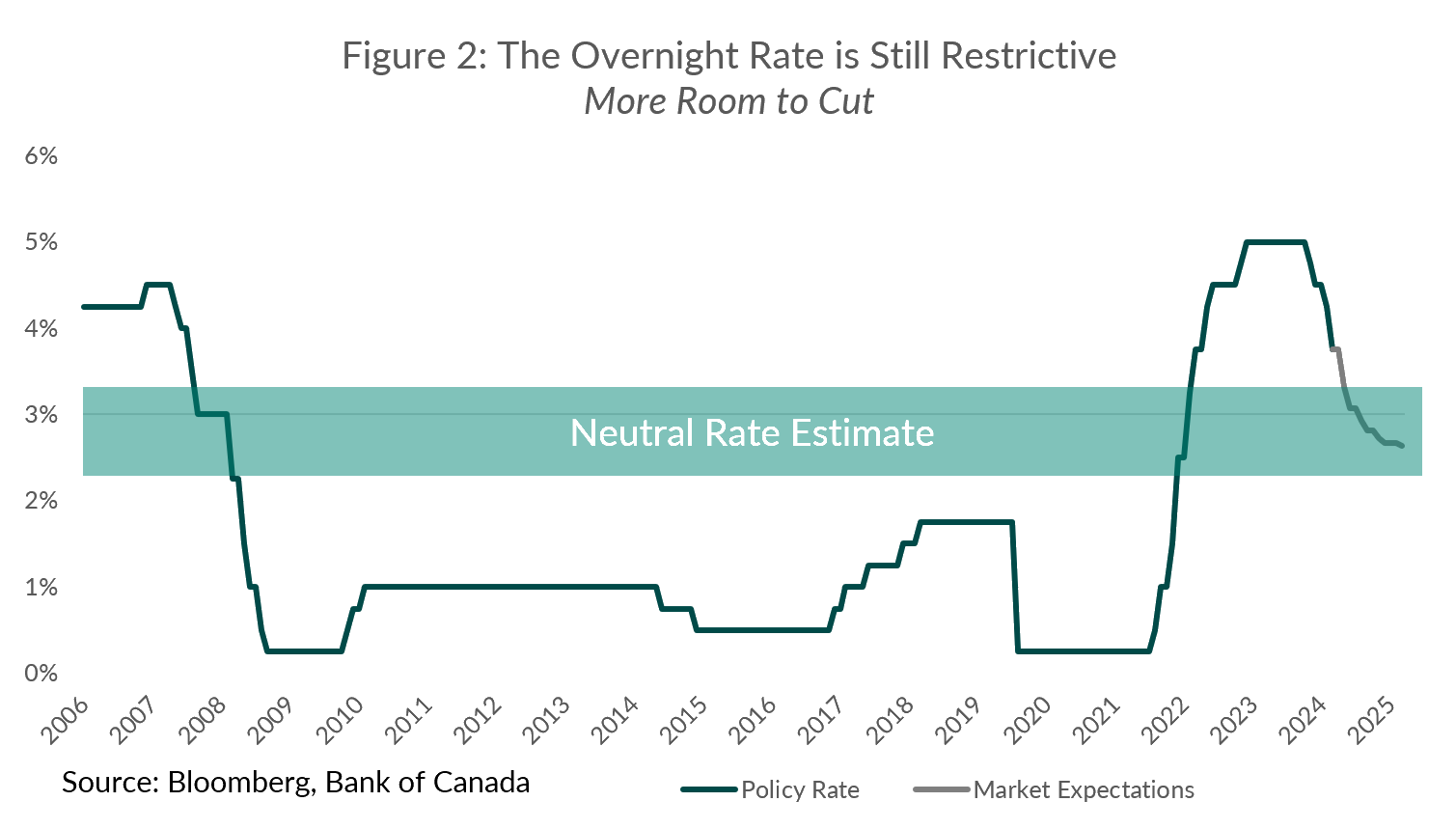

Interest rates here in Canada are still restrictive and will remain so until the BoC cuts below the neutral rate (i.e. the level of interest rates that neither stimulates nor restricts economic growth). That is of course an academic concept, and unobservable. But by the BoC’s account, the neutral rate in Canada is somewhere between 2.25% and 3.25%. So, for rates to be stimulative, we would need to see them cut to around 2%. As seen in Figure 2 below, current market expectations for the overnight rate in 2025 are still overly restrictive, seeing the BoC cut to around 2.6% by the Fall of 2025. That is too little for such a weak economy, as such we expect that over the next few quarters, Canadian government bond prices will keep rallying as it becomes increasingly clear that the Bank needs to cut more into stimulative territory. Our portfolio durations are positioned to benefit from this dynamic.

This doesn’t mean that all bonds will rally by the same measure. We are more comfortable with our call for short-term to intermediate term interest rates to decline, whereas longer-term rates (10 to 30 years) could remain elevated (and volatile). Why? Long-term interest rates are more susceptible to what happens globally, particularly the U.S. market. With inflation still sticky in the U.S. (Figure 3 below) and with fiscal and trade policies that could be inflationary, we expect the Fed to cut at a very measured pace next year, dragging its feet to gain greater clarity on the outlook. The economy there has been stronger and they might not feel the same urgency to cut as in Canada and Europe. This condition could cause the yield curve there to remain steep and longer dated interest rates high.

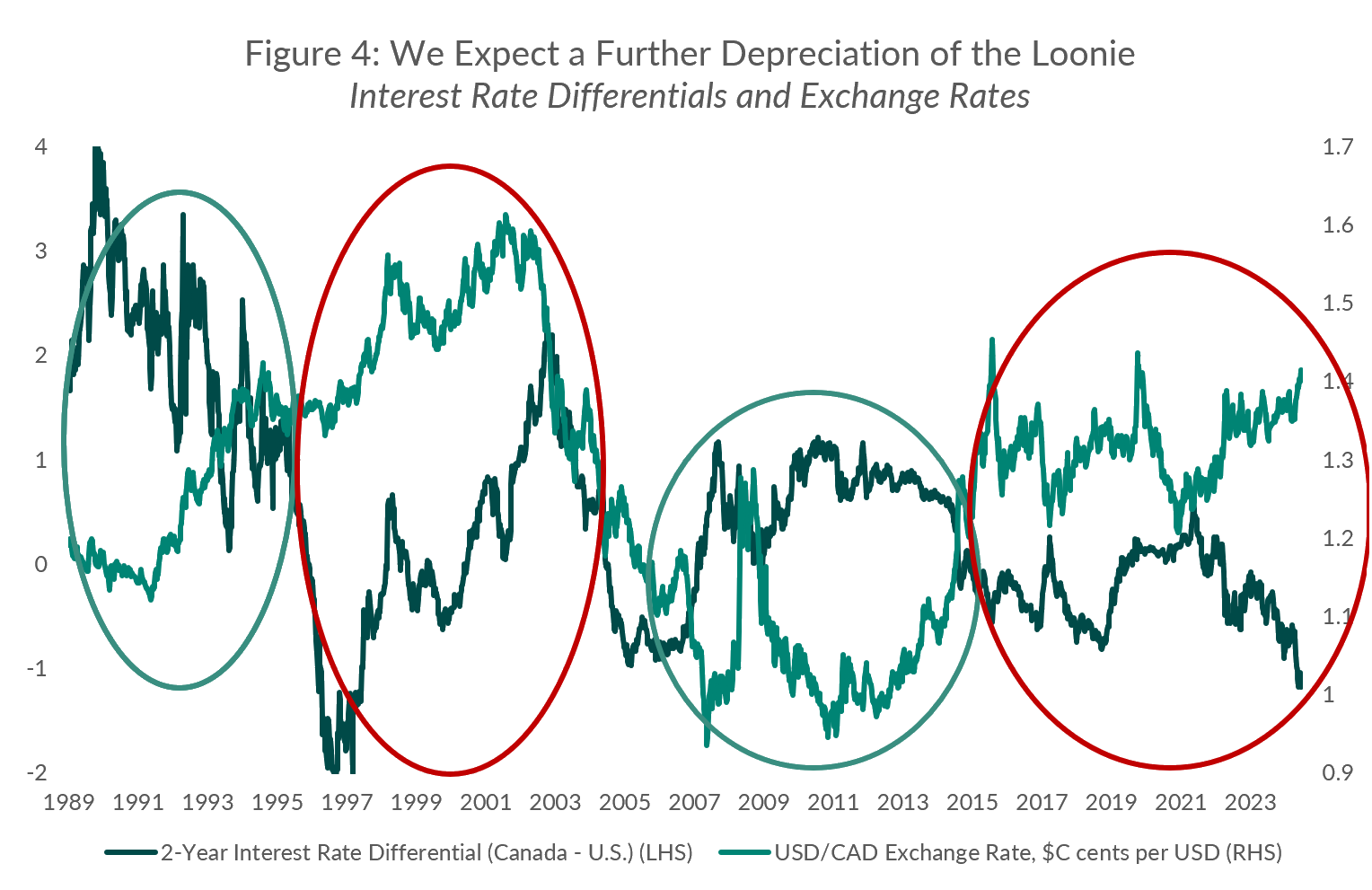

So as discussed last month, we see the Fed and the BoC policy diverging, widening the gap between interest rates here and in the U.S. to levels we haven’t seen in decades. This should put downside pressure on the Loonie, benefiting investment positions there are priced in U.S. Dollars. Figure 4 below shows the historical interest rate differential in Canada vs the U.S. (dark line left axis) along with the exchange rate (light green line right axis, higher is a weaker Loonie).

While this relationship isn’t perfect during periods of higher rates in Canada (periods circled in green), we generally see a stronger Canadian Dollar (ranging between 1-1.2), whereas the opposite is also true (periods circled in red highlight periods of elevated U.S. rates and a strong U.S. dollar). As things currently stand, we expect the interest rate differential to continue to widen, taking the Loonie lower. As clients know, we typically hedge most of our foreign exchange exposure. But with this unusual dynamic unfolding, we have decided to maintain a small net unhedged position in USD. Not only are short term interest rates in the U.S. much higher (i.e. we earn more on 1 to 2 year US bonds), the funds also stand to benefit from further depreciation of the CAD.

Credit

After a material gap tighter in credit spreads post the US election, the grind tighter continued into month end. Canadian IG spreads finished the month 8 basis points tighter and are now testing the COVID tights of 2021. As we alluded to last month, it is hard to imagine material spread tightening from here, but the case can be made for spreads to drift sideways until a catalyst emerges for a broader risk off move. Corporates have taken note of the spread environment and have opportunistically tapped the new issue market. After meeting with the management team of Gildan Activewear and Husky midstream, we decided to participate in their bond offerings in November, both rallied strongly in secondary markets. Wolf Midstream, a credit we like and own across the funds, revisited the market in the first week of December and we topped up our exposure to the company given it is an investment grade upgrade candidate (currently BB+ rated, owned and operated by CPPIB). Bank earnings came and went and thus far in December only CIBC and RY have decided to print in the CAD market. US valuations still look compelling for Canadian banks so time will tell whether they tap the CAD or global markets. This has been a record year for corporate bond issuance, and it finally feels like we will drift into holiday mode shortly.

Individual Fund Discussion

Ninepoint Diversified Bond Fund

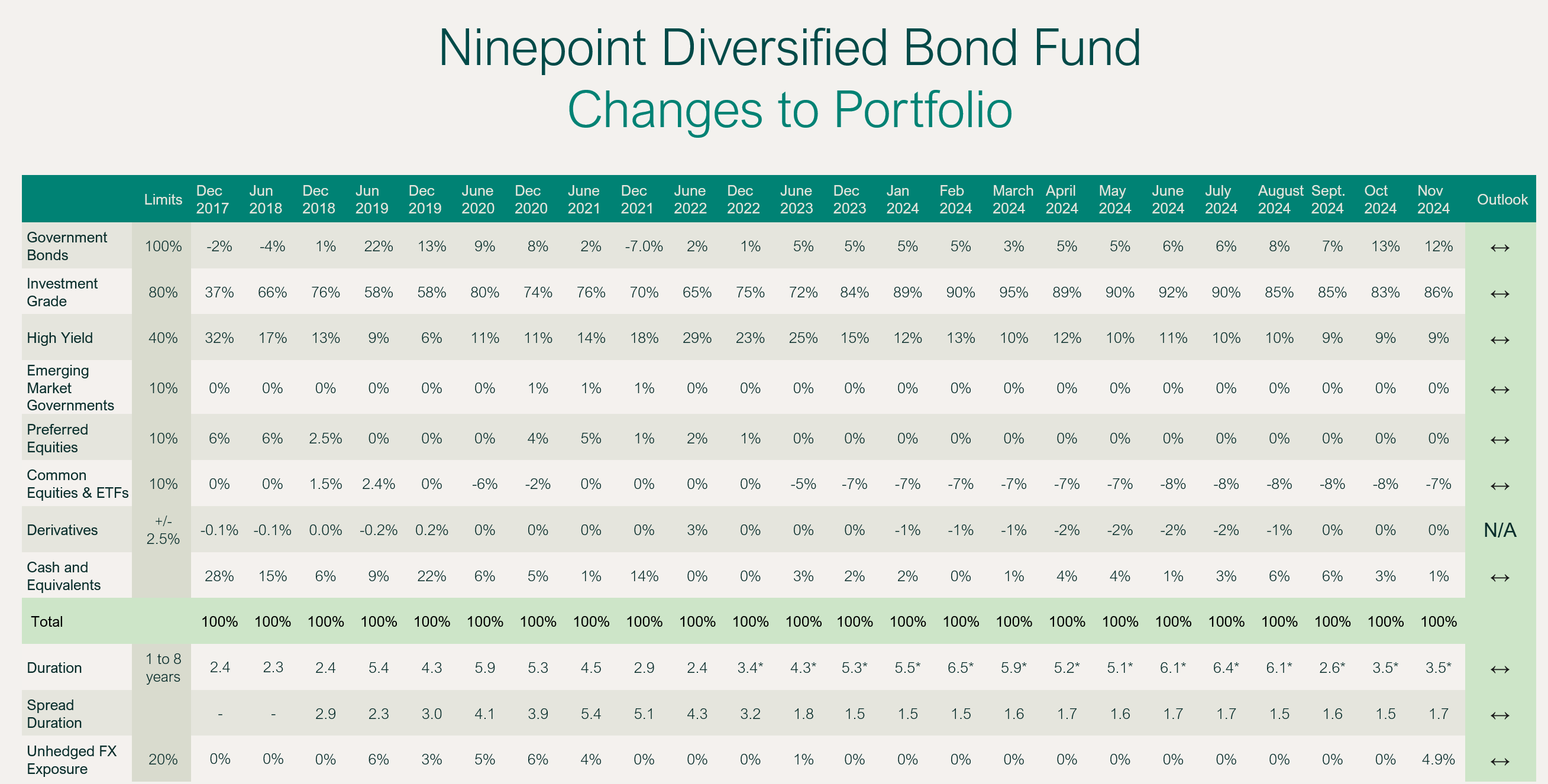

November was a very good month for the fund returning 86 basis points to put the year-to-date number at 7.61%. While we made some changes to duration throughout the Fall, duration was unchanged in November and remains at 3.5 years. The funds yield to maturity declined 30 basis points in November given the aforementioned spread tightening and lower front-end Canada yields and now sits at 5.0%. We have a net 5% position in U.S. dollars. Expect positioning to remain largely unchanged into 2025 as the market slowly calms down heading into the holiday season.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF NOVEMBER 30, 2024 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

0.9% |

7.6% |

3.0% |

6.9% |

11.5% |

1.1% |

1.7% |

2.8% |

3.5% |

Ninepoint Alternative Credit Opportunities Fund

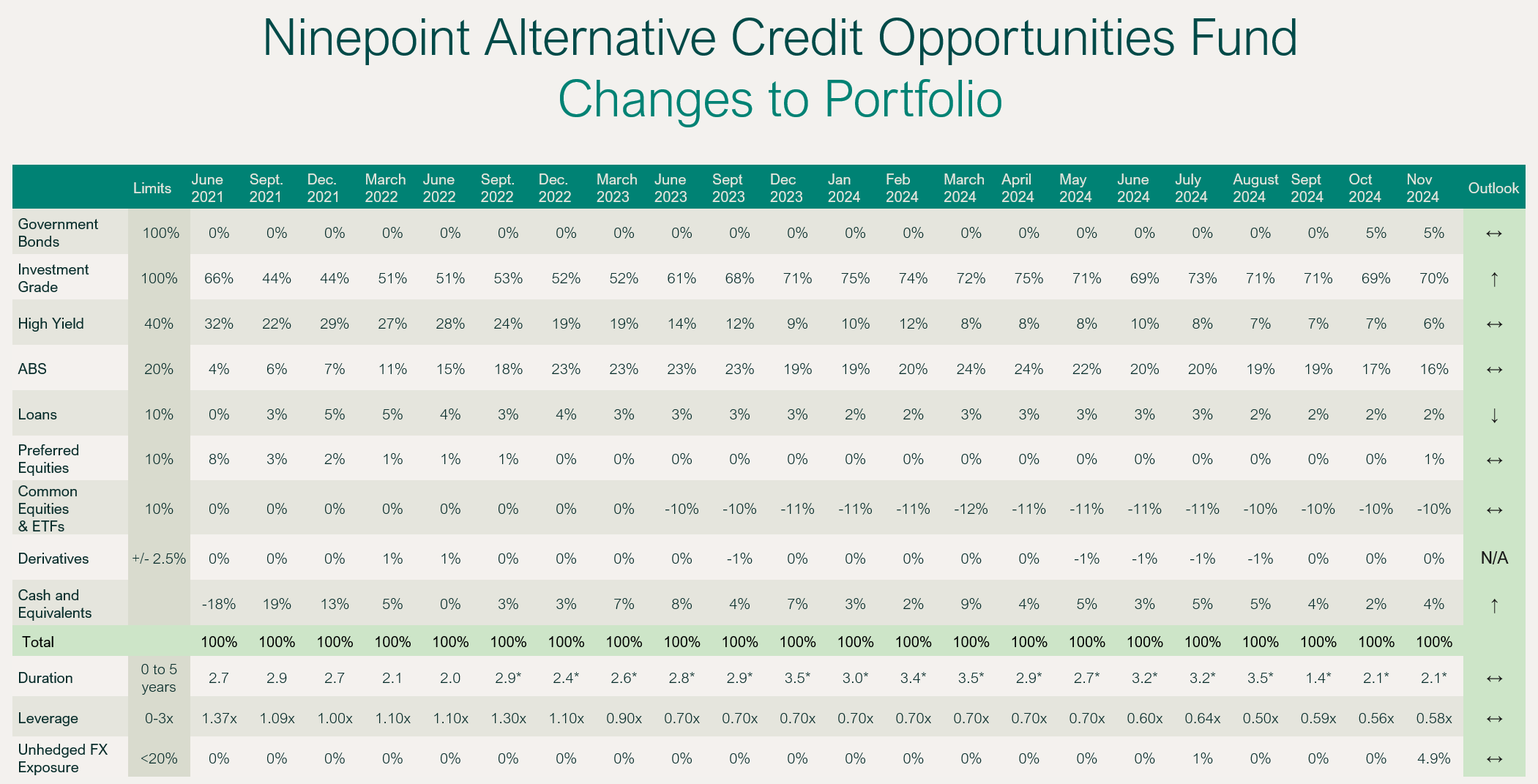

The fund had a very solid month of November returning 62 basis points bringing year-to-date performance to 9.34%. Duration was unchanged at 2.1 years in November after some adjustments in the Fall. Leverage remains low at 0.6x given the full valuations in credit. Yield to maturity declined 10 basis points and ended the month at 6.1%. We have a 5% weight in U.S. dollars.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF NOVEMBER 30, 2024 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.6% |

9.3% |

2.4% |

5.7% |

12.5% |

2.5% |

2.3% |

Ninepoint Credit Income Opportunities Fund

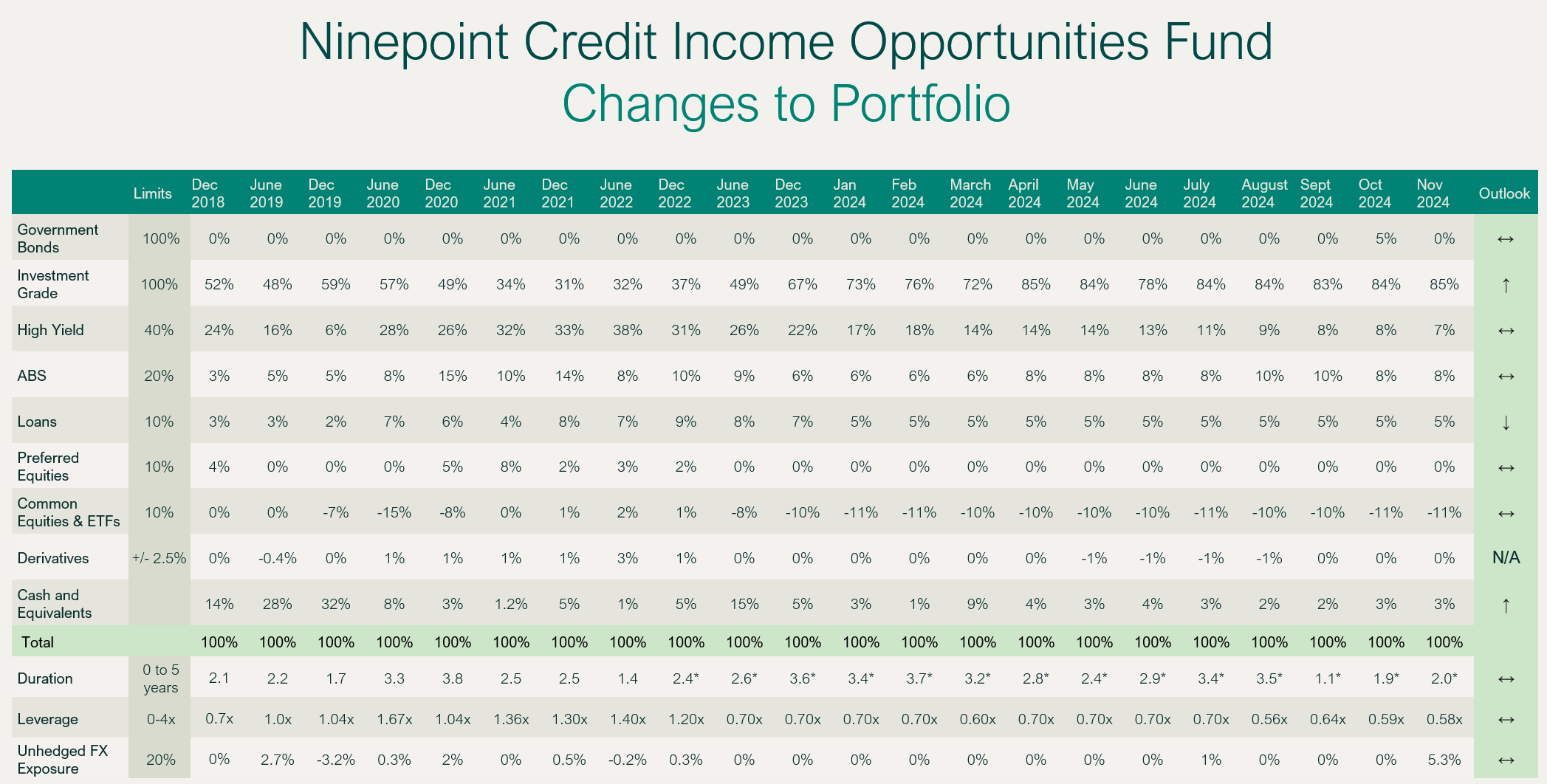

After 50 basis points of performance in October, the fund generated an additional 52 basis points in November bringing year-to-date performance to 9.28%. Leverage was flat on the month sitting at 0.6x given how tight credit spreads remain. Duration moved up ever so slightly to 2 years while yield-to-maturity declined 40 basis points ending the month at 6.2%. As with the other funds, we now have a net 5% exposure to USD.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF NOVEMBER 30, 2024 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

0.5% |

9.3% |

2.3% |

5.3% |

12.5% |

3.1% |

5.9% |

5.0% |

Conclusion

Even with a defensive posture, 2024 was a great year for our strategies. We took risks where we thought it made sense (LRCN and Hybrids), while maintaining a disciplined approach to overall credit risk (low spread duration, up in quality, and some credit hedges). We avoided the volatility around long-term interest rates, taking profits and re-engaging at opportune times. As we look to 2025, we believe that our portfolios are currently well positioned to benefit from the Canadian rate cut cycle that should continue at a brisk pace. We also have dry powder, should credit spreads widen from all time tights. And, as always, we remain flexible to alter the characteristics of the portfolios, when our outlook changes.

Happy Holidays and best wishes,

Mark, Etienne & Nick

November 30, 2024

November 30, 2024