Summary

The Ninepoint Cannabis & Alternative Health Fund is focussed on the key drivers affecting cannabis, health and wellness, pharma and consumer health sectors. We invest in companies that are embracing new modalities, innovative technology and effective distribution. We believe that people globally are becoming more aware of alternative treatments and seeking out the best providers of select services. Our goal is to invest in those companies best positioned to take advantage of these macro changes.

In this report we look at the year ahead and the key factors that will be driving the portfolio.

2024 was a mixed year for cannabis investors. The sector underperformed broader indices with Canadian companies outperforming US cannabis as American operators continue to lack access to liquid public markets. For the year, Canadian cannabis industry was up 5.3%1 while the US industry lagged down 49.4%2 YTD. Overall, fundamentals are the focus rather than reliance on regulatory catalysts, which means there are significant opportunities for growth amongst the leading US companies that continue to generate substantial cash flow while trading at what are considered traditional private company multiples.

Ninepoint Cannabis & Alternative Health Fund - Compounded Returns* as of December 31, 2024 (Series F NPP5421) | Inception Date - August 4, 2017

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

-5.33% |

-15.74% |

-18.97% |

-20.21% |

-15.74% |

-20.39% |

-7.78% |

1.30% |

US Cannabis

As we enter 2025, the market awaits catalysts, while skepticism regarding regulatory reform abounds. It appears that the Trump administration is not necessarily against cannabis but investors are sitting on the sidelines until there is clarity from the new administration. We believe there is a bifurcation amongst operators; haves and have nots, only the strong will survive. A renewed focus will be on cash flow generation, balance sheet strength and key state market exposure that could determine overall success prior to substantive catalysts.

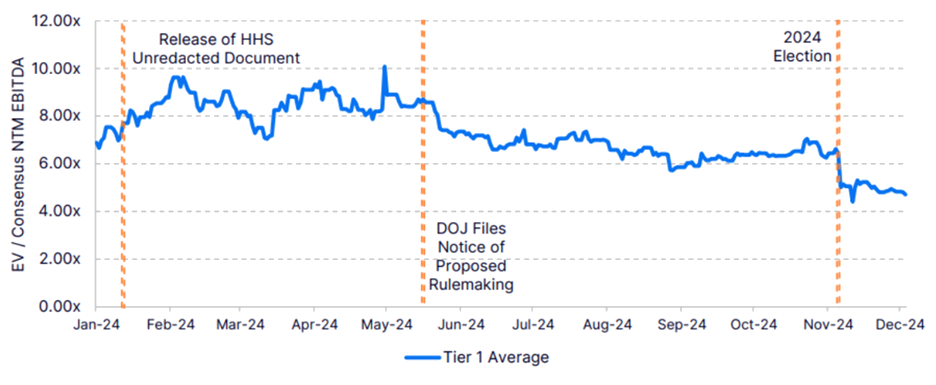

While most companies in the Fund are experiencing higher margins and have already gone through significant capital expenditure programs resulting in stronger cash flow, valuations are reflecting the malaise caused by lack of regulatory catalysts that did not materialize in 2024. Federal re-scheduling delays and the Florida Ballot on recreational changes missing the 60%3 threshold are primary factors that have dragged down equity prices into year end where we saw trading at valuation lows, close to 5x EBITDA for the US cannabis sector.

From a cash flow perspective, leading all MSO’s with cash flow from operations (LTM) are companies such as Green Thumb Industries (GTII) with $283 million in adjusted cash flow from operations; Verano Holdings (VRNO) with $93 million; Cresco Labs (CL) with $98 million and, Trulieve Cannabis (TRUL) with $75 million. (source: LSEG) That strength is not reflected in the multiples below.

EV Multiples for US Cannabis based on Consensus Next 12 Month EBITDA

The Impact of Re-scheduling on US Cannabis

Over the last two years, US Department of Health and Human Services (HHS) reviewed and assessed research that describes the efficacy of cannabis in treating various illnesses including chronic pain, epilepsy, anxiety, PTSD, and suggesting a lower risk of abuse than previously assumed. As a result of these findings released early in 2024, the Drug Enforcement Agency (DEA) agreed to hold administrative hearings scheduled to begin in late January of 2025 to determine if the findings from HHS are medically and scientifically sound enough to be relied upon to move forward with re-scheduling.

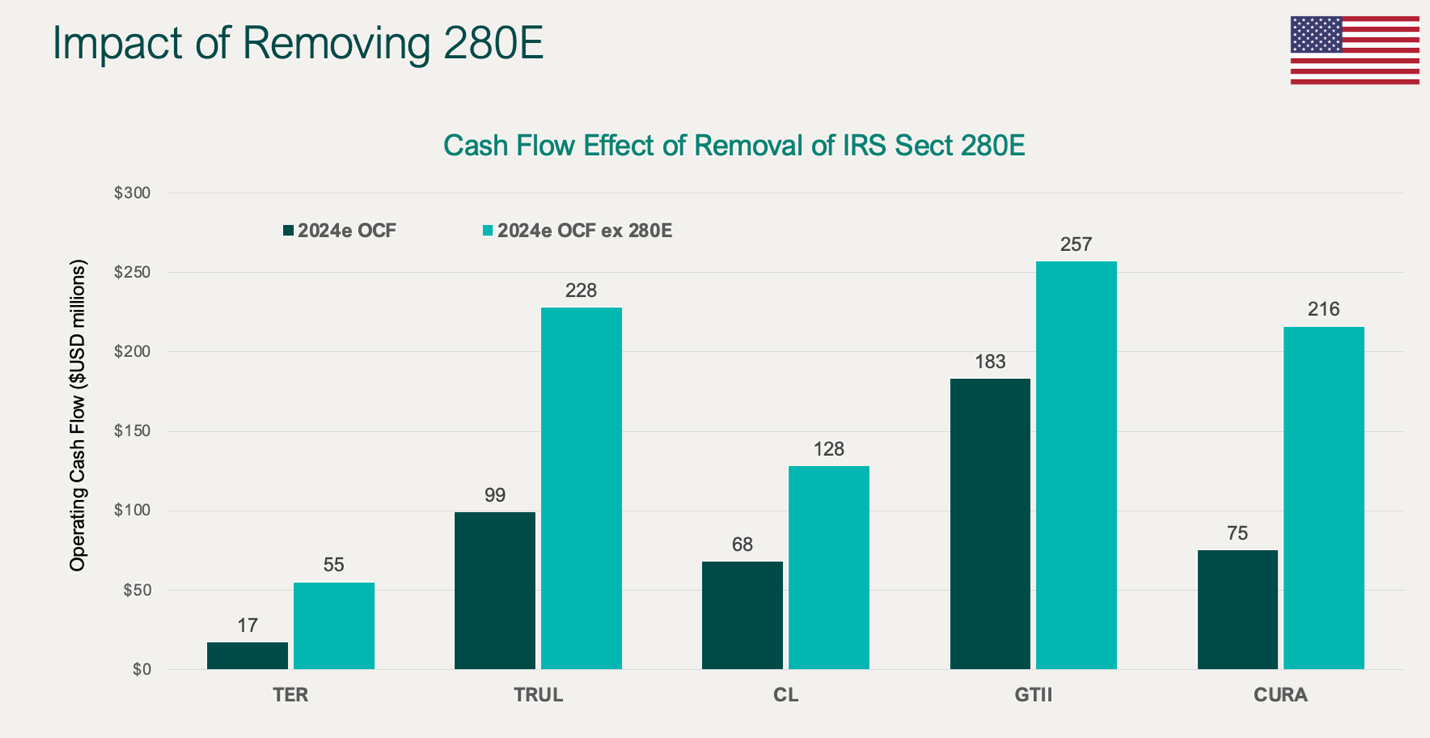

The re-scheduling hearing on cannabis within the Controlled Substances Act (CSA) is to be heard by DEA Administrative Law Judge John Mulrooney with the ultimate decision focused on the voracity of the medical and scientific research HHS has completed to determine whether cannabis has a sufficiently low potential of addiction as well as enough medical evidence for treatment of ailments to warrant it moving from Schedule I to a Schedule III drug. As Judge Mulrooney has stated “this is not a trial about whether marijuana is good or marijuana is bad… “My issues are much more narrow than that, and has to do with addiction potential…” It is important to note that re-scheduling removes various barriers to research, in addition to providing reduced stigma and potentially changes to various regulations with respect to Banking and Capital Markets. Re-scheduling will allow state-licensed cannabis business to take federal tax deductions unlike the current restrictions imposed under the Internal Revenue Service (IRS) code known as 280E, where Schedule I drugs must pay punitive tax rates. We have re-posted a chart that illustrates the impact of the removal of Section280E for various MSO’s in the portfolio. It is our belief that re-scheduling to Schedule III and removing IRS 280E would be a significant cash flow enhancement for the industry.

In the evening of January 13th, the Administrative Law Judge (ALJ) that oversees the Re-Scheduling hearings moving cannabis to Schedule III in the Controlled Substances Act (CSA), that were set to begin the week of Jan 20th, cancelled the evidentiary hearings. The reason for the cancellation is that proponents of re-scheduling have alleged that the DEA, who is supposed to be supporting re-scheduling based on the medical and scientific research HHS has done over the last 2 years, has in fact been communicating with prohibitionists, in effect conspiring against the passage of new CSA rules bringing cannabis to Schedule III.

The ALJ heard arguments from proponents suggesting the DEA be removed from the hearing process. The judge, however, does not have the legal authority to do so. ALJ Mulrooney suggested that the proponents’ allegations have legal merit. His comments describe communications between the DEA and anti re-scheduling advocates as “disturbing and embarrassing.” The group trying to remove the DEA will have 15 days to file an appeal, and both parties will be required to provide an update on the matter in 90 days to the tribunal. Should the legal conflicts continue thereafter, the parties will be required to provide an update every 90 days going forward. The result is that ALJ has issued a stay on the re-scheduling matter until the legal battle between the two parties is resolved.

Implications for US Cannabis:

In our view investors have left the sector, discouraged by the lack of progress on key policy initiatives such as re-scheduling and Florida adult use. This has left cannabis stocks trading at trough valuations, which we believe are unsustainably low even if no further positive catalyst take place in the near term. One must consider that given the established multi state businesses that generate hundreds of millions of dollars in cash flow, and the number of states that have already transitioned to adult use, valuations are unrealistically low. On top of that assumption, the incoming Administration, while it may ignore cannabis, has not given any indication that it intends to be hostile towards the state legal industry. Many Republicans are staunch supporters of states rights and any actions contrary would likely generate Republican push back. As a result, even if no regulatory changes occur, we believe valuations are at their bottom and the opportunity for upside, independent of catalysts is significant.

When we consider positive catalysts could be on the horizon, upside potential should not be ignored. Many of the stocks trade at all time valuation lows and as a result, offer a buying opportunity for long term investors. As mentioned above Green Thumb Industries (GTII) continues to lead the sector generating over $283 million in adjusted cash flow from operations during the last 12 months up to Q3-24. The company is in the second year of a share buy back program where they are able to buy back stock to maintain value for shareholders. Along with its strong margin profile, the company maintains a fairly clean Balance Sheet and could be active in M&A activity adding exposure to new and or growing state markets.

Canadian Cannabis

Canadian cannabis companies continue to suffer from high federal excise tax rates in addition to the overcrowding of retail outlets. Provincial government wholesale programs result in less cash flow to producers and limit product variety. Changes are required to adjust the excise tax regime and make adjustments to provincial regulatory barriers to help Cdn LPs and retailers to generate stronger cash flows. Our portfolio continues to hold two Canadian LP positions that offer what we believe are good opportunities. Cronos (CRON) is a unique NASDAQ listed cannabis company that due to its significant $1.8 billion investment from Altria in 2018, trades at or below cash value. And we have often discussed Village Farms International (VFF), in our view has the best large cap cultivation practices in the country, global operations, and is well positioned to enter the US market once appropriate regulatory changes occur.

Implications for Canadian Cannabis:

Without an overhaul to the Canadian market, we do not see how fundamentals can improve for Canadian cannabis companies. Subsequent to year end, TLRY announced Q2-25 financial results that missed revenue and cash flow estimates by a wide margin. In addition the company announced a program to create $25 million in synergies. TLRY is one of the leaders in the Canadian market. If TLRY with its vast operations can't seem to grow free cash flow, we believe it is a signal to be cautious in Canada. We continue to see operating excellence in the space from a company such as Village Farms (VFF) however the Canadian regulatory framework prevents ultimate success. VFF is a key proponent of US cannabis reform, given its US hemp business and its vast multi-million farm operation in Texas, that if converted to cannabis cultivation post re-scheduling could catapult VFF to the upper echelons of the North American industry.

Healthcare & Pharma: Headwinds from RFK and Trump to Make America Healthy Again

We see potential changes in the upcoming Trump Administration as it pertains to healthcare, pharmaceuticals and cannabis that should have dramatic implications for the portfolio. Its important to review the policy positions of various Cabinet posts to understand the implications on health policy.

President Trump has picked Jay Bhattacharya, M.D., Ph.D., to be the Director of the National Institutes of Health (NIH). Bhattacharya is a health economist and professor of medicine at Stanford University who rose to prominence with his contribution to a 2020 health strategy paper; The Great Barrington Declaration, a policy paper supporting herd immunity during the COVID-19 pandemic, contrary to official government mandated closures. He is known as an outsider to Washington circles and will, like RFK Jr question previous health policy priorities that could result in changes to longstanding industry practices.

For the Food & Drug Administration (FDA), President Trump has nominated Johns Hopkins surgeon and author Martin Makary, M.D. who has criticized how food in the U.S. is grown and processed. He has also been outspoken in his criticism of the Orphan Drug Act pathway with his view that pharma companies are exploiting the law by claiming orphan status for drugs that end up being marketed for more common conditions, generating millions while bypassing the more formal multi year drug approval process. Dr Makary was also a critic of the U.S. vaccine mandates during the pandemic – the most significant opposition being his views that children shouldn’t have to wear masks to reduce the spread of COVID 19 in playgrounds and schools.

The most high-profile nomination with respect to health policy is Robert F Kennedy Jr. (RFK) to lead Health and Human Services (HHS). The position has great importance in Cabinet for overseeing much of the US healthcare system. Kennedy will oversee an 80,000 person department, including the FDA and CMS, which provides insurance coverage to more than 160 million people. Speaking to National Public Radio in mid November Kennedy said Trump had given him three instructions: to remove “corruption” from health agencies, to return these bodies to “evidence-based science and medicine”, and “to end the chronic disease epidemic”.

We believe that the focus of HHS and its agencies could see a change with respect to the promotion of health strategies relative to the use of chronic condition medications. RFK Jr. has previously suggested patients taking GLP-1 drugs such as those provided by Eli Lilly and Novo Nordisk should instead work with registered dieticians on healthier food intake and fitness. Kennedy has called for budget cuts at HHS including departments at the FDA while devoting more funds towards “preventive, alternative and holistic approaches to health.”

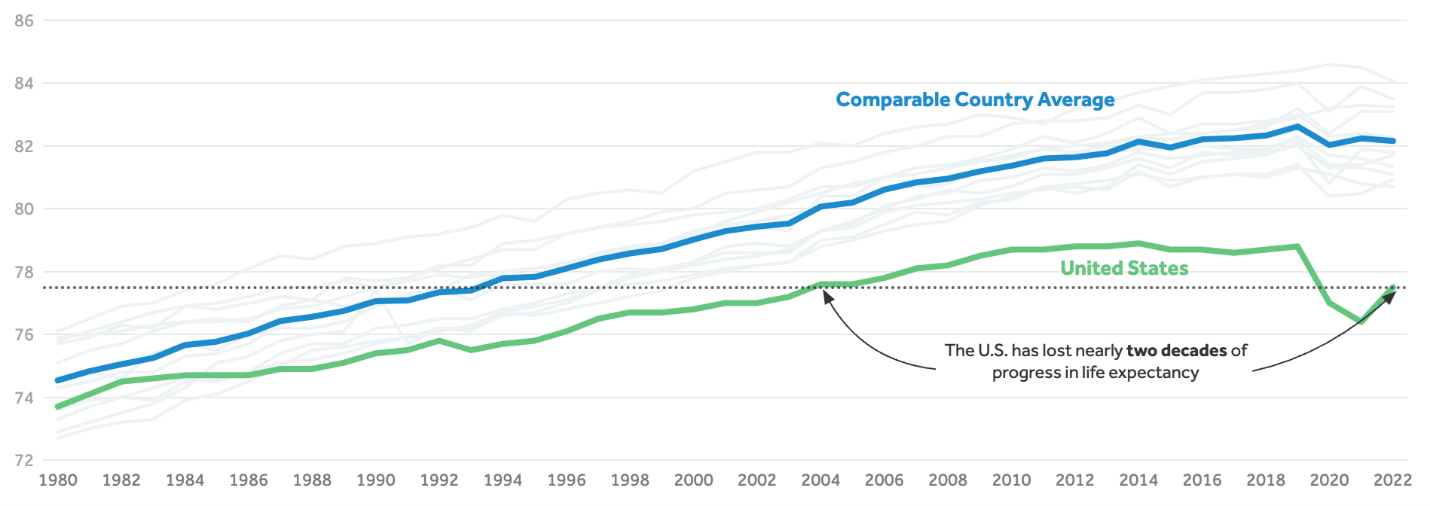

RFK Jr has been an outspoken advocate for “alternative health strategies” rather than current practice of relying on pharmaceuticals to solve all medical conditions. His advocacy focusses on the last 25 years of lower mortality rates for Americans relative to similarly higher-income OECD countries. As the chart below illustrates, there is a widening gap in life expectancy and RFK Jr. believes that over processed foods and the chronic disease mentality supported by pharmaceutical companies needs to change to put America back on a healthier track.

Life Expectancy at Birth: 1980-2022

The incoming head of HHS has also advocated for the legalization of cannabis, supporting cannabis retailer access to FDIC banking while creating excise taxes at the federal level to pay for healing centres that help treat addiction. He has also been outspoken about how the FDA has quashed psychedelics with his view being that there may be opportunities for better treatment of PTSD. He has called for restrictions on ultra-processed foods as part of an initiative to address the high rates of chronic disease in the United States.

The moderating factor in this discussion of a potential overhaul of the healthcare industry is that healthcare does not rank in the top five policy areas that are on President Trump's key agenda items. In addition, Republicans in the House and Senate are relatively split on their views on healthcare policy, as there is a constraint in terms of how to pay for cuts to healthcare with the US debt limit already a looming issue for this next Congress. Instead, it may be possible that changes to healthcare are made through tax policy.

President Trump's return to the White House could support Congressional Republicans who want to weaken or repeal the Affordable Care Act. To avoid negative press on the matter, Republicans could just avoid extending certain health budget incentives. The Affordable Care Act (ObamaCare) created subsidies to entice enrollment in health exchanges, the mechanism whereby consumers sign up for healthcare coverage. These will likely not be extended past 2025 under a Trump presidency given program costs. Trump’s view is that it is too expensive and represents government overreach.

To address the extension, Congress could change the ACA without a single Democratic vote, using a process known as "reconciliation." However the incoming President doesn't want these activities to be a public relations debacle at the expense of the policy items that he actually wants to get done. The best course of action is that Republicans can do nothing as temporary subsidies are set to expire at the end of next year without congressional action. Once they expire health premiums would increase substantially for subsidized consumers in 12 states who enrolled using the federal ACA exchange. That would mean fewer people could afford coverage on the ACA exchanges. Overall this fits more with Trump’s desire to reduce government overreach and reduce deficit spending while not directly impacting his legislative agenda.

Implications:

We believe that being underweight in certain sub sectors within healthcare is the best positioning in 1H25 as RFK Jr takes over at HHS. Given the combined focus of reduced government waste and leadership to alternative health strategies we see growth multiples coming down for biotech/pharma. We would carry that through to the GLP-1 drug leader such as NOVO and LLY as the lack of approval at the FDA seems likely, while inventory build up is weighing on equity values. One area that may stand up to these changes in policy could be managed care, particularly when you consider their deep integration in the system and valuable technology assets. Companies such as UNH, HUM and others continue to be central in the delivery of healthcare. The Fund’s ability to short names within the sector should provide support and potential positive returns to the Fund.

Consumer Health Trends

As inflation continues, and consumers are forced to continue to trade down, we believe that no retailer is better positioned in the consumer health space than COSTCO. The warehouse leader provides are broad array of vitamins, minerals and supplements under its private label Kirkland brand. In addition, it offers pharmacy, nutritional supplements; a variety of organic fruits and vegetables; gym equipment; optometry; telehealth services, hearing aids, and other wellness related products. With the annual membership fees maintained at over a 90%4 retention rate, the company is able to pass on savings to consumers that provide everyday low prices. The fund continues to hold COST as a top ten holding and believes its positioning and new store openings will continue to generate solid growth.

Performance Chart: 5 Yr Growth since 1st entry

Costco has 76.2 million paid household members, up 7.3%5 from the prior year while executive memberships grew 9.6%6 year over year to reach 35.4 million, now accounting for 46.5%7 of all paid members and driving 73.5%7 of worldwide sales. Costco opened 14 new warehouses during Q4, including 10 in the U.S. Overall, Costco operates 891 warehouses, including 614 in the United States and Puerto Rico, 108 in Canada, 40 in Mexico, 35 in Japan, 29 in the United Kingdom, 19 in Korea, 15 in Australia, 14 in Taiwan, 7 in China.

Health Technology

More recently, we have seen an emerging opportunity to increase the Fund’s exposure to healthcare related technologies. Technology companies are investing billions of dollars to drive healthcare innovations with a wide range of solutions that include patient care to drug discovery all with the use of AI being a particular focus. A particular focus from tech is how AI can improve patient outcomes. Whether it is precise diagnosis to modelling patient populations for emerging needs, advanced technology will be increasingly called upon to improve outcomes. We see health care management companies analyzing efficiencies in the delivery of healthcare services, while we also see analytics enhancing the review of digital images for early detection of diseases. In addition, as the sector has grown and become more complex large tech companies have developed specialized verticals with their companies to provide more customized solutions for health care.

Options Strategy

Statistical Analysis

Fund |

|

|---|---|

Cumulative Returns |

10.03% |

Standard Deviation |

27.53% |

Sharpe Ratio |

-0.09 |

Since inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately CAD$5.148 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

We will continue to write short dated covered calls on names we feel are range bound near term and from which we could receive above average premiums. We will also continue to write short dated cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, and introduce new names in the Fund.

The Ninepoint Cannabis & Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Cannabis & Alternative Health Fund

- ATB Report Dec 16, 2024 Canadian Cannabis 2025 Outlook

- ATB Report Dec 16, 2024 Canadian Cannabis 2025 Outlook

- https://floridaphoenix.com/2024/11/06/fl-lawmakers-recall-what-led-to-60-threshold-to-pass-constitutional-amendments/

- https://www.mytotalretail.com/article/costcos-membership-fee-increase-goes-into-effect/#:~:text=This%20loyalty%20is%20evident%20in,to%20find%20value%20in%20membership

- https://www.contimod.com/costco-statistics/#:~:text=Costco%20had%20132.0%20million%20members,United%20States%20and%20271%20abroad

- https://www.usatoday.com/story/money/2024/12/12/costco-membership-earnings-release/76943474007/#:~:text=Membership%20fees%20brought%20in%20$4.8,47%25)%20were%20executive%20memberships

- https://www.usatoday.com/story/money/2024/12/12/costco-membership-earnings-release/76943474007/#:~:text=Membership%20fees%20brought%20in%20$4.8,47%25)%20were%20executive%20memberships

- Faircourt Asset Management

December 31, 2024

December 31, 2024