Monthly Update

It was another excellent year for equities (and most other asset classes), with the S&P 500 posting a +23.3% return (+25.0% on a total return basis), making it two years of +20% returns in a row. For Canadian domestic investors, the TSX posted a +18.0% return (+21.7% on a total return basis), which was a relatively decent performance. Broadly speaking, US stocks outperformed Canadian stocks, large caps outperformed small caps and growth outperformed value, consistent with the trends of the past several years.

The only minor disappointment of 2024 was the failure of a Santa Claus rally to materialize over the last five trading days of the year. We know that we can’t really complain about much in 2024, but we did observe some weakness through the back half of December that was masked at the index level by strong year end performance of large cap growth stocks. We would attribute much of the underlying weakness to the US Federal Reserve and the “hawkish cut” on December 18th, when the FOMC cut the target interest rate by 25 basis points to a range of 4.25% to 4.50%. However, the ensuing press conference and the details contained in the Summary of Economic Projections seemed far less dovish than prior meetings, with only two interest rate cuts now forecasted in 2025, down from four cuts. We would point out that market expectations were already there, with the forward curve pricing in only two interest rate cuts in 2025 several months ahead of the final Fed meeting of 2024.

We do wonder if at least some of the hawkish shift was in anticipation of President Trump and his incoming administration’s policies (primarily aggressive fiscal spending and tariffs on foreign-produced goods) that could be largely inflationary. However, we are not convinced that resurgent inflation is lurking around the corner, since some of the President-elect’s policies may prove to be deflationary, and it remains to be seen what will ultimately be enacted. Unfortunately, this change in tone from the Fed was frustrating for many investors, since Chairman Powell had previously taken great pains to highlight his (backward-looking) data dependency.

The Bank of Canada is also easing monetary policy, cutting the policy rate by 50 basis points on December 11th, to 3.25%. The Canadian economy is likely in a more difficult spot than the US economy and the interest rate differential and recent weakness of the Canadian dollar relative to the US dollar are the most obvious signs. In any case, the market impact has been largely in line with our prior views: if interest rate cuts came in below expectations (implying fewer cuts than expected), large cap growth would outperform but if interest rate cuts came in above expectations (implying more cuts than expected) a rotation from growth to value (predominantly dividend-paying equities) would occur. As of today, this much anticipated rotation from growth to value has not persisted for longer than a few months at a time but in 2025, as earnings growth rates begin to converge for growth and value stocks, it is possible that we could see better relative performance from value-oriented sectors. In the meantime, generally lower interest rates remain supportive for the equity markets as long as the economic data does not deteriorate significantly from here.

Overall, our portfolio of Canadian high quality dividend payers performed well in 2024 and the net asset value of the Class A shares of the Canadian Large Cap Leaders Split Corp is significantly above the IPO price. The outlook for the portfolio remains solid and, as interest rates should continue moving lower in Canada, our holdings look even more attractive from a yield perspective, as demonstrated by the chart below:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

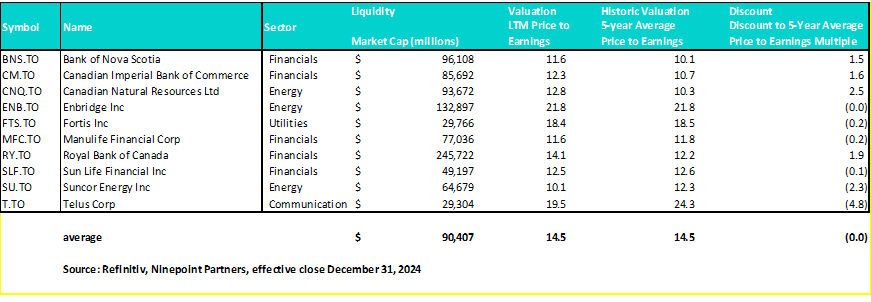

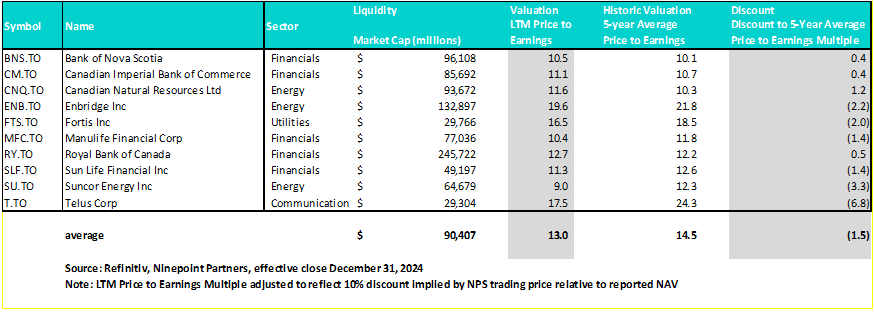

From the chart, we can see that our holdings, on average, trade at an LTM price to earnings multiple of 14.5x, compared to the 5-year average price to earnings multiple of 14.5x, almost exactly in line with history. However, given our outlook for lower interest rates (and supported by a significant discount to the S&P 500, which currently trades at about 21x forward earnings, according to FactSet), multiples still have plenty of room to expand in Canada. But with the Class A Shares trading approximately 10% below the reported NAV at the close on December 31, 2024, we can adjust this table to visualize the implied valuation today:

Information below is specific to individual securities held in the Portfolio. It is only intended to describe key characteristics of individual holdings at a point in time and makes no inference about the return nor yield of either the Preferred Shares or the Class A Shares of the Canadian Large Cap Leaders Split Corp.

The implied discount was currently 1.5x worth of multiple points at the close on December 31, 2024, which highlights the opportunity to buy our portfolio of Canadian high-quality, dividend payers significantly below long-term historic valuations through the purchase of shares of NPS on the open market. Given the discount, we continue to believe that buying stock today represents an attractive long-term investment opportunity for both new and existing shareholders and our Normal Course Issuer Bid remains in effect.

Finally, we would like to highlight that the Canadian Large Cap Leaders Split Corp has announced its next distributions, payable on January 14, 2025, to both Class A and Preferred Shareholders of record at the close of business on December 31, 2024. As planned, holders of the Class A Shares will receive the $0.12500 per share regular monthly dividend and holders of the Preferred Shares will receive the $0.18750 regular quarterly dividend.

As always, we appreciate the support of all those who have invested in the Canadian Large Cap Leaders Split Corp.

Until next month,

John, Jeff & Colin

Ninepoint Partners

December 31, 2024

December 31, 2024