The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Year in review

2024 saw the end of the hiking cycle in Canada, the U.S. and Europe. Central banks were on hold for most of the first half and started cutting rates in June after several months on hold, encouraged by lower headline and core inflation. However, the progress on inflation has been somewhat uneven, with the price of goods contributing to most of the decline, while services inflation remained elevated in jurisdictions where the labour market remains strong (i.e. the U.S. and Europe). Interestingly, that wasn’t the case in Canada, where the labour market had softened materially, resulting in a very dovish central bank cutting rates by a cumulative 175bps. It has been a good year for our strategies, which saw returns ranging between 7.93% for the Diversified Bond fund, to 10.16% for the Alternative Credit Opportunities fund. By contrast, the broad Canadian and U.S. bond indices gained about 4% and 1.3%, respectively.

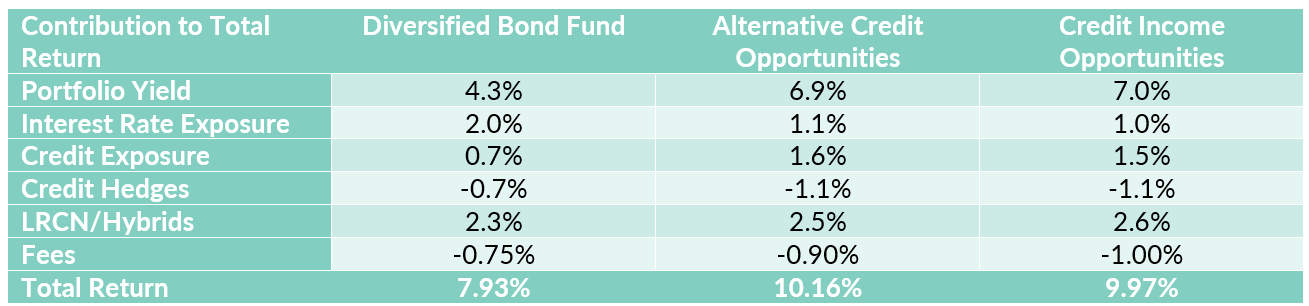

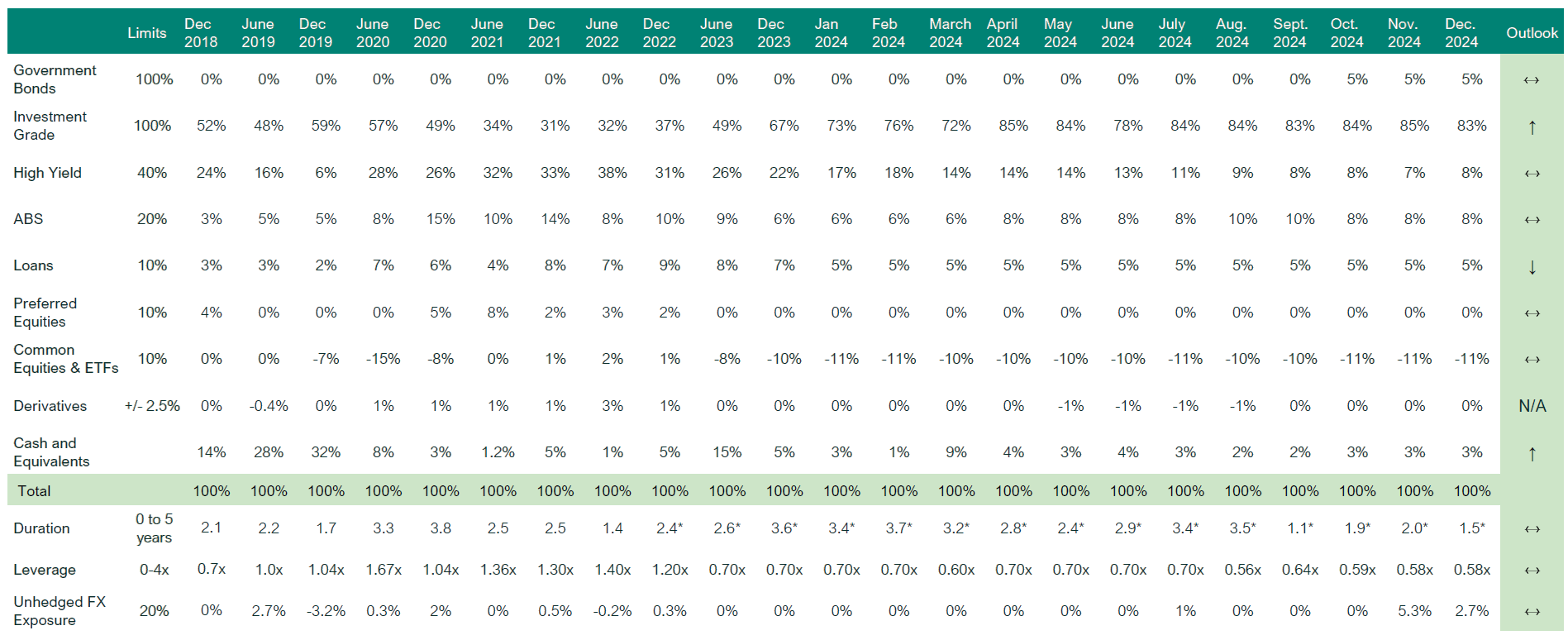

What drove performance in a tricky environment? The starting point in fixed income is always the portfolio yield, which acts as the first line of defense against price moves and volatility. At the beginning of 2024, our funds cash yield (or current yield) ranged between 4.3 to 7%. Of course, the funds benefited from aggressive Bank of Canada rate cuts, as we were predominantly positioned in short-term (1 to 3-year) Canadian bonds. Credit spreads also tightened (back to all-time tights), which resulted in additional gains. The main detractor to performance this year was our short position in U.S. High Yield (a credit hedge), which rallied along with all other risk assets. We remain committed to this hedging position and expect to retain it for the foreseeable future. Finally, our returns were enhanced by a strong contribution from Canadian LRCN and hybrid bonds, which we had dubbed the “cheapest in the world” in our 2024 outlook. The details for each mandate can be seen in Table 1 below.

Table 1: Summary Performance Attribution for 2024 (F-Class)

What do we think could happen in 2025?

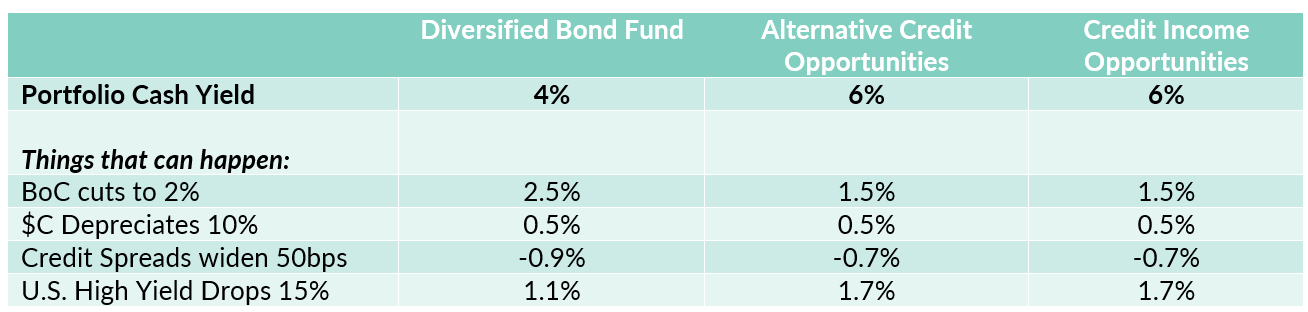

As mentioned above, portfolio yields are the first line of defense and an important starting point for returns in fixed income. As we exit 2024, our portfolios cash yields range from 4% to 6%. Still incredibly compelling relative to pre-pandemic levels. The balance of our projected 2025 return will be a function of price action and opportunities we uncover as conditions change.

Table 2 below summarizes the estimated impacts of a few things we think could happen in 2025 to our portfolios.

We remain of the view (explained in detail in our November commentary) that risks are to the downside for the Canadian economy, particularly in light of President-Elect Trump’s increasingly hawkish rhetoric. This should lead the BoC to cut rates beyond what is already priced-in (which isn’t much at this point), taking rates much lower in the front end of the Canadian curve (0-5 years). Given this view, we have positioned our funds accordingly, increasing interest rate exposure to the 0-5 year area of the curve to maximize returns.

As the trade war rhetoric heats up and monetary policy diverges further between Canada and the U.S., we expect to see more depreciation in the Canadian dollar. In this context, we now have a small net exposure to USD (3% currently, expecting it to increase to a maximum of 5%) through short term (1-year) investment grade US bonds. Not only are U.S. short-term rates higher, but if the Loonie was to depreciate further, we could see this become a very positive contributor to performance in 2025.

With credit spreads back to all-time tights across board (investment grade & high yield), risks are clearly tilted to the downside-wider credit spreads. Throughout history, there have been several periods of time where we saw credit spreads at these levels for extended periods of time (late 1990s and 2004-2007), so it is not inconceivable that spreads remain here for a while.

But, it is not hard to imagine a scenario where, just like in 2018, trade tensions lead to a slowing global and U.S. economy, causing risk assets to sell off. Although we have a very defensive posture in credit, we do own credit, and as such we will be vulnerable in this scenario. That is why we have credit hedges in the portfolios.

The last two rows in Table 2 below, give our best estimate of the impact on our portfolios of a 50bps increase in investment grade credit spreads and a 15% drop in High Yield prices, relative to our current positioning. As you can see, our portfolios will deliver higher income, but our positioning should protect that income and buffer the volatility, should it arise.

Table 2: Scenario Analysis for 2025

Conclusion

With the return of Trump to the White House and a Federal Election here at home, 2025 has the potential for lots of surprises and volatility. This isn’t anything new to us or something that challenges our convictions. We’ve been here before. We believe we are well positioned, with ample liquidity, hedges and a tool kit that allows us to be nimble.

To a happy and prosperous New Year,

Mark, Etienne & Nick

Appendix

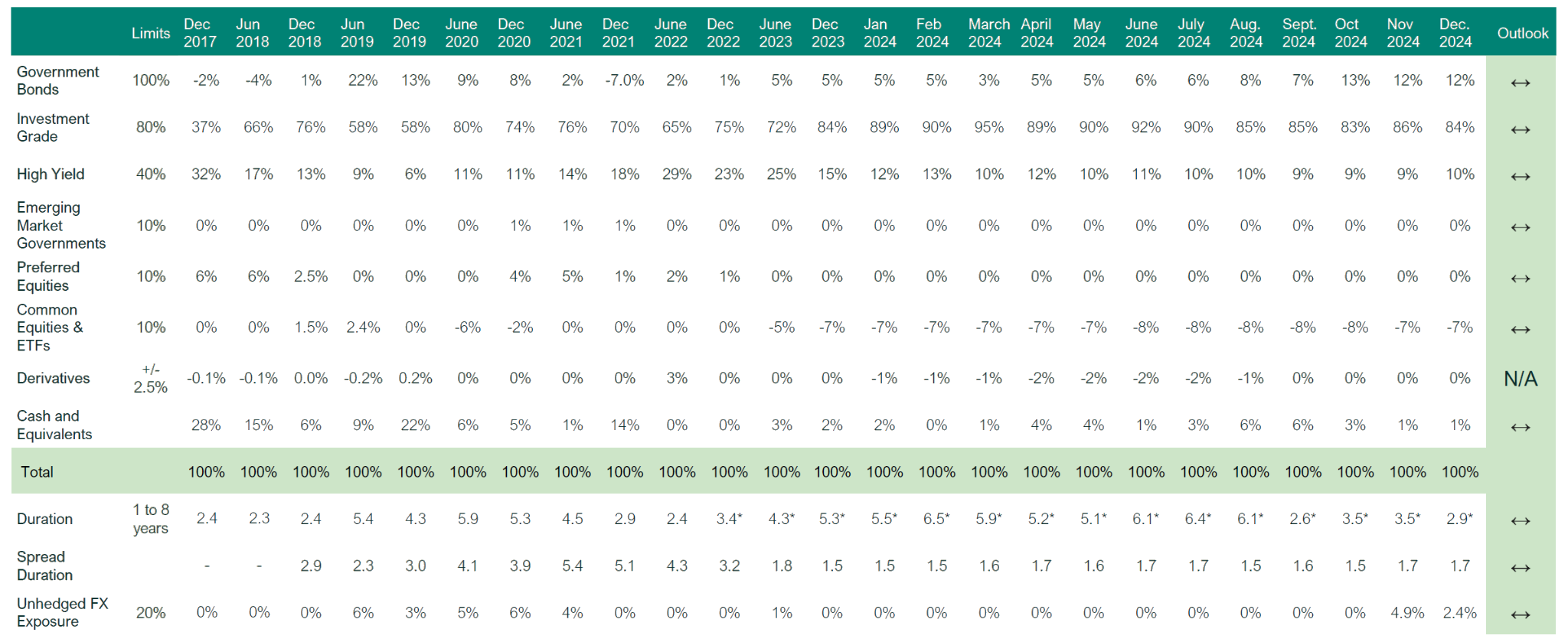

Ninepoint Diversified Bond Fund

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF DECEMBER 31, 2024 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

0.3% |

7.9% |

1.3% |

6.0% |

7.9% |

0.9% |

1.9% |

2.8% |

3.5% |

Ninepoint Alternative Credit Opportunities Fund

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF DECEMBER 31, 2024 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.8% |

10.2% |

1.8% |

5.0% |

10.2% |

2.6% |

2.5% |

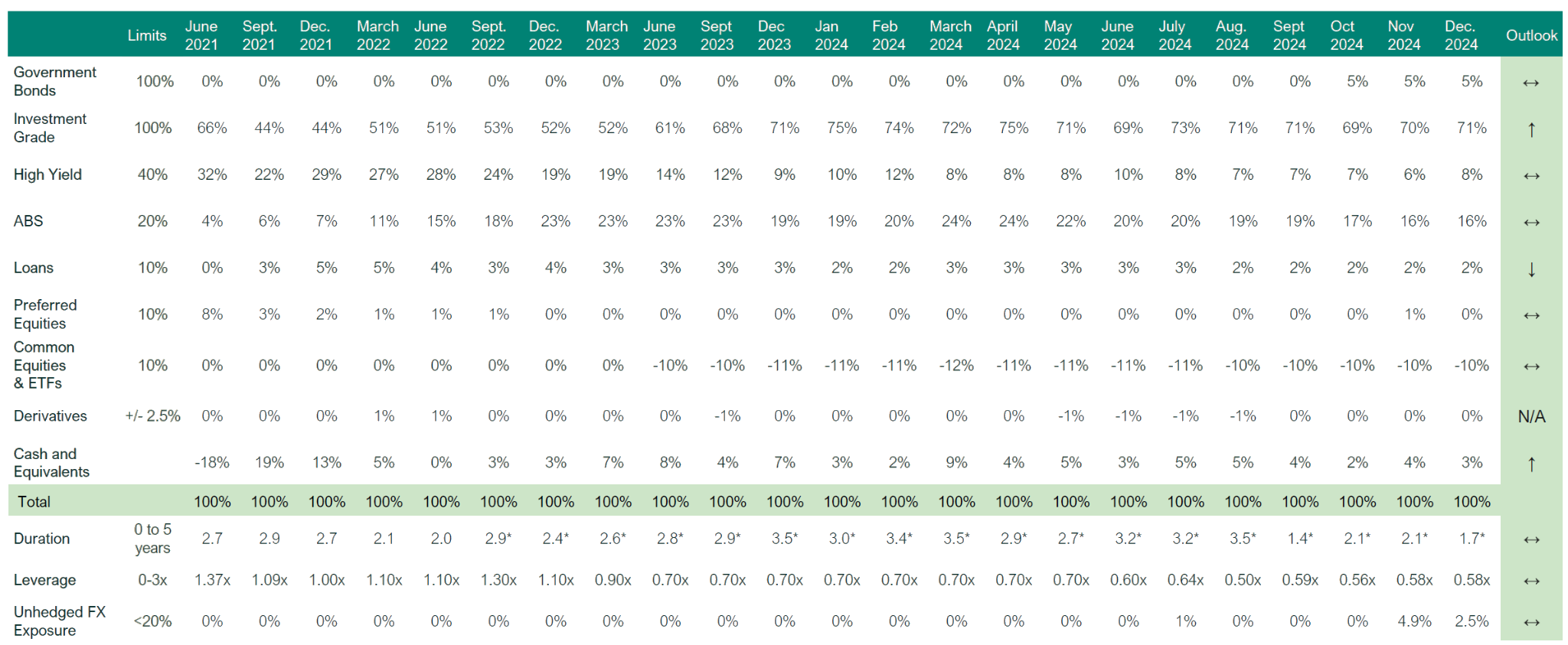

Ninepoint Credit Income Opportunities Fund

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF DECEMBER 31, 2024 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

0.6% |

10.0% |

1.7% |

4.8% |

10.0% |

3.2% |

6.0% |

5.0% |

December 31, 2024

December 31, 2024