Monthly Update

Year-to-date to December 31, the Ninepoint Global Infrastructure Fund generated a total return of 25.42% compared to the MSCI World Core Infrastructure Index, which generated a total return of 15.32%. For the month, the Fund generated a total return of -4.81% while the Index generated a total return of -4.26%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of December 31, 2024 (Series F NPP356) | Inception Date: September 1, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

-4.81% |

25.42% |

3.19% |

16.05% |

25.42% |

9.27% |

9.55% |

7.72% |

8.36% |

MSCI World Core Infrastructure NR (CAD) |

-4.26% |

15.32% |

-0.24% |

12.47% |

15.32% |

4.86% |

5.46% |

7.94% |

10.73% |

It was another excellent year for equities (and most other asset classes), with the S&P 500 posting a +23.3% return (+25.0% on a total return basis), making it two years of +20% returns in a row. The Dow Jones Industrial Average posted a +12.9% return (+15.0% on a total return basis) but, once again, the tech-heavy NASDAQ led the pack and posted a +28.6% return (+29.6% on a total return basis). For Canadian domestic investors, the TSX posted a +18.0% return (+21.7% on a total return basis), which was a relatively decent performance. Broadly speaking, US stocks outperformed international stocks, large caps outperformed small caps and growth outperformed value, consistent with the trends of the past several years. Crude oil was essentially flat for the year, most bond indexes posted positive returns and both gold and bitcoin posted significant gains.

The only minor disappointment of 2024 was the failure of a Santa Claus rally to materialize over the last five trading days of the year. We know that we can’t really complain about much in 2024, but we did observe some weakness through the back half of December that was masked at the index level by strong year end performance of the Magnificent 7 stocks. We would attribute much of the underlying weakness to the US Federal Reserve and the “hawkish cut” on December 18th, when the FOMC cut the target interest rate by 25 basis points to a range of 4.25% to 4.50%. However, the ensuing press conference and the details contained in the Summary of Economic Projections seemed far less dovish than prior meetings, with only two interest rate cuts now forecasted in 2025, down from four cuts. We would point out that market expectations were already there, with the forward curve pricing in only two interest rate cuts in 2025 several months ahead of the final Fed meeting of 2024.

We do wonder if at least some of the hawkish shift was in anticipation of President Trump and his incoming administration’s policies (primarily aggressive fiscal spending and tariffs on foreign-produced goods) that could be largely inflationary. However, we are not convinced that resurgent inflation is lurking around the corner, since some of the President-elect’s policies may prove to be deflationary, and it remains to be seen what will ultimately be enacted. Unfortunately, this change in tone from the Fed was frustrating for many investors, since Chairman Powell had previously taken great pains to highlight his (backward-looking) data dependency.

In any case, the market impact was largely in line with our prior views: if interest rate cuts came in below expectations (implying fewer cuts than expected), large cap growth would outperform but if interest rate cuts came in above expectations (implying more cuts than expected) a rotation from growth to value would occur. As of today, this much anticipated rotation from growth to value has not persisted for longer than a few months at a time but in 2025, as earnings growth rates begin to converge for growth and value stocks, it is possible that we could see better relative performance from value. In the meantime, generally lower interest rates remain supportive for the equity markets as long as the economic data does not deteriorate significantly from here.

Into 2025, we are optimistic for continued positive equity performance and the underlying weakness in December offers a better setup for the year. However, we are mindful that volatility around inauguration day and the potential for portfolio rebalancing during Q1 could create some weakness at the index level. Again, we think that the growth rate differential between the Mag7 and the rest of the market should narrow in 2025, which could support a more lasting rotation from growth to value stocks. Importantly, with S&P 500 consensus earnings estimates rising through 2024, and currently at approximately $280 for 2025 and approximately $305 for 2026 (according to LSEG), we still think equity markets can post solid gains in 2025.

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Utilities (+1,419 bps), Energy (+868 bps) and Industrials (+383 bps), while top detractors by sector included Communication Services (-39 bps) and Information Technology (-19 bps) on an absolute basis.

On a relative basis, positive return contributions from the Utilities (+526 bps), Industrials (+351 bps) and Real Estate (+272 bps) sectors were offset by negative contributions from the Communication Services (-45 bps) and Information Technology (-22 bps) sectors.

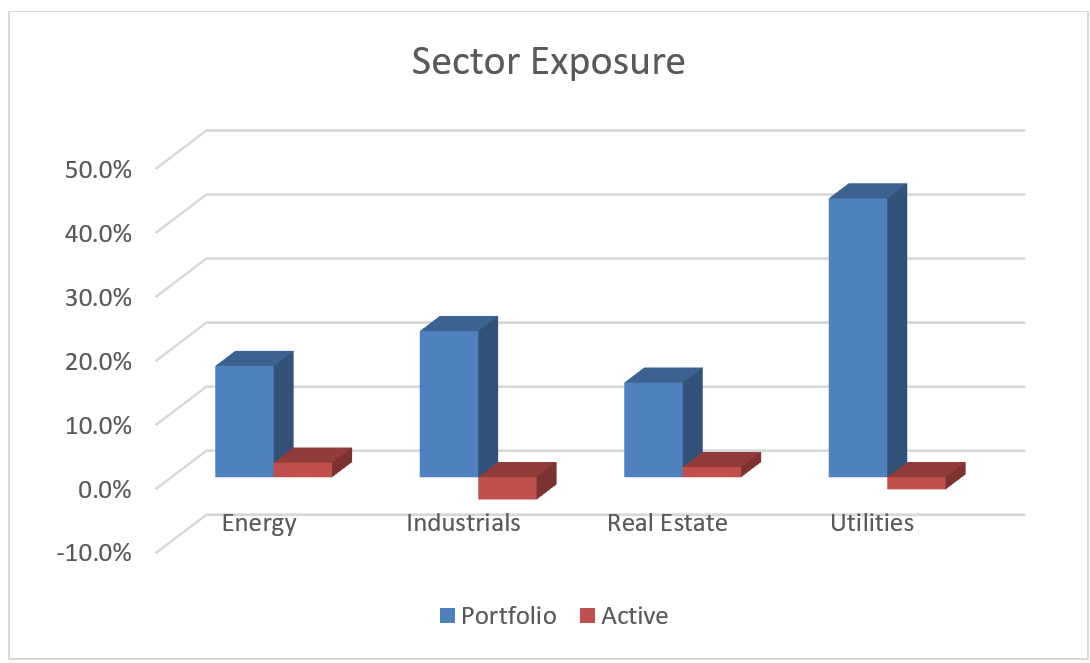

We are currently slightly overweight the Energy and Real Estate sectors and slightly underweight the Industrials and Utilities sectors. As we approach inauguration day, we will be carefully watching for policy announcements from the incoming President’s administration and the potential impact on growth and inflation expectations. Although we are optimistic about 2025, the key question for the equity markets will be whether President Trump’s policies prove significantly inflationary, thus creating a spike in bond yields.

If we do see a spike in inflation and interest rates, we plan to actively manage our exposure in the Ninepoint Global Infrastructure Fund by reducing interest rate-sensitive sectors (Real Estate and Utilities) and adding more GDP/inflation-sensitive sectors (Energy and Industrials). In the meantime, we remain focused on high quality, dividend paying infrastructure assets that have demonstrated the ability to consistently generate revenue and earnings growth through the business cycle.

Finally, we continue to believe that the infrastructure asset class is ideally positioned to benefit from two significant investment themes for many years ahead: the Electrification of the US Economy and the Energy Transition. Importantly, electricity demand is expected to accelerate dramatically, led by the construction of AI-focused data centers, the onshoring of industrial manufacturing and the continued growth of electrified transportation. Therefore, we are comfortable having exposure to various infrastructure sub-sectors or sub-industries, including traditional energy investments, and electrical, natural gas, nuclear or multi-utilities in the Ninepoint Global Infrastructure Fund to take advantage of these themes.

The Ninepoint Global Infrastructure Fund was concentrated in 30 positions as at December 31, 2024 with the top 10 holdings accounting for approximately 37.2% of the fund. Over the prior fiscal year, 23 out of our 30 holdings have announced a dividend increase, with an average hike of 13.5% (median hike of 5.6%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

December 31, 2024

December 31, 2024