Silver’s Outlook Remains Robust

Silver had a strong 2024, rising 21.46% through the year. The Silver Institute expects that silver will yet again be in a deficit for 2024 as robust industrial demand for silver is expected to continue. The supply demand deficit is expected to continue for the fourth consecutive year. During the first three quarters of 2024, strong demand for silver and rising premiums seen in China catalyzed a move to nearly $35 per ounce—the highest level since 2012. If it were not for the large pullback silver experienced in Q4, silver would have outperformed gold’s exceptional returns.

According to Philip Newman, Managing Director, and Sarah Tomlinson, Director of Mine Supply at Metals Focus, global silver demand is expected to reach 1.21 billion ounces in 2024. This growth is underpinned by record-breaking industrial consumption and a recovery in the jewelry and silverware sectors, while mine supply is anticipated to rise by just 1%.

Industrial silver demand is forecasted to increase by 7% in 2024, surpassing 700 million ounces for the first time. This expansion is primarily driven by green economy applications, particularly within the solar energy sector. Additionally, the increasing sophistication of components in the automotive industry is expected to elevate silver usage. Other sectors are also forecasted to grow, with silver jewelry and silverware demand projected to rise by 5%, led by strong consumption in India. Jewelry demand in the United States is similarly expected to experience growth, according to Metals Focus.

Exchange-traded products (ETPs) are on track to record their first annual inflows in three years, bolstered by expectations of Federal Reserve rate cuts, periods of dollar depreciation, and declining bond yields, which have enhanced silver’s attractiveness as an investment. However, physical investment in silver, including coins and bars, is expected to decline by 15% to a four-year low of 208 million ounces. This decline is largely concentrated in the United States, where coin and bar demand has fallen by 40%, reflecting the absence of new crises to drive investment.

Amid rising demand, global mine production is projected to grow modestly by 1% year-over-year, reaching 837 million ounces. Silver’s supply demand deficit is highlighted by limited growth in silver mine production versus demand that continues to outpace supply. We are likely to witness yet another year of silver deficit in 2025, which in turn points towards a potential for a silver supply squeeze as above ground stockpiles reach precipitously low levels. We saw an analogue of this play out in palladium. As demand outgrew supply without a supply response, palladium ran from ~$520/oz in 2016 to north of $3000/oz in 2021.

Miners continue benefiting from record margins

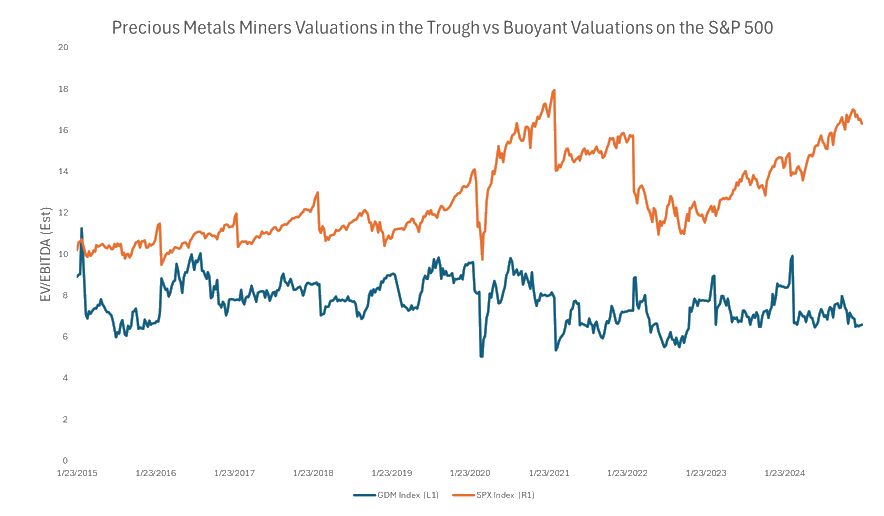

Through 2024, gold averaged $2388/ounce while silver averaged just over $28/ounce. Despite the weakness in gold and silver during Q4, both metals were trading above their 2024 averages. The strength in gold and silver have been a boon for producers who are expected to generate record profit margins in 2024 at prevailing metal prices while also delivering strong EPS and FCF growth. Valuation multiples remain historically low as general investors have not ventured into precious metal equities. We believe general investors remain hypnotized to the AI/tech flame. In the meantime, precious metal equities have continued to post strong price returns while sporting the sweet combination of low multiples and rising earnings.

It is important not to lose sight of the big picture here. We are in a precious metals bull market and the all-round performance of precious metals through 2024 will likely be seen as an opportune entry point.

We remain bullish towards silver above all things precious in 2025.

Maria Smirnova and Shree Kargutkar

Sprott Asset Management

Sub-advisor to the Ninepoint Silver Equities Fund and the Ninepoint Silver Bullion Fund

NINEPOINT SILVER BULLION FUND - COMPOUNDED RETURNS¹ AS OF DECEMBER 31, 2024 (SERIES F NPP326) | INCEPTION DATE: MAY 9, 2011

MTD |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

-3.05% |

30.28% |

-1.45% |

3.78% |

30.28% |

10.59% |

10.79% |

6.67% |

-0.98% |

NINEPOINT SILVER EQUITIES FUND - COMPOUNDED RETURNS¹ AS OF DECEMBER 31, 2024 (SERIES F NPP866) | INCEPTION DATE: FEBRUARY 28, 2012

MTD |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

-8.71% |

18.25% |

-7.76% |

2.75% |

18.25% |

-7.80% |

1.30% |

5.47% |

-1.87% |

December 31, 2024

December 31, 2024