Ninepoint Target Income Fund - Q4 2024 Year-End Commentary

The first half of 2024 witnessed unusually low index volatility, characterized by muted correlations between equities and low single-stock volatility. The VIX Index, a key volatility measure, averaged a mere 13.5 during this period, reminiscent of pre-COVID market conditions. This was a key contributor to the lower premium potential through 2024 as volatility rose in the second half, with the VIX index averaging 17, closer to the 10-year average of 18.5. Our expectation is that the low volatility regime of the first half will be the exception not the norm, with equities witnessing a more normalized (higher) volatility environment going forward offering the potential for higher put premiums on newly initiated puts.

Higher average volatility, while offering increased income potential, also comes with heightened risks. This was acutely demonstrated in August 2024 when equities experienced a sudden and dramatic surge in volatility, triggered by the unwinding of Yen carry trade positions. During this challenging period, the Ninepoint Target Income Fund provided defensive attributes, with the F class experiencing a relatively modest decline of -57bps during the August 1st to 6th drawdown. The fund's subsequent recovery, with a return of 37bps in August, showcased the ability to weather volatile markets.

Despite expectations of a return to a more normalized (higher) volatility environment, offering higher potential put premiums, the recent decline in short-term cash yields due to ~150bps of rate cuts by the Bank of Canada has had a counterbalancing effect. As a reminder, cash-secured put selling generates income through both put premiums and short-term cash yields. In response to changing market dynamics, the distribution rate for the Target Income Fund has been adjusted to 5% from 6%, aligning with the lower income potential of many common income-focused investments, which have also seen yields moderate in sympathy with lower short-term rates.

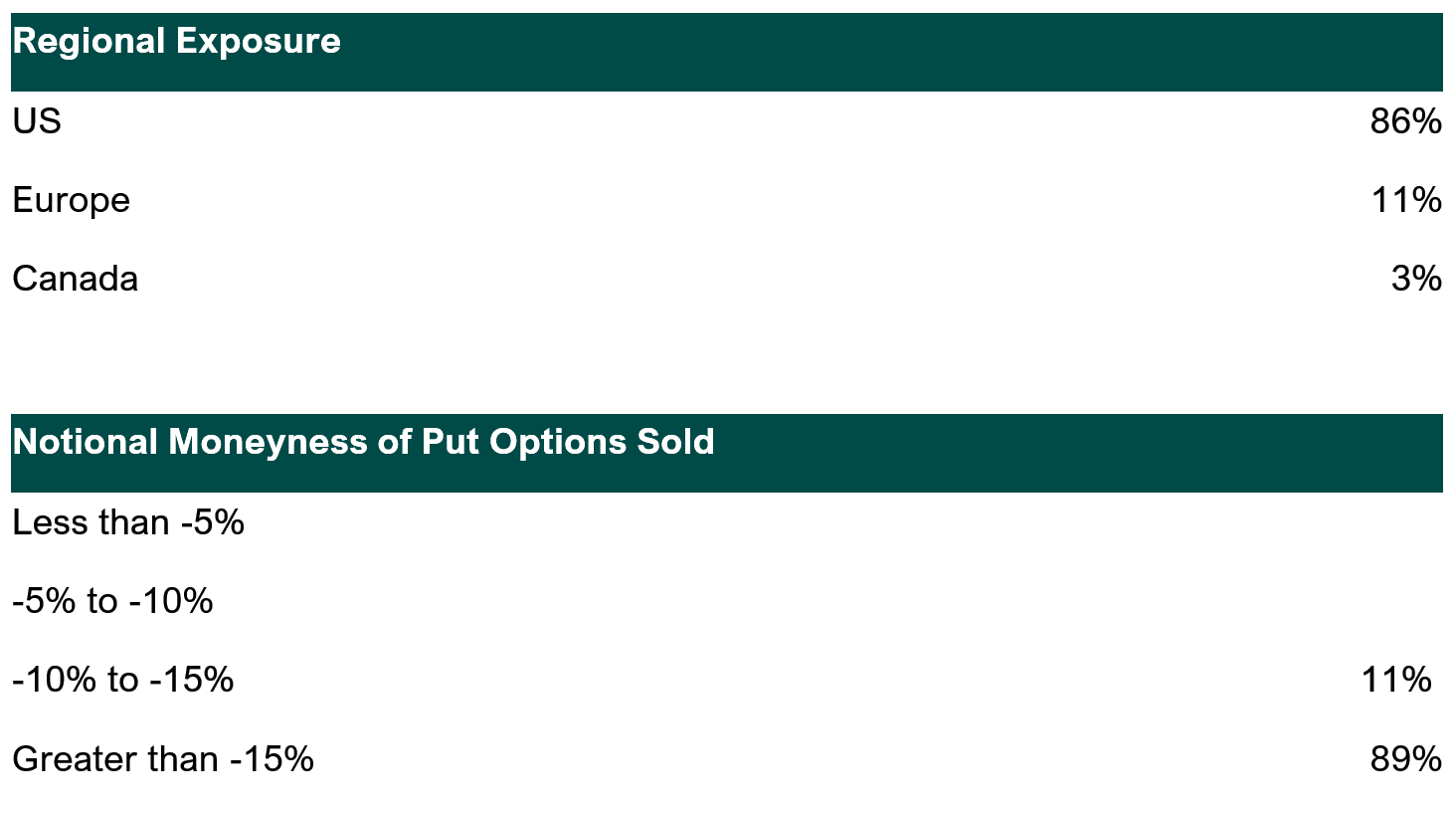

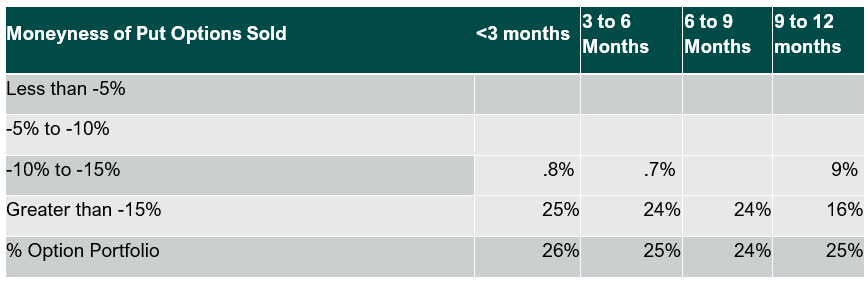

The investment strategy prioritized a conservative approach, rolling put ladders at just under 15% out-of-the-money for new 1-year put options. This provided moderate rolling downside protection, before option premiums and investment principal are at risk upon expiry. A quarter of the Target Income funds options portfolio was rolled into new 1-year put options in mid-December. Most of the portfolio was positioned with strikes greater than -15% out-of-the-money at year-end. This posture aims to weather volatile markets, manage potential losses during market declines while providing the income potential and diversification income portfolios seek.

Colin Watson

Portfolio Manager

Ninepoint Partners

Why Invest in the Ninepoint Target Income Fund?

-

Defensive Equity Income Strategy:

Generates an annual 5% target income distribution with the potential for moderate downside protection in market declines.

-

Income Diversification:

Provides a differentiated income stream via put option premiums to complement traditional income portfolios.

-

Active Risk Management:

Ability to manage risk and index exposures to achieve investment goals.

December 31, 2024

December 31, 2024