The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

While still feeling the effects of the largest rate hike cycle since the 1980s, the global economy finished 2024 in a vulnerable state. In response, central banks started cutting rates, hoping to revive demand and investment. Unfortunately, the world is now faced with another negative shock: Trump and his love of trade wars. There is no telling how far a trade war will go, but one thing is certain, the U.S. President strongly believes that tariffs are the tool of choice to enact retribution against America’s allies and enemies alike.

This is by far the largest downside risk to the global economy, and at its January meeting, the Bank of Canada did its best to analyse the potential repercussions. The bottom line: a recession is likely under the worst of scenarios. As the Governor said during the press conference, with inflation back at target and the Canadian economy already operating under potential, there is room for monetary policy to help (i.e. cut rates further). We expect the Bank of Canada to continue cutting rates this year into stimulative territory (i.e. 2% or under). Our funds are positioned accordingly, with substantially all of our interest rate exposure in the front end of the Canadian curve (5-years and under), to benefit the most from further rate cuts.

Even if we somehow manage to avoid the worst of the tariffs, the damage to business confidence is here to stay. Why would one invest when, at the stroke of a pen, the U.S. President can completely change the economic environment. The domestic economy has been weak, and the risks continue to remain tilted to the downside.

In the U.S., the FOMC remained on hold in January, and Chair Powell told us they can remain patient. Why cut when inflation remains elevated, growth is strong, and the labour market remains at full employment. While growth might be hurt by the trade wars, they are also inflationary, which puts the Fed in a pickle. A one-off increase in inflation is something the central bank could usually look through, but with the labour market still tight (and potentially getting tighter with all the immigration policies getting implemented there), could an increase in goods prices lead to another wage-price spiral? That is certainly a risk that, in the current circumstances, is unique to the Fed and the U.S. economy.

With that, we expect monetary policy in Canada and the U.S. to continue to diverge, keeping downside pressure on our currency. Since November, we have been building a position in U.S. dollars, buying short term high quality corporate bonds with yields around 5%. Not only do we get a higher yield than for equivalent bonds in Canada, we gain exposure to the U.S. dollar, which has been appreciating. Now, there is a limit to how much foreign currency exposure we want in the funds, and we are more or less at that limit right now. Across the funds, we have a 10% U.S. dollar exposure, which we fully hedged with options, resulting in a net delta notional weight of about 5% – an exposure we think is tactical in the current environment. This options wrapper allows us to partially benefit from a continued appreciation in the U.S. dollar, up to a certain point (laddered short call positions at 1.47, 1.50 and 1.51), while remaining hedged if the Canadian dollar was to suddenly rally (laddered put-spreads at 1.42/1.38 to 1.39/1.33). We see this as the best of both worlds: tail hedge with dollars, more yield for the funds.

Credit

Throughout January, the corporate new issue market felt very soft in Canada. Deals were poorly attended (low number of buyers) and often didn’t perform well in secondary markets. This is usually a sign that the tide is turning. With the 25% tariffs on Canadian goods becoming increasingly real, we have seen a large back up in credit spreads late in January and into early February. The situation remains extremely fluid, but one thing is certain, market participants can no longer dismiss the threat of trade actions as mere negotiating tactics.

In preparation for what seemed like an inevitable trade war, we have trimmed exposure to sectors that we thought would be most vulnerable (autos) and higher volatility credit (low-coupon LRCN). Spread duration across the funds is low, and we have credit hedges for additional protection, and therefore feel like we are well positioned for volatility. There will be a time when it makes sense to add to credit risk, but we are a long way from that. Dry powder remains high.

Individual Fund Discussion

Ninepoint Diversified Bond Fund

January was a very good month for the fund returning 1.07%. Duration moved up slightly to 3.5 years (from 3.2 last month) as we added more 5-year Canadian bond futures. The fund’s yield to maturity continues to grind lower, now standing at 4.5%. This is due to lower rates and the monetization of our low-coupon LRCN positions.

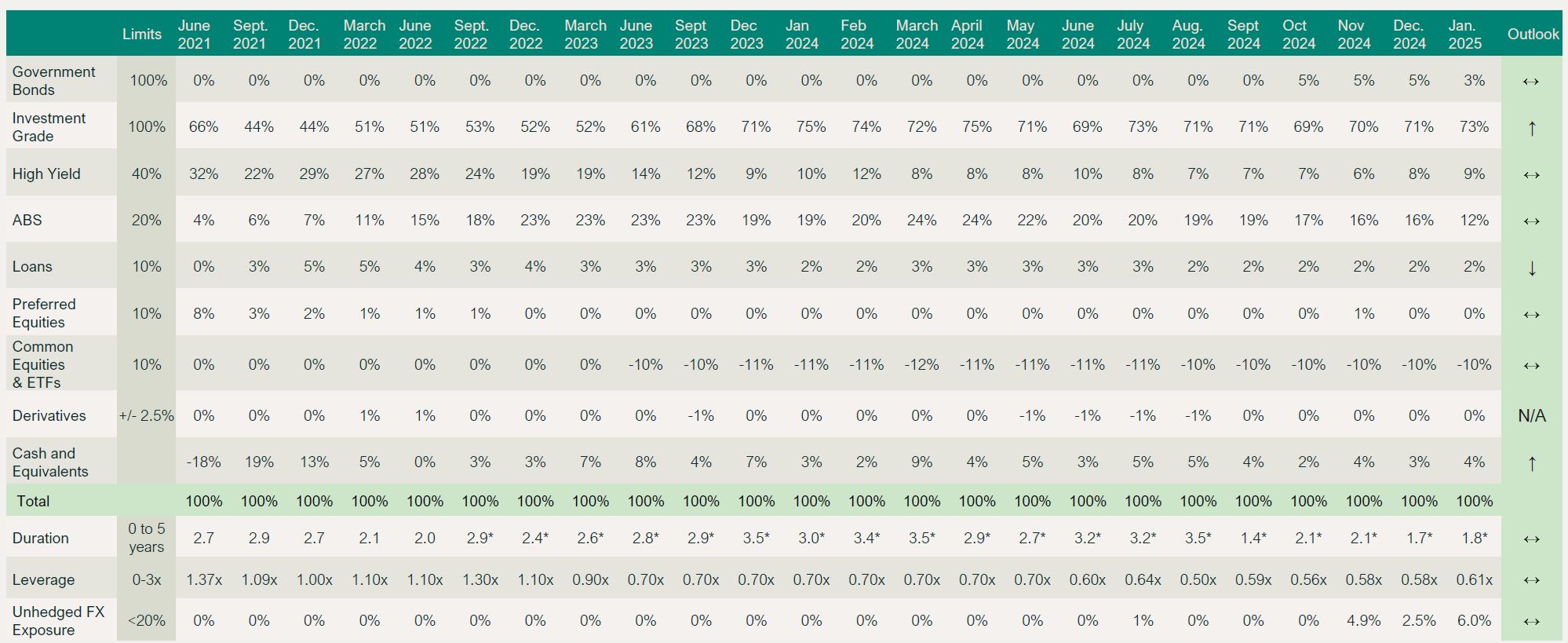

As explained above, we have a net 5% position in U.S. dollars and a short position in the HYG and JNK ETFs, which we see as a good credit hedge (shown in “equities/ETFs” in the table below).

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF JANUARY 31, 2025 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

1.07% |

1.07% |

2.24% |

5.00% |

9.36% |

1.85% |

1.86% |

2.55% |

3.58% |

Ninepoint Diversified Bond Fund – Portfolio Characteristics

Ninepoint Alternative Credit Opportunities Fund

The fund had a good month returning 77 basis points. Duration was almost unchanged at 1.8 years month-over-month. Leverage remains low at 0.6x given the full valuations in credit. Yield to maturity declined to 5.2% with rates and less exposure to LRCN. As discussed above, we have a 5% net weight in U.S. dollars.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF JANUARY 31, 2025 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.77% |

0.77% |

2.15% |

4.52% |

10.46% |

3.45% |

2.63% |

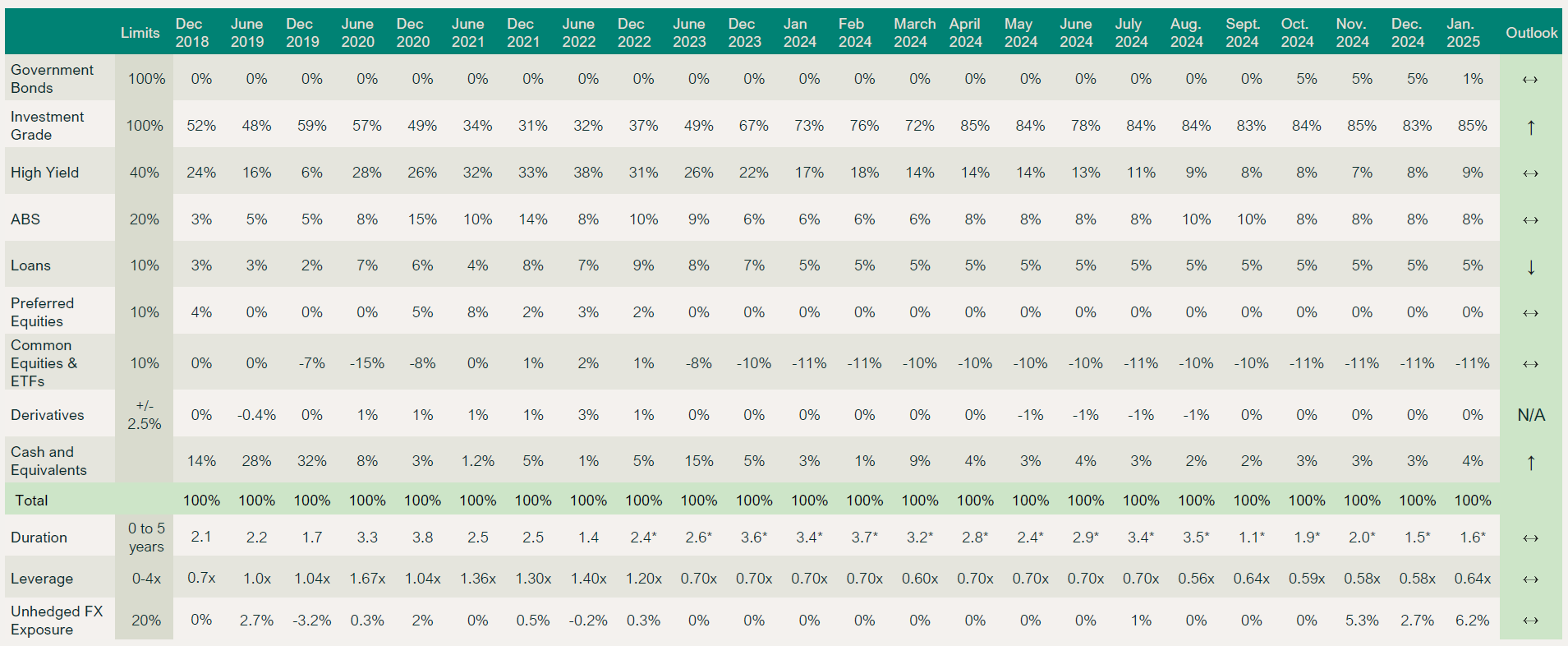

Ninepoint Alternative Credit Opportunities Fund – Portfolio Characteristics

Ninepoint Credit Income Opportunities Fund

The fund generated 82 basis points in January, a strong start to the year. Leverage was flat on the month sitting at 0.6x given how tight credit spreads remain. Duration moved up ever so slightly to 1.6 years while yield-to-maturity declined 50 basis points ending the month at 5.5% (lower rates and less LRCN). As with the other funds, we now have a net 5% exposure to USD.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF JANUARY 31, 2025 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

0.82% |

0.82% |

1.99% |

4.42% |

10.01% |

4.02% |

6.01% |

5.03% |

Ninepoint Credit Income Opportunities Fund – Portfolio Characteristics

Conclusion

This trade war is an unfortunate reality. As a country, this is a wake-up call to diversify our trade relationships, reduce interprovincial trade barriers, cut red tape and invest for growth. In the past, it had been too easy to simply trade with the large client next door. We have other free trade agreements, and it's time to use them. This is a great opportunity for our country to stand together and buy Canadian as much as we can!

Until next month,

Mark, Etienne & Nick

January 31, 2025

January 31, 2025