Monthly Update

Year-to-date to January 31, the Ninepoint Global Infrastructure Fund generated a total return of 4.49% compared to the MSCI World Core Infrastructure Index, which generated a total return of 2.42%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of January 31, 2025 (Series F NPP356) | Inception Date: September 1, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

4.5% |

4.5% |

5.7% |

15.1% |

33.0% |

12.3% |

9.1% |

7.6% |

8.7% |

MSCI World Core Infrastructure NR (CAD) |

2.4% |

2.4% |

2.0% |

6.8% |

20.3% |

6.7% |

5.0% |

7.2% |

10.9% |

Despite a weak December (specifically post Fed meeting), 2024 was an excellent year for stocks and it felt much less volatile than most years because of the steady gains. However, with President Trump’s inauguration and his new administration now in Washington, it made sense to prepare for greater volatility as a slew of Presidential Executive Orders looked set to hit the tape. The final week of January somehow managed to surpass our expectations for greater volatility, with the introduction of DeepSeek to the world, a Fed meeting where they paused monetary policy easing and a US-instigated trade war with everyone from its closest neighbors and allies to its largest adversaries.

DeepSeek, the Chinese AI company that develops open-source large language models, was shocking since it appeared to perform nearly as well as existing AI models from OpenAI (the developer of ChatGPT) for a fraction of the cost. This called into question the entire AI-trade that had captivated investors through 2024, hitting everyone from semiconductor manufacturers, industrial and electrical equipment manufacturers, data center operators and even power producers. However, upon greater analysis and reflection, DeepSeek works well enough but is likely a mix of incomplete accounting, intellectual property theft and outright propaganda. It does serve as a stark reminder that technology always becomes better, cheaper and more efficient over time. We doubt that any US-based company will be able to integrate or monetize the use of DeepSeek and we have already seen attempts to ban or block the chatbot. Further, the US-based hyperscalers will continue to spend almost unbelievable amounts to maintain their technological advantage and therefore we think that the AI-trade is far from over.

The second major catalyst was the US FOMC meeting on January 29, where the Fed refrained from lowering interest rates after cutting a total of 100 bps over the prior three meetings. This should not have been a surprise to anyone after the December FOMC meeting, given comments suggesting that several members of the FOMC were concerned about the impact of future fiscal policies (which should be interpreted as the threat of tariffs) on the growth and inflation outlook. There were a few minutes of concern after the release of the statement when some pointed out the removal of the phrase “…has made progress toward the Committee’s 2 percent objective…” (regarding inflation) but Powell quickly confirmed in the press conference that they were just “cleaning up” the language. Today, based on the interest rate forward curve, the market is expecting one or two more cuts in 2025, likely around July and December, and we broadly agree with this assessment.

Finally, on the last Friday of January, we began hearing rumblings of Trump’s strategy of instigating a trade war to achieve his egocentric worldview. Word spread that he was about to slap 25% tariffs on his two closest trading partners, Canada and Mexico, and 10% additional tariffs on China to right past perceived wrongs, improve border security, reduce the flow of fentanyl, incentivize industrial onshoring, fix trade imbalances, boost defense spending and whatever other goals he could come up with. Clearly, the world is more complicated than he understands it to be and the adverse market reaction, across equities, fixed income and currencies signalled how misguided he is. Thankfully, Mexico and Canada received a temporary reprieve from the tariffs after high-level calls with the President of Mexico and the Prime Minister of Canada on the following Monday. But this should serve as a reminder that President Trump would likely want to annex our country if given half a chance and, as Canadians, we must unify to strongly oppose any policies that could weaken the bond between our two countries. We must also use this as a warning and look to strengthen our domestic economy, diversify our international trade network, build oil and gas export infrastructure and improve our standing globally so that we cannot be bullied into submission by our southern neighbour.

Beyond the wild week of (negative) macro catalysts, earnings, the biggest factor that drives stocks and the markets over the long-term, have been quite good. According to FactSet, with 62% of the S&P 500 companies having reported actual results, 63% of the companies have reported a positive revenue surprise and 77% of the companies have reported a positive EPS surprise. Currently, the blended year-over-year earnings growth rate for the S&P 500 is 16.4%, the highest year-over-year growth rate since Q4 2021. For 2025, we are optimistic for continued positive equity performance and volatility through the year will likely offer many investment opportunities. Importantly, with S&P 500 bottom-up consensus earnings estimates currently at approximately $272 for 2025 and approximately $309 for 2026 (according to FactSet), we think equity markets can still post solid gains in 2025.

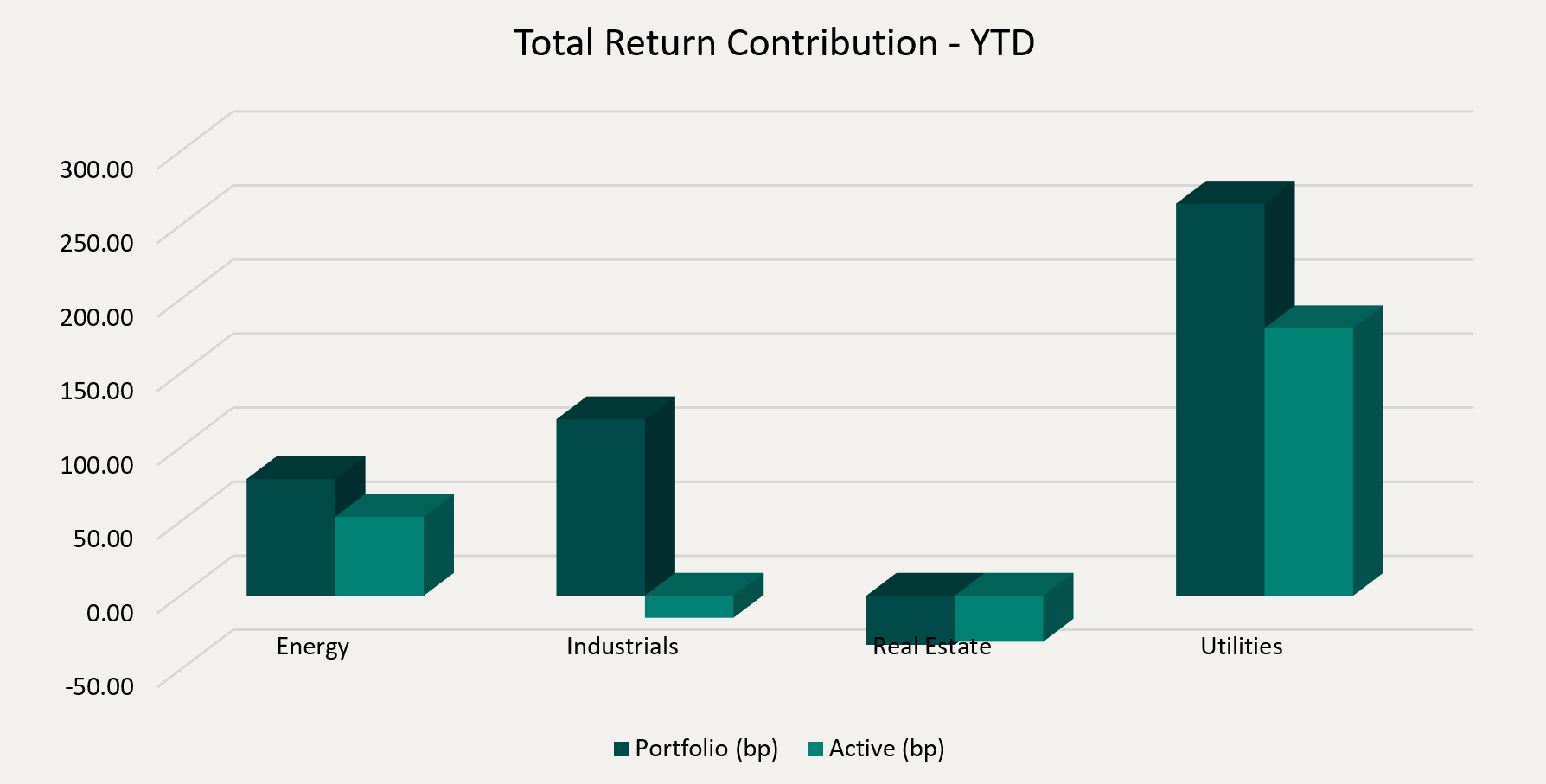

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Utilities (+265 bps), Industrials (+119 bps) and Energy (+79 bps), while only the Real Estate (-33 bps) sector detracted from performance on an absolute basis.

On a relative basis, positive return contributions from the Utilities (+181 bps) and Energy (+53 bps) were offset by negative contributions from the Real Estate (-31 bps) and Industrials (-15 bps) sectors.

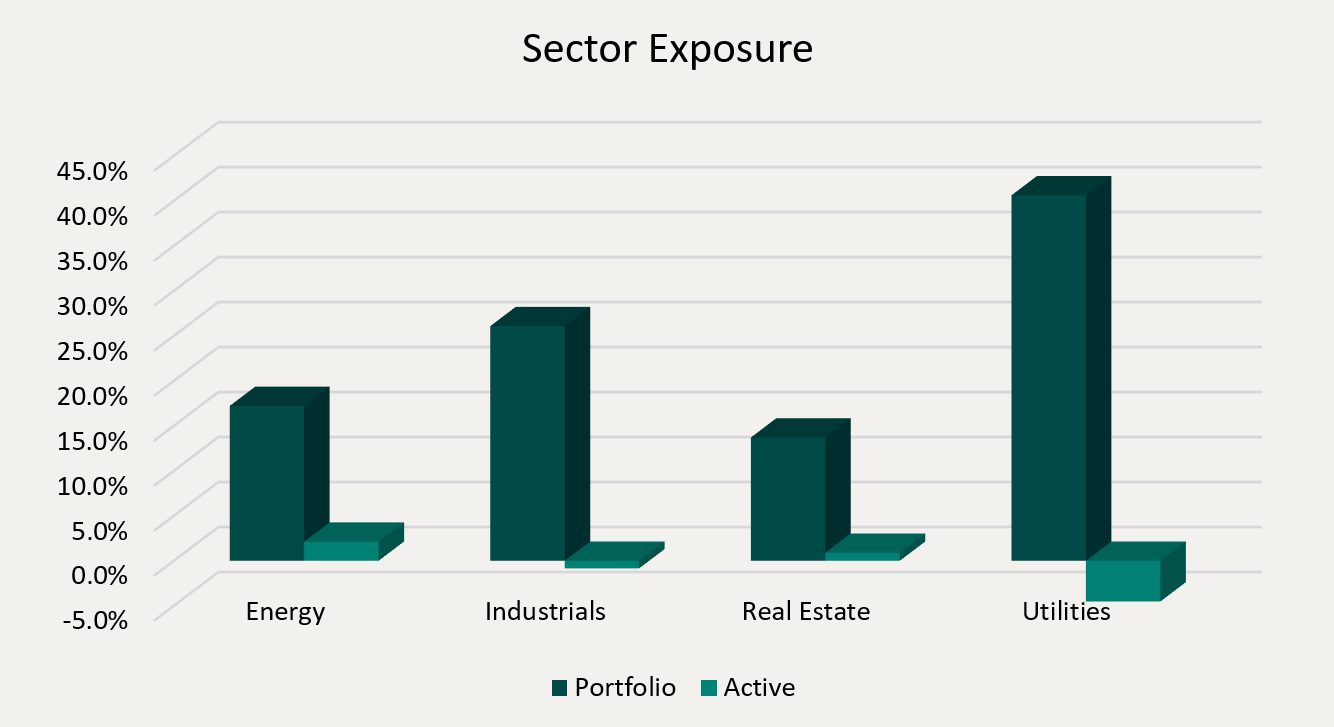

We are currently slightly overweight the Energy and Real Estate sectors and slightly underweight the Industrials and Utilities sectors. Just a few weeks into President Trump’s second term, policy announcements from his administration have already led to greater volatility in the equity, fixed income and currency markets. Although we are optimistic about 2025, the key question for the equity markets will be whether President Trump’s policies prove significantly inflationary, thus creating a spike in bond yields.

Finally, we continue to believe that the infrastructure asset class is ideally positioned to benefit from the Electrification of the US Economy investment theme and the related Energy Transition theme. Importantly, electricity demand is expected to accelerate dramatically, led primarily by the construction of AI-focused data centers and the onshoring of industrial manufacturing. Therefore, we are comfortable having exposure to various infrastructure sub-sectors or sub-industries in the Ninepoint Global Infrastructure Fund that are positioned to benefit from these themes, including traditional energy investments, and electrical, natural gas, nuclear or multi-utilities.

The Ninepoint Global Infrastructure Fund was concentrated in 30 positions as at January 31, 2025 with the top 10 holdings accounting for approximately 37.6% of the fund. Over the prior fiscal year, 21 out of our 30 holdings have announced a dividend increase, with an average hike of 11.6% (median hike of 4.6%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

January 31, 2025

January 31, 2025