The Ninepoint Cannabis & Alternative Health Fund is focused on the key drivers affecting cannabis, health and wellness, pharma and consumer health sectors. We invest in companies that are embracing new modalities, innovative technology and effective distribution. We believe that people globally are becoming more aware of alternative treatments and seeking out the best providers of select services. Our goal is to invest in those companies best positioned to take advantage of these macro changes.

Summary

In this month’s commentary, we review the quarterly and year-end financial results of the top ten holdings in the US cannabis sector as well as the top ten consumer name Walmart Inc (WMT). We also dive into the hemp-derived drink industry, a sub-category of the US cannabis sector that is gaining traction amongst producers and consumers alike. Given the new White House Cabinet focus on deficit reduction, we discuss the potential impact and portfolio implications this overarching policy approach will have on the consumer health, healthcare and pharmaceutical sectors.

Equity Market Dynamics

Equity markets have become more volatile evidenced by the recent Cboe Volatility Index reaching 20+. Headlines from Washington focus on the uncertainty created by new tariffs and job losses from government efficiency plans. The market has reacted negatively to tariffs and retaliatory tariffs as these announcements affect investor outlook. Although the private sector drives the economy, it is important to note that over the last 3 years, a high percentage of job creation emanated from government vs historic norms. Given the current focus on making the US government more efficient, that is going to moderate consumer sentiment. The Fund management team anticipates that Q1-25 US GDP could reflect a decrease in consumer and government spending as the Trump administration begins to implement fiscal restraint in domestic and foreign policy areas. The stated goal is to reduce the deficit and get the US back to a more sustainable GDP with less fiscal assistance (reduced issuance of short-term Treasuries) from the government and more contribution from the private sector. The goal is more resilient consumer spending and improved manufacturing capacity. Relative to Q4’s GDP growth of 2.51% Y/Y, we expect Q1 GDP growth to decelerate towards 2.30% Y/Y level.

Since mid-February, equity markets have witnessed a change in sentiment, as uncertainty with respect to policy changes has impacted previous market leaders in favour of more defensive sectors. Markets can adjust to good news and bad news but have no easy way to price in uncertainty. There is still optimism for the economy and the stock market tied to a Trump Presidency with expectations of tax relief, regulatory rollbacks, and pro-growth policies. As a result, despite near-term softness, we anticipate that equity growth to continue through 2025.

Financial Results: US Cannabis Holdings

During the month, the US cannabis companies released their Q4-24 and fiscal year-end 2024 financial results. Although market reception remains subdued for the sector, it is important to highlight that the leading names in the Fund continue to generate significant cash flows while maintaining leads in various state markets. Green Thumb Industries (GTII) stands out as an efficient operator generating positive cash flow in addition to having the strongest balance sheet in the industry. Q4 and FYE results illustrate their operational strength despite the competitive US cannabis landscape.

For the year, revenues reached $1.1 billion, 8% growth YoY, while adj. EBITDA reached $371 million or 33% of revenue, a 14% increase YoY. The company’s wholesale (CPG) revenue was up almost 20% YoY as GTII remains a market leader in many of its core states. Q4 revenues were $294.3 million, beating consensus of $289 million, up 2.6% QoQ and 5.8% YoY. Gross Margin in the quarter was 53.7% or $158 million, well ahead of consensus 50.6% while Q4 adj. EBITDA was $97.8 million, 33.2% of revenues. The Company finished the year with $171.7m in cash and $255 million in debt. A final note to mention is the impressive cash strength of GTII, the first cannabis company to announce share buybacks; over the last 18 months, GTII completed $82.9 million in share buybacks to December 2024, repurchasing a cumulative 7.8 million at an average price of $US10.62/share.

Trulieve Cannabis (TRUL) reported Q4 and full-year earnings that handily beat consensus estimates. For the quarter revenue was $301 million ahead of consensus of $293 million, up 5% increase YoY. Retail revenue for the quarter was $285 million, + 4% YoY and 6% QoQ, with customer traffic up 13% YoY. The company highlighted its revised loyalty program on its earnings call where they detailed that over 550,000 high-volume members are on the program, with shopping results of loyalty members representing 2.3 times more dollars spent than average customers. In addition, the company mentioned the strength of client retention, 68% company-wide and over 76% in medical-only states. That type of customer loyalty and customer service leads to solid revenue growth quarter after quarter. Q4 gross margin reached 62%, as TRUL continues to enjoy efficiency benefits from its 4 million sq ft of cultivation assets across its state markets. Adjusted EBITDA in Q4 was $111 million up +27% YoY, representing a 37% margin well ahead of consensus at $94 million.

The company finished the year with cash and short-term investments of $300 million. For 2025, Trulieve expects to generate at least $250 million in cash from operations (CFO) and spend up to $40 million in capex, implying annual free cash flow (FCF) growth of at least 40%. Finally, during its earnings call, TRUL announced it is getting into the hemp-derived beverage business with the launch of a premium non-alcoholic THC beverage- Onward. These will be 2018 Farm Bill-compliant beverages, available online across 36 states and soon to be available at Total Wine locations in Florida stores in Clearwater, Fort Lauderdale, Jacksonville, Miami, Orlando, Tallahassee, Tampa, and St. Petersburg.

Glass House Brands (GLASF), a California-based cannabis company is a name we have added in the last 6 months. GLASF demonstrates operational strength in the challenging California cannabis market. Revenue for the quarter was $52 million, +31% YoY with cost of production down to <$115/lb. The company’s adjusted EBITDA is trending in the right direction as it is estimated to reach $7-$9 million in Q4. As at year-end the company had cash on the Balance Sheet of ~$37 million. For the year, the company saw its average sales price of >$243/lb down from the previous year at $312/lb. Despite sales price pressures emanating from the challenging California market, the company has been able to reduce its cost of production for the year down to <$125/lb from $136 from the prior year. From a cash flow perspective, adjusted EBITDA is estimated to be in the range of $38-$40 million, +59% YoY while operating cash flow grew 21% YoY to $27 million.

Its Q4 FY24 pre-release outlines its preparations for a potential addition to hemp cultivation this year. The addition of hemp cultivation, a US federally legal crop under the 2018 Farm Bill, could provide a significant opportunity through interstate commerce of hemp-derived, Farm Bill-compliant products, thereby unlocking new revenue streams. GLASF’s Phase III expansion announced earlier this year with Greenhouse 2 is projected to produce 275,000 pounds of hemp biomass in its first full year of cultivation, enabling the company to supply white-label biomass to CPG companies across the US. The company remains committed to cannabis in California despite continued price compression in the California cannabis market with its low-cost production model and operational efficiency with large-scale greenhouse cultivation.

Hemp Derived Beverages

Hemp-derived beverages, also called “Farm Bill compliant”, “Delta 9”, “intoxicating hemp”, and “Delta 8 Hemp” beverages are terms that describe US federally legal products under the 2018 Farm Bill. Over the last few months, given the delay in federal cannabis reforms, various cannabis companies have announced plans to enter the hemp space. It is a grey area that the Farm Bill’s interpretation of hemp and cannabis has created, allowing some producers the opportunity to exploit. Cannabis companies stalled on federal re-scheduling have started their assault on the specialty non- alcoholic drink sector. GTII with its $20 million acquisition of Agrify, TRUL announcing its new beverage brand Onward, and GLASF constructing its next 1 million sq ft greenhouse to potentially provide biomass for the hemp-derived non-alcoholic beverage market. We believe this will continue to be a significant theme in the US cannabis space in 2025.

Background: The Farm Bill & Legalized Hemp

The 2018 Farm Bill legalized hemp and its derivatives as long as a plant contains no more than 0.3% THC on a dry weight basis2 meaning the percentage of THC by weight in a plant or extract after removing moisture. Under the 2018 Farm Bill, hemp is federally legal, however, the >.3% dry-weight THC in hemp can be activated to produce the same effects of THC as provided in cannabis thus creating a legal loophole because you can buy similar products composed of hemp but have different regulations. Hemp-derived beverages are non-alcoholic drinks that contain cannabinoids, terpenes, or fibres from hemp. They can include THC, CBD, and other minor cannabinoids1,3. They are being sold in most states, and are available to purchase online through a direct-to-consumer channel. Cannabis cannot be sold across state lines. This major distribution difference leads to considerable debate and has caused cannabis companies to consider enhanced distribution opportunities. As the THC content of a 10mg cannabis-infused drink falls within the 0.3% THC limit, the Farm Bill may provide these distributors with some legal cover.

Brightfield Group, a market research firm that reports on the cannabis industry, estimates that hemp-derived cannabis beverages brought in approx. $400 million in sales last year and U.S. sales will grow to nearly $750 million by 2029. Hemp-derived THC drinks can be found in certain states in restaurants, taprooms, liquor stores and online DTC. Total Wine sells hemp-derived Farm Bill-compliant beverages, and in some states, DoorDash delivers hemp-derived drinks. As a result of the reduced regulatory framework and greater distribution capabilities, hemp-derived beverages are a category for cannabis companies to explore as reform challenges continue to persist for their core product offering.

Walmart Inc (WMT) reported sales of $180.6billion in Q4, slightly ahead of consensus, with U.S. sales +4.6% and 4Q adj EPS $0.66 with consolidated gross margin +53bps y/y (from +21bps in 3Q). Over this past year, WMT has refocused its efforts on health and wellness to offer a wider product line in addition to new services that provide better value in the health space. A central feature of driving sales growth is health and wellness where the health category was up mid-teens YoY. The category was also a driver of sales growth in Q4, contributing to +4% sales growth in the country.

This past year the grocery giant launched its private label, “Bettergoods” brand which focuses on healthier choices, many without added sugars or dyes, along with gluten-free and dairy-free options. In addition, to emphasize its everyday low prices model, many of the new items are priced under $5.00. On the pharmacy side, the company redirected its efforts towards pharmacy and vision care, where it could better capitalize on synergies like selling popular GLP-1 medications alongside groceries. WMT offers certain generic drugs starting at just $4 and its pharmacy generally accepts local insurance plans throughout the US, aligning the pharmacy with the overall low-price operating model. In addition, WMT has merged the delivery services for both prescription and grocery orders, making both categories easier to access.

Since 2014, Walmart has hosted Wellness Days that have provided more than 5 million free screenings, particularly benefiting rural and underserved communities offering free health screenings and affordable immunizations at nearly 4,600 pharmacies across the US. Customers can receive screenings for glucose, cholesterol, blood pressure and BMI, as well as vaccines for flu and other conditions. The event also includes the opportunity to speak with pharmacists about health topics like maintaining a healthy lifestyle and medications. Its large retail footprint allows WMT to deliver essential health services to the masses where the strategy drives significant foot traffic, while also positioning WMT as a trusted partner in the preventative and primary care market. We see an opportunity for WMT to play a role in an expanded disease prevention strategy envisioned by RFK Jr.4

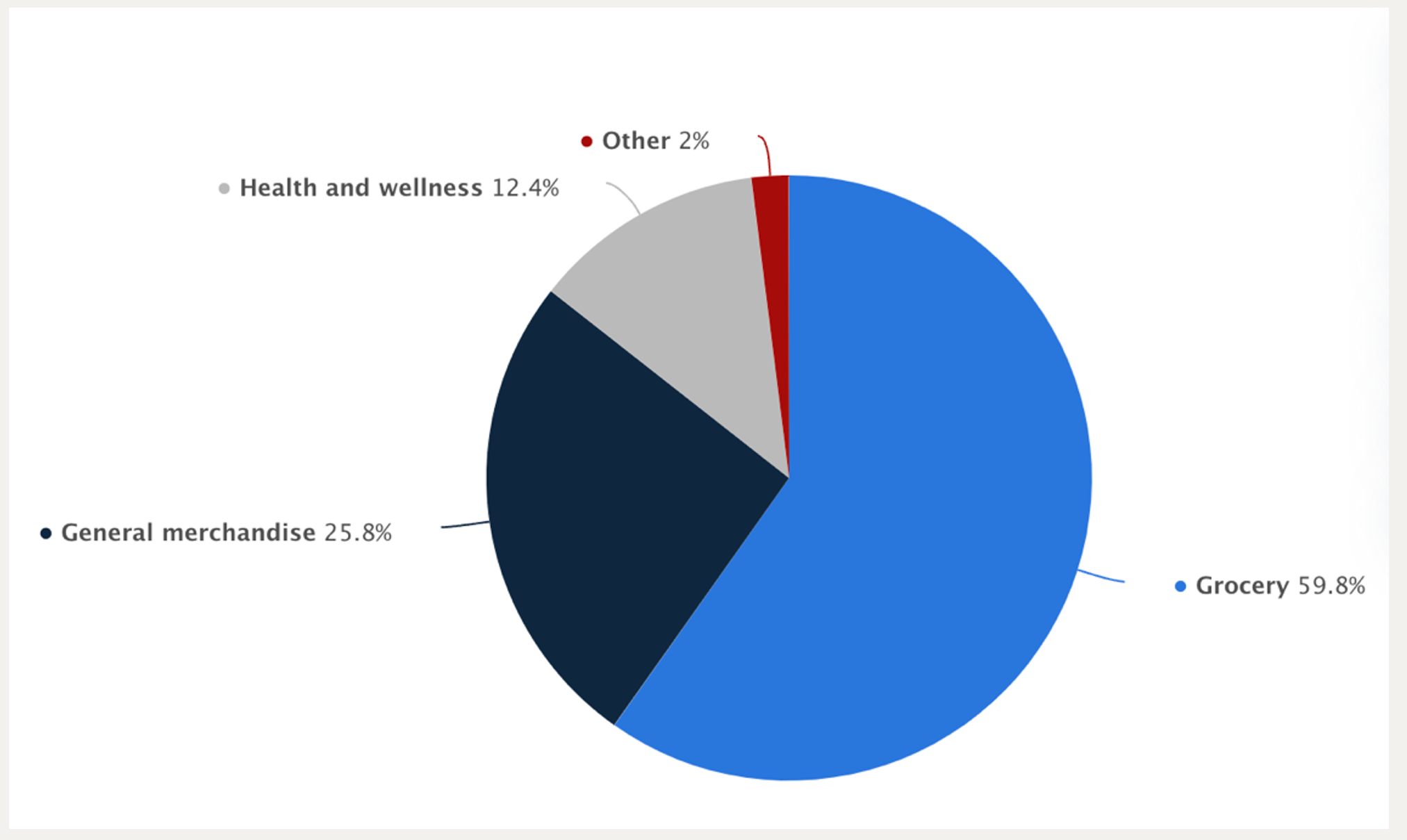

Health and Wellness +12% of Walmart US Sales

US Health & Human Services (HHS): Healthcare Funding & Potential Policy Goals

On February 7, HHS Secretary Robert F Kennedy Jr directed the National Institutes of Health (NIH) to reduce its portion of funding pharmaceutical grants to university researchers to 15%, from the previous HHS funding rate of 50%5. This funding had been accessed by researchers at well-regarded university sites. The cuts in grant funding could lead to potential delays in new drug development, reduced research and development funding from universities and potentially lead to reduced pipeline progress for pharmaceutical companies due to the uncertainty and potential for stricter regulations imposed at the federal level. Regardless of the temporary injunctions that may be sought, it is clear that changes to NIH funding and staffing are a focus for Secretary Kennedy and the Trump administration and their impact on the pharma industry could have direct negative implications.

In mid- February President Trump signed an executive order establishing the Make America Healthy Again Commission, to be chaired by Department of Health and Human Services Secretary Robert F. Kennedy Jr. The commission is tasked with “investigating and addressing the root causes of America’s escalating health crisis, with an initial focus on childhood chronic diseases.”6 At the same time, President Trump and his cabinet are focused on deficit reduction by removing waste in government spending. The healthcare industry is an area that is under the microscope. The United States spends more on healthcare per capita than any other country, yet it ranks poorly in life expectancy and chronic disease rates. According to the Commonwealth Fund, the United States spends more than twice the average of other high-income nations but sees higher rates of obesity, diabetes and preventable deaths.

RFK Jr has advocated for shifting the focus of health care from disease management to disease prevention. The plan encourages proactive strategies such as healthier eating, exercise and routine check ups and screenings with the goal of reducing chronic illnesses such as diabetes and heart disease. By focusing on prevention rather than long-term treatment, the belief is that healthcare spending can be focused on treatment priorities and less on man-made chronic disease.

As a result of this focus on healthcare spending and healthier outcomes, the question to ask is what will be the impact on those companies that operate within the sector. The Fund management team sees pressure on traditional pharmaceutical and biotech companies facing limited growth prospects and could be good candidates for our shorting strategy. We began our short strategy this year selecting names that we believed would see significant pressure from these policy changes. We continue to analyze short candidates that fit our investment parameters with such factors as recent significant unsustainable stock price run-ups, with weakening regulatory or operational prospects.

Options Strategy

Since inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately CAD$5.25 million. We will continue to utilize our options program to look for attractive opportunities given the volatility in the sector and to assist in rebalancing the portfolio in favor of names we prefer as we strongly believe that option writing can continue to add incremental value going forward.

We continue to write short dated covered calls on names we feel are range bound near term and from which we could receive above average premiums which included UnitedHealth Group Inc. (UNH). We also continue to write short dated cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including Nike Inc. (NKE).

Ninepoint Cannabis & Alternative Health Fund - Compounded Returns* as of February 28, 2025 (Series F NPP5421) | Inception Date - August 4, 2017

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

-0.50% |

-2.62% |

-7.81% |

-16.05% |

-28.31% |

-17.82% |

-6.38% |

0.92% |

Statistical Analysis

Fund |

|

|---|---|

Cumulative Returns |

7.2% |

Standard Deviation |

27.2% |

Sharpe Ratio |

-0.11 |

The Ninepoint Cannabis & Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Cannabis & Alternative Health Fund

- https://www.alcohollawadvisor.com/2024/10/navigating-the-buzz-how-state-agencies-are-addressing-confusion-around-hemp-and-low-dose-thc-beverages/#:~:text=Understanding%20Hemp%20and%20Low%2DDose,or%20as%20alternatives%20to%20alcohol.

- https://www.webmd.com/mental-health/addiction/what-is-thca

- https://www.cannabinoidclinical.com/covering-cannabinoids/volume-3/the-thc-0.3-percent-threshold

- https://finimize.com/content/walmart-shifts-health-strategy-with-executive-departure-and-clinic-closures

- Under RFK Jr., US Health Policy and FDA Operations May See Major Shifts

- https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-establishes-the-make-america-healthy-again-commission/

February 28, 2025

February 28, 2025