The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

After giving Mexico and Canada one month to show progress in stopping the flow of illegal drugs through their respective borders, the Trump administration decided that not enough had been done, and imposed on March 4, 25% tariffs on each (with a 10% exemption for Canadian energy). Given the overall trade rhetoric that we have heard from this administration, it doesn’t seem like Canada could have done anything to avoid these tariffs. This sounds more like an excuse than a meaningful request from Canada.

In our view, this is only the “first round” of the trade war. There is a broader trade war coming. We heard from Commerce Secretary Lutnik that on April 2, they will go after what they consider to be “unfair trade practices”, which will include anything ranging from reciprocal tariffs, value added taxes (VAT), sales taxes (HST/GST), subsidies and other trade barriers. Specifically for Canada, they have mentioned things like autos, banking, agricultural products, and sales taxes. This is part of a broader effort to completely reshape the global trade order, and go back to a world where trade is minimal and most things that are sold in the U.S. are made in the U.S.

The U.S. has a trade deficit not because other countries are taking advantage of America, but because it simply consumes more than it produces, issuing IOUs against the goods it purchases abroad. That’s why the government has seen such an increase in debt. The solution to the trade deficit is to consume less and close the deficit, not particularly appealing to most Americans, and difficult to do when the administration keeps on promising to cut taxes even more. This utopian vision of the future is probably not possible, but it won’t stop them from trying, inflicting great damage to U.S. and global economies.

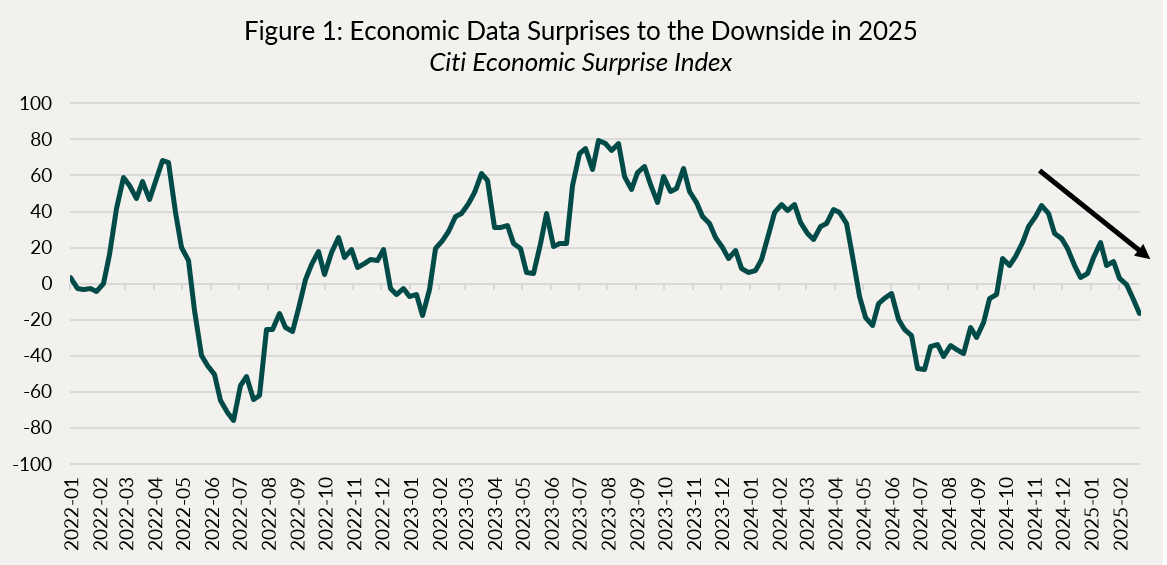

With that, the honeymoon between investors and the White House is coming to an abrupt end because of all the uncertainty (and now the impending damage) surrounding this administration’s policies (not just trade, but immigration, regulation, government jobs, fiscal, etc). Households and businesses need some sort of certainty around the economic environment to make decisions, and this mayhem in Washington is keeping everyone on their toes. Survey data has been very weak (consumer and business confidence have fallen very rapidly, while their inflation expectations have risen), economic data has generally surprised to the downside (Figure 1), and the market has taken notice.

There is no doubt the trade actions taken by the U.S. government and the necessary retaliation will be negative for growth (broad ranges, but we have seen estimates of ~2% for Canada and ~1% for the U.S.) and lead to increases in goods inflation. We do not know how far this will go, but there is a risk tensions heat up even more in April. With a trade war as the base case, we expect a recession here in Canada and subpar growth in the U.S.. But it can worsen if the shock to sentiment/confidence leads to a more general pullback in economic activity.

In terms of monetary policy response, Canada and the U.S. also have very different starting points:

- Canada’s economy has been weak, unemployment has risen, and the economy is operating under potential. The result has been a decline in inflation (around the target since August 2024). That means the Bank of Canada has the ability to help dampen the negative effects of the trade war. Yes goods inflation will go up, but that will be offset by an economy in recession. We expect them to cut interest rates to stimulative territory (<2%).

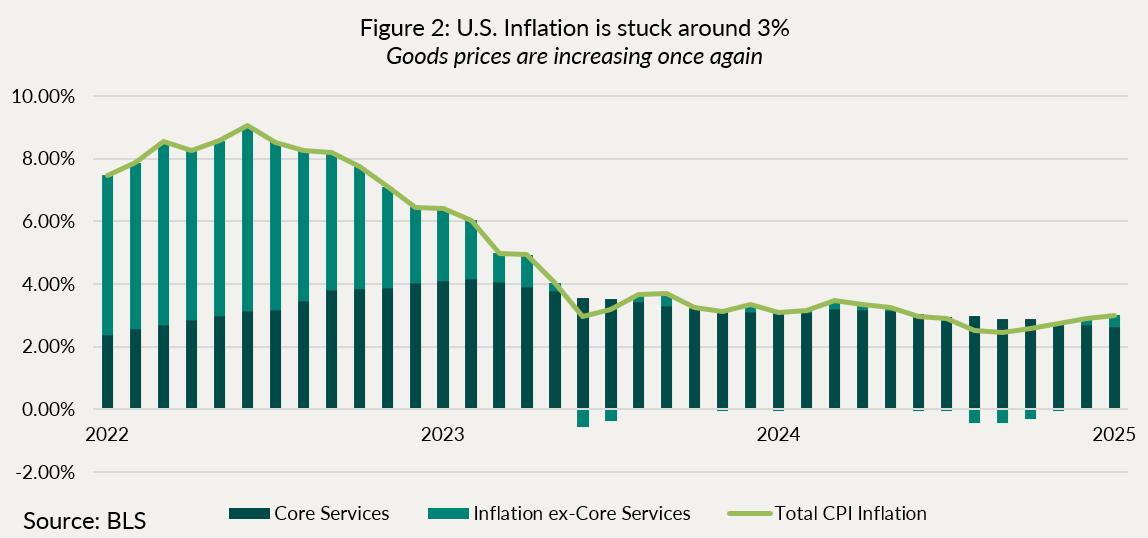

- US economy has been incredibly resilient, the labour market is very tight still, growth has been strong and inflation is sticky (Figure 2). Higher goods prices due to tariffs have the potential to restart the wage price spiral the Fed has worked so hard to suppress. So unless the labour market sees a rapid and marked deterioration, we expect the Fed to hold rates steady this year.

Obviously, the net impact of all this will depend hugely on what actions firms and households take. For example, how much substitution takes place away from American products here in Canada? Can we source some of these products from other trading partners and can we sell our own products to those? Canada has free trade agreements with Europe and many industrialized countries in Asia/Pacific. It is time to make use of them. One thing is clear, America is not the reliable trading partner it once was, and supply chains will have to be reorganized. This will take time and will be very economically disruptive.

Credit

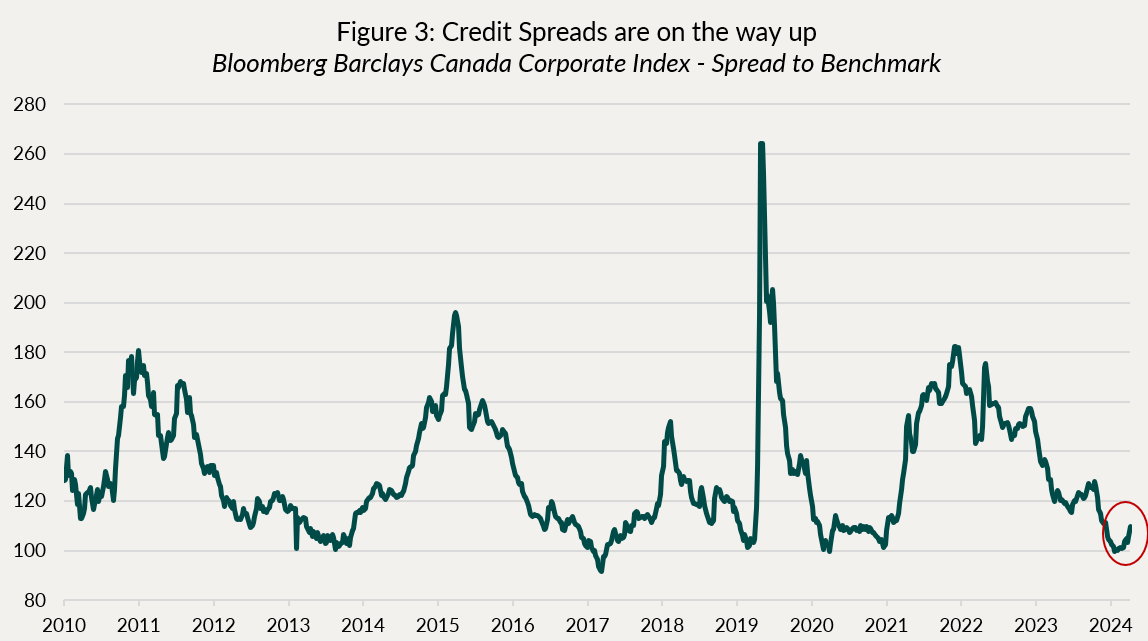

February was a continuation of the weakness we saw in January. New issues were few and far between, and those that came to market didn’t perform well. We have avoided most of them as we still see little value in adding credit exposure in this environment. As you can see from Figure 3 below, Canadian corporate credit spreads historically spend very little time at these rock-bottom spread levels we have seen lately. That’s why we have been so defensive: why take risks when we aren’t being adequately compensated, particularly when the clouds of a trade war were approaching.

We expect to remain defensively positioned in credit for the foreseeable future. We have credit hedges and generally low exposure to riskier parts of the market, so that should position us well to take advantage of wider spreads once they become more attractive again. This trade war is just beginning, and the economic ramifications will take some time to be reflected in risk assets.

Individual Fund Discussion

Ninepoint Diversified Bond Fund

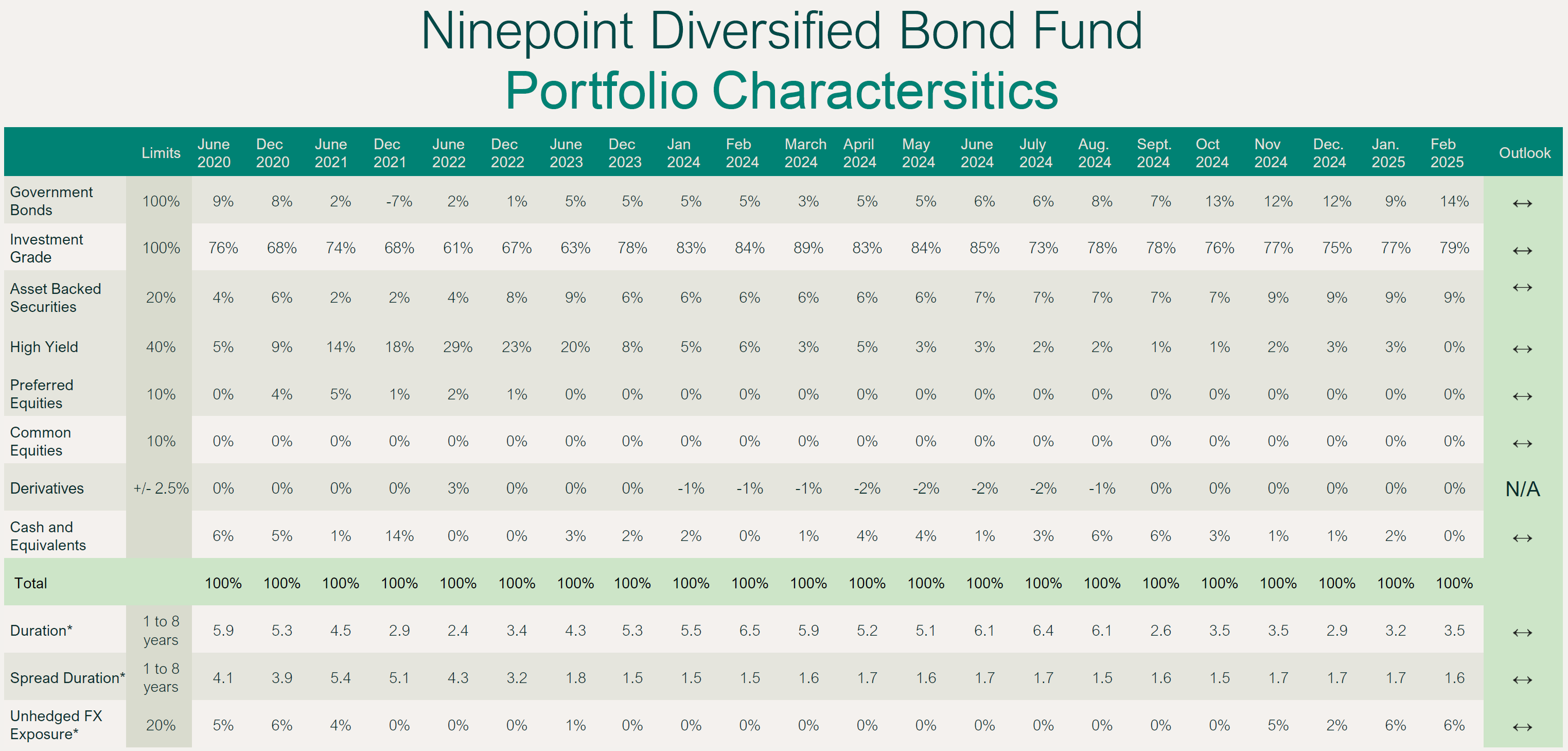

February was a good month for the Fund returning 64 basis points. We benefited from lower rates and a further weakening in the Canadian dollar. While credit spreads widened, our light positioning and credit hedges provided an offset. Duration remained flat at 3.5 years. The fund’s yield to maturity was also stable at 4.5%.

We have made some changes to the positioning table below to better reflect our strategy. From now on (and retroactively), we will show Asset Backed Securities (ABS) in their own category (they were lumped in with investment grade bonds before), with an exposure limit of 20%. We removed the “Emerging Markets Bonds” category since we are not active in this market. We will also move bond ETFs away from the “Equities and ETFs” and into the corresponding category (i.e. TLT will show up in government bonds, HYG/JNK in high yield, etc.).

Finally, we will increase the limit on Investment Grade bonds to 100% since we often buy very short-term investment grade bonds in lieu of commercial paper or other cash equivalents, resulting in a larger weight than was the case historically. We hope this increased disclosure will help investors understand our positioning better.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF FEBRUARY 28, 2025 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

0.64% |

1.72% |

2.02% |

5.03% |

9.57% |

2.48% |

1.80% |

2.62% |

3.60% |

Ninepoint Alternative Credit Opportunities Fund

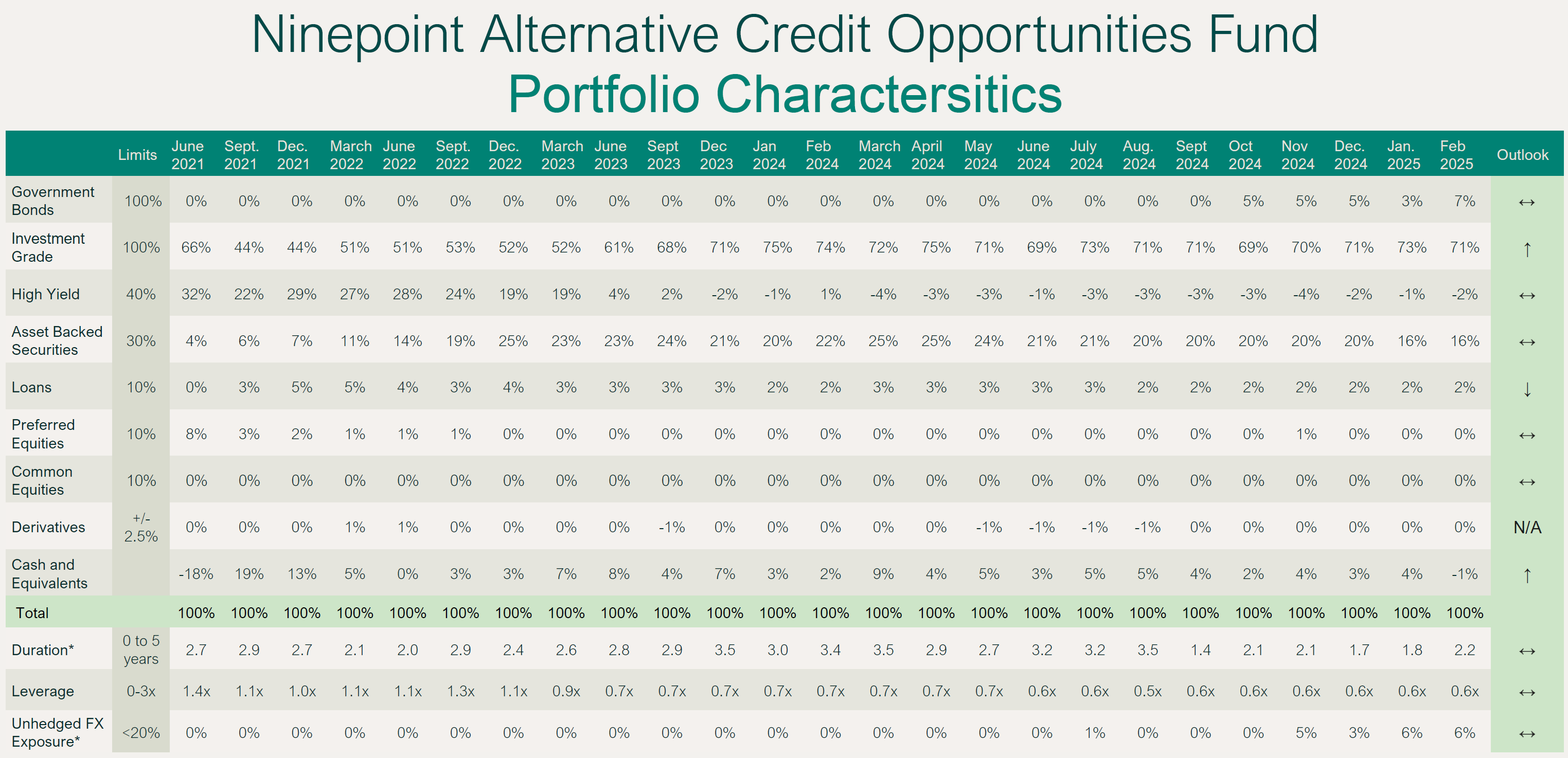

The Fund had a good month returning 55 basis points. Duration increased slightly to 2.2 years as we added a few more government bonds in the 1 to 5-year area. Leverage remains low at 0.6x, and has decreased further following month end. Yield to maturity increased slightly to 5.3% (from 5.2%) as credit spreads widened.

Similar to the Ninepoint Diversified Bond Fund, we have made some minor changes to the positioning table below to increase transparency. From now on (and retroactively), we will move bond ETFs away from the “Equities and ETFs” and into the corresponding category (i.e. TLT will show up in government bonds, HYG/JNK in high yield). We have also increased the limit on Asset Backed Securities from 20% to 30%, as we increasingly find attractive risk/reward opportunities in this space.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF FEBRUARY 28, 2025 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.55% |

1.32% |

2.08% |

4.49% |

9.96% |

4.32% |

2.72% |

Ninepoint Credit Income Opportunities Fund

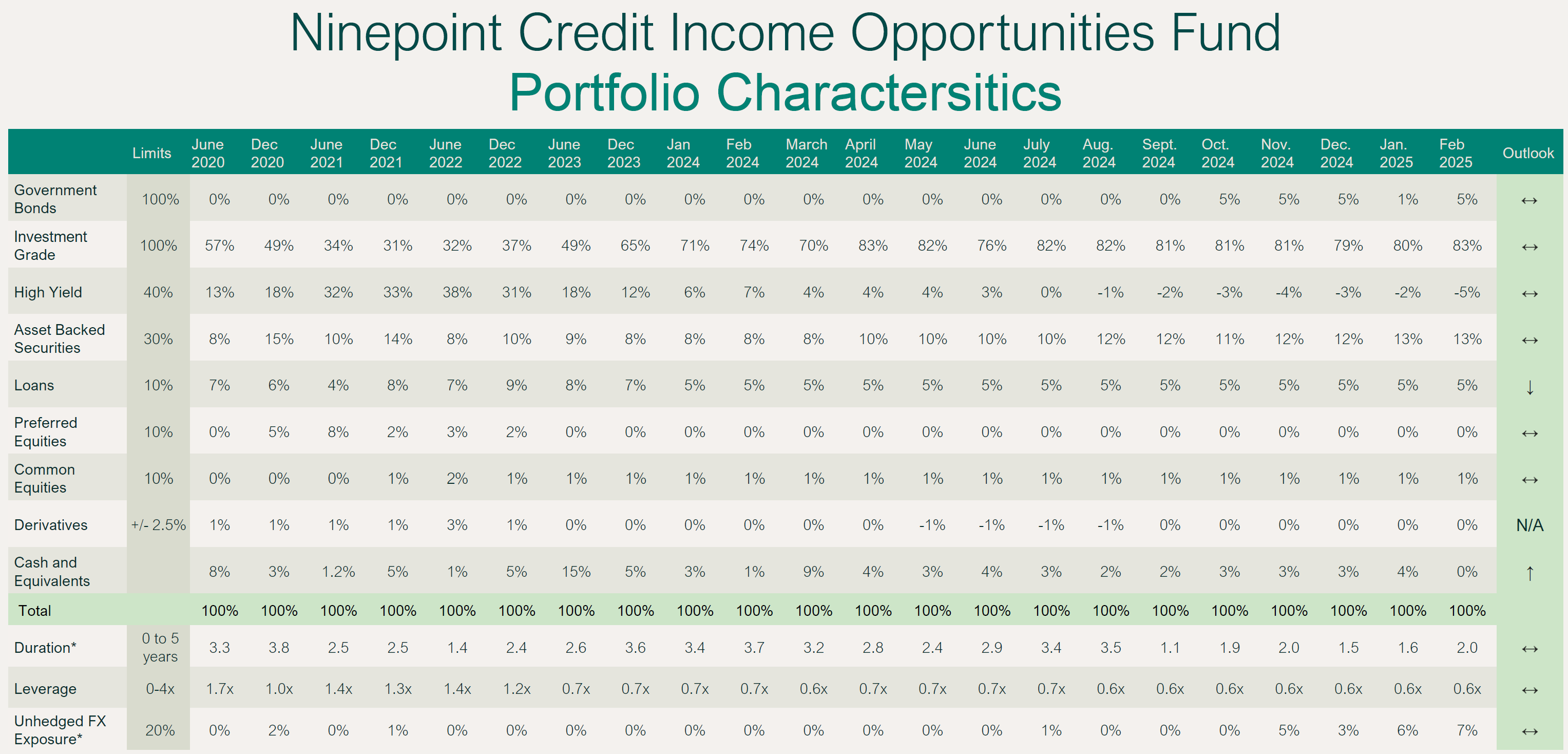

The Fund generated 72 basis points in February, helped by lower rates and a weaker Canadian dollar. Leverage was flat on the month sitting at 0.6x given how tight credit spreads remain. Duration moved up to 2 years while yield-to-maturity remained flat at 5.5%. Following month end, we reduced leverage further. We also made the same change in the positioning table as for the Ninepoint Alternative Credit Opportunities Fund.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF FEBRUARY 28, 2025 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

0.72% |

1.55% |

2.19% |

4.49% |

9.67% |

4.90% |

6.07% |

5.07% |

Conclusion

We don’t think the market had initially taken Trump’s threat of tariffs that seriously. As 2025 unfolds, a global trade war looks to be the unfortunate reality. Our funds have been positioned accordingly, with this reality in mind. Our aim is to protect capital and position our portfolios to capitalize on dislocations. Ideally, this situation doesn’t persist for an extended period or create a global crisis.

Until next month,

Mark, Etienne & Nick

February 28, 2025

February 28, 2025