The monthly commentary discusses recent developments across the Ninepoint Diversified Bond, Ninepoint Alternative Credit Opportunities and Ninepoint Credit Income Opportunities Funds.

Macro

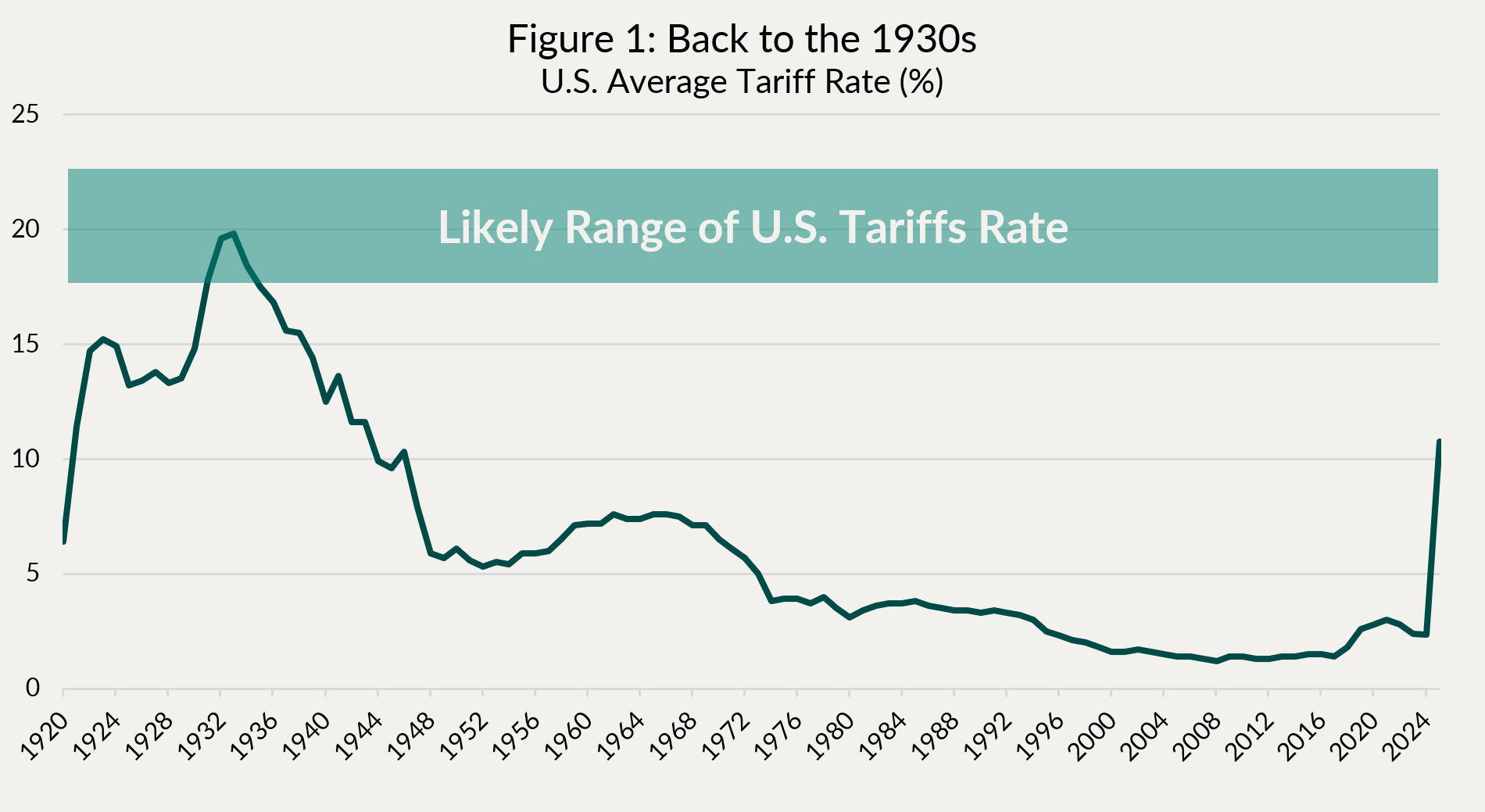

The Trump Trade War is now global, with tariffs on a multitude of products and countries, taking the U.S.’s average tariff rate to a level last seen in the 1930s (Figure 1 below). Back then, the Smoot-Hawley Tariff Act significantly raised duties on imported goods and is broadly associated with a worsening of the Great Depression. The big difference then was that imports of goods were only about 2% of GDP, not 10%! As of the time of writing, we expect the overall U.S. tariff rate to increase to roughly 18-22%, but escalation could bring it even higher.

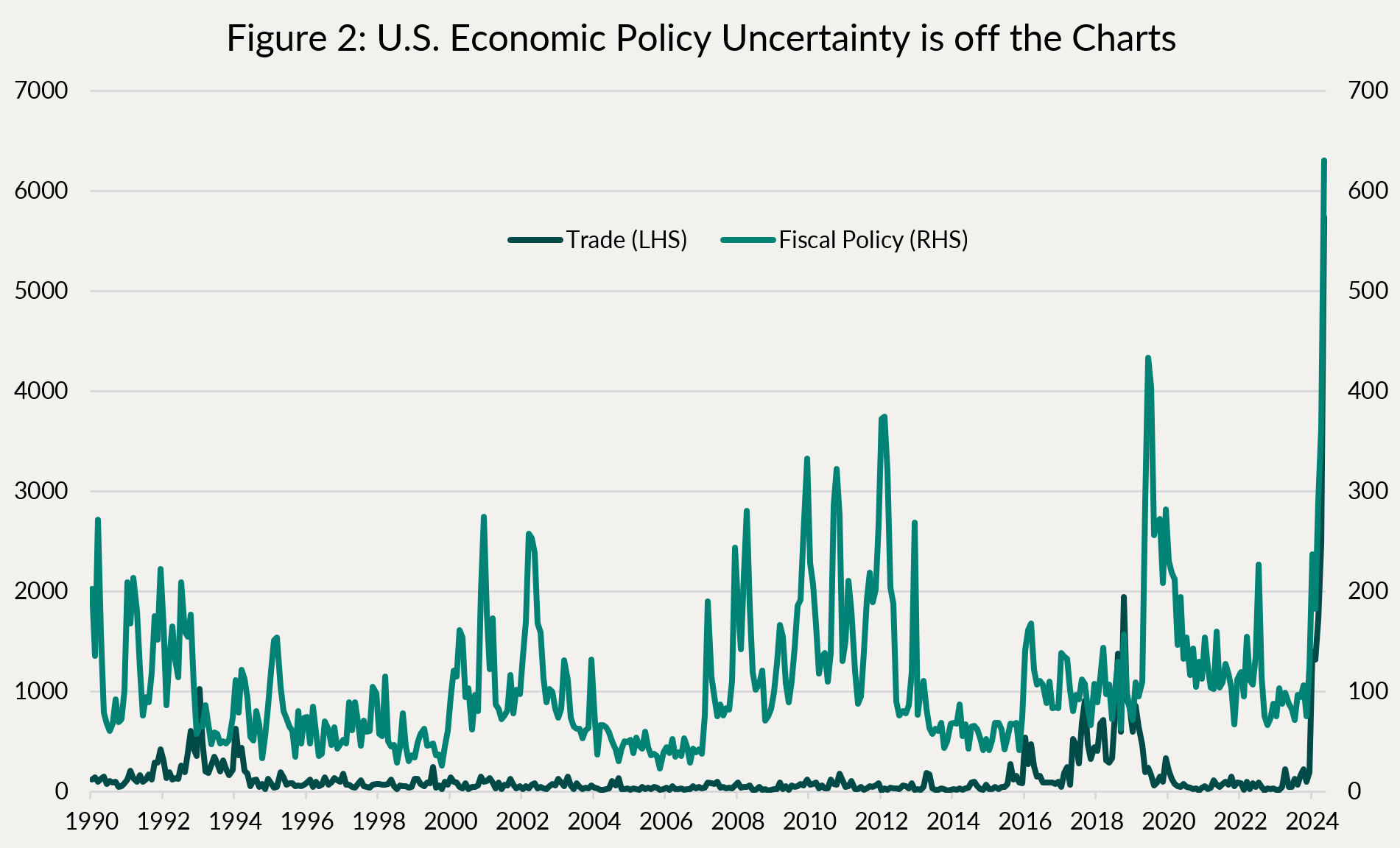

With that, economic policy uncertainty is off the charts (Figure 2), not only on trade matters but also fiscal policy and other government matters (immigration, hiring, etc.).

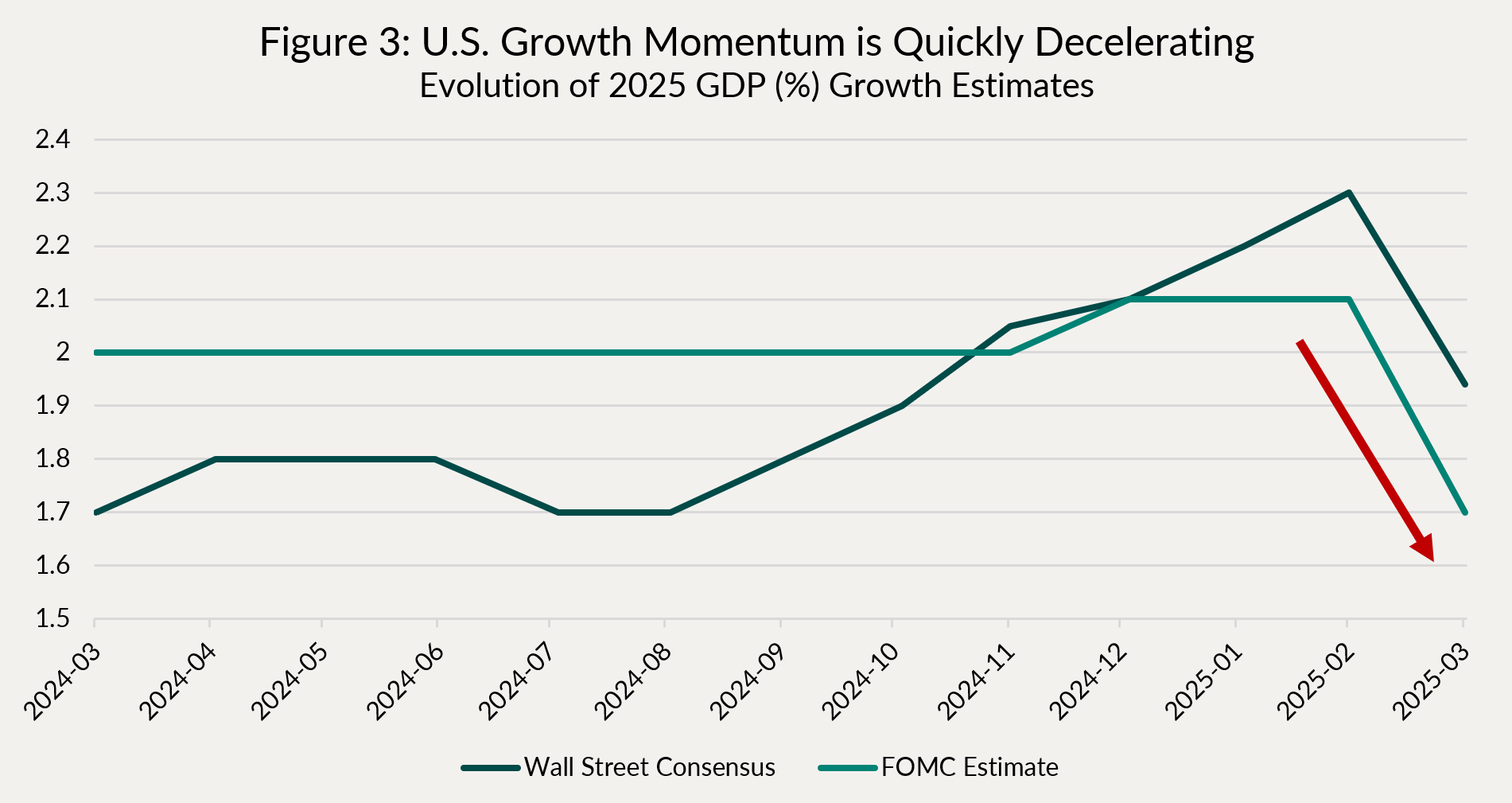

Uncertainty is the enemy of economic activity; households are deferring large purchases, companies put off hiring and investment decisions. Add to this uncertainty the economic cost of tariffs (yes, they are a tax on consumers, or eat into companies’ margins, or both), and you have a recipe for economic weakness. At their March meeting, the Federal Reserve provided updated economic projections for 2025, revising growth down by 20% (Figure 3). Wall Street is taking notice and has also started to revise its projections down. Given the magnitude of the tariffs that have been announced on “Liberation Day” [sic] , downside risks to the U.S. and global economy are materializing quickly. The Trump administration seems determined to follow through with its plans, no matter the cost.

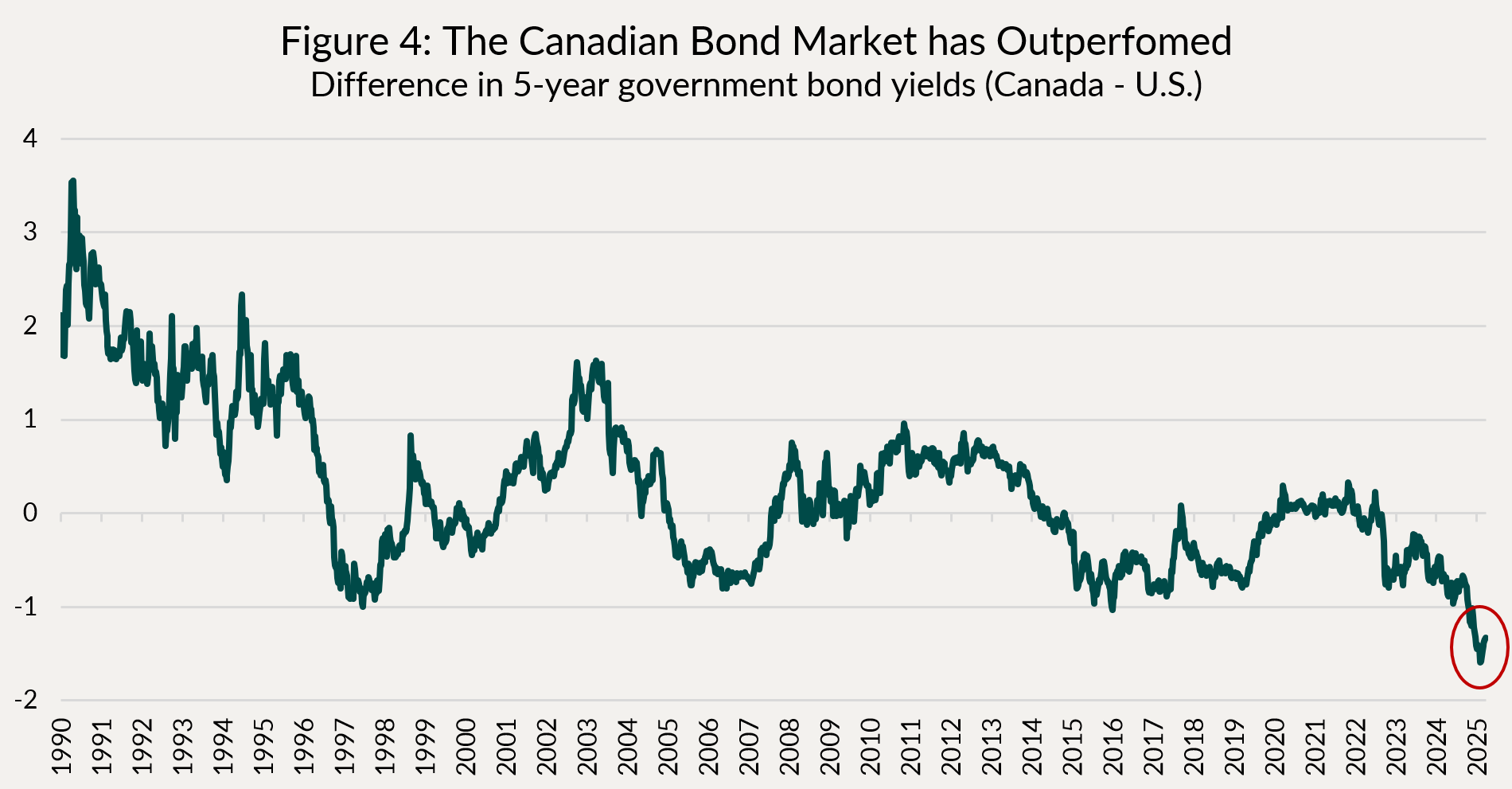

In the summer of 2024, we recognized that the Canadian economy was significantly weaker than the U.S., leading the Bank of Canada to cut rates more aggressively than the Federal Reserve. We positioned our funds accordingly. This has largely played out, with the BoC now cutting a cumulative 2.25% vs the Fed’s 1%, resulting in material outperformance of Canadian bonds (Figure 4 below shows the difference between 5-year Canadian and U.S. government bond yields).

This gap in monetary policy has now reached historical extremes, and with the U.S. growth outlook deteriorating quickly, we decided to shift some of our duration exposure from Canada to the U.S., where we see a higher likelihood of further rate cuts getting priced-in. We like the 5-year sector as this provides a good responsiveness to monetary policy actions, without the risk of higher term premiums the 10 and 30-year sectors can see emanating from fiscal largesse (another risk to the U.S. outlook is unbridled fiscal spending).

Credit

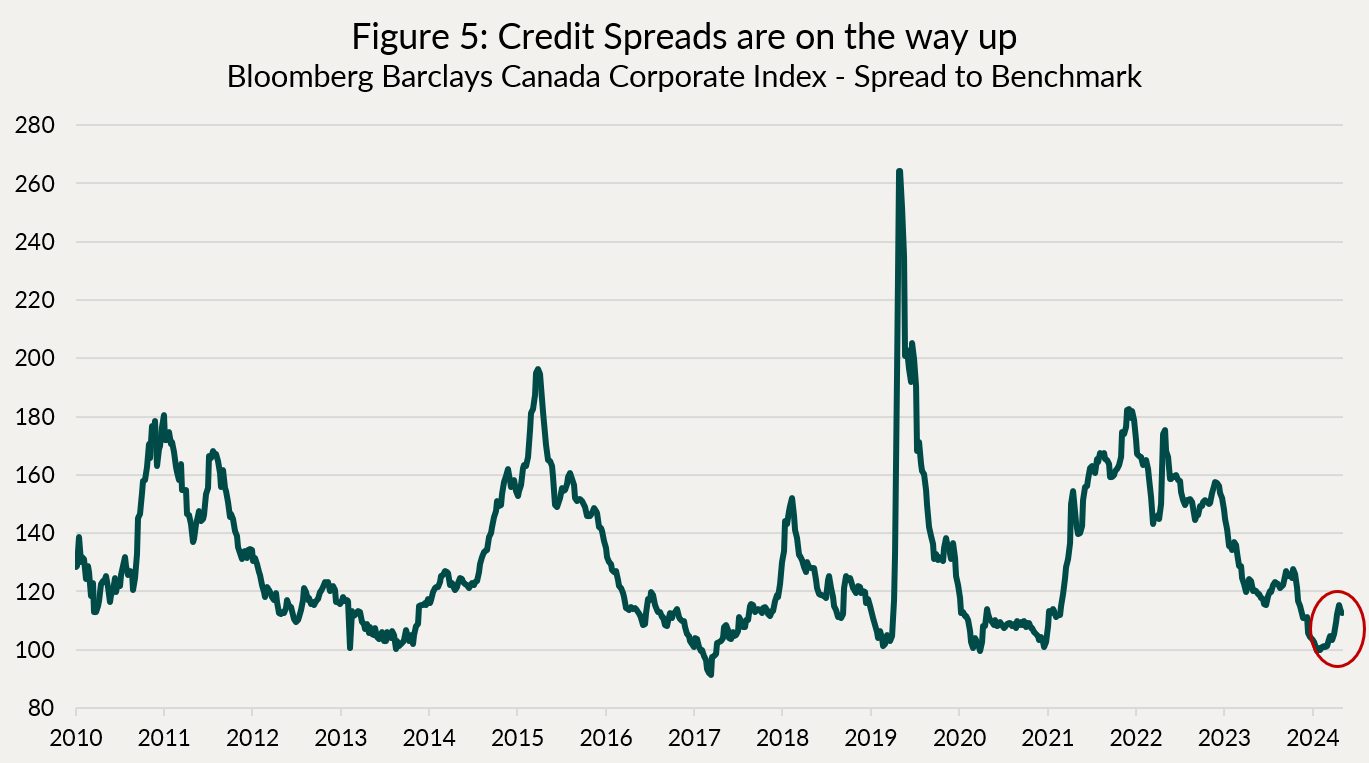

Despite all the volatility in markets, March was quite busy in Canadian credit. New issue volumes are tracking roughly in line with last year at $35.7bn year-to-date ($36.2bn last year), but the tone has shifted meaningfully. Issuers now need to offer material new issue concessions (5-10 basis points) to get deals over the finish line, and those new issues tend to rerack secondary markets wider. We haven’t seen this dynamic in several years (last time was in 2022), and it usually leads to wider credit spreads.

We expect to remain defensively positioned in credit for the foreseeable future. We have credit hedges (short U.S. High Yield Indices) and generally low exposure to riskier parts of the market, so that should position us well to take advantage of wider spreads once they become more attractive again. This trade war is just beginning, and the economic ramifications will take some time to be reflected in risk assets. (Figure 5)

Individual Fund Discussion

Ninepoint Diversified Bond Fund

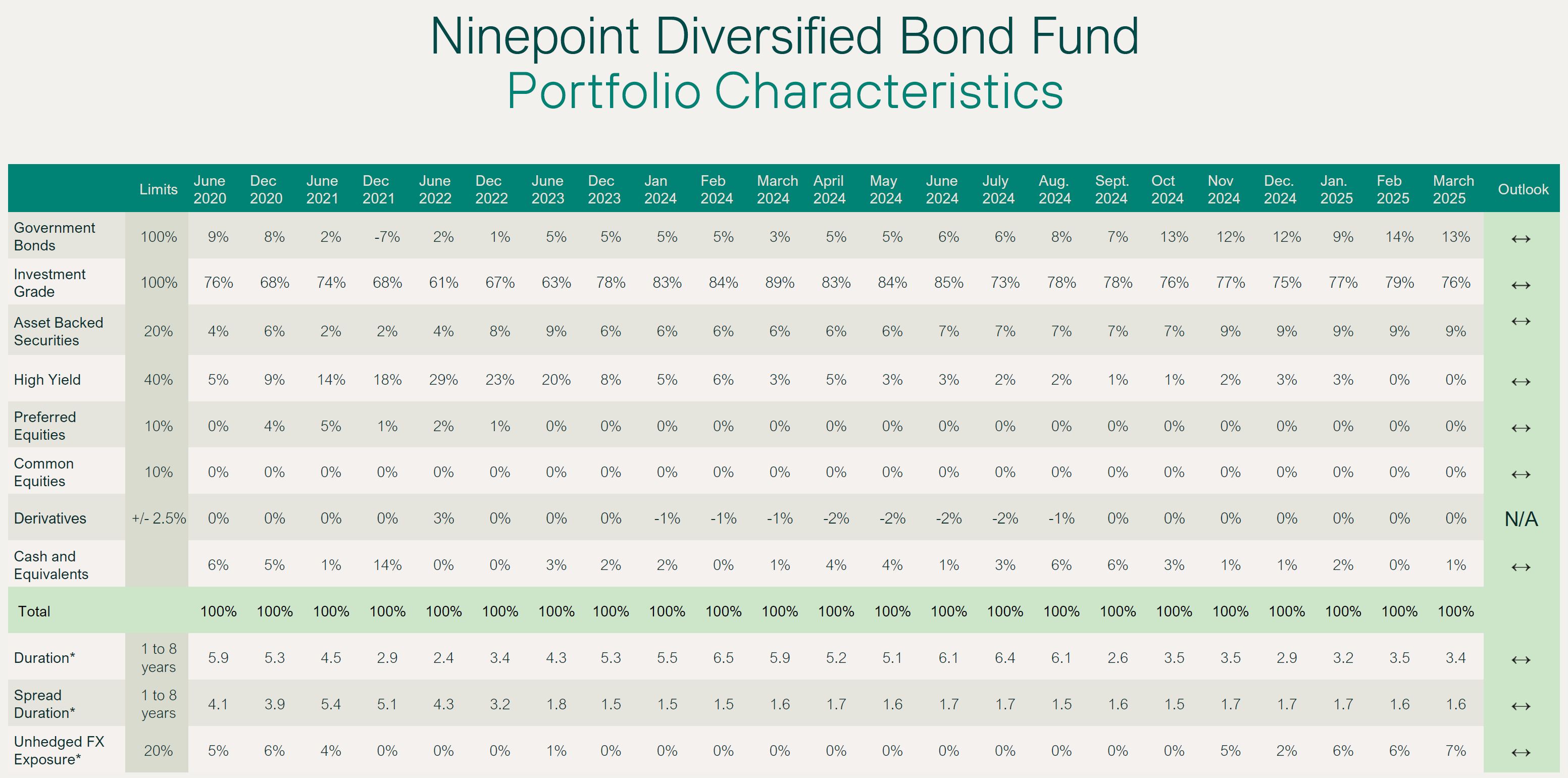

March was a good month for the fund returning 28 basis points. Our credit hedges (U.S. High Yield) managed to offset wider credit spreads and slightly higher interest rates. Total duration remained almost flat at 3.4 years, of which about 1 year comes from the U.S. market. The fund’s yield to maturity was also stable at 4.4%.

NINEPOINT DIVERSIFIED BOND FUND - COMPOUNDED RETURNS¹ AS OF MARCH 31, 2025 (SERIES F NPP118) | INCEPTION DATE: AUGUST 5, 2010

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

0.28% |

2.00% |

2.00% |

3.36% |

8.91% |

3.23% |

2.25% |

2.63% |

3.60% |

Ninepoint Alternative Credit Opportunities Fund

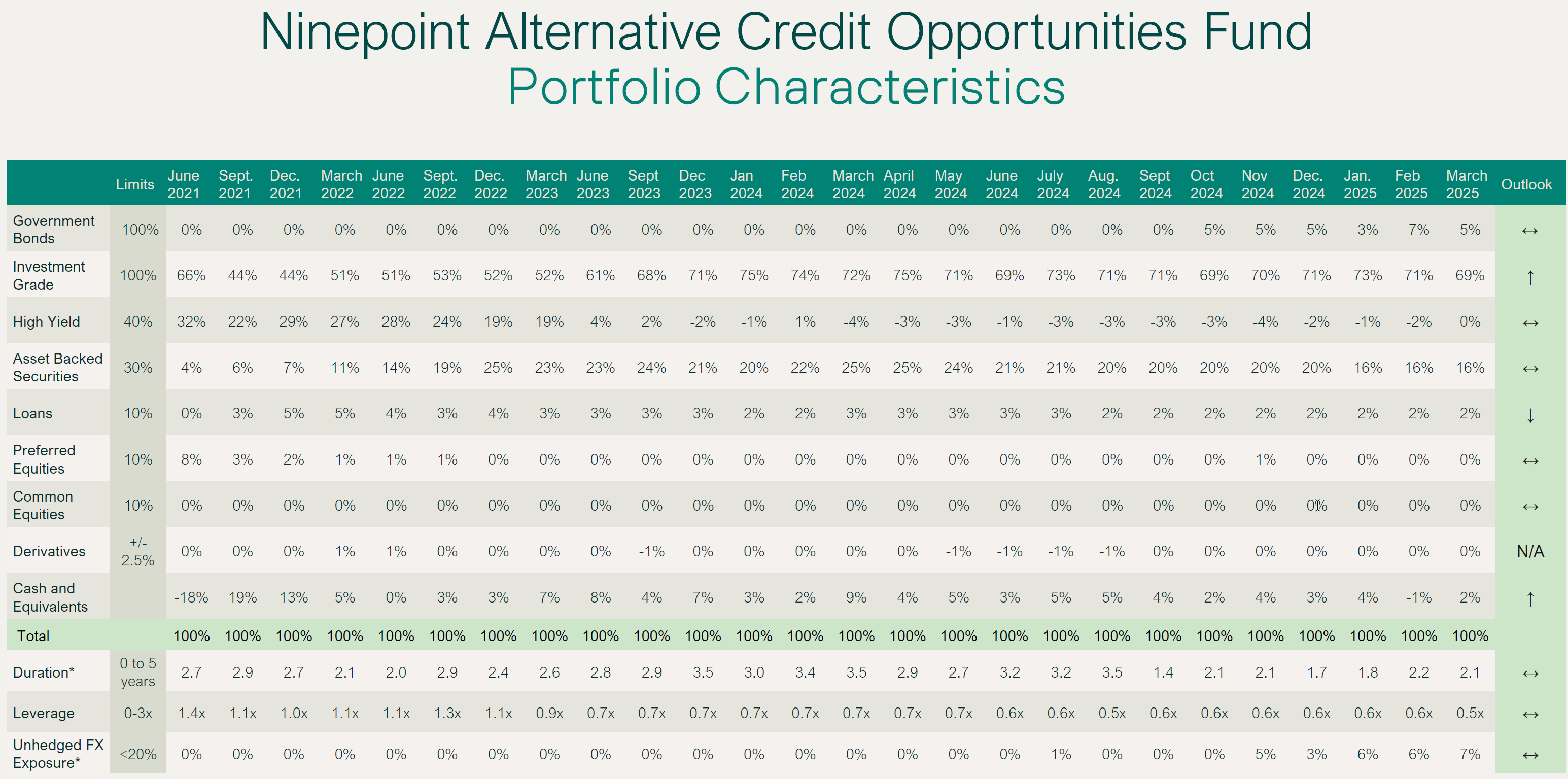

Despite wider credit spreads, the fund returned 11 basis points this past month. Credit hedges helped offset wider credit spreads. Duration decreased slightly to 2.1 years and leverage declined to 0.5x as we sold down higher beta positions. Yield-to-maturity decreased slightly to 5.2% (from 5.3%) as leverage declined.

NINEPOINT ALTERNATIVE CREDIT OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF MARCH 31, 2025 (SERIES F NPP931) | INCEPTION DATE: APRIL 30, 2021

1M |

YTD |

3M |

6M |

1YR |

3YR |

Inception |

|

|---|---|---|---|---|---|---|---|

Fund |

0.11% |

1.42% |

1.42% |

3.22% |

9.14% |

4.69% |

2.69% |

Ninepoint Credit Income Opportunities Fund

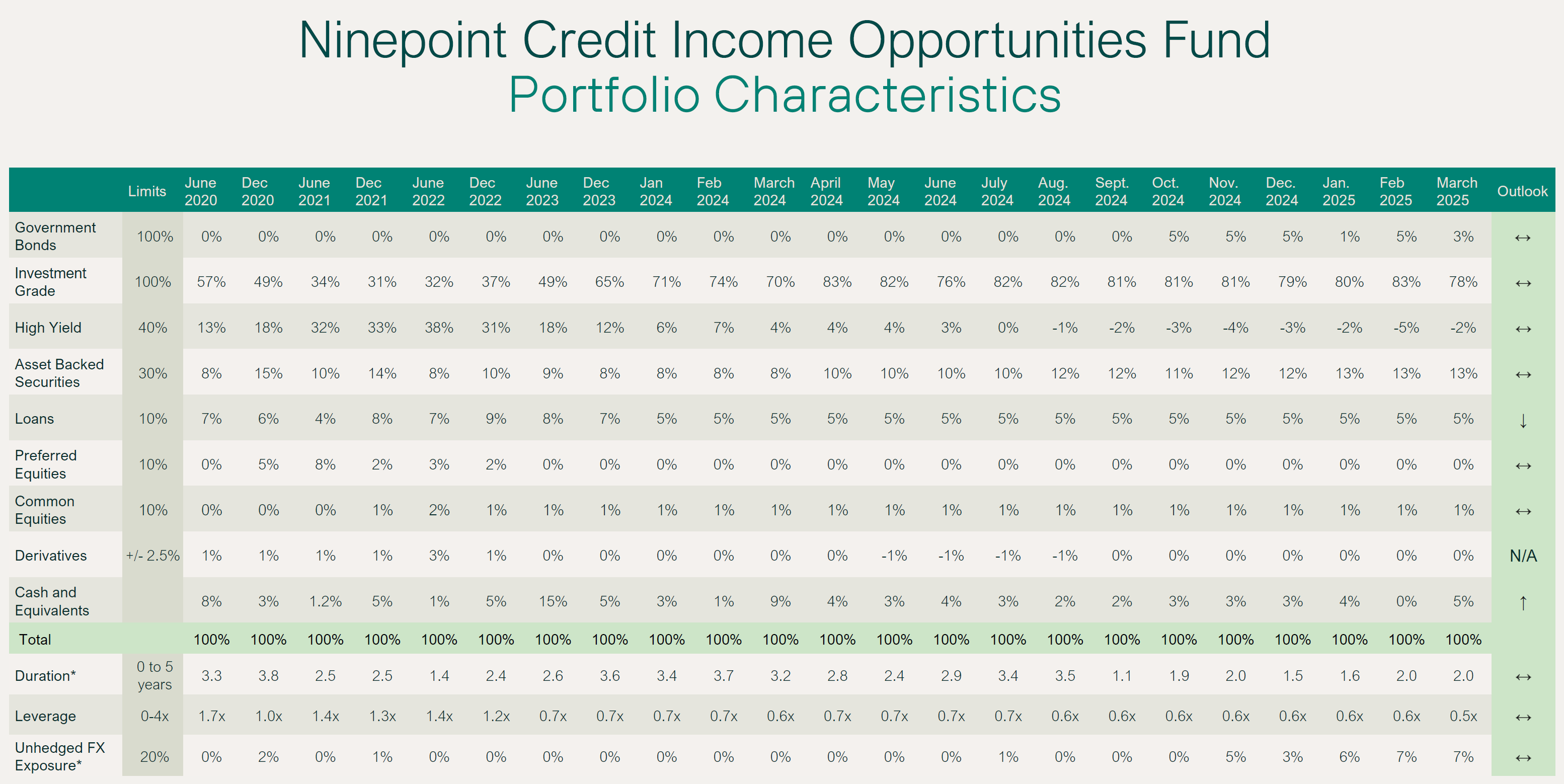

The fund was down 7 basis points in March; due to wider credit spreads. Leverage was down to 0.5x as we sold any remaining high beta positions. Duration was flat at 2 years while yield-to-maturity declined slightly to 5.3%.

NINEPOINT CREDIT INCOME OPPORTUNITIES FUND - COMPOUNDED RETURNS¹ AS OF MARCH 31, 2025 (SERIES F NPP507) | INCEPTION DATE: JULY 1, 2015

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|

Fund |

-0.07% |

1.48% |

1.48% |

3.18% |

8.64% |

4.79% |

7.55% |

5.02% |

Conclusion

Our funds are very well positioned for this trade war, and the stability of our returns so far this year is a testament to our preparedness.

Until next month,

Mark, Etienne & Nick

As always, please feel free to reach out to your product specialist if you have any questions.

March 31, 2025

March 31, 2025