Monthly Update

Year-to-date to March 31, the Ninepoint Global Infrastructure Fund generated a total return of 3.85% compared to the MSCI World Core Infrastructure Index, which generated a total return of 7.65%. For the month, the Fund generated a total return of -0.52% while the Index generated a total return of 2.56%.

Ninepoint Global Infrastructure Fund - Compounded Returns¹ As of March 31, 2025 (Series F NPP356) | Inception Date: September 1, 2011

1M |

YTD |

3M |

6M |

1YR |

3YR |

5YR |

10YR |

Inception |

|

|---|---|---|---|---|---|---|---|---|---|

Fund |

-0.52% |

3.85% |

3.85% |

7.16% |

21.99% |

9.85% |

12.08% |

7.47% |

8.51% |

MSCI World Core Infrastructure NR (CAD) |

2.56% |

7.65% |

7.65% |

7.39% |

21.16% |

6.89% |

9.57% |

7.95% |

11.13% |

President Trump’s so-called Liberation Day of “reciprocal” tariffs has triggered the worst one-day selloff since the depths of the Covid-19 crisis in 2020. On a two-day basis, the roughly 10% drawdown is comparable to the 1987 stock market crash, the 2008 Global Financial Crisis and the Covid-19 pandemic. The math used to justify the retaliatory tariffs is dubious at best and the mechanism used to apply specific rates to individual countries seems to have come from ChatGPT or some other LLMs, based on attempts to recreate the logic.

Beyond the ridiculous methodology, Trump’s ultimate goal of reshoring all industrial manufacturing to the United States seems questionable. Does he really believe that American consumers will be willing to pay significantly higher prices for domestically manufactured goods just to “Buy American”? It may not be a perfect system, but globalization has raised the standard of living around the world and generated tremendous wealth for millions and millions of people.

The stock market understands the risks of Trump’s trade war and the bizarre situation of a single individual looking to break the global economy without much evidence of any tangible benefits in the future. To be clear, the current tariff rates are worse than the worst-case scenarios of almost every economist or strategist. Most now expect that prices will surge, global growth will slow, and job losses will increase. Perhaps the correction becomes a true bear market before investors see some relief. But it is important to remember that selloffs eventually end and, given the pace of this most recent decline, even the tiniest bit of positive news could spark a powerful rally.

Importantly, valuations have become much more palatable, and the S&P 500 now trades back in line with the 10-year average forward P/E multiple of 18.5x (according to FactSet). We would also point out that the interest rate forward curve is currently pricing in four rate cuts in 2025, which should offer some downside support if the outlook continues to deteriorate. In this environment, we don’t want to panic, but we have reduced outsized allocations to individual stocks and investment themes while remaining invested in a diversified portfolio of dividend-paying, high-quality companies.

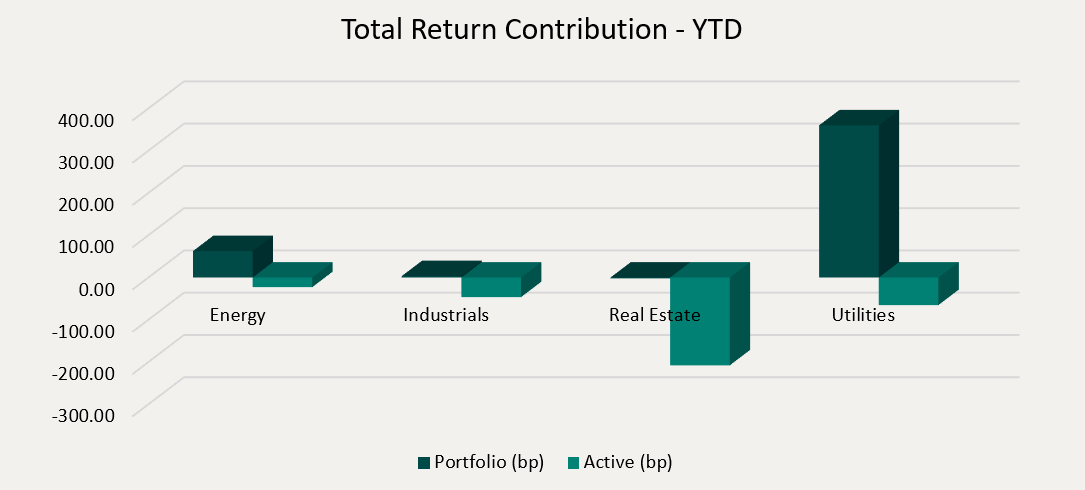

Top contributors to the year-to-date performance of the Ninepoint Global Infrastructure Fund by sector included Utilities (+360 bps), Energy (+63 bps) and Industrials (+3 bps), while only the Real Estate (-2 bps) sector detracted from performance on an absolute basis.

On a relative basis, no sector generated a positive return contribution, while negative contributions were generated from the Real Estate (-208 bps), Industrials (-46 bps) and Energy (-23 bps) sectors.

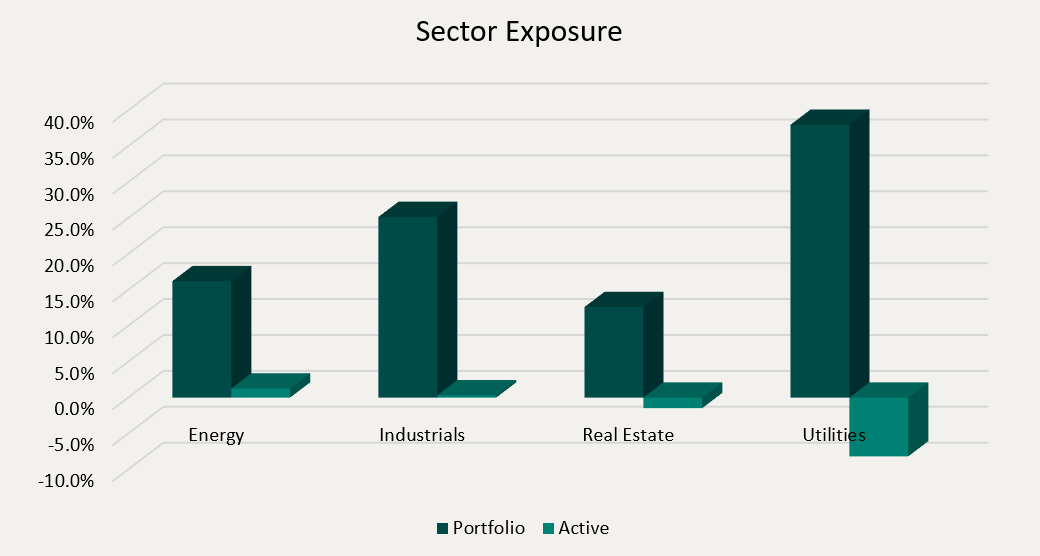

We are currently slightly overweight the Energy sector, market weight the Industrials sector and slightly underweight the Utilities and Real Estate sectors. Unfortunately, President Trump’s willingness to instigate a global trade war has led to a selloff in equities and greater volatility in the commodity, fixed income and currency markets worldwide. Although we are still optimistic about the back-half of 2025, chaos from the administration will keep the market on edge in the near-term.

We continue to believe that the infrastructure asset class is ideally positioned to benefit from the electrification of the US economy and increased fiscal spending on infrastructure in Europe. Importantly, electricity demand is expected to accelerate dramatically, led primarily by the construction of AI-focused data centers and the onshoring of industrial manufacturing. Therefore, we are comfortable having exposure to various infrastructure sub-sectors or sub-industries in the Ninepoint Global Infrastructure Fund that are positioned to benefit from these themes, including traditional energy investments, electrical, natural gas, nuclear & multi-utilities and engineering & construction contractors.

The Ninepoint Global Infrastructure Fund was concentrated in 28 positions as at March 31, 2025 with the top 10 holdings accounting for approximately 37.2% of the fund. Over the prior fiscal year, 16 out of our 28 holdings have announced a dividend increase, with an average hike of 3.9% (median hike of 1.4%). Using a total infrastructure approach, we will continue to apply a disciplined investment process, balancing valuation, growth, and yield in an effort to generate solid risk-adjusted returns.

Jeffrey Sayer, CFA

Ninepoint Partners

March 31, 2025

March 31, 2025