Ninepoint Fixed Income Strategy

February 2023 Commentary

Monthly commentary discusses recent developments across the Diversified Bond, Alternative Credit Opportunities and Credit Income Opportunities Funds.

Summary

- Stronger than expected economic data is prompting investors to reconsider just how far the Federal Reserve will have to raise interest rates, roiling global markets.

- In preparation for what looks to be an eventual recession, we have taken advantage of the recent increase in long-term interest rates to increase our funds' duration.

- Investment Grade Credit continues to outperform, due to high investor demand and limited supply. We favour low coupon, low price investment grade bonds for their tax efficiency.

- We continue to reduce High Yield. What we have left is short dated and of higher quality.

Macro

What a difference a month makes. In January, risk assets were rallying on the back of the “peak inflation and interest rates” story, with odds of a soft landing seemingly higher and even rate cuts later this year. Then in February, we saw a complete unwind of the prior month’s narrative. Stronger than expected payrolls and revisions to inflation made it less likely in investors’ minds that we would achieve the 2% inflation target any time soon. Result: higher interest rates across the curve, weaker equities market, and no more expected rate cuts in the back half of 2023. Perhaps even a higher terminal rate (futures pricing currently show a peak of 5.5% Fed Funds Rate this summer).

As we discussed in last month’s commentary, the road back to 2% inflation will be long and treacherous. For the next several months, every monthly inflation release will be scrutinized for signs that all the categories are heading in the right direction. Similarly, payrolls and wage numbers will be analyzed for hints of a long-awaited deceleration. And as it always does, economic data will no doubt surprise us all, positively and negatively, shifting around the narrative on any given day. Unfortunately, this volatility in economic indicators will be reflected in the markets but may create interesting opportunities down the road.

Our role, as stewards of our clients’ savings, is to navigate these swings, keeping an eye on the big picture and position the portfolios appropriately. No one can perfectly time every swing in market sentiment, but one must aim to be directionally accurate.

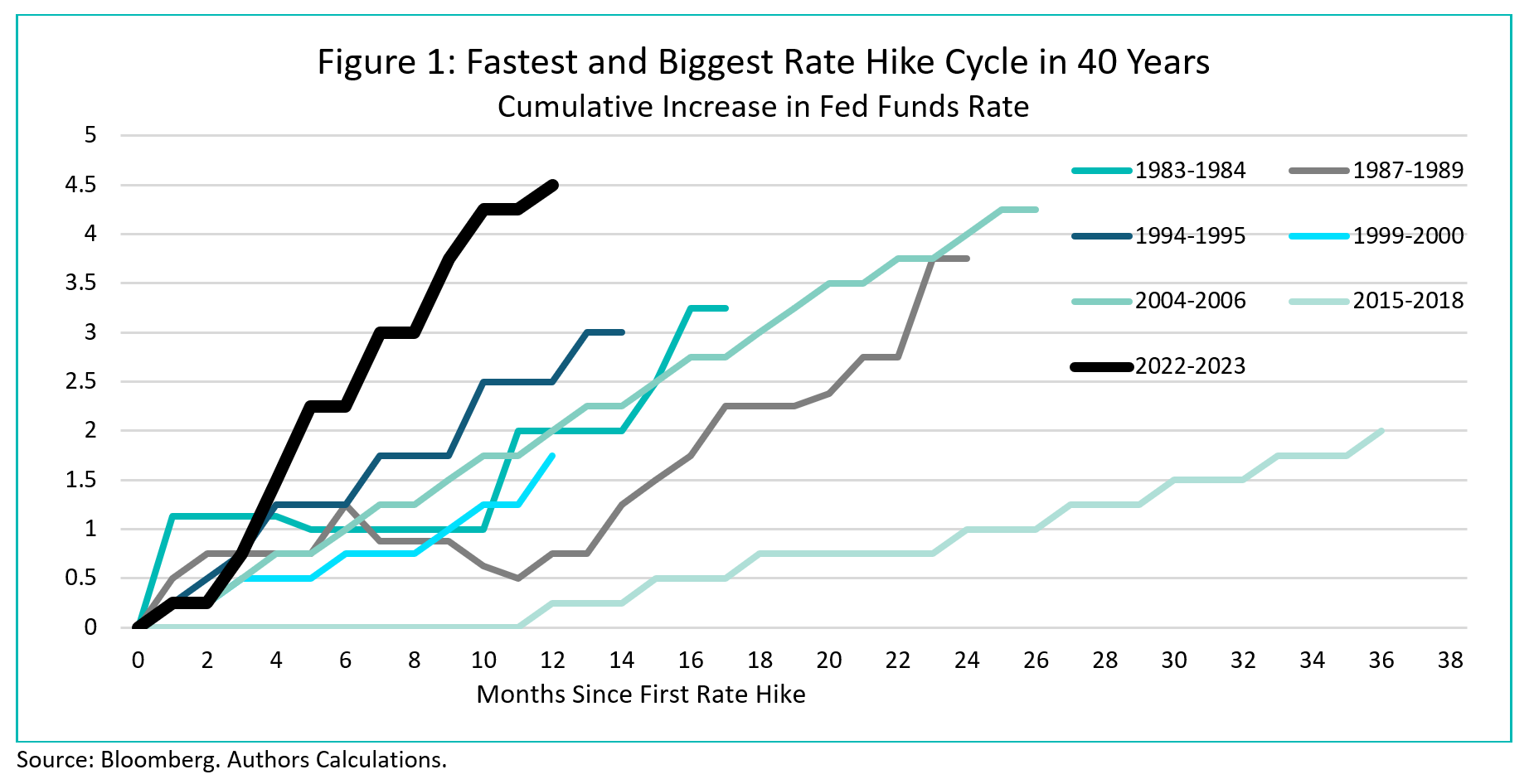

So far, 2023 continues to be similar to last year, we have an overheating economy, demand is too high, supply must catch up, and central bankers are tapping the brakes to tamper demand and reduce inflation. As shown in Figure 1 below, this U.S. rate hike cycle has been the fastest and largest on record since the double-dip recession of the early 1980s. And with a further 50-75bps of tightening in the US, (we expect maybe 1 hike here in Canada if things do not slow down enough) this hike cycle will rival the Volker years at the Fed. Monetary policy has a history of working, it is simply a matter of time before demand finally wanes. And there hasn’t been much time since those rates hikes began.

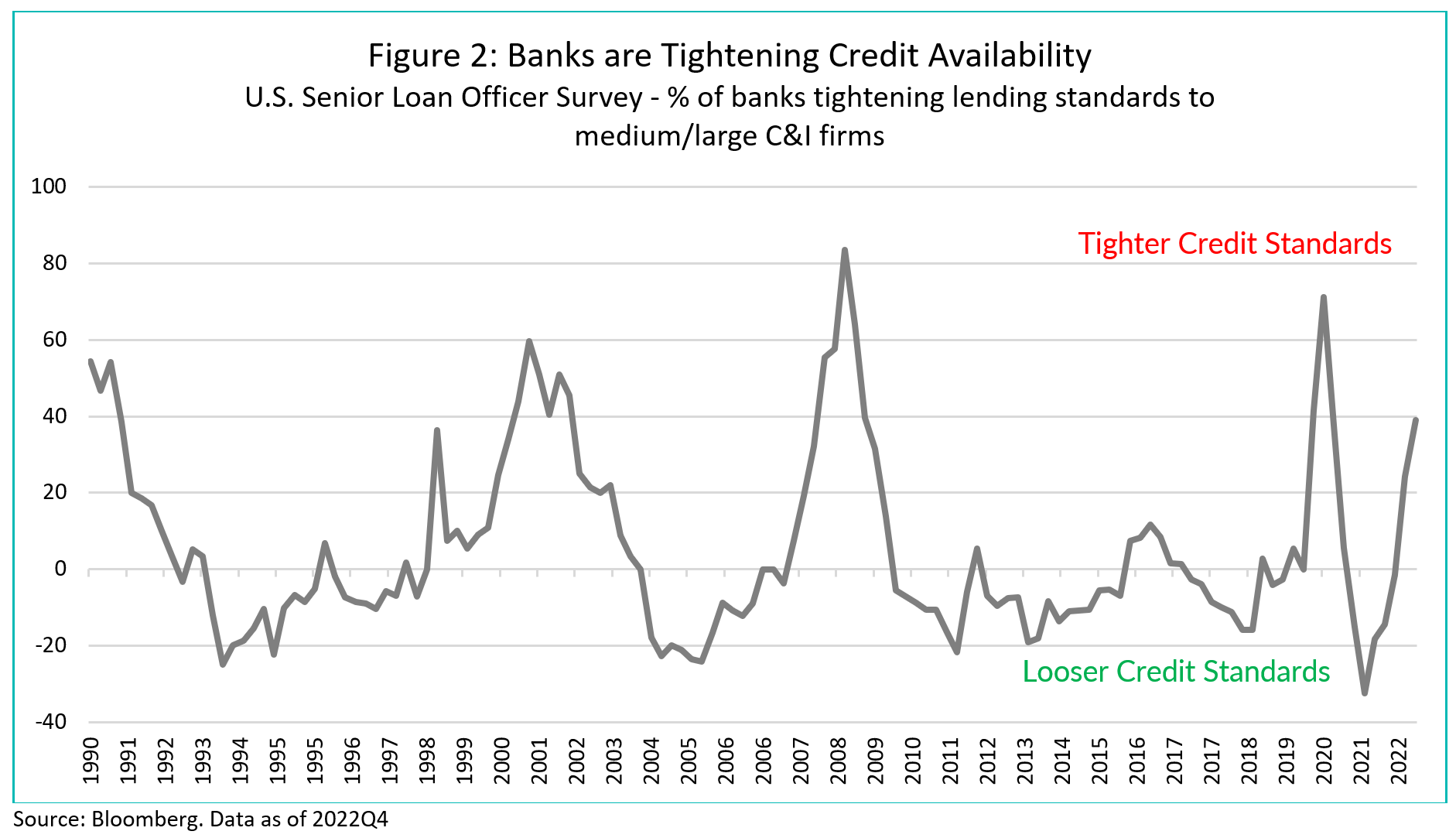

Banks have started to reduce credit availability (Figure 2), another reliable signal that the economy will soften going forward. We chose to show lending standards for firms, but the same applies to almost all categories of loans, from commercial real estate to mortgages and cards. We are also seeing the same in Canada, but time series aren’t as long, so we prefer to show U.S. data for better historical perspective.

So, it is going to take time, and economic data releases will swing market narratives back and forth, but from our perspective the direction of travel remains clear: the economy will decelerate, and, if history is any guide, enter recession at some point in the foreseeable future. That is the only way to bring inflation back to target in a sustainable fashion.

To prepare our portfolios for the inevitability of a recession, we are increasing government bond duration, improving credit quality and liquidity, reducing our allocation to High Yield, and layering in credit hedges. All our funds have yields-to-maturity ranging from 7.3% to 10.5%, not a bad place to be invested going into recession.

Credit

Canadian credit continued to perform well in February, with the Bloomberg Barclays Canada Aggregate Index tightening by 5bps, far better than the 9bps of widening in the US. The resilient tone in Canadian credit can be attributed to strong inflows into fixed income, a relatively slow month for new issuance and still extremely attractive all-in yields. Turning to sector performance, higher-beta sectors outperformed (e.g. autos, REITs, subordinated bank debt), while lower-beta sectors were the underperformers (e.g. utilities, pipelines, and telcos). Credit curves continued to steepen as the demand for front-end corporate paper remains very strong given that is where investors find the highest all-in yields (i.e. courtesy of a deeply inverted government bond yield curve).

February was a relatively slow month in terms of new issues in Canada, especially when compared to prior years. For the deals that did come to market, the order books remained very healthy, despite very slim new issue concessions (i.e. issuers are not being asked to pay-up to get a new issue across the finish line).

We continue to opportunistically high-grade the portfolios by increasing credit quality, increasing liquidity, reducing term, moving into lower-priced bonds, and reducing high-yield exposure. We outline some examples of this below across the funds which should serve as a helpful reminder on our active management approach.

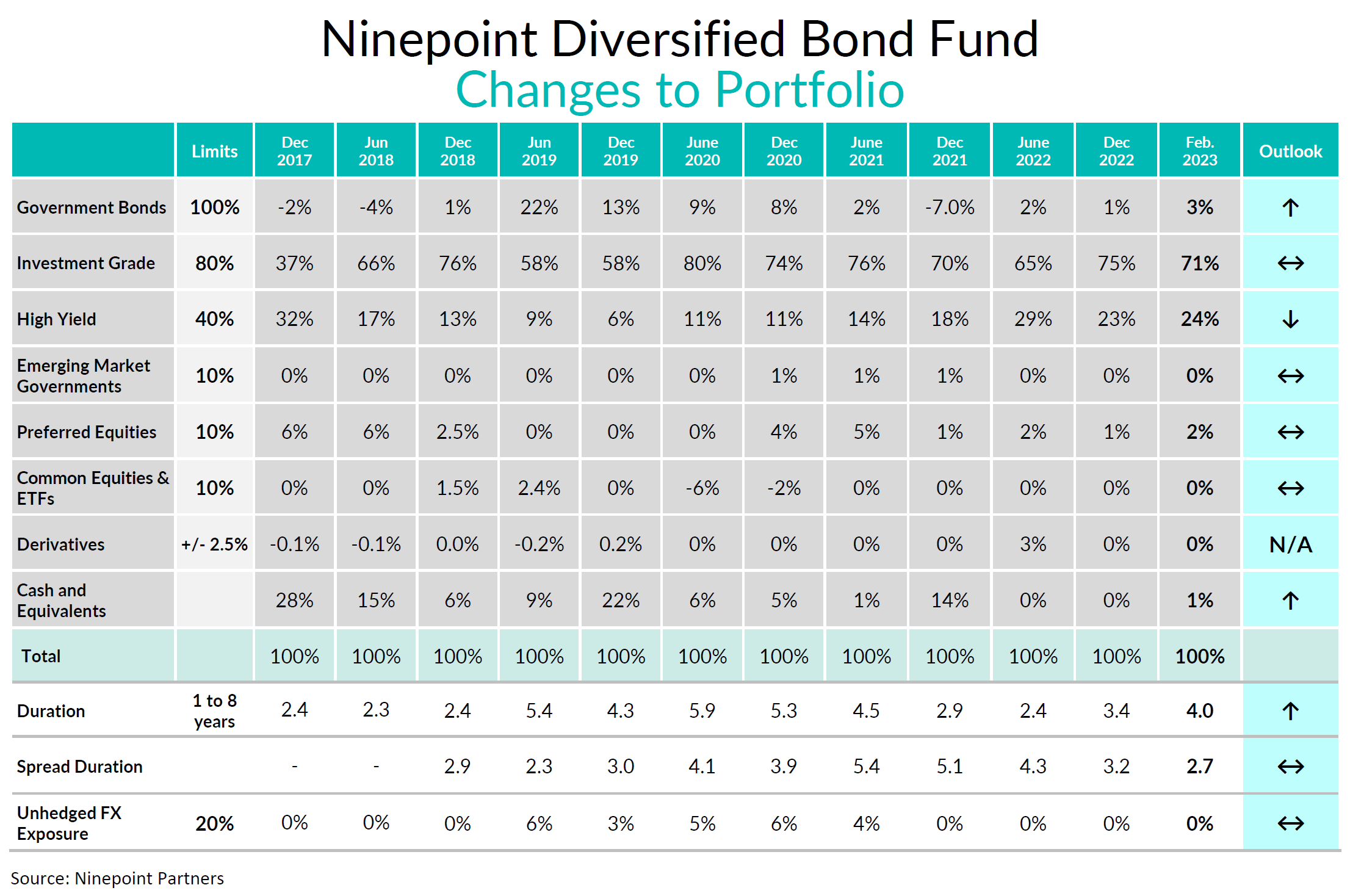

Ninepoint Diversified Bond Fund (DBF)

We increased our exposure to long Government of Canada bonds while adding upside option exposure to the TLT ETF (which tracks long-dated US Government bonds). As a result of this, our duration moved up to 4 years (from 3.5 years one month prior). We also continued to prudently reduce credit risk with the fund’s spread duration moving down 0.3 years to 2.7 years during the month. As of month-end, the portfolio’s yield-to maturity was 7.3% (up slightly from 7.2% in January).

To help showcase just one of the many opportunities we are unable to uncover, the following trade was executed this month. We sold a Laurentian Bank subordinated bond callable in 2027 at a $96 price to move into a Ford bond with a 2026 maturity. We liked this trade for numerous reasons including picking up 21bps in yield, taking out $7 in price, retracting term by one year while maintaining credit quality (both bonds are rated BB+). We continue to scour secondary markets to find opportunities like these.

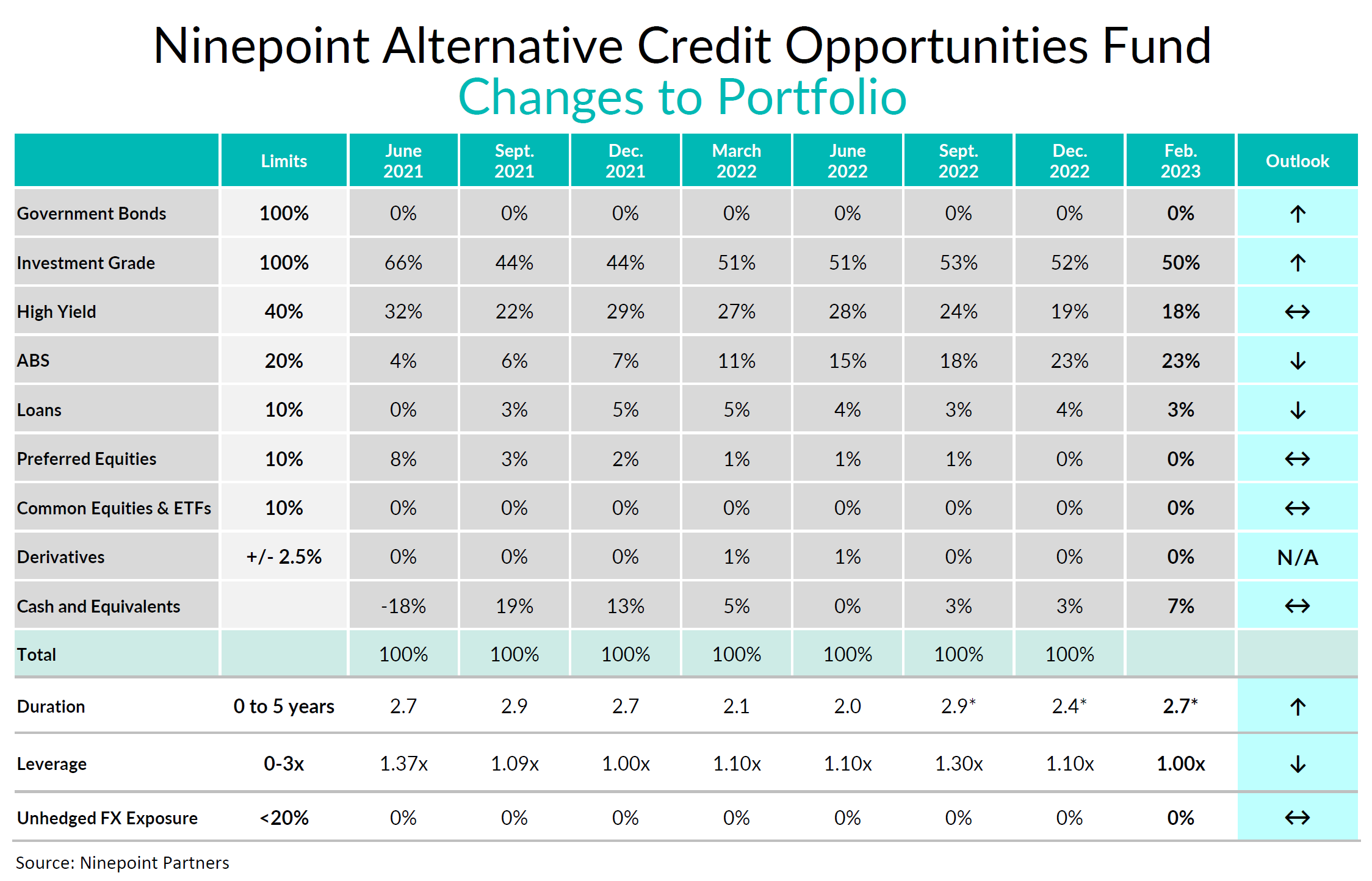

Ninepoint Alternative Credit Opportunities Fund (NACO)

We increased duration to 2.7 years, from 2.2 years one month ago, by adding upside option exposure to the TLT ETF (which tracks long-dated US Government bonds). We also brought our credit risk down, with spread duration now down to 6.2 years (from 6.6 years one month prior). Leverage was unchanged month-over-month at 1.0x which we feel comfortable with at this juncture.

We also took profits on a Metro 10-year bond as the spread compressed materially since the January 30, 2023 issue date. We also fully exited our position in 7-year Choice Properties as it materially tightened following the 10-year Choice Properties new issue. As a replacement, we moved into a National Bank subordinated bond callable in 2027, increasing yield and liquidity while also reducing term.

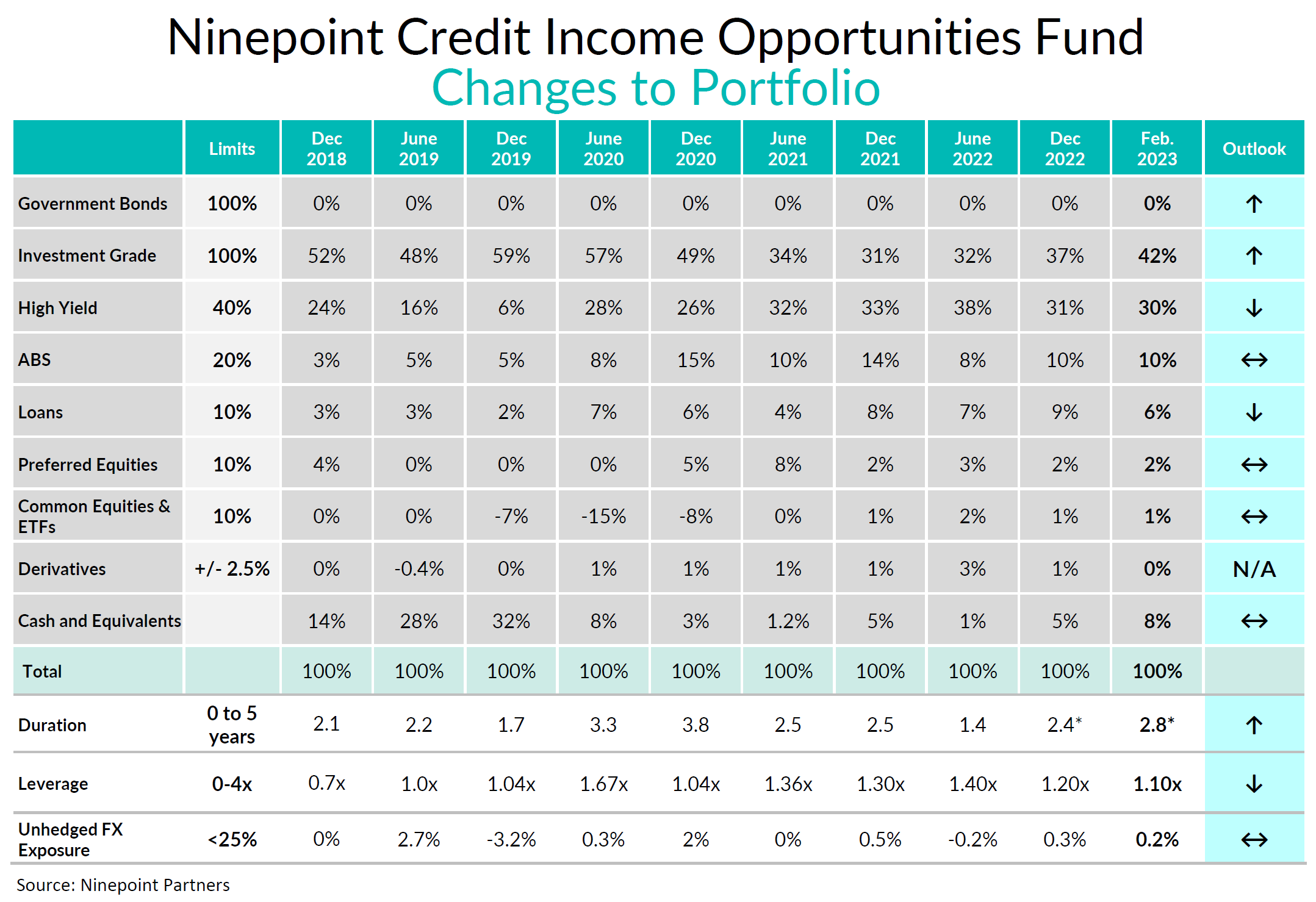

Ninepoint Credit Income Opportunities Fund (Credit Ops)

We increased duration in the portfolio to 2.8 years from 2.2 years one month ago via adding upside option exposure to the TLT ETF (which tracks long-dated US Government bonds). We also brought our credit risk down during the month with the funds spread duration now at 6.5 years (from 7.1 years one month prior). Leverage was unchanged month-over-month at 1.1x.

We executed numerous switch trades to take advantage of various market dislocations. For example, we sold a Penske bond maturing in December 2025 to buy a Wells Fargo bond maturing in May 2025. We moved into an A- credit from a BBB credit, picked 19bps in all-in yield, reduced price by $3 and reduced term by 0.5 years. We also sold a VW bond maturing in November 2025 to buy a Manulife bond callable in August 2024. We reduced term by over a year, picked up 30bps in yield, reduced price by ~$5 and moved into an A- credit from a BBB+ credit.

Conclusion

We believe having lower credit duration, higher government bond duration, better liquidity and credit hedges are the best way to prepare for the coming recession. You can expect us to continue to move in that direction. The good news is that all these defensive actions don’t sacrifice the funds’ yields, which still range from 7.3% to 10.5%.

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at February 28, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at February 28, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at February 28, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended February 28, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 01/2023