Ninepoint Silver Equities Fund

February 2023 Commentary

All that Glitters is Gold & Silver!

It is often said that central bank policies work with a lag. Precisely a year ago, the Federal Reserve started raising rates to put the inflation genie back in the bottle. The aim of the Fed policy and other central banks around the world was to increase the cost of borrowing and throttle the creation of easy, low-cost credit. Unfortunately, inflation has remained stubbornly high - albeit appears to be rolling over. The unintended consequences of the Fed policy have been a significant increase in market risk.

The Ninepoint Silver Equities Fund, Series F returned -12.8% for February 28, 2023.

NINEPOINT SILVER EQUITIES FUND - COMPOUNDED RETURNS¹ AS OF FEBRUARY 28, 2023 (SERIES F NPP866) | INCEPTION DATE: FEBRUARY 28, 2012

| 1M | YTD | 3M | 6M | 1YR | 3YR | 5YR | 10YR | Inception | |

| Fund | -12.8% | -8.7% | -7.0% | 10.7% | -29.3% | 5.2% | 4.6% | 0.5% | -3.1% |

| MSCI Silver Select (CAD) | -13.1% | -7.5% | -8.2% | 16.8% | -19.6% | 3.8% | 2.6% | -1.9% | -4.6% |

Market risk is the possibility that an individual or other entity will experience losses due to factors that affect the overall performance of investments in the financial markets. So far, market risk has made victims out of a few US regional banks, including the highly coveted fall of Silicon Valley Bank and Signature Bank. Across the Atlantic, Credit Suisse, which is among the 33 institutions deemed to be systematically important, is teetering. Silicon Valley Bank failed because of an asset-liability mismatch. They purchased securities with long duration and low yields whose values were crushed due to high rates, rendering the bank insolvent when depositors demanded their money back.

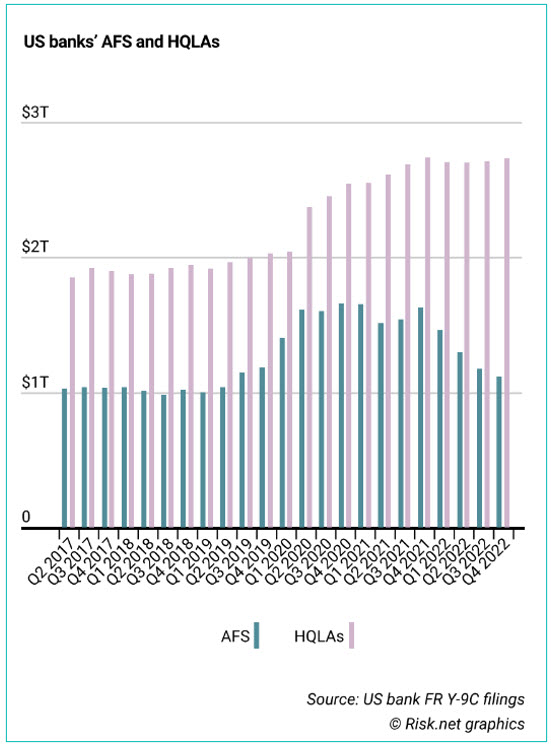

I suspect that virtually all banks are not only exposed to duration risk but are holding securities that would sell at a steep loss today in a liquidation scenario. This is best visualized when comparing the "Available for Sale" securities (AFS) versus the "High-Quality Liquid Assets" (HQLA). As the chart below from Risk.net shows, the securities available for sale have significantly decreased in recent quarters versus high-quality liquid assets. The reason is simple – more and more of the assets deemed to be "high quality" are deeply underwater.

What we are seeing today is a storm surge in market risk. As a market commentator at Merrion Capital Group pointed out, 'The Fed is the systemic risk.'

I am willing to bet a dollar that this sudden increase in market risk is enough to spook banking institutions of all sizes and across geographies. This, in turn, will lead to a reduction in credit that banks extend, which really is quite deflationary. Perhaps this is precisely what the Fed and other central banks around the world wanted to see happen.

What comes next is the more problematic part. A storm surge in market risk, which leads to a reduction in credit extended by banks, is likely to lead to events that are linked to credit risk.

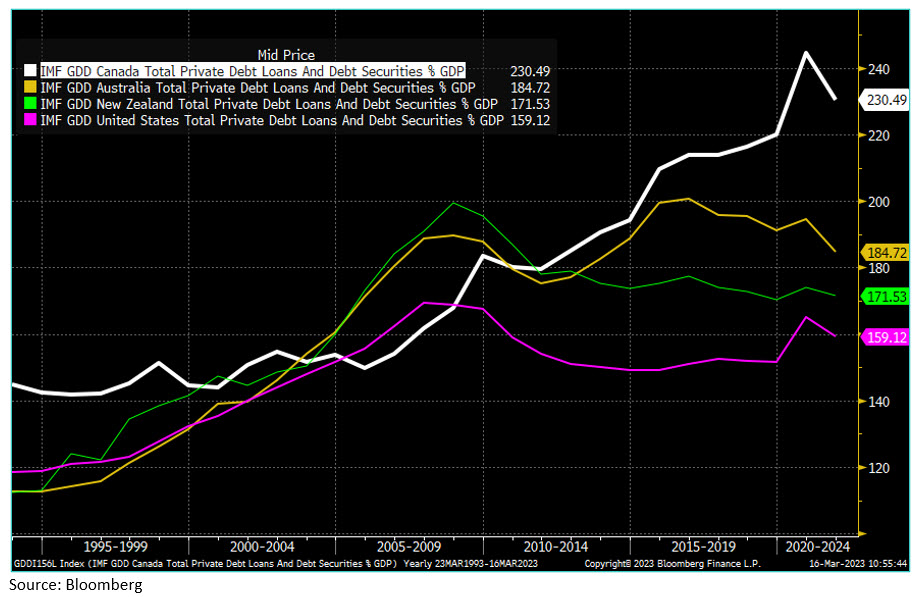

Credit risk is defined as the possibility of a loss resulting from a borrower's failure to repay a loan or meet contractual obligations. Credit is the lubricant in the modern economy. When banks reduce the amount of credit available, those in debt are most at risk of defaulting on their loans. Today, in many parts of the world, especially in countries like the US, Canada, Australia, and New Zealand, the amount of private debt far eclipses the total annual GDP of these countries. All these countries, in addition to many developed nations, are exposed to credit risk arising from the throttling of bank credit. If you want to look at a country most exposed to credit risk, look no further than north of the 49th parallel.

Market risk and credit risk are two very different animals. Market risk can be siloed and contained. Credit risk, like what we saw in 2008, spreads like wildfire and often requires a response from the central banks.

It is safe to assume that banks will lend less given today’s environment to protect their balance sheets. Lower credit creation is deflationary, and this is precisely what the central banks want to see happen. The big uncertainty here is how drastic the tightening of credit will be. If banks hit the brakes, we are certain to see a hard landing combined with rapid deflation. If the banks gently tap the brakes, the economy will slow, but in a less drastic fashion. The latter is the preferred outcome, but the big unknown is the impact this will have on the inflation picture – which continues to rage. The Feb 2023 CPI printed at 6%, which is still uncomfortably high.

The potential impact of a recession on precious metals is a fascinating area to explore. If the economy experiences a moderate to severe recession, central banks may have to become more accommodative by cutting rates. This could create a negative real interest rate environment, which historically has been positive for gold and other real assets. Furthermore, any new rounds of quantitative easing (QE) could push bond yields below the rate of inflation, which would increase the risk of fiat currency debasement. The current buoyant price of gold suggests that central banks are anticipating these developments.

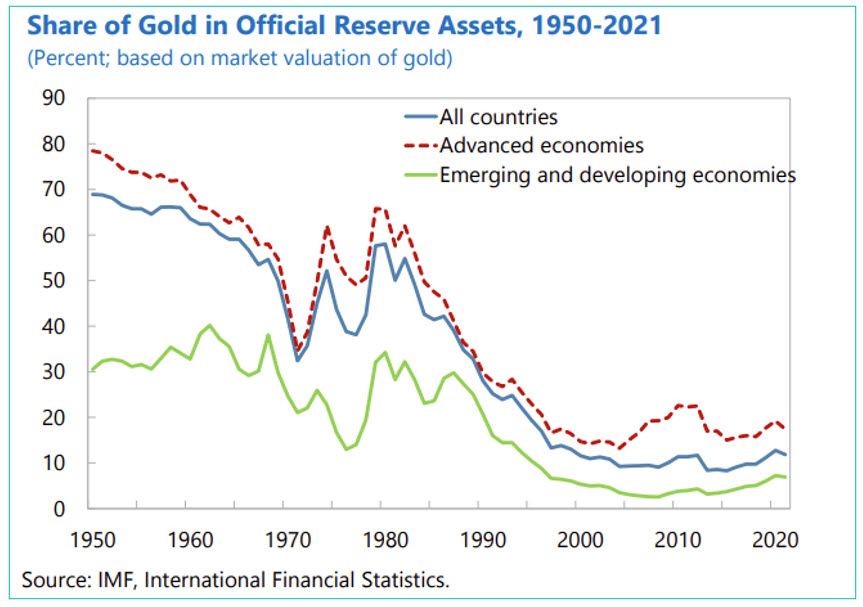

Central banks around the world have also recognized the importance of holding gold as a reserve asset. In fact, there were record levels of central bank gold purchases in 2022, while the USD's share of global reserves continued to decline. It's worth noting that gold used to account for about 70% of global central bank reserves in 1950, and advanced economies held nearly 80% of their reserve assets in gold at that time.

Over the past few years, we have seen central banks emerge as buyers of gold while they rotate out of fiat currencies such as the USD and the Euro. The freezing of all Russian-held USD and Euro-denominated reserves highlighted the importance of holding gold even further to all countries around the world should they be deemed “unfriendly” by the West. The trend is towards CBs owning more gold and less fiat.

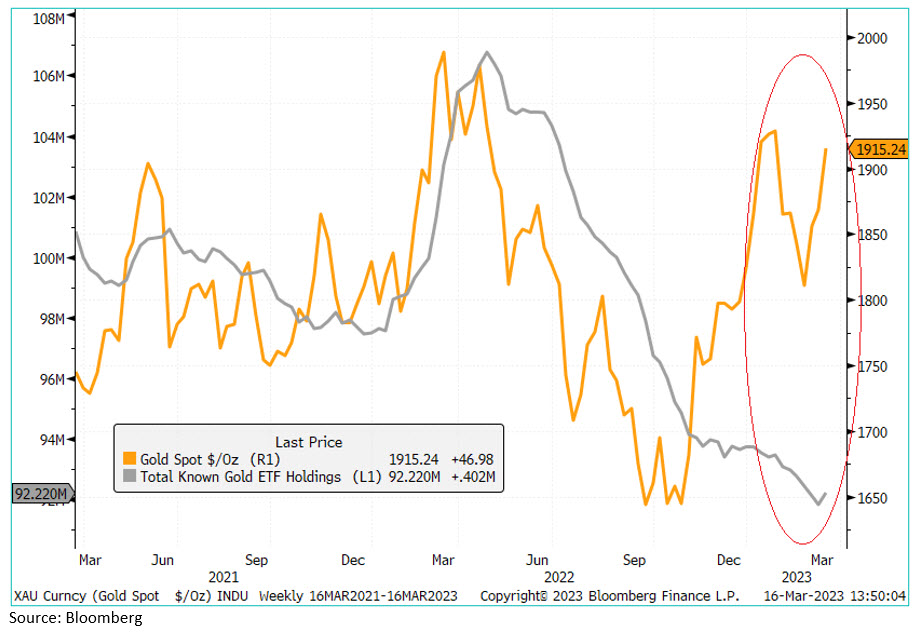

Investors and institutions at large have not been paying attention to gold. It has to be pointed out that the recent run-up in gold has occurred despite investors redeeming their ETF bullion holdings.

Retail and institutional investors should be reminded of the importance of owning the "barbarous relic" in their portfolios, not for its cash flows or its ability to pay interest but for the simple fact that gold and silver cannot be debased and are no one else’s liability. In a recent article, Ray Dalio of Bridgewater eloquently articulated the current state of the market when he said, “With the enormous size of US debt assets and liabilities outstanding, plus lots more to come, there is a high risk that the supply of government debt will be much larger than the demand for it”. We posit that the same situation is occurring for ALL debt assets of varying quality. It is for this reason that the banks are caught holding assets to maturity because a sale of the “high quality” assets on their books is sure to trigger a loss.

We are at an important juncture in the financial markets, where market risk is present and credit risk is nigh. Volatility across asset classes seems like a highly probable outcome as does the probability of fiat money being worth less. We believe that using volatility to add real assets, especially on dips in bullion and precious metal equities, could generate glittering returns. Precious metals, which have been one of the most underappreciated and under-owned asset classes, are about to get their day in the sun.

Maria Smirnova MBA, CFA

Sprott Asset Management

Sub-Advisor to the Ninepoint Silver Equities Fund

1 All returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at February 28, 2023; e) 2012 annual returns are from 02/28/12 to 12/31/12. The index is 100% MSCI ACWI Select Silver Miners IMI (CAD) Index and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: capital gains risk; class risk; commodity risk; concentration risk; currency risk; cybersecurity risk; derivatives risk; exchange traded funds risk; foreign investment risk; inflation risk; liquidity risk; market risk; securities lending, repurchase and reverse repurchase transactions risk; series risk; short selling risk; small capitalization natural resource company risk; specific issuer risk; sub-advisor risk; substantial shareholder risk; tax risk; uninsured losses risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended February 28, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540