Ninepoint Fixed Income Strategy

March 2023 Commentary

Monthly commentary discusses recent developments across the Diversified Bond, Alternative Credit Opportunities and Credit Income Opportunities Funds.

Summary

- The failure of 3 US regional banks is the first obvious consequence of the recent rate hike cycle. Beyond the failed institutions, this will have negative repercussions for the economy for several quarters.

- The turmoil in US banks spread to Europe’s weakest link: Credit Suisse, which in the end was taken over by UBS. For now, it seems like the contagion stops there.

- After surprising to the upside earlier in the year, March economic data has been consistently weaker than expected, amplifying the banking induced gloom.

- From our perspective, the events of the past month highlight the important lags with which monetary policy affects the real economy, principally through the banking system.

- Expect continued weakness in economic data to take interest rates lower in anticipation of rate cuts perhaps later 2023 or early 2024.

Macro

A decade of rock-bottom interest rates, followed by the sharpest increase in interest rates since the 1980s, was bound to create some damage. On March 8th, after a failed attempt at recapitalization, Silicon Valley Bank (SVB) was on its way to becoming the second largest bank failure in the history of the U.S. banking system. The FDIC took over both SVB and New York based Signature Bank, with the intention of winding them down. The U.S. Treasury and the Federal Reserve also announced emergency measures as a backstop to stem deposit outflows and stabilize the banking system. The following week, Credit Suisse comes under pressure, leading to a complete takeover by rival UBS. Since then, things have finally stabilized, but sentiment has clearly shifted to the downside.

How did we get here, should we expect more bank failures, and what are the implications for the overall economy?

The genesis of this most recent episode of banking stress can be traced back to the pandemic-era quantitative easing (QE). At that time, to stabilize markets, provide liquidity and stimulate the economy, the Fed bought very large quantities of bonds. When they buy bonds, the cash they pay to the seller becomes a deposit somewhere. Consequently, the main beneficiary, the banking system, became very flush with cash and deposits. Banks are in the business of taking deposits, and making loans with cash, employing about 10:1 leverage on their capital. During this pandemic period, banks had huge deposits and very few loans were being made, so they decided to invest in more bonds with their cash. Because interest rates were so low in 2020 and 2021, many of those banks bought bonds with longer terms to maturity, to earn a higher level of interest.

Silicon Valley Bank, as its name implies, had a very focused business model, catering to businesses and owners of technology, crypto and biopharma companies that make up the Silicon Valley ecosystem. During the most recent tech bubble, these companies and their backers (venture capital firms) had so much money they didn’t know what to do with it. So, they placed it as deposits with SVB. And in turn, SVB bought a lot of long dated US Treasury bonds and Mortgage-Backed Securities. In 2018, SBV had ~$50bn in assets. By 2022, it had more than quadrupled to ~$212bn. Their capital did not grow as fast, resulting in an increase in leverage (Assets-to-Equity) from 11x to 17x over the same period. This rapid asset growth and increase in leverage should have been red flags for investors and regulators, but both were ignored.

Fast forward to 2022, as the Fed is hiking interest rates at a furious pace to combat inflation, bond prices are plummeting 10-15%, and these banks are now facing large paper losses on these bond portfolios that were predominantly bought in 2020 and 2021, when prices were very high and interest rates much lower. Accounting rules in the U.S. allow banks to designate bonds as “hold-to-maturity”, in effect not marking their prices to market, as opposed to an investment fund like ours where bond prices are marked daily, reflected in NAV on a daily basis. For those banks, in theory at least, they can hold on to those bonds to maturity and never realize the paper loss, as long as they can keep on funding them with deposits until their maturity. Unfortunately for SVB, this is not what happened. Following the tech and crypto crash of 2022, many of SVB’s clients had to withdraw deposits to fund business operations. Deposit withdrawals forced SVB to sell part of their bond portfolio to raise cash, crystalizing losses. Because of the magnitude of those losses (amplified by their high leverage), they were undercapitalized, and tried to raise capital by selling equity in a secondary offering. But investors quickly realized that there were big problems with SVBs bond portfolio: these unrealized losses were so large that they completely dwarfed their capital (i.e. accounting for those bond losses, their book value was negative). The deposit outflow accelerated, the equity sale was pulled, and the rest is history.

Can the troubles at SVB be generalized to the rest of the U.S. (and global) banking sector? We do not think so.

SVB had a very concentrated set of clients, all exposed to the same microeconomic factors (i.e. VC/tech/crypto). It grew very quickly (4x in 4 years), and their interest rate risk mismanagement was egregious. It is unlikely that we will see another such spectacular collapse for the same reasons. But the consequences of this bank failure have much broader ramifications. Prior to this, depositors generally assumed that their deposits were safe, regardless of size and institution. This confidence has been shaken, and will disproportionally impact smaller banks, who will either have to pay more for the same deposits to entice depositors or lose deposits at the expense of larger banks and money market funds.

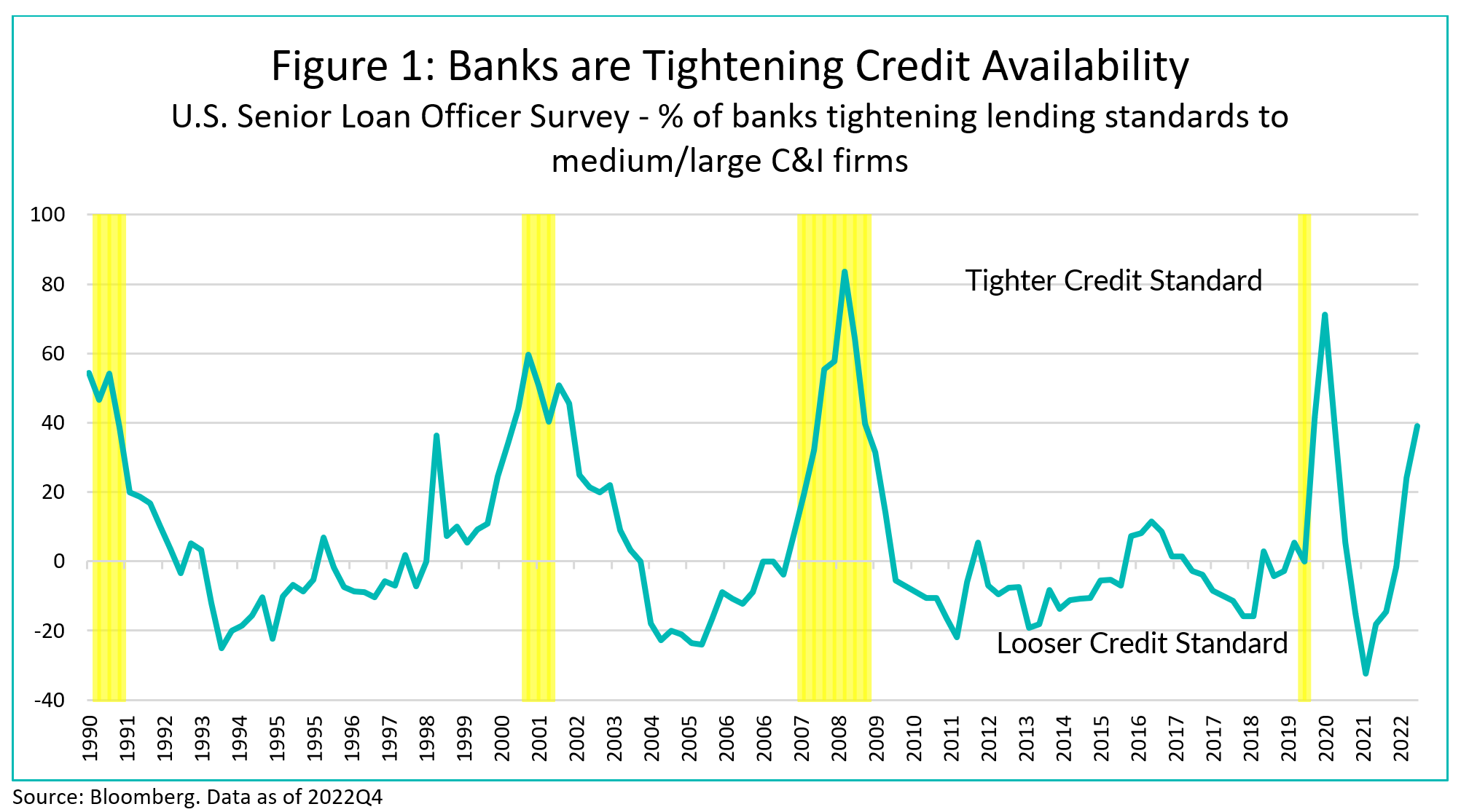

Credit was already getting more difficult to get (Figure 1 above), as banks were tightening credit availability for all types of loans. Unlike Canada, where the Big 6 Banks control most of the market, the U.S. banking system is more fragmented, and smaller banks account for a large proportion of bank lending. Banks with less than $250bn in assets account for 50% of total bank business lending. For commercial real estate (CRE), that figure is 80%. We, therefore, expect all banks to tighten lending standards further, with a disproportionate impact on business and CRE lending.

This is particularly bad timing for owners and operators of Commercial Real Estate. Fundamentals in this sector have been weak for some time. In 2018 it was retail that faced a series of bankruptcies. Now investors are concerned about office space, where occupancy levels are low, and prices are starting to decline. Apartment and industrial (warehouses) have seen a large amount of construction over the past few years and could be next in line. Weak fundamentals, coupled with higher interest rates and tighter credit availability, will prove a real headwind to real estate investment going forward.

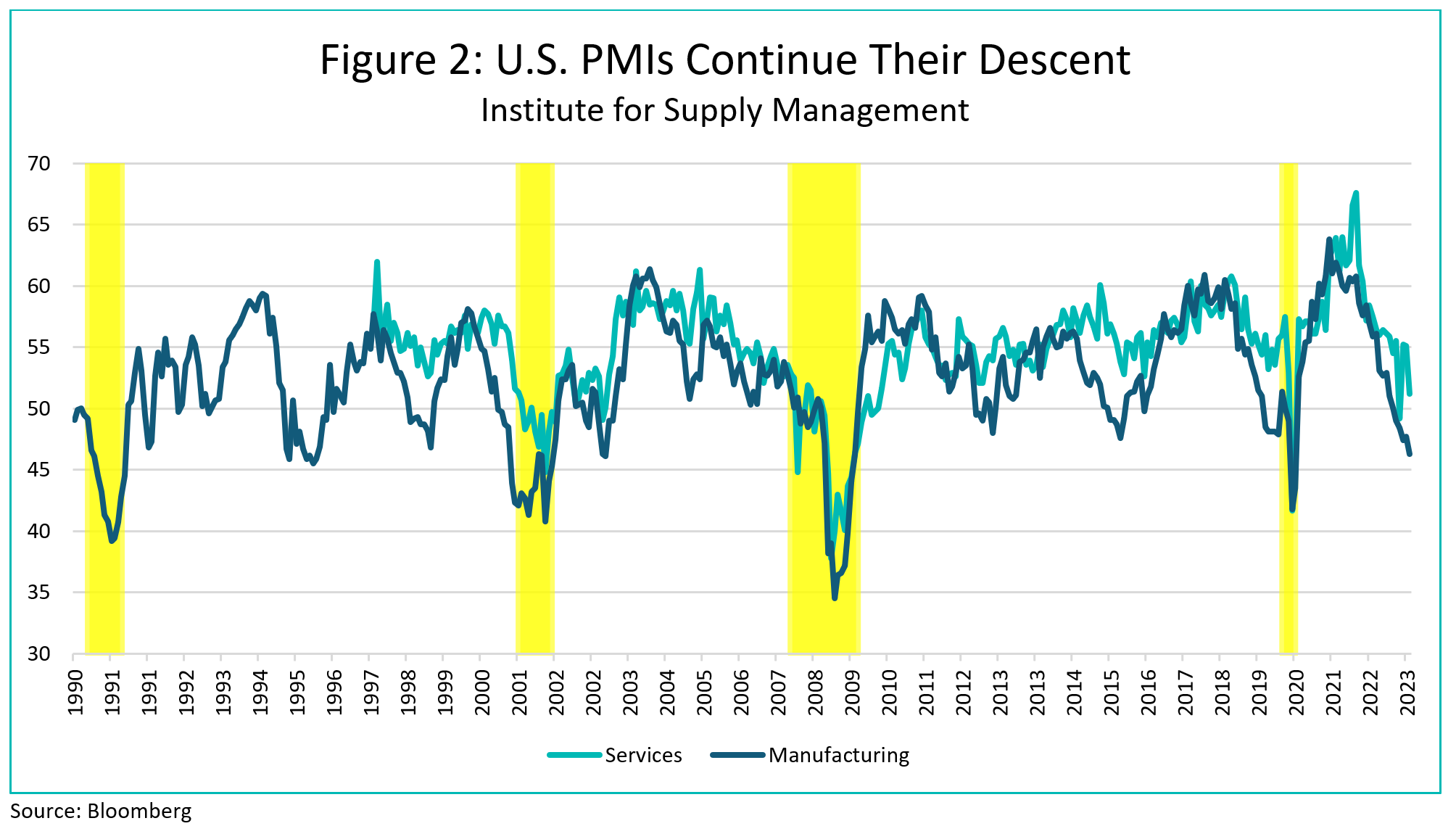

Meanwhile, survey data from both services and manufacturing firms continue to decelerate (Figure 2 below).

In a capitalist economy, credit is the oil that greases the wheels of the system. Credit was already getting more difficult to get, and the events of the past few weeks will have accelerated this trend.

Markets have now stabilized, and some of the credit spread widening, particularly bank bonds, has subsided. But REIT credit spreads and Commercial Mortgage-Backed Securities (CMBS) understandably remain under pressure. As economic data continues to slow, we expect interest rates to continue to decline in anticipation of rate cuts. During the month, we added more upside exposure to U.S. government bonds with options, a strategy we have used in the past. We also monetized some Investment Grade Credit Hedges, rolling the profit into High Yield Credit Hedges, where we think issuers are more vulnerable to a slowing economy.

Credit

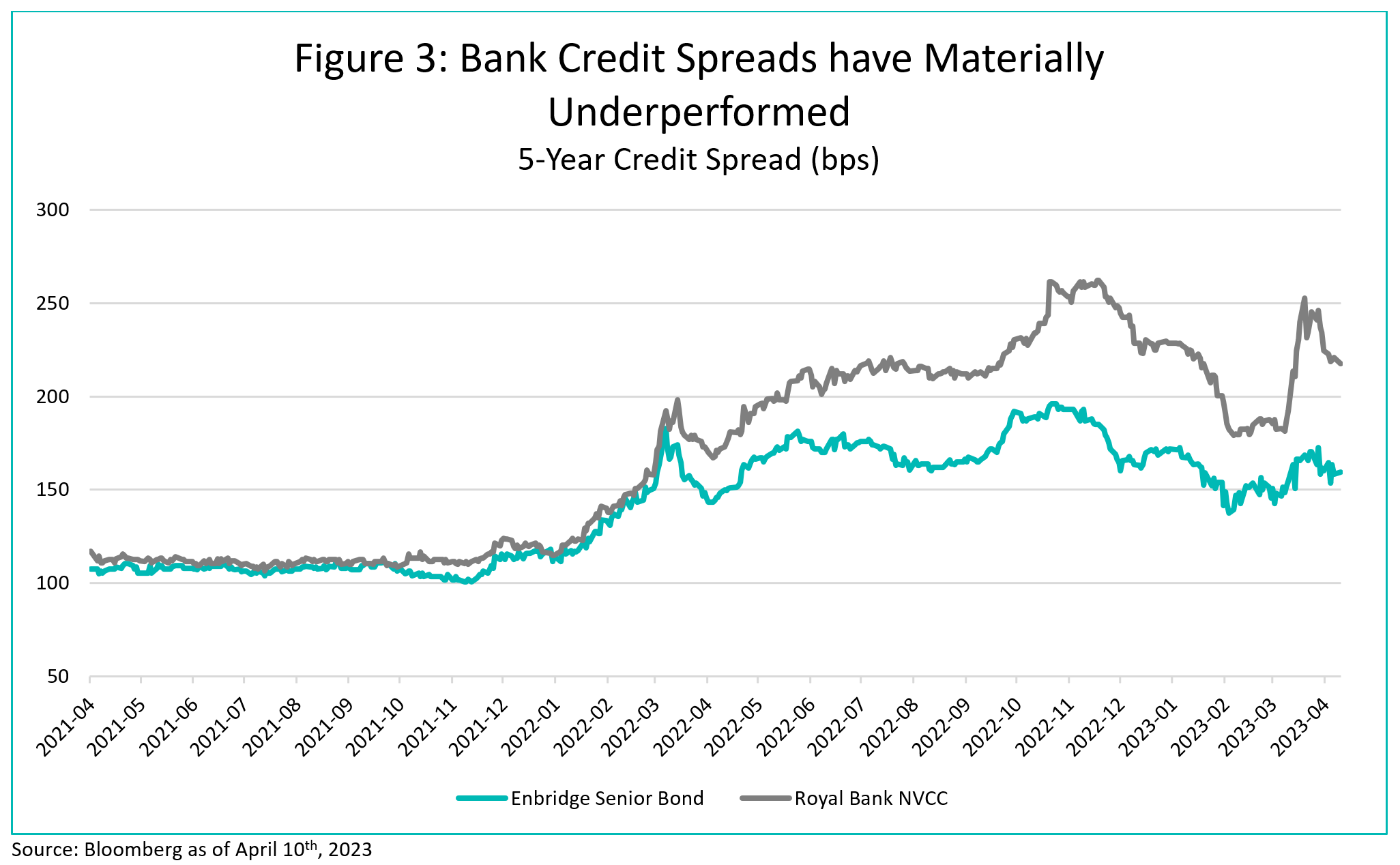

While credit spread performance was strong in both January and February, come mid-March credit spreads across the globe widened materially, given the turmoil in the US and European banking sectors. For context, the credit spread on the Bloomberg US Corporate Bond Index entered March at +132bps, peaked at +171bps, but then sharply rallied heading into month end and closed 16bps wider for the month. In Canada, similar directional moves transpired albeit less pronounced (as is often the case), both on the knee-jerk widening but also on the subsequent rally. The credit spread on the Bloomberg Canada Corporate Bond Index entered March at +146, widened to +175 but failed to snap tighter with the US. As expected, the worst performing sector was financials while the relative outperformers were the more defensive sectors such as utilities and pipelines. Figure 3 below shows the 5-year credit spreads on Enbridge (rated BBB+) and Royal Bank subordinated bonds (rated A-). The difference is striking, with RY underperforming ENB by a factor of 3 during the peak of the panic in March. Given our overweight in high quality Canadian and US financials (thankfully, we have avoided real estate (REITS) since last summer), our strategies underperformed our expectations, but we expect this differential to reverse over the coming months, especially given the strong performance of late credit spreads for financials in the US market (Canada always lags the U.S.).

Given the volatility, the new issue market was light and effectively shut for a week or so mid-month. Corporate bond supply year-to-date is drastically trailing last year’s elevated pace and now sits at just ~$24bln vs ~$43bln this time last year. Given our recent conversations with various debt syndication desks, the new issue pipeline remains muted going forward, which traditionally bodes well for secondary market credit spread performance. Of the deals that did launch this month, the order books remained strong (similar to February) while new issue concessions were elevated (i.e. issuers are being asked to pay-up to get a new issue across the finish line).

Ninepoint Diversified Bond Fund (DBF)

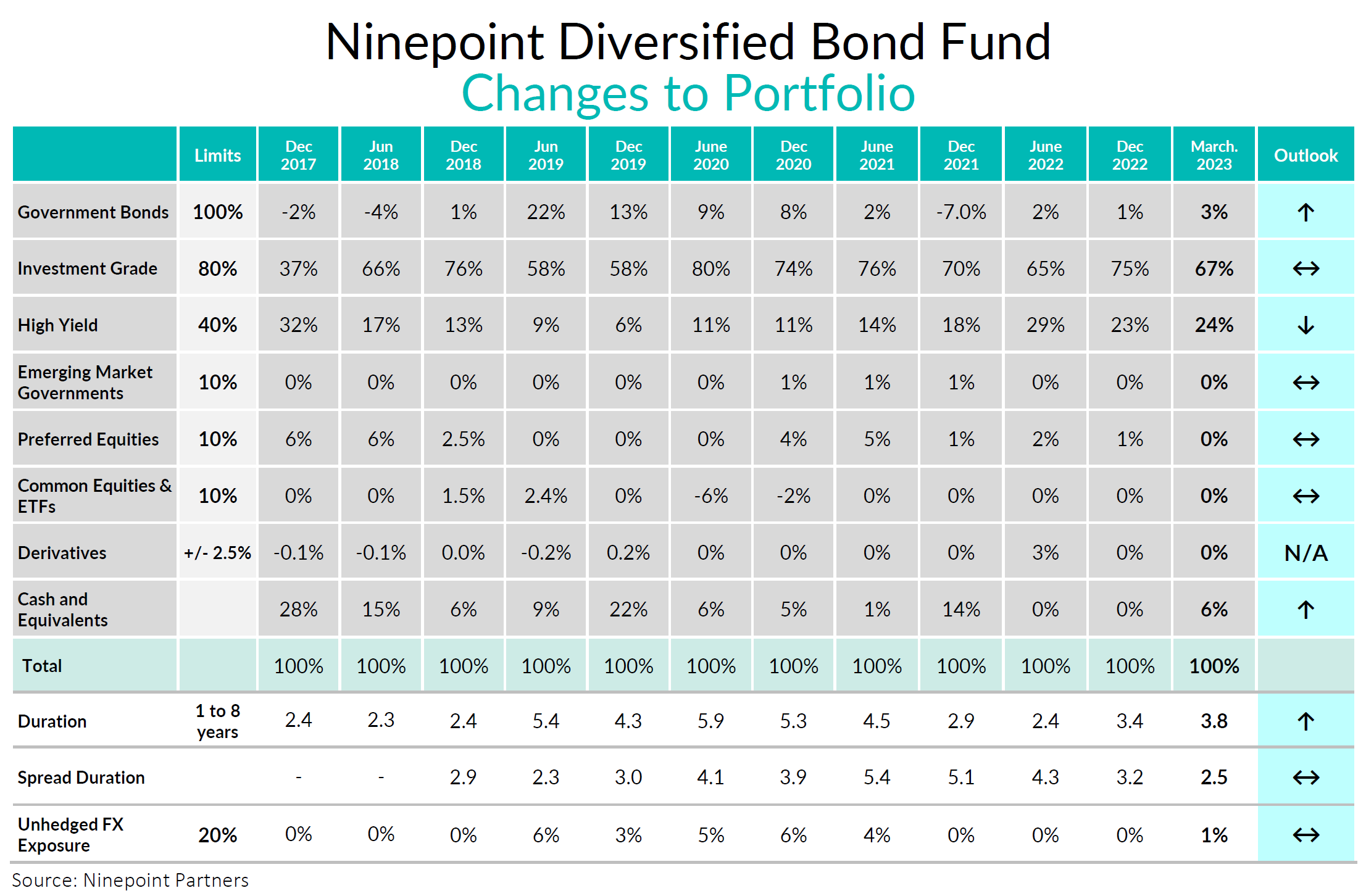

Over the past several months we have been increasing duration and decreasing spread duration and believe our current positioning remains appropriate given our macro-economic outlook. Our spread duration nudged down a touch as we trimmed some longer-dated financial exposure to move into one month Enbridge commercial paper at very attractive yields (>5.4%). While we began materially reducing our exposure to REITs in the summer of 2022, we have become increasingly cautious about the sector (especially office) and decided to further trim a few small positions. No major changes were made to duration which now sits at 3.8 years as of month-end. Expect the funds duration to gradually increase going forward but we will remain disciplined, thoughtful, and patient in doing so. The fund’s yield-to-maturity moved up slightly to 7.6% given the weakness in banks.

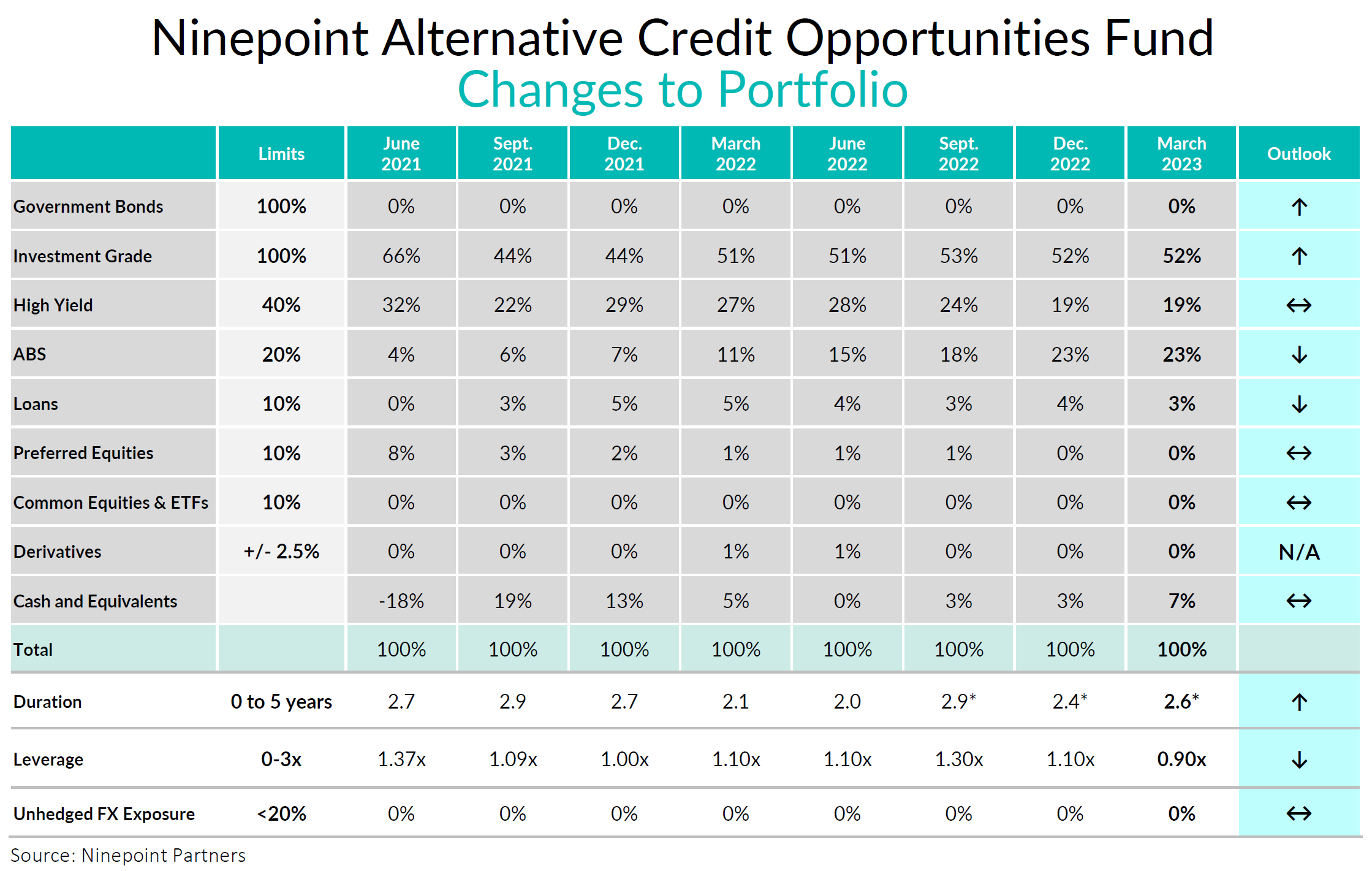

Ninepoint Alternative Credit Opportunities Fund (NACO)

Even though new issuance remained light in the month, we did participate in two TC Energy new issues, one fixed coupon and one floating coupon, both with 2026 maturities. Leverage moved down on the month to 0.9x from 1.0x, spread duration moved from 6.2 years to 5.8 years and duration remained largely unchanged at 2.6 years. The fund’s yield-to-maturity remains very attractive at 10.5% vs 9.6% as of last month.

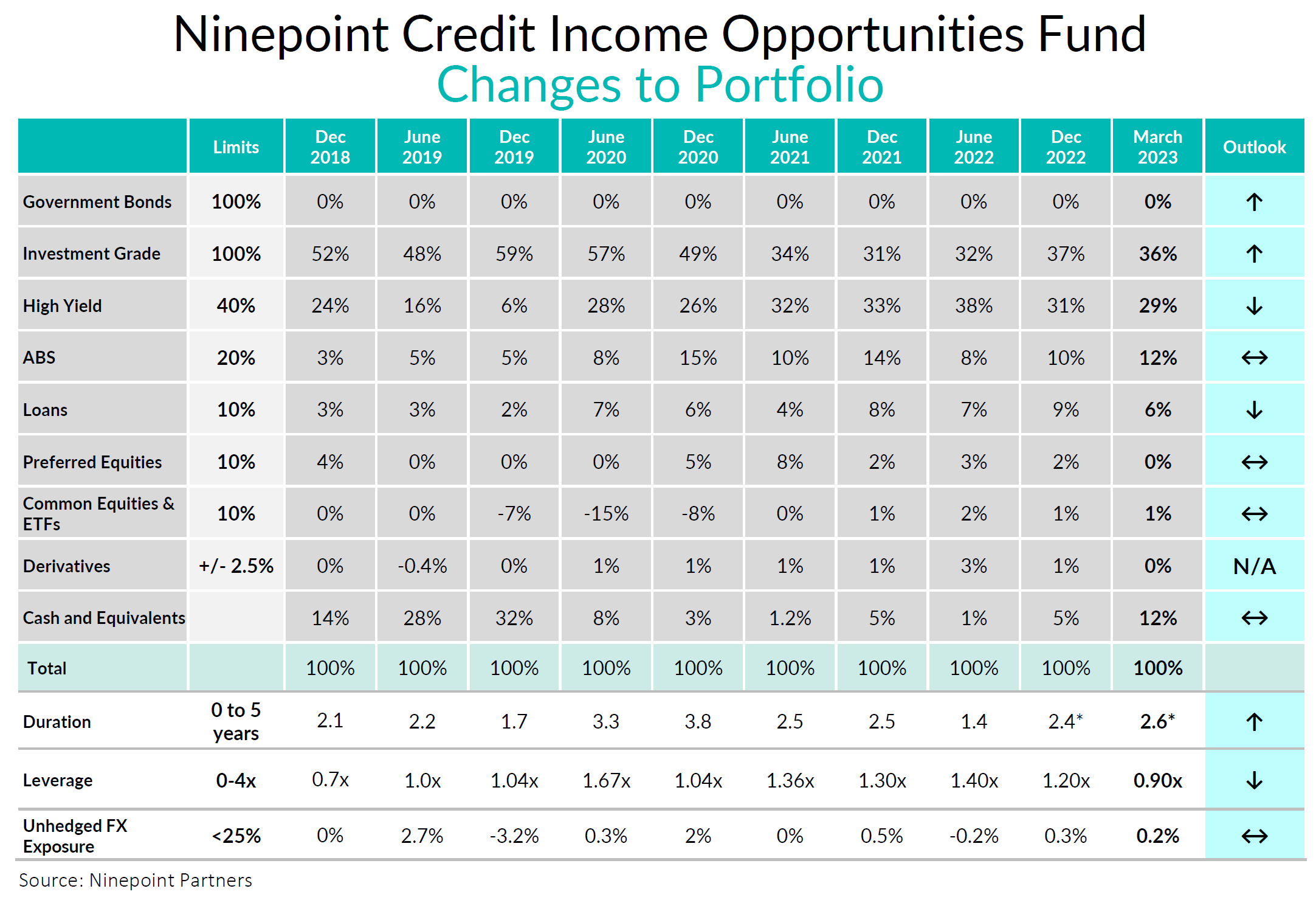

Ninepoint Credit Income Opportunities Fund (Credit Ops)

Even though new issuance remained light in the month, we did participate in two TC Energy new issues, one fixed coupon and one floating coupon, both with 2026 maturities. Leverage moved down on the month to 0.9x from 1.1x, spread duration moved from 6.5 years to 5.8 years and duration remained largely unchanged at 2.6 years. The fund’s yield-to-maturity remains very attractive at 11.1% vs 10.5% as of last month.

Conclusion

We don’t think this is a repeat of the Great Financial Crisis of 2008. Large banks are well capitalized, have a good oversight and strong liquidity. Moreover, Canadian and European banks do not suffer from the same accounting gimmicks (hold-to-maturity investments carried at amortized cost) as U.S. banks, making their financial reporting and capital adequacy more transparent. But that doesn’t mean we are out of the woods yet, this shock to confidence will take some time to work itself through the system and there’s always the risk of what we don’t yet know. Monetary policy’s impact on the economy is just starting to show up. Interest rates have probably peaked for this cycle, and investment grade credit spreads already reflect quite a bit of stress (particularly banks), making the all-in yield of IG credit very attractive.

From an interest rate perspective, we think the worst is over. Rates are unlikely to reach anywhere near the old highs. That will be very constructive for bonds and our funds.

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at March 31, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at March 31, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at March 31, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended March 31, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 04/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023