Ninepoint Carbon Credit ETF Commentary

March 2023 Commentary

Fund Overview

The Ninepoint Carbon Credit ETF (“Fund”) seeks to achieve its investment objectives by primarily investing directly in carbon allowance futures. The Fund currently invests in the major carbon allowance futures globally, namely;

- European Union Allowance (the “EUA”)

- California Carbon Allowance (the “CCA”)

- UK Allowance (the “UKA”)

- Regional Greenhouse Gas Initiative (the “RGGI”)

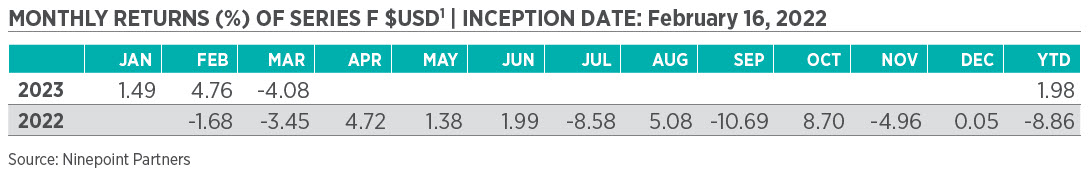

Fund Performance

As of March 31, 2023, the Ninepoint Carbon Credit ETF generated a net loss of -4.08% (Series F $USD), with a YTD net return of 1.98%.

Market Update

The global financial market was momentarily disrupted this month by banking events.

Silicon Valley Bank failed on Friday March 10th, with share prices of regional US banks declining, and First Citizens Bank agreeing to purchase the remains of SVB. In Europe, Credit Suisse received liquidity support from the Swiss National Bank before it was ultimately acquired by UBS. Going forward, there is still some lingering uncertainty with regards to the health of the banking sector, regulatory policy and central bank responses.

In the meantime, financial market volatility and uncertainty increased throughout the month. Since the news on SVB problems surfaced, yields on Treasury securities have plummeted in response to a flight to safety. The S&P 500 posted a 3.15% gain (+ 7.03% YTD: Q4 2022 was up 7.08%). Of the 11 sectors, 7 were up (Information Technology was the best (+ 10.87%), while Financials was the worst (- 9.74%). The Index saw substantial day-to-day and intra-day moves, but it declined only by about 0.5% since the news about SVB broke. The commodity markets experienced a mixed month with the Bloomberg Commodity Index down -0.6% (-6.5% YTD), Brent Oil down -4.9% (-7.15% YTD), and Gold up 7.8% (+8.0% YTD).

On-going inflation pressure has supported the case for even more rate hikes in March. As such, the Federal Reserve continued tightening its monetary policy with a 25-bps increase to 4.9%, the Bank of England also raised its interest rates by a quarter of a percentage point to 4.25% and the European Central Bank increased interest rates by half a percentage point. A record-setting warm winter plus the higher probability of recession due to tighter credit conditions are being discounted as possibly creating lower demand in global carbon markets through a decrease of industrial demand for carbon allowances.

In the carbon market, the month of March experienced mixed results and heightened volatility. The European Union Allowance (EUA) Dec-23 contract was down -7.8% while the UK Allowance (UKA) Dec-23 contract also declined by -12.7%. The EUA market experienced volatility as a result of the uncertainty regarding the quantity and timing of the Re-Power EUA auction volume decision as well as the quarterly options expiry, with carbon price going as low as approx. €90/tonne. Similarly, prices in the UKA market declined as a result of bearish power sector fundamentals.

In North America, the ICE California Carbon Allowance (CCA) Carbon Futures Index gained 3.74% this month. The ICE Regional Greenhouse Gas Initiative (RGGI) Carbon Futures Index also posted a positive gain of 2.2% this month, as a result of the possibility of additional policy reforms to be announced later this year, as well as the hype surrounding the newly proposed New York’s Cap-and-Invest program.

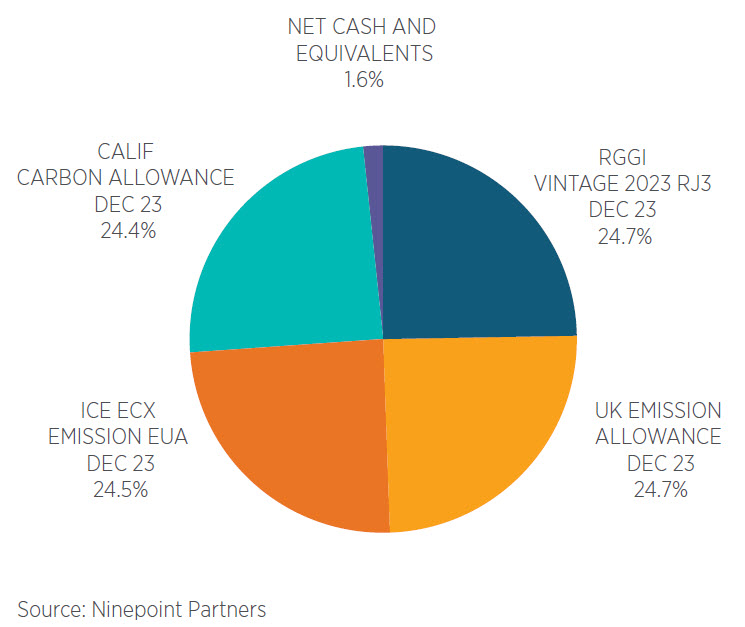

Portfolio Recap

The fund has had a positive start to the year, posting returns of 1.98% year-to-date. The best performer in March was the CCA market, contributing approximately +0.77% to the total return, the top distractor was the UKA contract, contributing approximately -3.36% to the total return.

Sector Allocation Notional2

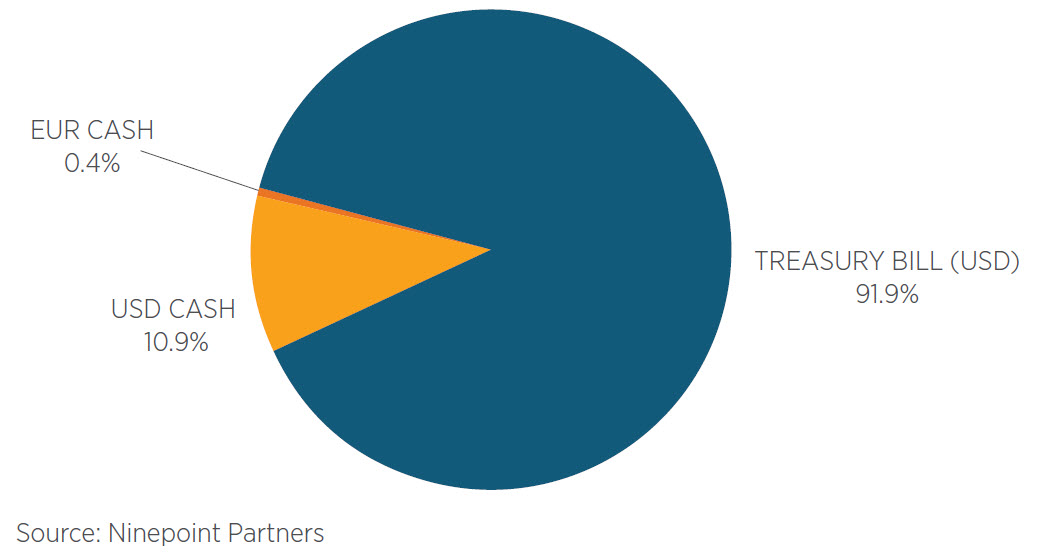

Collateral and Currency Management2

Why Ninepoint Carbon Credit ETF?

For an emerging asset class like carbon credit, diversification is at the heart of our fund strategy. At the moment, the Ninepoint Carbon Credit ETF invests equally in the four major ETS markets globally with a minimum quarterly rebalancing. Having a diverse market exposure has demonstrated its benefits in serving investors well. Below are five key reasons for investors to consider Ninepoint Carbon Credit ETF:

Risk Mitigation – Balanced exposure to all carbon credit markets can help minimize single jurisdiction risk by eliminating over-concentration to any single market, as recent market action has demonstrated. Having a diversified underlying market portfolio is important for an emerging asset class with volatile price patterns, like carbon credits.

Diversification – Carbon Credit investments demonstrate low or negative correlation to traditional asset classes.

Global Exposure – The fund provides investors with access to a US$851 billion global carbon credit market which has grown by 18x since 20171. Compared to volume-weighted fund or funds that invest in one single market, we believe that our equal-weighted fund strategy has a better value proposition, over the long-term, given its overweight to the under-represented and rapidly growing carbon credit trading markets.

Core Value - As a Canadian fund, by overweighting the North American market relative to its total index weight, we are aligning our strategy with our values and our local community.

Easy Access - The fund is structured as an alternative mutual fund offering on Fundserv as well as an ETF series on the Cboe Canada Exchange (Cboe:CBON / CBON.U).

Product Inquiries:

Pamela Gagne, MBA

Business Development Manager

Ninepoint Partners

pgagne@ninepoint.com

1Refinitiv, “Carbon Market Year in Review 2021”.

Global carbon markets value surged to a record $851 bln last year-Refinitiv (Reuters - January 2022).

1All returns and fund details are a) based on Series F $USD units; b) net of fees; c) annualized if period is greater than one year; d) as at March 31, 2023.

2Sector allocation as at March 31, 2023. Sector allocation based on % of net asset value. Numbers may not add up due to rounding. Cash and cash equivalents include non-portfolio assets and/or liabilities.

The Ninepoint Carbon Credit ETF is generally exposed to the following risks See the prospectus of the Fund for a description of these risks Absence of an active market for ETF Series risk, cap and trade risk, collateral risk, commodity risk, concentration risk, cybersecurity risk, derivatives risk, foreign currency risk, foreign investment risk, Halted trading of ETF Series risk, inflation risk, interest rate risk, liquidity risk, market risk, regulatory risk, securities lending, repurchase and reverse repurchase transactions risk, series risk, substantial securityholder risk, tax risk, trading price of etf series risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended March 31, 2023 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540