Ninepoint Fixed Income Strategy

April 2023 Commentary

Monthly commentary discusses recent developments across the Diversified Bond, Alternative Credit Opportunities and Credit Income Opportunities Funds.

Summary

- The BoC is still on pause, and the Fed hiked one more time to what will likely be the last this cycle.

- Turmoil at U.S. regional banks continues, with First Republic Bank the latest to fail.

- The tightening of lending conditions will continue to put pressure on the economy.

- The labour market remains tight and needs to soften to relieve inflationary pressures.

- Eventually, we expect that continued weakness in economic data will take intermediate interest rates lower in anticipation of rate cuts perhaps later Q4-2023 or early Q1-2024.

- The U.S. Debt Ceiling debate is the next large risk on our radar. The odds of an accidental default are low, but not zero.

Macro

Never a dull moment.

After a brief period of stabilization post the failures of Credit Suisse, Silicon Valley and Signature Banks, the latest casualty of this banking turmoil, First Republic Bank, was taken over by the FDIC, later to be acquired by JP Morgan. It would be foolish to assume that it will be the last bank to fail in 2023, but for now, we cannot find another bank of this size with negative book value after accounting for unrealized losses on their loan and securities portfolios. That was the common characteristic of these failed US banks and it prevented anyone from buying them prior to FDIC involvement.

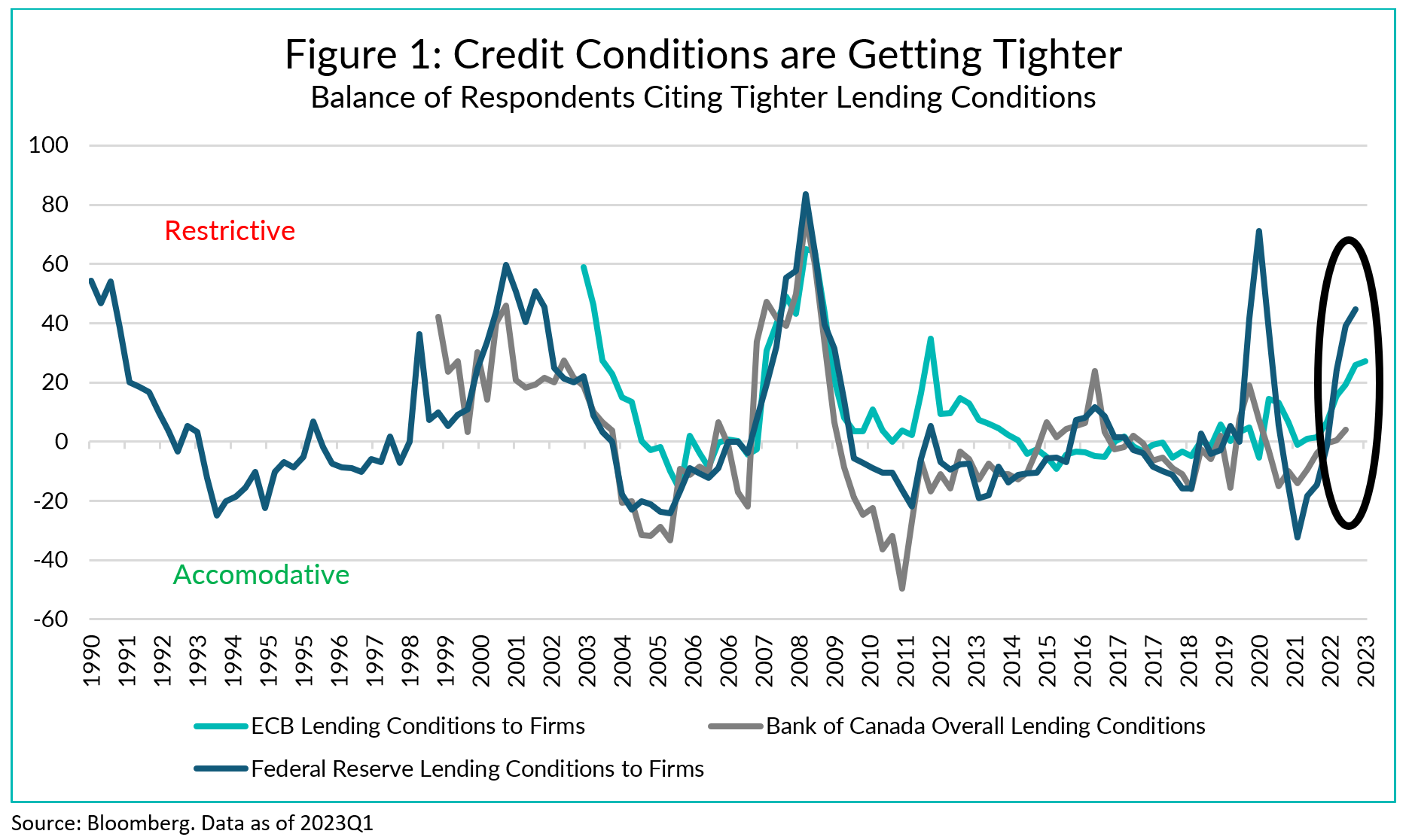

At this juncture, it feels like we are moving into the second chapter of this episode of banking stress. The past two months have been all about liquidity and bank runs. The next several quarters will be about credit quality, capital adequacy and the impact on the real economy. Generally, banks (and other providers of credit to the economy) tighten the availability of credit when the perceived credit worthiness of a borrower declines. When banks face increasingly higher costs to fund themselves, this pressures their own profitability and makes them reticent to lend more. Across Canada, the U.S. and the Eurozone, both things are now happening at the same time, leading commercial banks to reduce the supply of loans to the economy (Figure 1).

Interestingly, lending conditions across Canada, the U.S. and the Eurozone tend to be quite correlated, reflecting both the interconnectedness of the global financial system and synchronization of the business cycle across geographies.

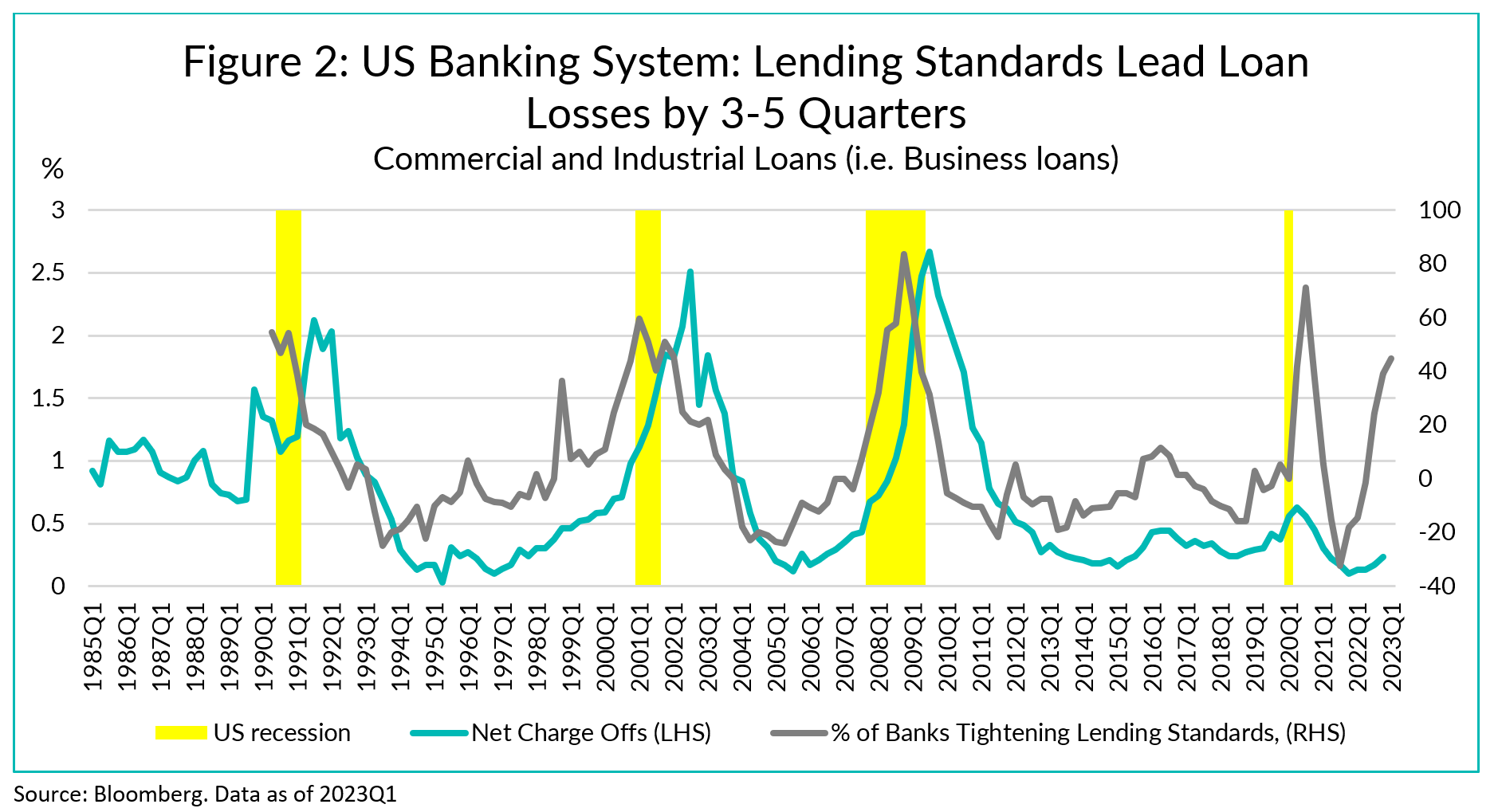

Now, why do we care so much about lending standards at banks? Because they are both an excellent leading indicators of recessions and of loan losses. As shown in Figure 2 below, lending standards at U.S. banks for business loans (grey line, RHS) tend to lead net charge-offs (loan losses) for those same types of loans by 3 to 5 quarters. We use business loans here simply because of the length of that time series but the same applies to other types of loans. Loan losses, in turn, are what impact bank earnings and their willingness to make new loans (risk appetite).

Thankfully, because of the lessons learned from the Great Financial Crisis (GFC), large banks are now very well capitalized, with less leverage and more oversight, making the outright failure of one of those institutions much less likely. However, it is now clear that we are moving into the late innings of this business cycle. The pace and magnitude of this rate hike cycle are rivalled only by those of the early 1980s, and its impacts are just starting to get felt through the usual transmission channels. First, the most interest rate sensitive sectors of the economy, such as housing, start slowing down. Inventories accumulate. Then higher interest rates impact companies profits (interest expense) and balance sheets (lower asset values, worse coverage ratios), leading to lower availability of credit, less investment, and, eventually, layoffs. Small firms, which provide the bulk of employment, are usually hurt more than large firms, which can access capital through markets.1

Different time, similar outcome.

The failures of SVB, Signature, First Republic and Credit Suisse are not the cause of the impending downturn, but simply the first obvious consequences of the Fed/BoC/ECB’s fight against inflation; banks were already tightening credit availability in the summer of 2022, well before any of this happened. It will simply prove an accelerant.

Where does that leave us?

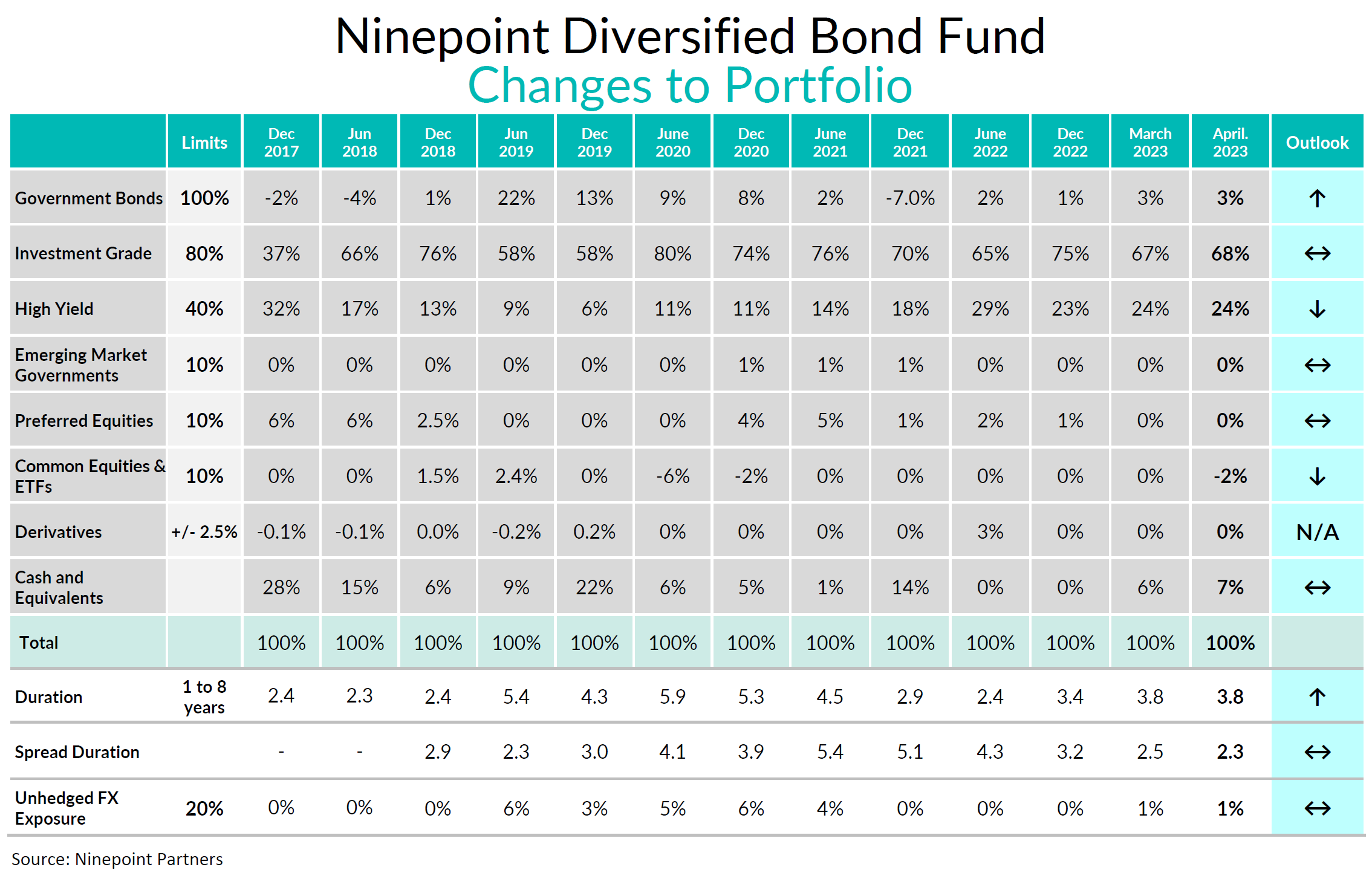

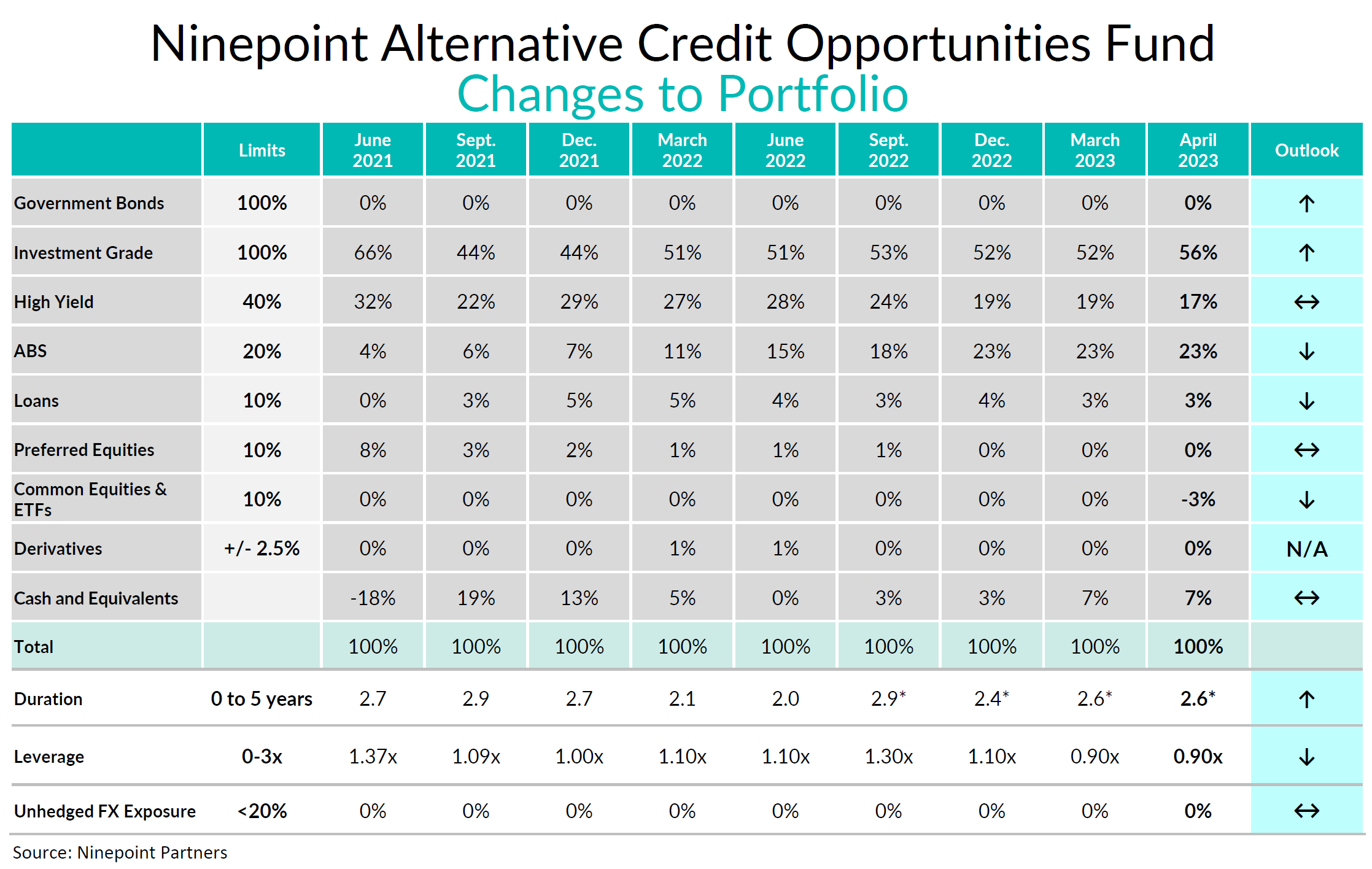

Across our three funds, we continue to add government bond duration, reduce credit duration (focus on short-dated credit, which is less volatile), reduce high yield exposure and layer-in credit hedges (short HYG ETF). This is the same playbook we used in late 2019 and early 2020, which served our clients very well.

Credit

The rally in credit spreads that began at the end of March continued throughout April as the turmoil in the US and European banking sectors appeared to be less of a concern, for now. In April, the Bloomberg Canada Corporate Bond Index tightened by 9bps while the Bloomberg US Corporate Bond Index tightened by 3bps. Given Canadian credit spreads were slow to follow the sharp tightening in the US throughout March, the Canadian outperformance shouldn’t come as a huge surprise, especially given the divergence in new issue supply between the two markets (more on that below). Turning to sector performance, April was a mirror image of March in that what worked in March didn’t in April, and vice versa. More specifically, defensive sectors like utilities, telecommunication and pipelines outperformed in March and underperformed in April. Financials which underperformed in March, had a very strong performance in April, especially subordinated bonds, but they are still materially wider than the February tights. As we have an overweight exposure to subordinated high quality Canadian bank bonds, our monthly performance was strong across all strategies.

The Canadian primary market was very light, the slowest April in a decade. Corporate bond supply totaled just $5 billion, half of which came from one RBC bond issue. In terms of YTD supply, we are now trailing last year’s issuance by a whopping 47%. The lack of Canadian primary issuance coupled with elevated all-in yields were contributing factors to the strong performance in secondary credit spreads in Canada. While May brings about Q1-2023 earnings season for many corporates (which results in blackout periods in terms of issuance) various debt syndication desks we speak to are hopeful of a more robust issuance pipeline this spring. Corporate issuers may try to opportunistically issue bonds heading into the traditionally slower summer months. As always, we use the new issue market to pro-actively add to credits we like but remain judicious in our approach.

Ninepoint Diversified Bond Fund (DBF)

Given our macroeconomic outlook, the portfolio is becoming more defensively positioned. In the month, we trimmed some longer dated corporate bonds which led to spread duration moving 0.2 years lower month over month to 2.3 years. We continue to take advantage of relative value opportunities as they arise. For example, we sold a BNS bond to move into a BMO bond. We liked this switch for numerous reasons: picked up all-in yield, retracted tenor by nine months, and took out $5 in price. The yield-to-maturity of the portfolio remained unchanged at 7.6% month-over-month while duration also remained unchanged at 3.8 years. We added more duration in the early part of May, so expect duration to directionally move higher going forward, as we have messaged for some time. Credit hedges (short HYG ETF) will be reflected in the “Equity” bucket, we are currently targeting a -5% position.

Ninepoint Alternative Credit Opportunities Fund (NACO)

Given our macroeconomic outlook, the portfolio continues to be defensively positioned. During the month, we trimmed some longer dated corporate bonds which led to spread duration moving lower settling at 5.6 years as of month end (vs 5.8 years one month prior). We continue to keep leverage low, move up in credit quality and liquidity where we can, and reduce spread duration. While our REIT exposure has moved materially lower since summer 2022, we decided to trim a few select securities to ensure the REITs we own are very short dated and higher quality which we believe to offer an attractive risk/reward profile. We continue to roll Enbridge Commercial Paper as they come due, the yield is extremely attractive (>5.5% with a one-month maturity). Yield-to-maturity ended the month at 10.5% (unchanged vs one month prior) while leverage also remained unchanged at 0.9x month over month. We added more duration in the early part of May, so expect duration to directionally move higher going forward, as we have messaged for some time. Credit hedges (short HYG ETF) will be reflected in the “Equity” bucket, we are currently targeting a -10% position.

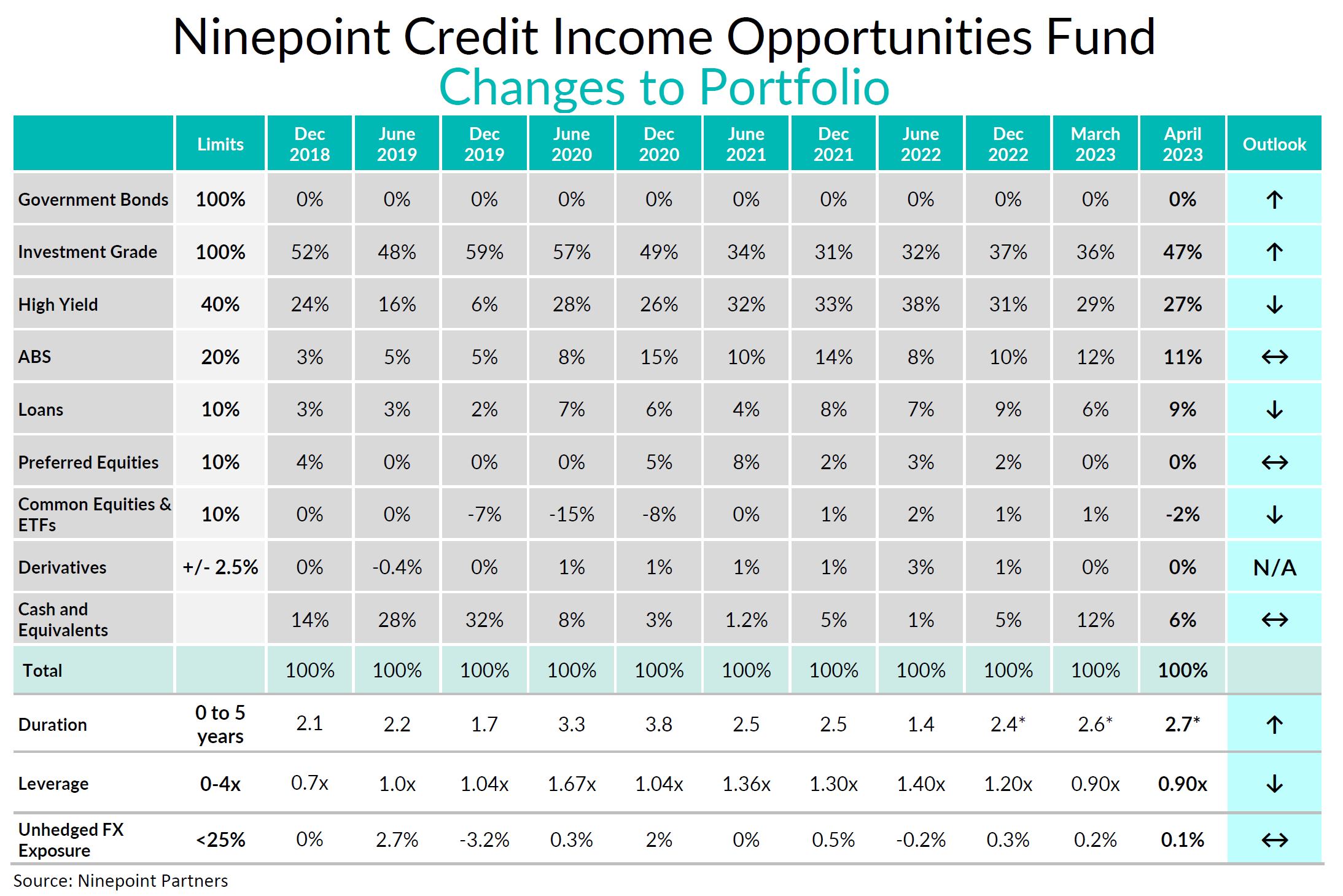

Ninepoint Credit Income Opportunities Fund (Credit Ops)

Given our macroeconomic outlook, the portfolio continues to be defensively positioned. We trimmed some longer dated subordinated bonds which led to spread duration moving lower, settling at 5.4 years as of month end. We continue to keep leverage low, move up in credit quality and liquidity, and reduce spread duration. For example, we exited a 2-year Wells Fargo position to move into a Sun Life bond callable in one year. We thought this was a prudent switch given we retracted tenor by a year, picked up all-in yield, took out $1 in price and moved up one notch in terms of credit ratings. While our REIT exposure had moved materially lower since the summer of 2022, we decided to further trim a few select securities to ensure the REITs we own are very short dated (which we view to offer a very attractive risk/reward profile). Yield-to-maturity ended the month at 11.5%, up from 11.1% as of March month-end, while leverage remained unchanged at 0.9x. We added more duration in the early part of May, so expect duration to directionally move higher going forward, as we have messaged for some time. Credit hedges (short HYG ETF) will be reflected in the “Equity” bucket, we are currently targeting a -10% position.

Conclusion

Our portfolios are essentially barbelled here:

• A high allocation to short dated corporate bonds provides a high level of yield (inverted yield curve) while minimizing volatility.

• Short positions in HYG and more duration through 30-year government bonds adds ballast.

• And an allocation to low priced hybrids and LRCN provides extra yield and price upside for what will ultimately be a rally in interest rates and credit spreads, once the recession is there.

And we’re still pursuing tax efficiency, in general, we favour discount priced bonds, over premium bonds.

Until next month,

Mark, Etienne & Nick

Ninepoint Partners

1For those interested in a much more thorough discussion of the transmission of monetary policy to the economy, I recommend this 1995 paper by Ben Bernanke.

1 All Ninepoint Diversified Bond Fund returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at April 30, 2023 1 All Ninepoint Credit Income Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at April 30, 2023. 1 All Ninepoint Alternative Credit Opportunities Fund returns and fund details are a) based on Class F units; b) net of fees; c) annualized if period is greater than one year; d) as at April 30, 2023.

The Risks associated worth investing in a Fund depend on the securities and assets in which the Funds invests, based upon the Fund's particular objectives. There is no assurance that any Fund will achieve its investment objective, and its net asset value, yield and investment return will fluctuate from time to time with market conditions. There is no guarantee that the full amount of your original investment in a Fund will be returned to you. The Funds are not insured by the Canada Deposit Insurance Corporation or any other government deposit insurer. Please read a Fund's prospectus or offering memorandum before investing.

Ninepoint Credit Income Opportunities Fund is offered on a private placement basis pursuant to an offering memorandum and are only available to investors who meet certain eligibility or minimum purchase amount requirements under applicable securities legislation. The offering memorandum contains important information about the Funds, including their investment objective and strategies, purchase options, applicable management fees, performance fees, other charges and expenses, and should be read carefully before investing in the Funds. Performance data represents past performance of the Fund and is not indicative of future performance. Data based on performance history of less than five years may not give prospective investors enough information to base investment decisions on. Please contact your own personal advisor on your particular circumstance. This communication does not constitute an offer to sell or solicitation to purchase securities of the Fund.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), other charges and expenses all may be associated with mutual fund investments. Please read the prospectus carefully before investing. The indicated rate of return for series F units of the Fund for the period ended April 30, 2023 is based on the historical annual compounded total return including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Fixed Income Strategy 12/2023

- Fixed Income Strategy 11/2023

- Fixed Income Strategy 10/2023

- Fixed Income Strategy 09/2023

- Fixed Income Strategy 08/2023

- Fixed Income Strategy 07/2023

- Fixed Income Strategy 06/2023

- Fixed Income - H1 2023 Market Review and Outlook

- Fixed Income Strategy 05/2023

- Fixed Income Strategy 03/2023

- Fixed Income Strategy 02/2023

- Fixed Income Strategy 01/2023