Ninepoint Target Income Fund

Q2 2023 Commentary

June 2023 Quarterly Update

Large cap technology shares continue to dominate index performance, with the most recent sell-off in long-term rates having limited impact on valuations after being a key driver of valuation declines in 2022. Major global equity indexes lagged US indices partially due to the structurally lower tech exposure. Market breadth started to improve towards the end of the quarter with cyclicals rallying on better-than-expected economic data.

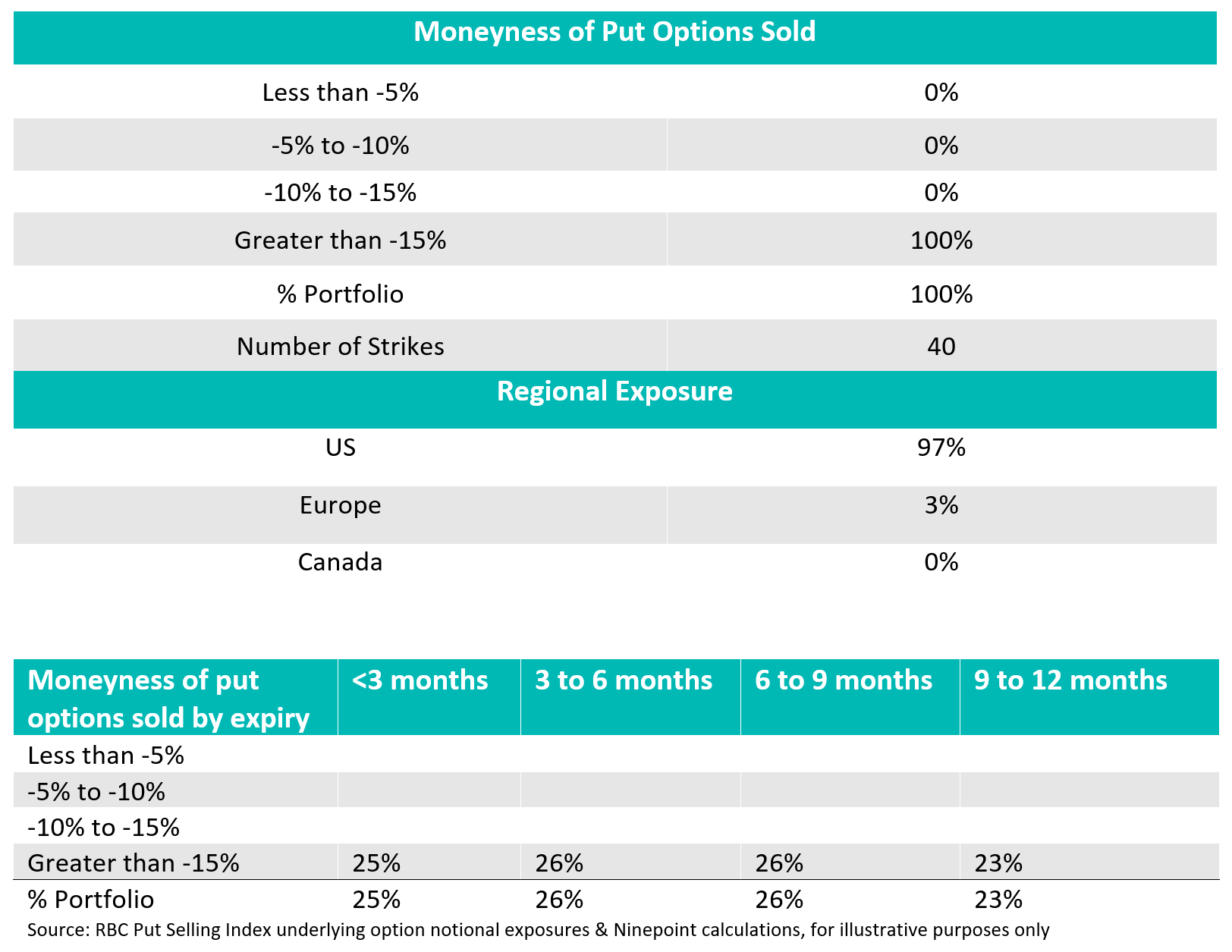

In the Ninepoint Target Income Fund, a quarter of the options portfolio rolled in mid-June into new 1 year put options. The options portfolio continues to have a weighted average strike price greater than -15% below June 30th index levels, providing downside protection before options premiums and investment principal are at risk at expiry. If volatility rises in the coming months, premiums on newly initiated puts should increase meanwhile the fund currently has a conservative buffer to weather downside in equities.

Until Next Time,

Colin Watson

Portfolio Manager

Ninepoint Partners

Why Invest in the Ninepoint Target Income Fund?

- Targeted Equity Yield: The Target Income Fund utilizes a cash covered put selling strategy to target a 6% yield while potentially offering a buffer against market declines

- Accessible: Offered in a low-medium risk rated traditional mutual fund structure with daily liquidity at NAV

- Income Potential & Diversification: options-based income strategies can offer a competitive yield and may provide diversification to traditional income portfolios during challenging markets

- Execution Partnership: Leverages RBC Quantitative Investment Solutions diversified, rules based put selling strategies to generate income and diversification

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Important information about the Ninepoint Partners LP Funds, including their investment objectives and strategies, purchase options, and applicable management fees, performance fees (if any), other charges and expenses, is contained in their respective simplified prospectus, long-form prospectus or offering memorandum. Please read these documents carefully before investing. Commissions, trailing commissions, management fees, performance fees, other charges and expenses all may be associated with investing in the Ninepoint Partners LP Funds. Unless noted otherwise, the indicated rates of return for one or more classes or series of units or shares of the Ninepoint Partners LP Funds for periods greater than one year are based on historical annual compounded total returns and include changes in unit/share value and reinvestment of all distributions or dividends, but do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Ninepoint Partners LP Funds referred to on this website may be lawfully sold in their jurisdiction.

The Ninepoint Target Income Fund is generally exposed to the following risks. See the simplified prospectus of the Fund for a description of these risks: Absence of an active market for ETF Series risk; Concentration risk; Currency risk; Derivatives risk; Foreign investment risk; Halted trading of ETF Series risk; Inflation risk; Interest rate risk; Liquidity risk; Market risk; Securities lending, repurchase and reverse repurchase transactions risk; Series risk; Short selling risk; Substantial unitholder risk; Tax risk and Trading price of ETF Series risk.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540