Ninepoint Flow-Through Update

Q4 2023 Commentary

Ninepoint 2022 Flow-Through Update

The NAV for the Ninepoint 2022 Flow-Through - National Fund Series A and the Ninepoint 2022 Short Duration Flow-Through Fund on December 29, 2023 was $8.26/unit and $13.30/unit, respectively.

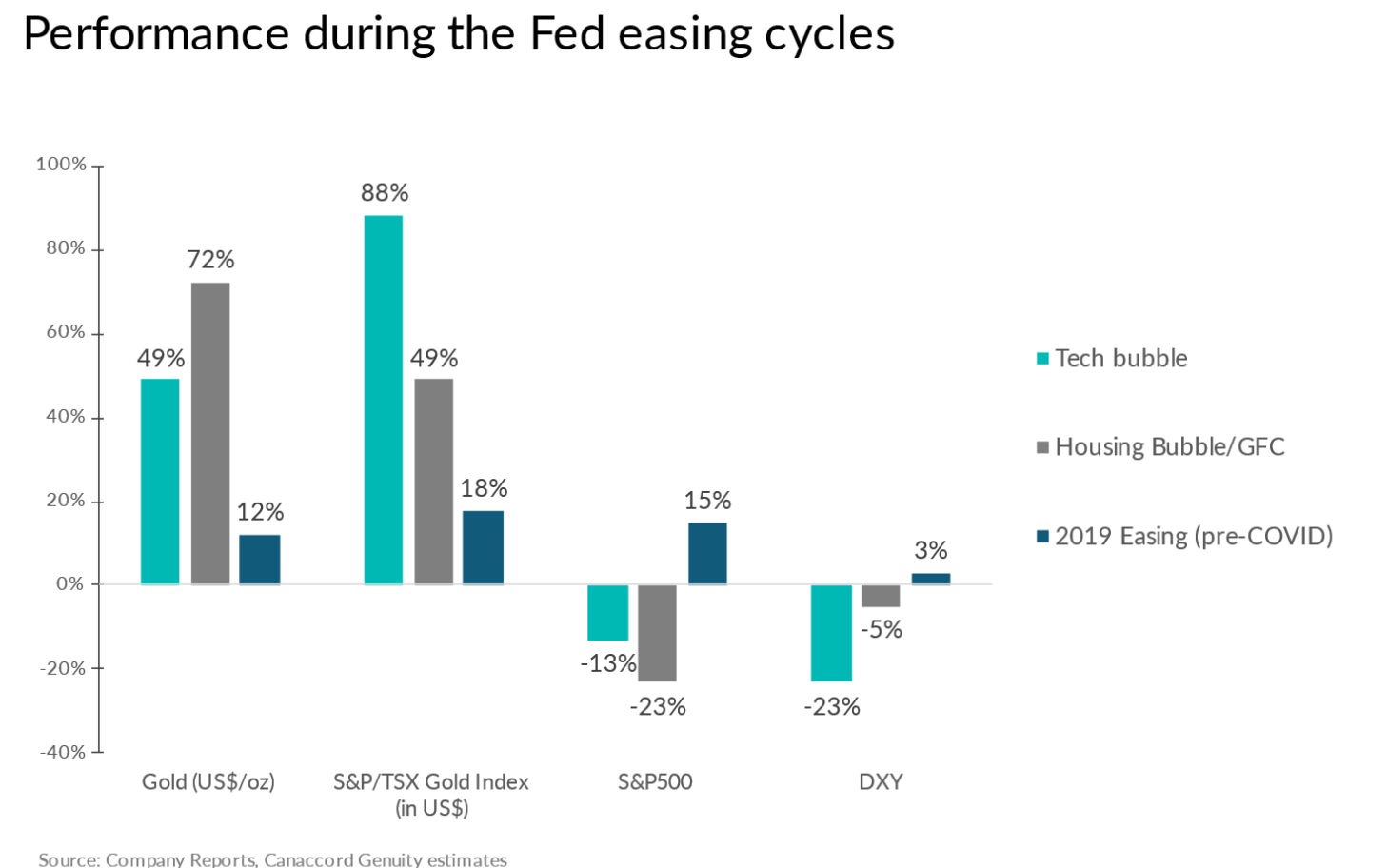

We have always stressed to clients that commodities and resource equities are incredibly volatile. The performance of flow-through funds will range from spectacular to awful. After two years of posting triple-digit after-tax returns in the 2019 and 2020 flow-through limited partnerships, microcap resource equities underperformed in both 2022 and 2023. Underperformance was most pronounced amongst microcap, gold exploration equities which comprise most of the flow-through fund portfolios. The underperformance of microcap, gold exploration equities in 2023 was baffling since gold bullion appreciated 13%. However, the gold bullion outlook has improved markedly. At the December FOMC meeting, the Federal Reserve abruptly changed course when it signaled a willingness to significantly reduce the federal funds rate in 2024. Historically, gold equities have dramatically outperformed during Fed easing cycles as illustrated below. If this thesis comes to fruition, unitholders who will be provided with liquidity when the 2022 flow-through funds rollover in mid-February may be best served to remain invested in the rollover fund.

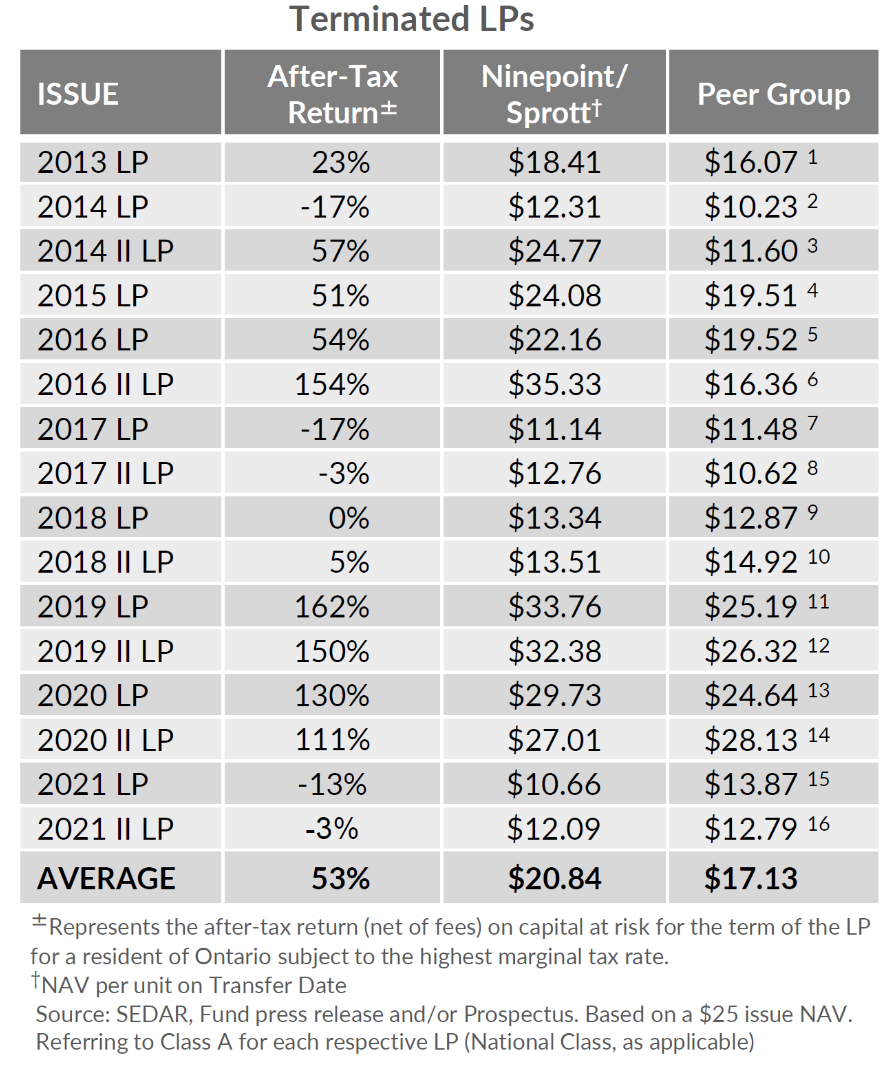

While digesting the performance of the 2022 LPs, I would like to remind investors of the track record and the need to evaluate returns on an after-tax basis. I would also remind clients of the importance of remaining committed to the flow-through strategy during poorly performing periods because the product track record clearly illustrates the benefit of consistent participation.

Investors are routinely fixated on pre-tax returns. This is surprising considering investors rarely capture those returns on an after-tax basis as most investors are taxed on capital gains and income. When evaluating the returns of a flow-through fund the only meaningful measure of performance is on an after-tax basis considering it is a tax mitigating product. Although after-tax return figures are not calculated until the fund is terminated, investors should consider some of the following points when gauging how the investment is performing on an after-tax basis. Many investors incorrectly evaluate the performance of the fund based on the initial investment of $25/unit and as a result, do not account for any of the tax benefits.

It is also important to remember the $25/unit is not adjusted for initial fees, premiums paid to acquire flow-through shares or tax benefits. Most importantly, it is critical that investors understand how impactful the tax benefits are to the per-unit economics. As disclosed in the 2023 Short Duration Flow-Through LP prospectus, the breakeven point on an after-tax basis for an Ontario investor taxed at the highest marginal rate is approximately $11.75/unit, which assumes only 25% of the portfolio qualifies for the Critical Minerals Exploration Tax Credit. The bogey for a flow-through fund is the aforementioned after-tax breakeven point, not the $25/unit initial offering price. Investors need to understand this to correctly evaluate the performance of any flow-through fund

Ninepoint 2023 Flow-Through National Update

The NAV of the Ninepoint 2023 Flow-Through National Fund, Series A on December 29, 2023 was $16.47/unit.

The fund successfully raised $33M in April 2023. 100% of the initial proceeds were invested by year end. 62% had been allocated to gold mining equities, 12% to base metal equities while uranium and other metals account for the balance. The portfolio currently consists of 30 companies with a weighted average market capitalization of $105M. The weighted average premium paid was 5%.

As disclosed in the 2023 Flow-Through LP prospectus, the breakeven point on an after-tax basis for an Ontario investor taxed at the highest marginal rate is approximately $12.00/unit. Note that this breakeven figure does not include the enhanced Critical Minerals Exploration Tax Credit. The bogey for a flow-through fund is the after-tax breakeven point, not the $25/unit initial offering price. Investors need to understand this to correctly evaluate the performance of any flow-through fund.

Ninepoint 2023 Short Duration Flow-Through Update

The NAV of the Ninepoint 2023 Short Duration Flow-Through Fund, Series A on December 29, 2023 was $23.51/unit.

The fund successfully raised $20M in October 2023. 100% of the initial proceeds were invested by year end. 60% had been allocated to gold mining equities, 22% to uranium equities and 18% to base metal equities. The portfolio currently consists of 20 companies with a weighted average market capitalization of $70M. The weighted average premium paid was 2%.

As disclosed in the 2023 Short Duration Flow-Through LP prospectus, the breakeven point on an after-tax basis for an Ontario investor taxed at the highest marginal rate is approximately $11.75/unit. The bogey for a flow-through fund is the after-tax breakeven point, not the $25/unit initial offering price. Investors need to understand this to correctly evaluate the performance of any flow-through fund.

Jason Mayer CFA, MBA

Sprott Asset Management

Sub-Advisor to the Fund

References

1. Peer Group includes: Middlefield, Frontstreet, NCE, Brompton, Maple Leaf, CMP

2. Peer Group includes: Middlefield, Frontstreet, NCE, Brompton, Maple Leaf, CMP, Canoe

3. Peer Group includes: Middlefield, Frontstreet, Maple Leaf

4. Peer Group includes: Middlefield, NCE, Brompton, Maple Leaf, CMP, Canoe

5. Peer Group includes: Middlefield, NCE, Maple Leaf, CMP, Canoe

6. Peer Group includes: Marquest, Maple Leaf

7. Peer Group includes: Middlefield, Brompton, Maple Leaf, CMP

8. Peer Group includes: Middlefield, Maple Leaf

9. Peer Group includes: Middlefield, Maple Leaf, CMP

10. Peer Group includes: Maple Leaf

11. Peer Group includes: Middlefield, CMP, Maple Leaf

12. Peer Group includes: Middlefield, Maple Leaf

13. Peer Group includes: Middlefield, CMP, Maple Leaf

14. Peer Group includes: Middlefield, Maple Leaf

15. Peer Group includes: Middlefield, CMP

16. Peer Group includes: Middlefield, Maple Leaf

Series A NAV Details ($) Per Unit as at December 29, 2023 (Before Tax)

| Fund Name | NAV (Series A) |

| Ninepoint 2022 Flow-Through LP - National | $8.26 |

| Ninepoint 2022 Flow-Through LP - Quebec | $7.95 |

| Ninepoint 2022 Short Duration Flow-Through LP | $13.30 |

| Ninepoint 2023 Flow-Through LP | $16.47 |

| Ninepoint 2023 Short Duration Flow-Through LP | $23.51 |

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: concentration risk; credit risk; currency risk; cybersecurity risk; derivatives risk; exchange traded funds risk; foreign investment risk; inflation risk; interest rate risk; liquidity risk; market risk; regulatory risk; securities lending, repurchase and reverse repurchase transactions risk; series risk; short selling risk; small capitalization natural resource company risk; specific issuer risk; tax risk.

Ninepoint Partners LP is the investment manager to a number of funds (collectively, the “Funds”). Important information about these Funds, including their investment objectives and strategies, purchase options, and applicable management fees, performance fees (if any), and expenses, is contained in their prospectus. Please read the prospectus carefully before investing. Commissions, trailing commissions, management fees, performance fees, other charges and expenses all may be associated with investing in the Funds. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. This communication does not constitute an offer to sell or solicitation to purchase securities of the Funds. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540