Ninepoint Focused Global Dividend Fund

May 2023 Commentary

Year-to-date to May 31, the Ninepoint Focused Global Dividend Fund generated a total return of 4.28% compared to the S&P Global 1200 Index, which generated a total return of 8.97%. For the month, the Fund generated a total return of -2.22% while the Index generated a total return of -0.63%.

Ninepoint Focused Global Dividend Fund - Compounded Returns¹ As of May 31, 2023 (Series F NPP964) | Inception Date: November 25, 2015

| 1M | YTD | 3M | 6M | 1YR | 3YR | 5YR | Inception | |

| Fund | -2.2% | 4.3% | 4.1% | 0.2% | 4.4% | 7.1% | 6.1% | 6.7% |

| S&P Global 1200 TR (CAD) | -0.6% | 9.0% | 4.1% | 4.4% | 10.0% | 11.0% | 9.3% | 9.8% |

One of the biggest overhangs facing the market this year, the US potentially breaching its debt ceiling covenant and triggering default, has come to a successful resolution. Unlike the 2011 debt ceiling crisis, where stocks dropped almost 20% during the contentious negotiations, both political parties were able to make enough concessions to agree to a deal. Although neither side may be completely satisfied, tense negotiations resulted in the suspension of the $31.4 trillion debt limit through January 1, 2025 (also ensuring the issue doesn’t flare up again during the 2024 Presidential election). Details include capping defense spending, rescinding some Covid-19 relief funds, cutting some of the previously expanded IRS budget and restarting student loan payments while maintaining the Inflation Reduction Act’s funding for climate and clean energy investment. To be honest, the outcome couldn’t have been any better than what was achieved but we do believe that the US political system needs to separate negotiations over the debt limit (and potentially defaulting on its prior obligations) from the political debate surrounding future spending.

After everything that investors have had to deal with since the start of the year (never mind the past three years), including one of the fastest Fed tightening cycles in over forty years, a banking crisis culminating in the failure of several major regional banks, the debt ceiling negotiations, the ongoing debate over forward earnings expectations and the continuous struggle to correctly value those future earnings streams, investors have found a new theme to chase. Unlike the “metaverse”, artificial intelligence is a significant development that will likely result in tangible benefits in terms of productivity in the coming years. Admittedly, some jobs will be eliminated, but many other types of jobs will be created, and technology will become even more integrated into our daily lives. Clearly, investors are optimistic regarding the future of AI and AI-related companies, with huge rallies in semiconductor manufacturers, wafer fab equipment manufacturers and the software companies that are the most likely to benefit from artificial intelligence and the use of machine learning algorithms.

From our perspective, as dividend and real asset focused investors, this nascent investment theme has made our lives quite difficult (at least in the short term and on a relative basis). Much like in the late 1990s, investors seem willing to price in years of future growth immediately while ignoring almost all other asset classes irrespective of their merits. We can illustrate this point by looking at the year-to-date sector-specific performance of the S&P 500. The impressive gains have been led by the Information Technology, Communication and Consumer Discretionary sectors and powered by about seven stocks: NVIDIA, Meta Platforms, Tesla, Amazon, Alphabet, Apple, and Microsoft. Unfortunately, the sectors with solid dividend payouts are mostly down year-to-date, including the Energy, Utilities, Health Care, Financials and Consumer Staples sectors. But having seen the late 1990s to early 2000s tech bubble and burst, we are committed to our investment philosophy over the long term.

Unfortunately, investors still need to contend with the lagged impact of tighter monetary policy, as we work through the final stages of the economic cycle. Thankfully, inflation looks to have peaked in June 2022 at 9.1%, and has steadily trended lower ever since, but unemployment rates are now finally beginning to tick up (to 3.7% in May from 3.4% in April). Because the current midpoint of the range of the Fed funds rate is above the most recent CPI report, we believe that the tightening cycle is finally complete. Signs of credit stress further support the case for an end to rate hikes and we remain concerned about the impact of more stringent regulations and tighter lending standards on future economic growth. Essentially, we believe that inflation readings would have to reaccelerate dramatically before any additional rate hikes and economic growth would have to decline significantly before any pivot to easier monetary policy. We believe that a pause would allow some of the lagging sectors to participate in the year-to-date equity rally however investors need to be careful about being whipsawed during what could be a volatile but still rangebound market over the balance of 2023.

In an environment of moderating inflation but slowing growth through 2023, the most important drivers of investment performance will likely be valuation, balance sheet strength and the ability to consistently generate cash flow and earnings. As the speculative anything-AI-related rally burns itself out, a greater component of total returns will likely come from dividend yields, which suggests better relative performance from our strategies going forward. In keeping with our mandates, we are concentrating our efforts on free cash flow positive, high quality, dividend growth companies and real asset investments given our positive assessment of the risk/reward outlook over the next two to three years.

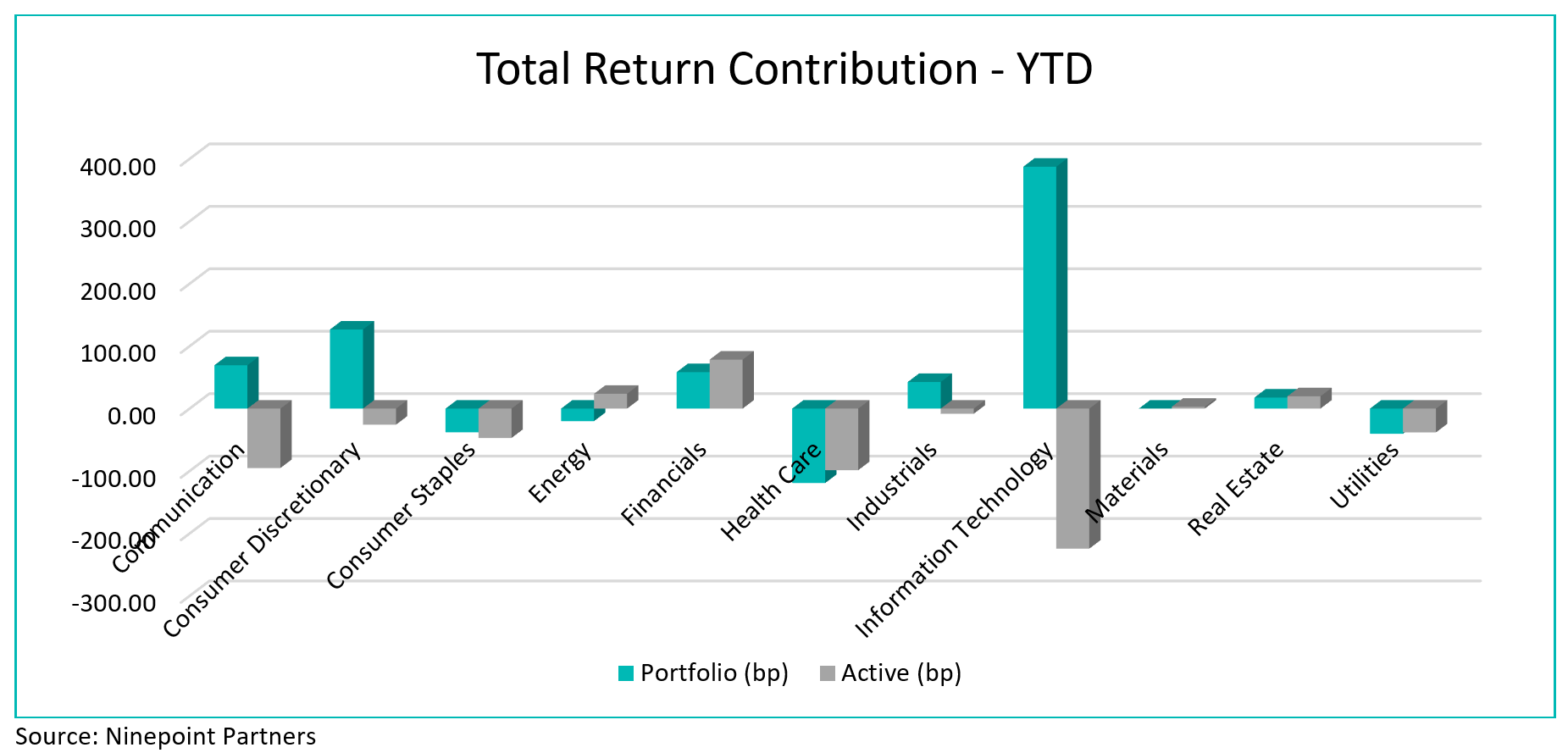

Top contributors to the year-to-date performance of the Ninepoint Focused Global Dividend Fund by sector included Information Technology (+387 bps), Consumer Discretionary (+127 bps) and Communication (+69 bps) while top detractors by sector included Health Care (-119 bps), Utilities (-40 bps) and Consumer Staples (-38 bps) on an absolute basis.

On a relative basis, positive return contributions from the Financials (+78 bps), Energy (+24 bps) and Real Estate (+20 bps) sectors were offset by negative contributions from the Information Technology (-224 bps), Health Care (-99 bps) and Communication (-95 bps) sectors.

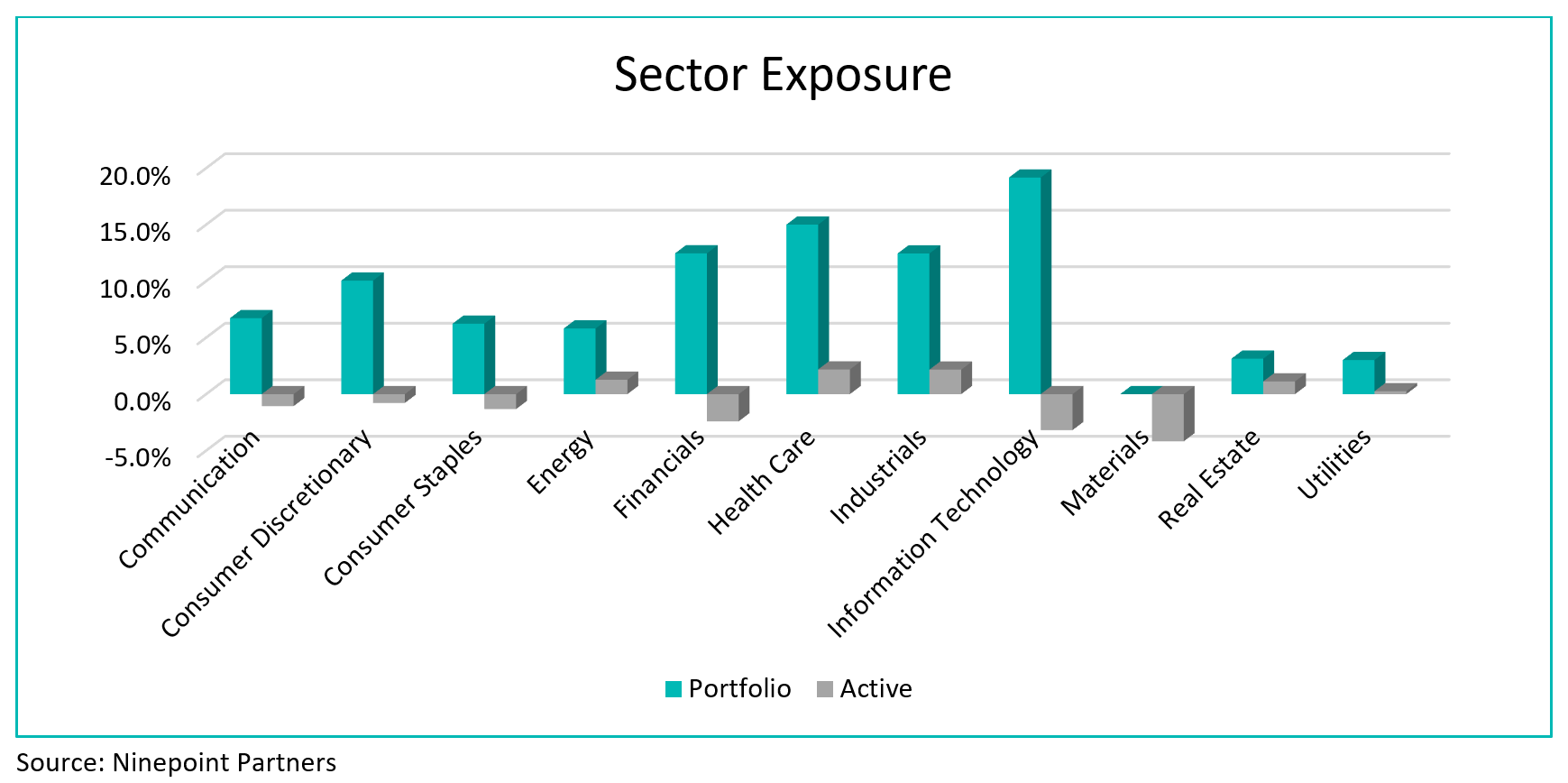

We are currently overweight the Health Care, Industrials and Energy sectors, while underweight the Materials, Information Technology and Financials sectors. The US Federal Reserve is now likely on pause as inflation continues to trend lower, but unemployment begins to trend higher. With market returns narrowly driven by a handful of AI-related stocks in the Information Technology sector, we are cautiously waiting for participation to broaden before fully committing to the rally. As the late stages of one of the most highly anticipated downturns ever continues to play out, we remain focused on high quality, dividend payers that have demonstrated the ability to consistently generate revenue and earnings growth through the cycle.

The Ninepoint Focused Global Dividend Fund was concentrated in 28 positions as at May 31, 2023 with the top 10 holdings accounting for approximately 39.7% of the fund. Over the prior fiscal year, 20 out of our 28 holdings have announced a dividend increase, with an average hike of 10.3% (median hike of 8.6%). We will continue to apply a disciplined investment process, balancing various quality and valuation metrics, in an effort to generate solid risk-adjusted returns.

Jeffery Sayer, CFA

Ninepoint Partners

1 All returns and fund details are a) based on Series F shares; b) net of fees; c) annualized if period is greater than one year; d) as at May 31, 2023; e) 2015 annual returns are from 11/25/15 to 12/31/15. The index is S&P GLOBAL 1200 TR (CAD) and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: ADR risk; Capital depletion risk; Concentration risk; Credit risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded funds risk; Foreign investment risk; Inflation risk; Interest rate risk; Liquidity risk; Market risk; Rule 144A and other exempted securities risk; Securities lending, Repurchase and reverse repurchase transactions risk; Series risk; Short selling risk; Specific issuer risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended May 31, 2023 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/ or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering or tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on the specific circumstances before taking any action.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Focused Global Dividend Fund 12/2023

- Focused Global Dividend Fund 11/2023

- Focused Global Dividend Fund 10/2023

- Focused Global Dividend Fund 09/2023

- Focused Global Dividend Fund 08/2023

- Focused Global Dividend Fund 07/2023

- Focused Global Dividend Fund 06/2023

- Jeff Sayer - H1 2023 Market Review and Outlook - Focused Global Dividend Fund

- Focused Global Dividend Fund 04/2023

- Focused Global Dividend Fund 03/2023

- Focused Global Dividend Fund 02/2023

- Focused Global Dividend Fund 01/2023